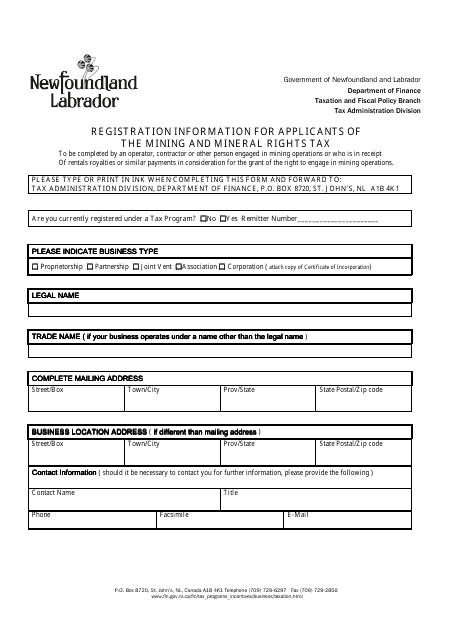

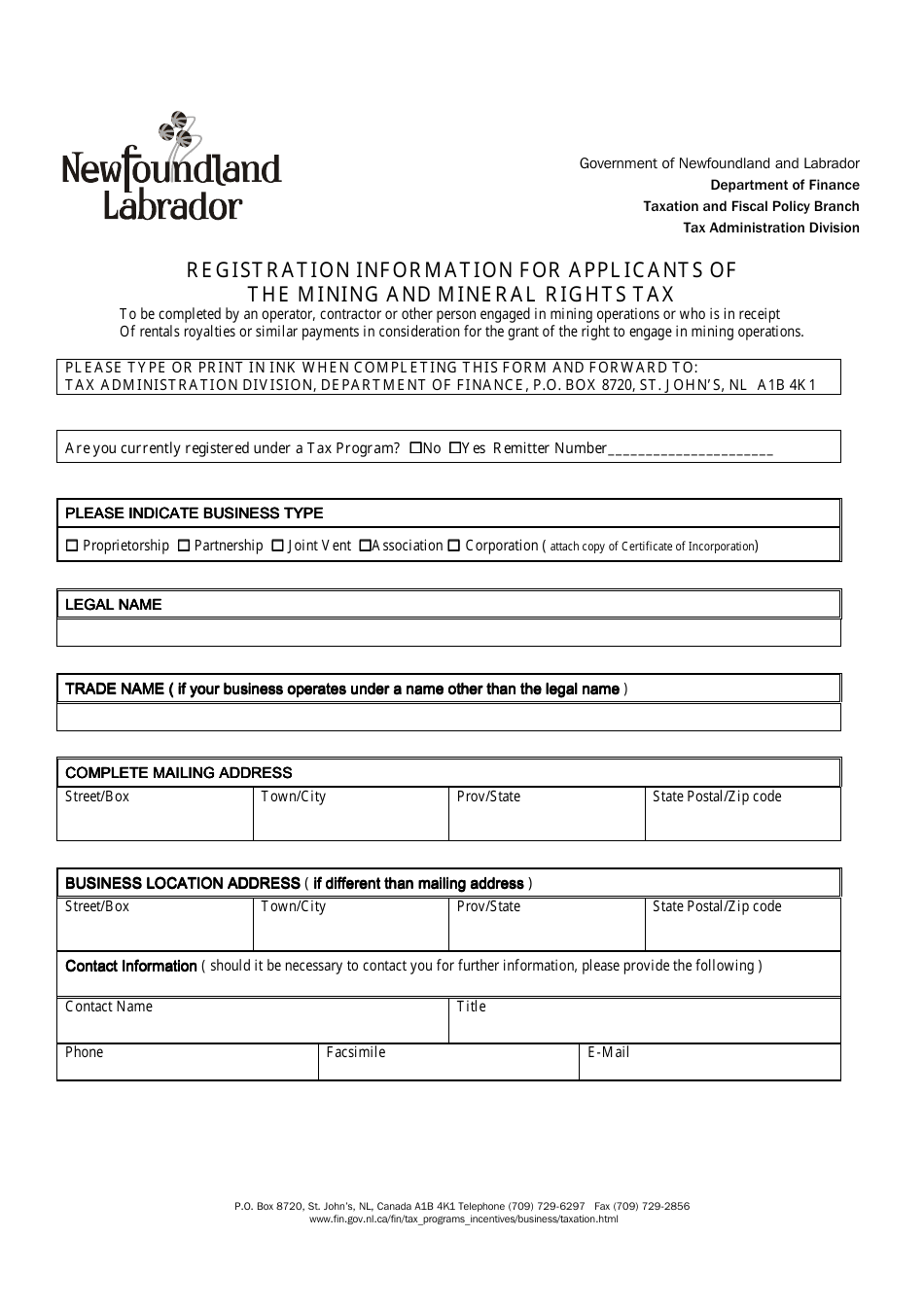

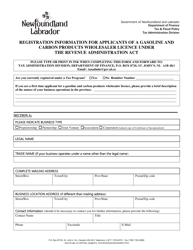

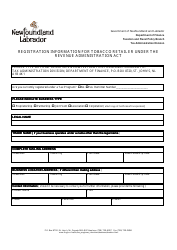

Registration Information for Applicants of the Mining and Mineral Rights Tax - Newfoundland and Labrador, Canada

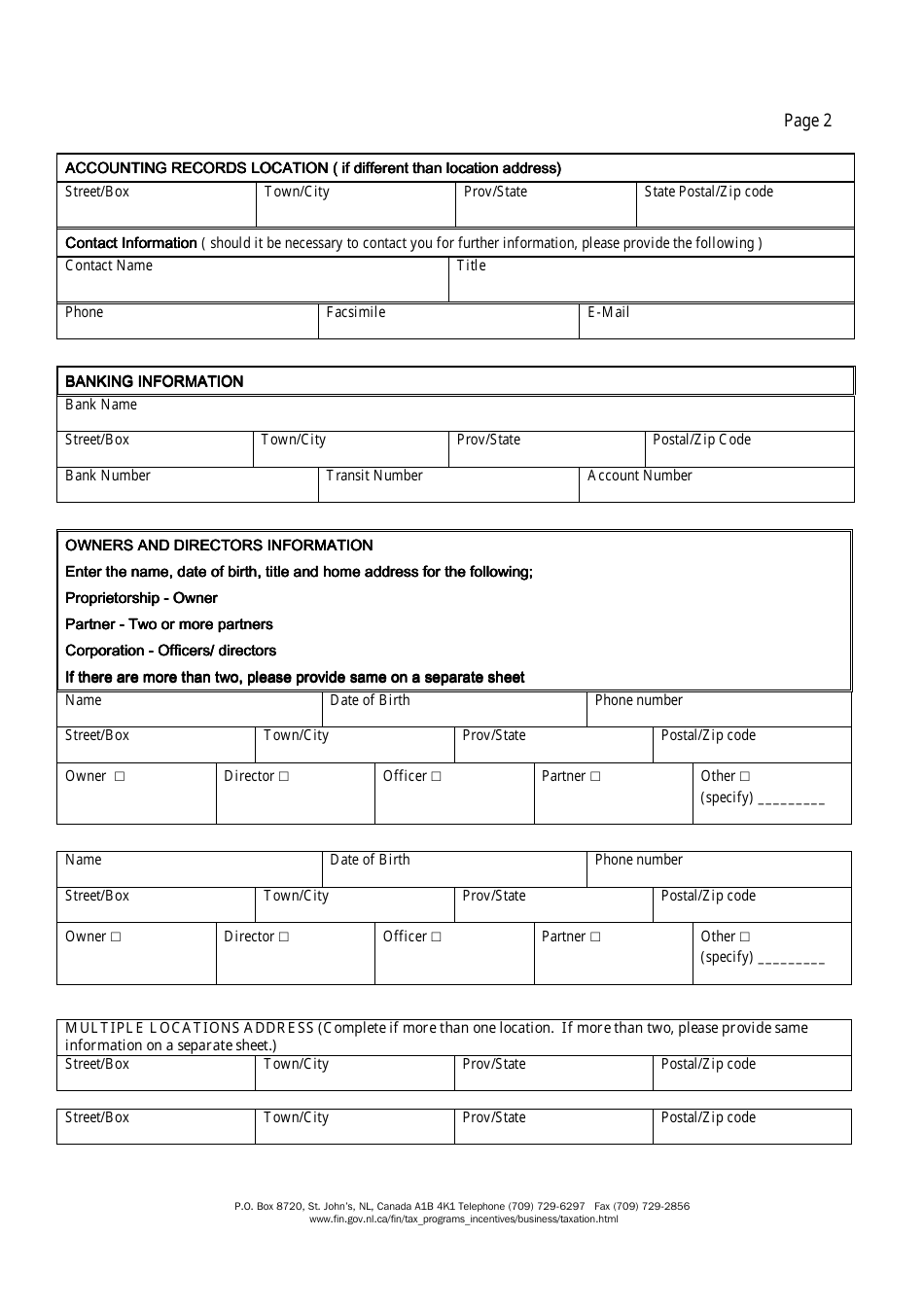

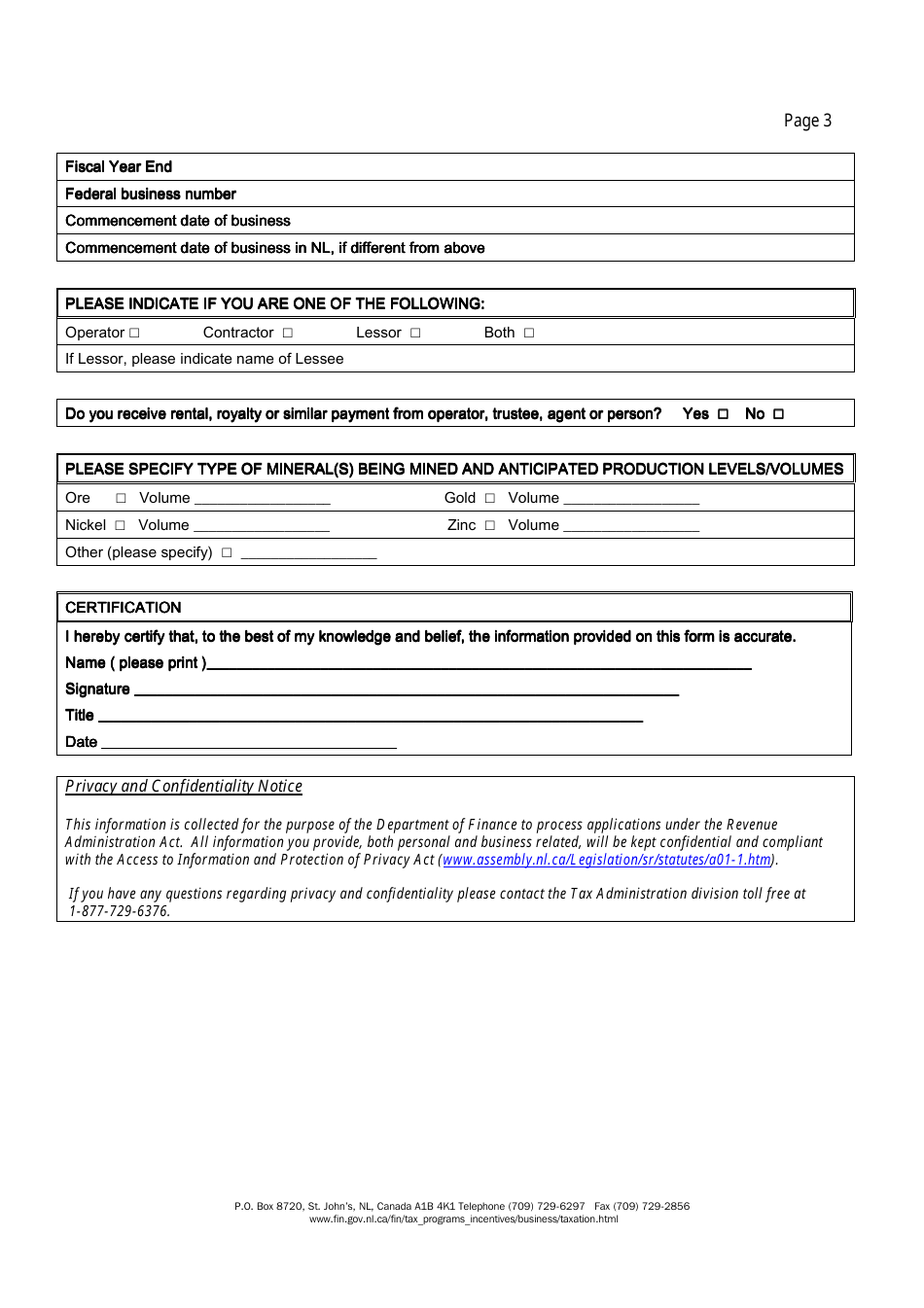

This Newfoundland and Labrador-specific " Registration Information For Applicants Of The Mining And Mineral Rights Tax " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: Who should register for the Mining and Mineral Rights Tax?

A: Any individual or company involved in mining and mineral rights in Newfoundland and Labrador, Canada should register for the tax.

Q: What is the Mining and Mineral Rights Tax?

A: The Mining and Mineral Rights Tax is a tax imposed on individuals and companies engaged in mining and mineral rights activities in Newfoundland and Labrador.

Q: Are there any exemptions or deductions available for the Mining and Mineral Rights Tax?

A: There may be exemptions or deductions available for the Mining and Mineral Rights Tax, but they will depend on the specific circumstances. It's best to consult with a tax professional or refer to the government's guidelines for more information.