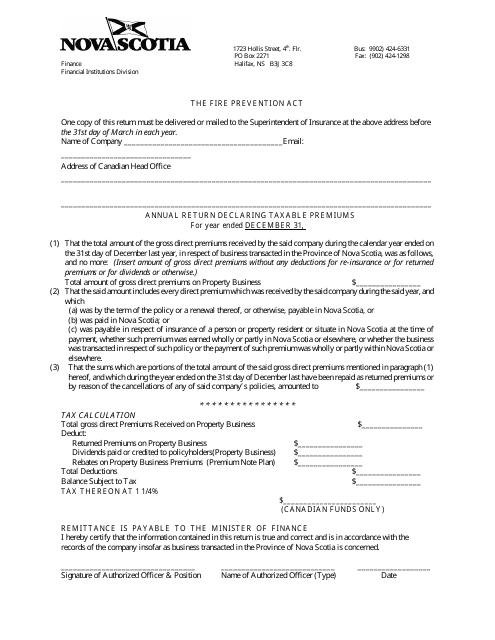

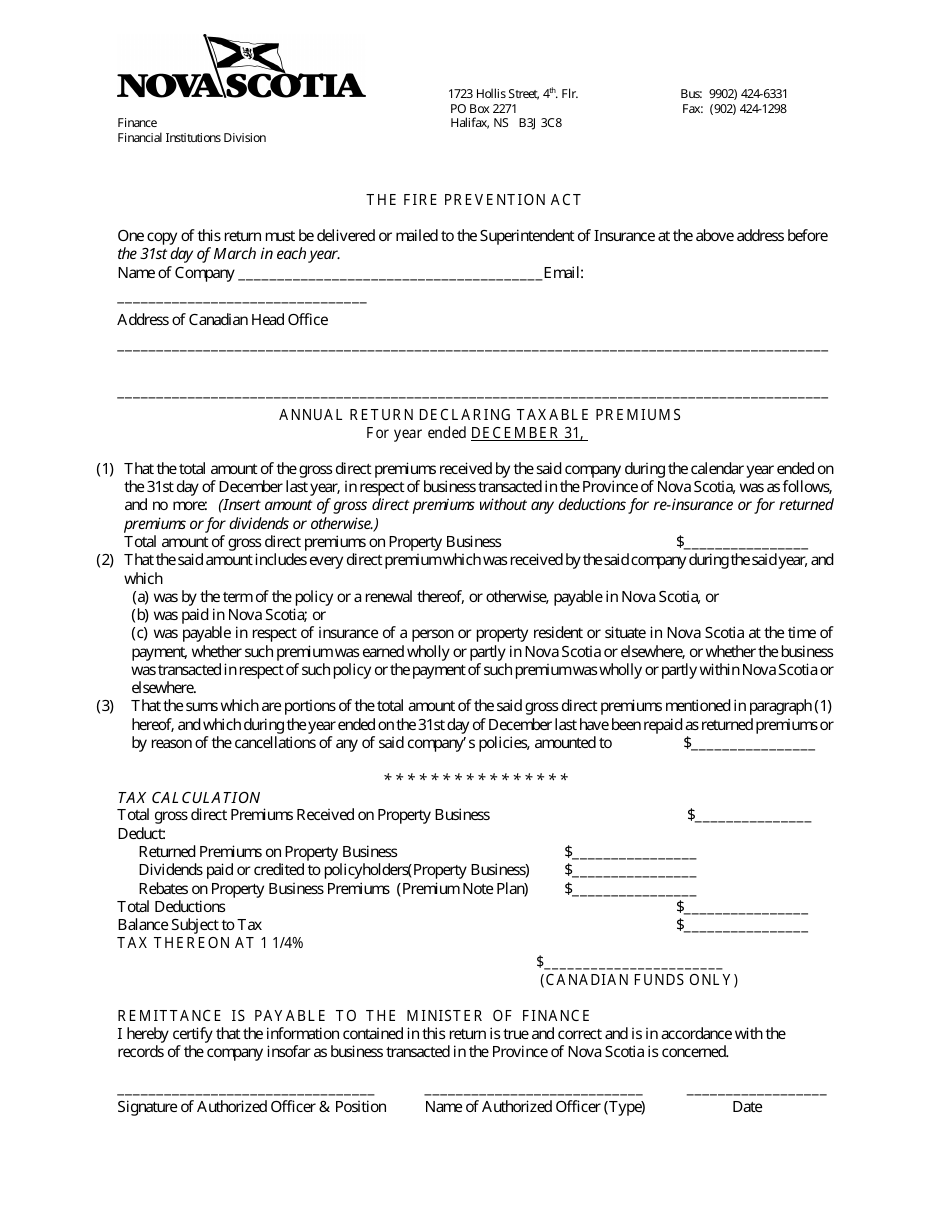

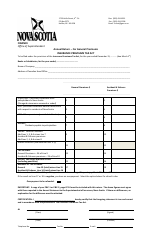

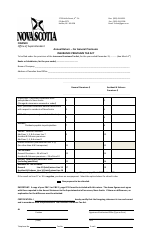

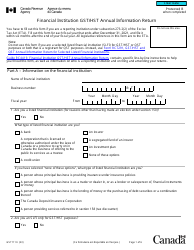

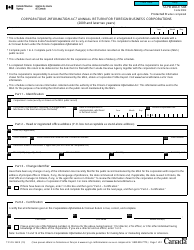

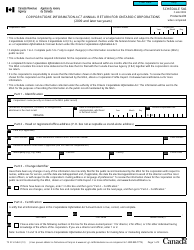

Annual Return Declaring Taxable Premiums - Nova Scotia, Canada

This fillable " Annual Return Declaring Taxable Premiums " is a document issued by the Nova Scotia Finance and Treasury Board specifically for Nova Scotia residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is an annual return for declaring taxable premiums in Nova Scotia?

A: An annual return is a form that individuals or businesses in Nova Scotia need to file to declare their taxable premiums.

Q: Who needs to file an annual return for taxable premiums in Nova Scotia?

A: Individuals or businesses in Nova Scotia who have received taxable premiums need to file an annual return.

Q: What are taxable premiums?

A: Taxable premiums refer to the money earned from insuring risks in Nova Scotia.

Q: How often do I need to file an annual return for taxable premiums in Nova Scotia?

A: You need to file an annual return for taxable premiums in Nova Scotia once a year.

Q: When is the deadline for filing an annual return for taxable premiums in Nova Scotia?

A: The deadline for filing an annual return for taxable premiums in Nova Scotia is usually April 30th of each year.

Q: What happens if I don't file an annual return for taxable premiums in Nova Scotia?

A: If you don't file an annual return for taxable premiums in Nova Scotia, you may face penalties or interest charges.

Q: Are there any exemptions or deductions available for taxable premiums in Nova Scotia?

A: There may be certain exemptions or deductions available for taxable premiums in Nova Scotia. It is best to consult the tax regulations or seek professional advice.

Q: Is the annual return for taxable premiums in Nova Scotia the same as the income tax return?

A: No, the annual return for taxable premiums in Nova Scotia is a separate form that focuses specifically on reporting taxable premiums.