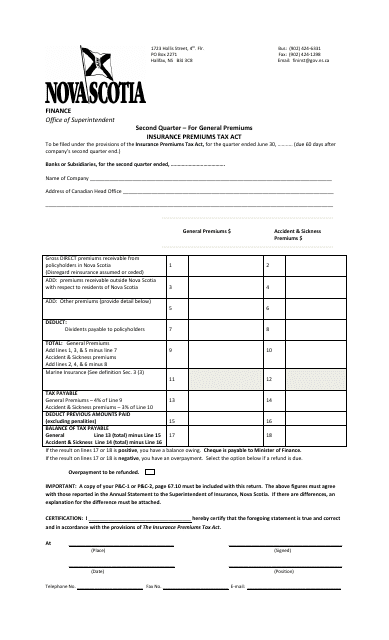

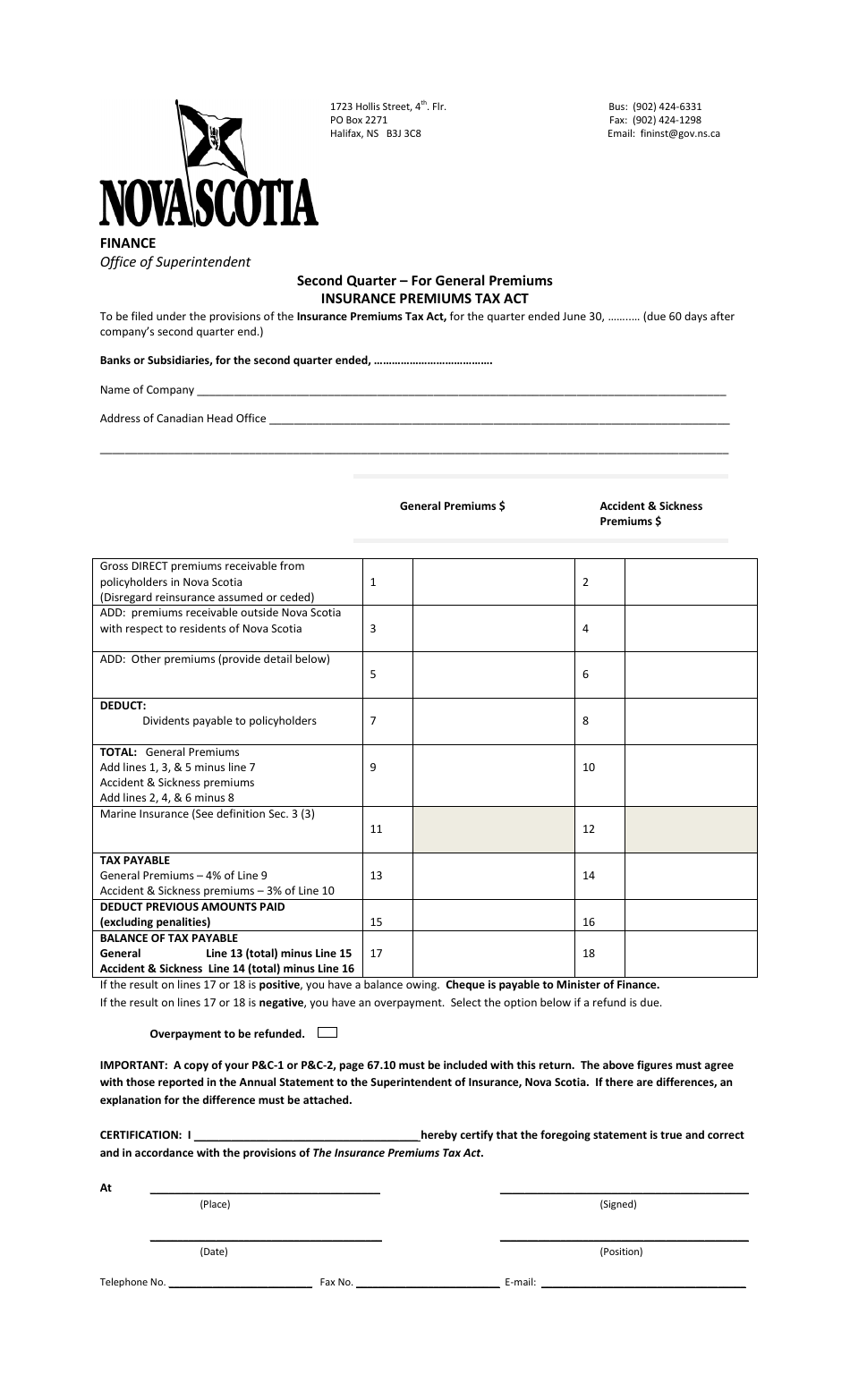

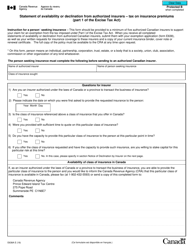

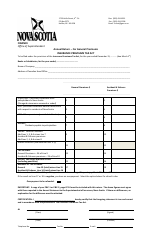

Second Quarter Insurance Premiums Tax Act for General Premiums - Nova Scotia, Canada

This Nova Scotia-specific " Second Quarter Insurance Premiums Tax Act For General Premiums " is a document released by the Nova Scotia Finance and Treasury Board .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is the Second QuarterInsurance Premiums Tax Act?

A: The Second Quarter Insurance Premiums Tax Act is a law in Nova Scotia, Canada that governs the taxation of insurance premiums.

Q: What are general premiums?

A: General premiums refer to the payments made for general insurance policies, such as auto insurance, home insurance, and business insurance.

Q: What is the purpose of the Second Quarter Insurance Premiums Tax Act?

A: The purpose of the act is to levy a tax on general insurance premiums in order to generate revenue for the government of Nova Scotia.

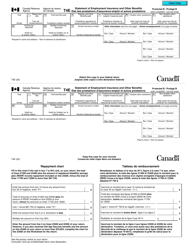

Q: Who is responsible for paying the insurance premiums tax?

A: Insurance companies are responsible for collecting and remitting the tax on insurance premiums to the government.

Q: When are the insurance premiums taxes due?

A: The taxes on insurance premiums are due quarterly, with the Second Quarter Insurance Premiums Tax Act specifically dealing with the tax for the second quarter of the year.