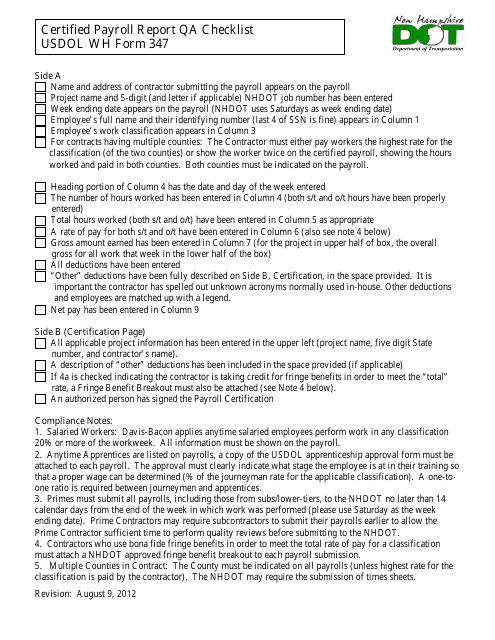

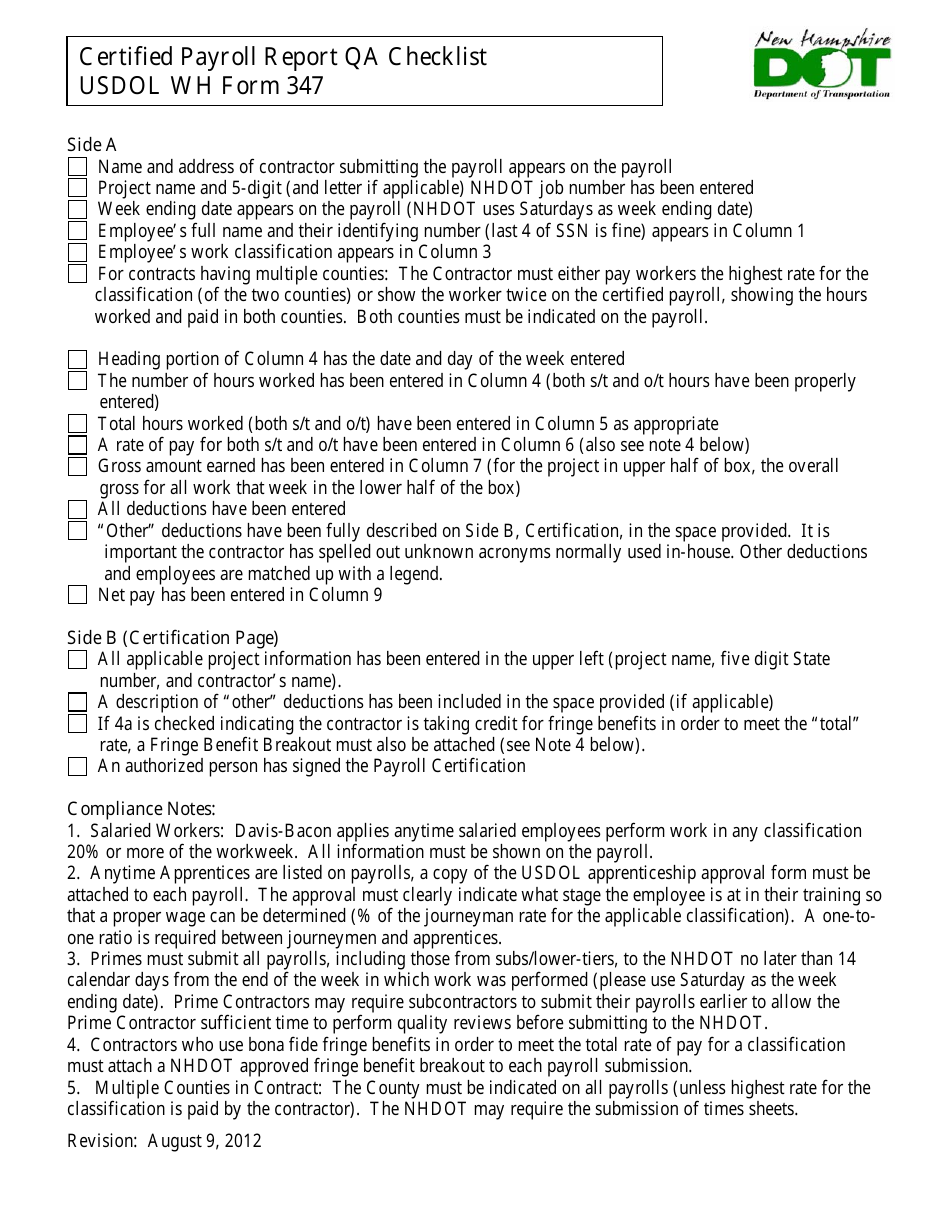

USDOL WH Form 347 Certified Payroll Report Qa Checklist - New Hampshire

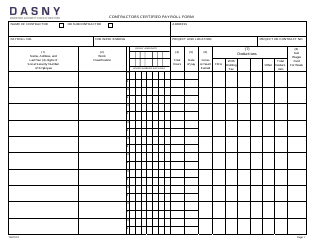

What Is USDOL WH Form 347?

This is a legal form that was released by the New Hampshire Department of Transportation - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the USDOL WH Form 347?

A: The USDOL WH Form 347 is a Certified Payroll Report.

Q: What is the purpose of the Certified Payroll Report?

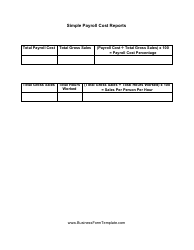

A: The purpose of the Certified Payroll Report is to ensure compliance with prevailing wage requirements on federal construction projects.

Q: Who needs to submit the Certified Payroll Report?

A: Contractors and subcontractors working on federal construction projects need to submit the Certified Payroll Report.

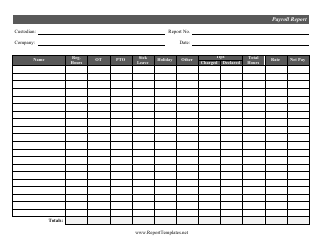

Q: What information is included in the Certified Payroll Report?

A: The Certified Payroll Report includes information about employees' wages, fringe benefits, and hours worked.

Q: Do I need to submit the Certified Payroll Report for each employee?

A: Yes, you need to submit the Certified Payroll Report for each employee working on the project.

Q: What is the deadline for submitting the Certified Payroll Report?

A: The deadline for submitting the Certified Payroll Report is usually weekly, but it may vary depending on the project.

Q: What happens if I fail to submit the Certified Payroll Report?

A: Failure to submit the Certified Payroll Report may result in penalties or contract termination.

Q: Is the Certified Payroll Report required in all states?

A: No, the Certified Payroll Report is only required for federal construction projects.

Q: Is there a specific form for the Certified Payroll Report in New Hampshire?

A: No, the USDOL WH Form 347 is used for the Certified Payroll Report in all states.

Form Details:

- Released on August 9, 2012;

- The latest edition provided by the New Hampshire Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of USDOL WH Form 347 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Transportation.