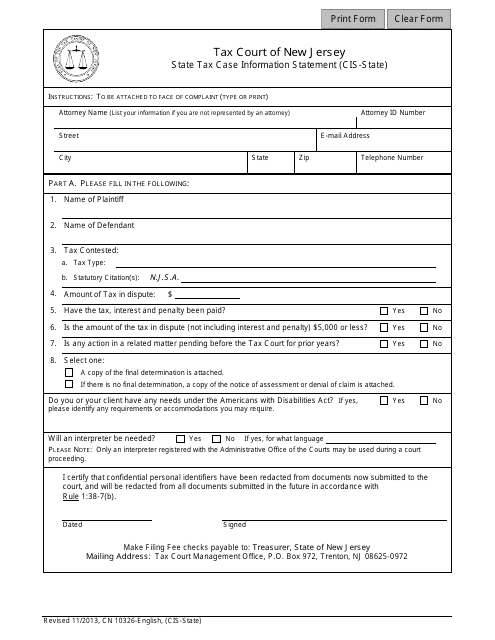

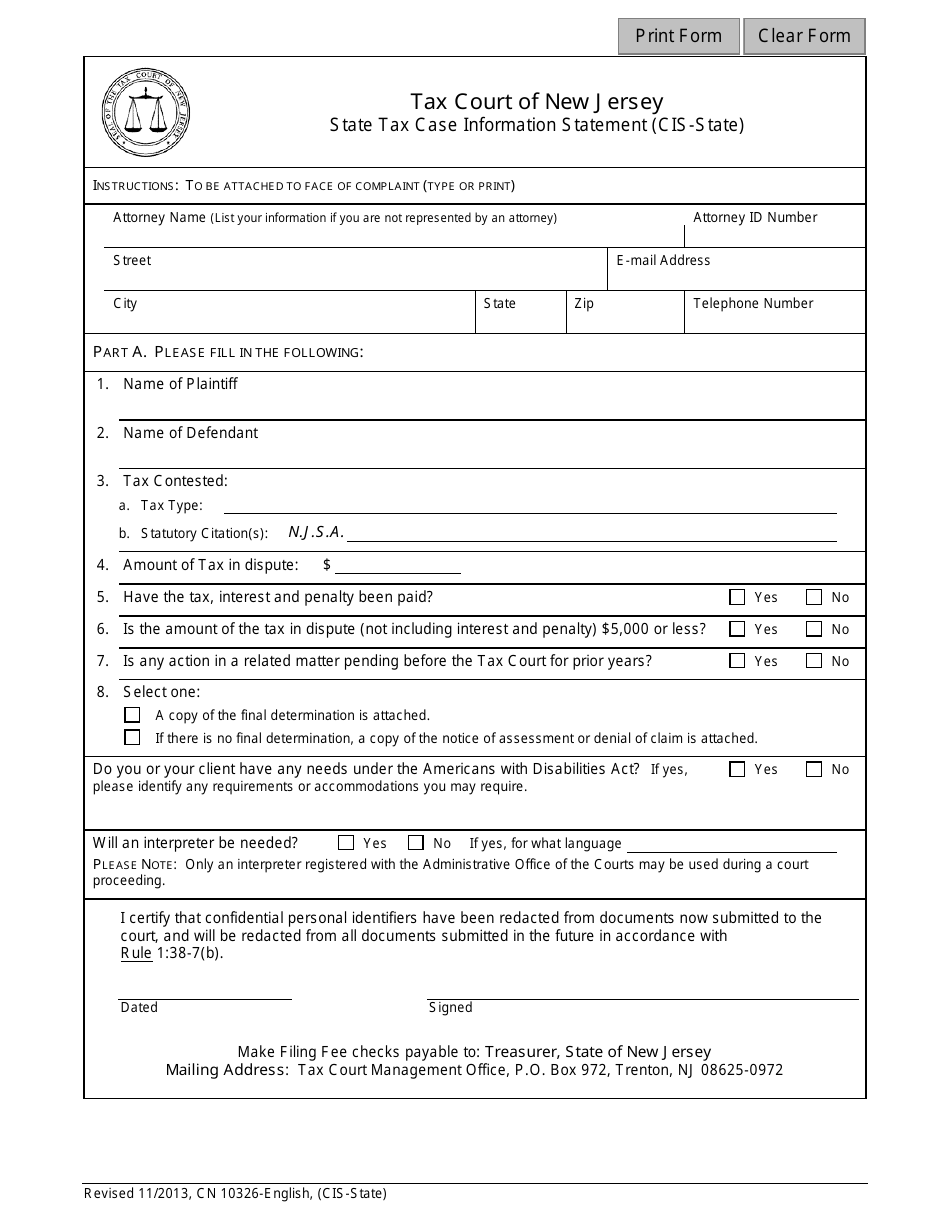

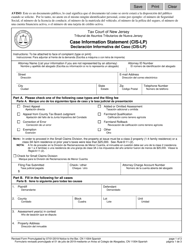

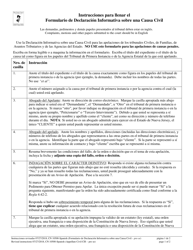

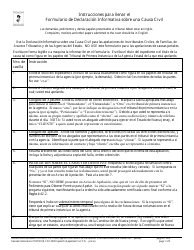

Form 10326 State Tax Case Information Statement (Cis-State) - New Jersey

What Is Form 10326?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

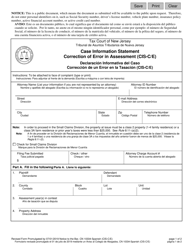

Q: What is Form 10326 State Tax Case Information Statement?

A: Form 10326 is a State Tax Case Information Statement (CIS-State) used in New Jersey.

Q: What is the purpose of Form 10326?

A: The purpose of Form 10326 is to provide detailed information about a tax case in New Jersey.

Q: Who needs to fill out Form 10326?

A: Any individual or business involved in a tax case in New Jersey may need to fill out Form 10326.

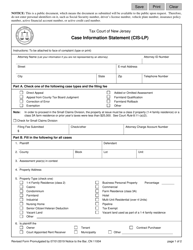

Q: When is Form 10326 due?

A: The due date for Form 10326 may vary depending on the specific circumstances of the tax case. It is usually submitted along with other tax documents.

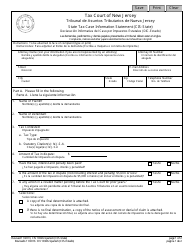

Q: Is Form 10326 specific to New Jersey?

A: Yes, Form 10326 is specific to New Jersey and is used for state tax cases.

Q: Are there any fees associated with filing Form 10326?

A: There are no specific fees associated with filing Form 10326, but there may be costs related to the tax case itself.

Q: What should I do if I have questions about Form 10326?

A: If you have questions about Form 10326, it is recommended to consult with a tax professional or contact the New Jersey Division of Taxation.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10326 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.