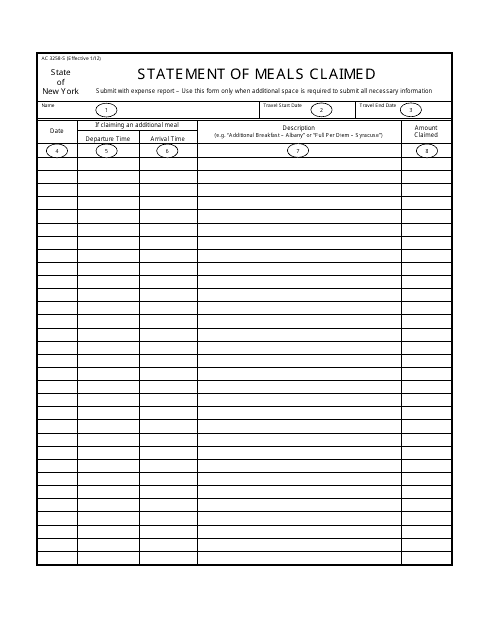

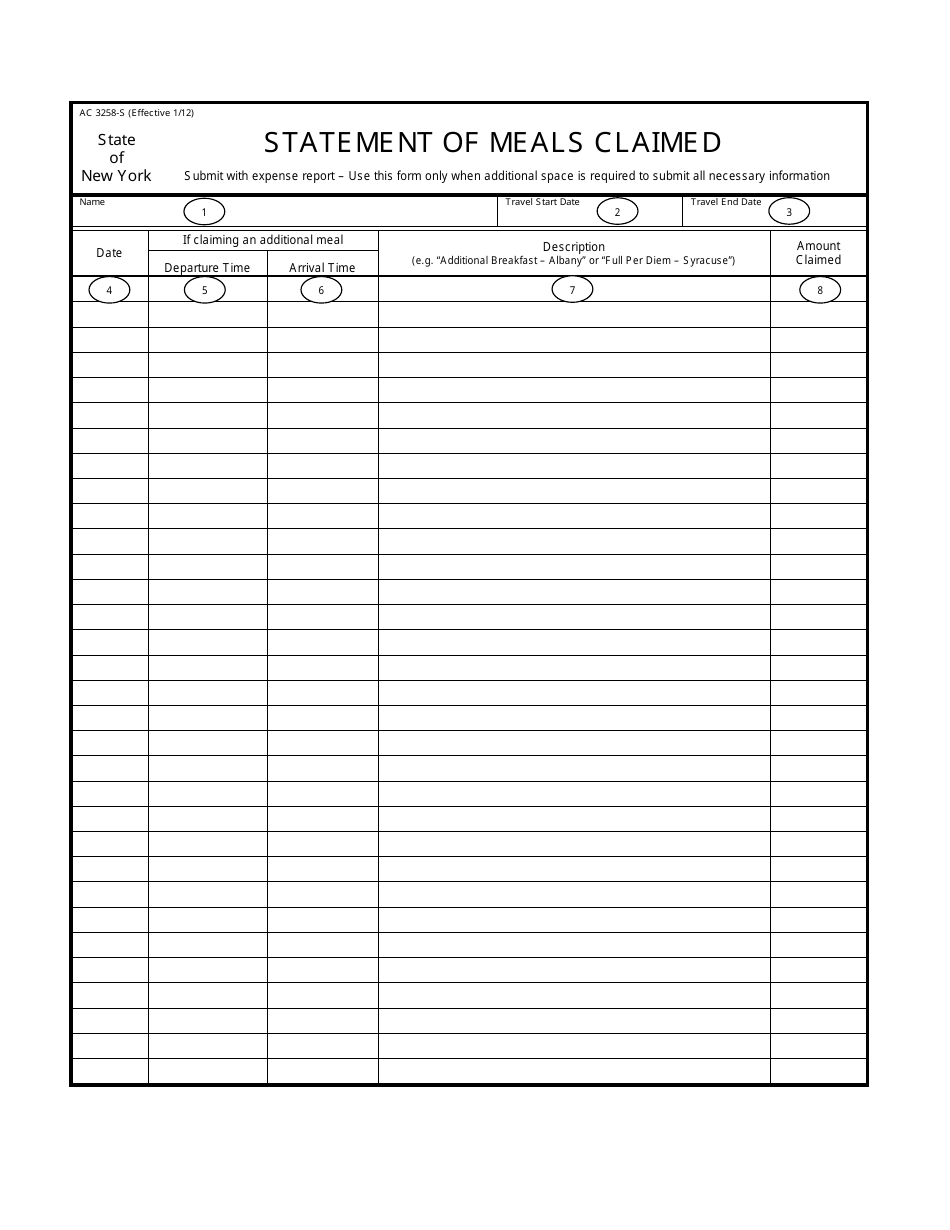

Instructions for Form AC3258-S Statement of Meals Claimed - New York

This document contains official instructions for Form AC3258-S , Statement of Meals Claimed - a form released and collected by the Office of the New York State Comptroller. An up-to-date fillable Form AC3258-S is available for download through this link.

FAQ

Q: What is Form AC3258-S?

A: Form AC3258-S is a statement used to claim meals expenses in New York.

Q: Who needs to fill out Form AC3258-S?

A: Anyone who wants to claim meals expenses in New York needs to fill out Form AC3258-S.

Q: What is the purpose of Form AC3258-S?

A: Form AC3258-S is used to report and claim meals expenses incurred in relation to business or employment purposes in New York.

Q: Are there any eligibility criteria for claiming meals expenses using Form AC3258-S?

A: Yes, the meals must meet certain criteria, including being necessary, proportionate, and directly related to business or employment activities.

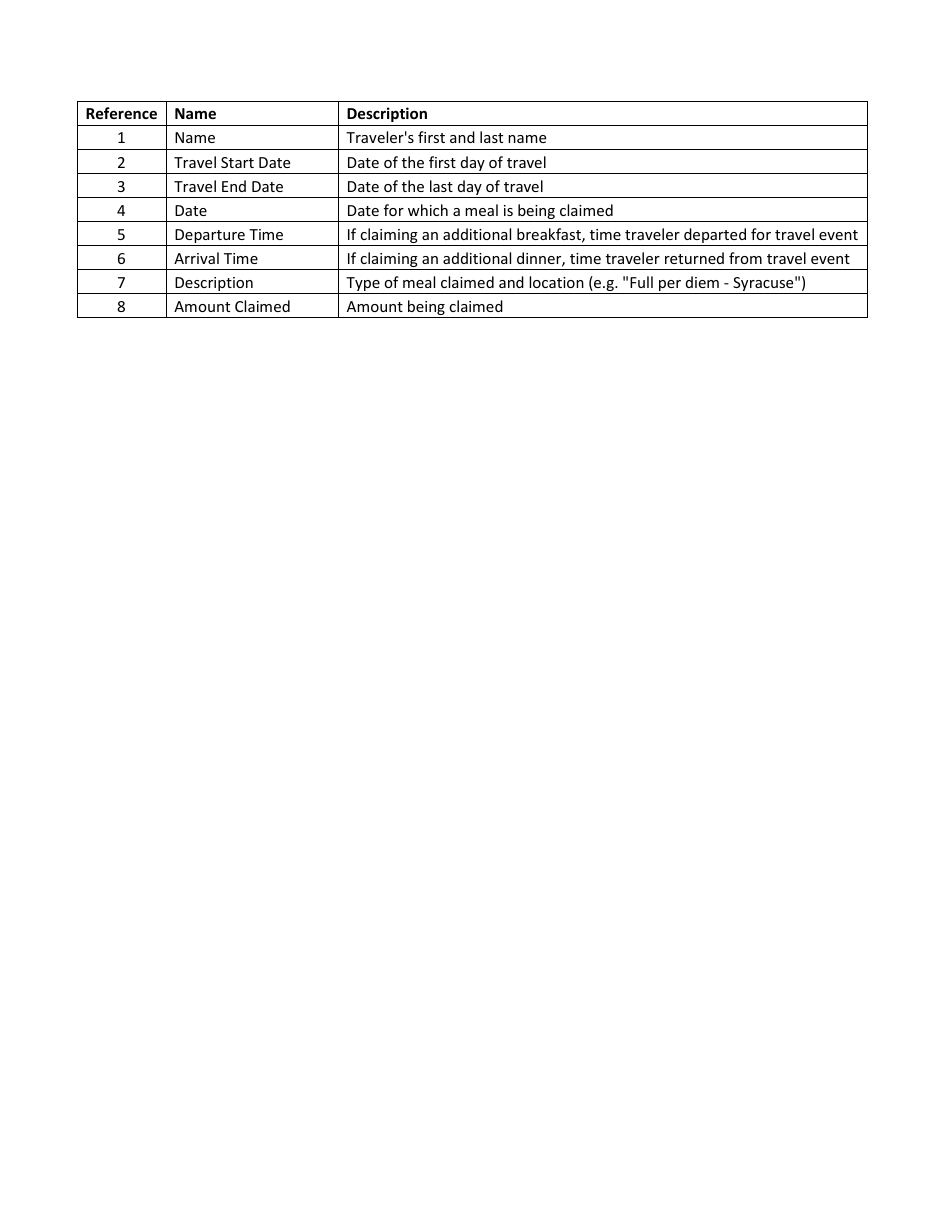

Q: How should I fill out Form AC3258-S?

A: You should provide your personal details, including your name, address, and social security number. You should also provide detailed information about each meal claimed, including the date, location, and purpose.

Q: Are there any supporting documents required for Form AC3258-S?

A: Yes, you need to attach supporting documentation that verifies the expenses claimed, such as receipts or invoices.

Q: Is there a deadline for filing Form AC3258-S?

A: Yes, the form should be filed within three years from the due date of the return or within three years from the date the return was filed, whichever is later.

Q: Can I claim meals expenses on my federal tax return using Form AC3258-S?

A: No, Form AC3258-S is specific to claiming meals expenses in New York and is not used for federal tax purposes.

Q: Is there a limit on the amount of meals expenses that can be claimed using Form AC3258-S?

A: Yes, there are limits on the amount of meals expenses that can be claimed, depending on the type of meal and the location.

Q: Are there any penalties for filing an incorrect or incomplete Form AC3258-S?

A: Yes, if the form is not filled out correctly or if false information is provided, penalties may be imposed by the New York State Department of Taxation and Finance.

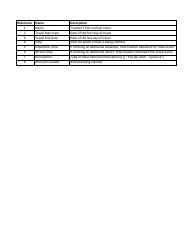

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Office of the New York State Comptroller.