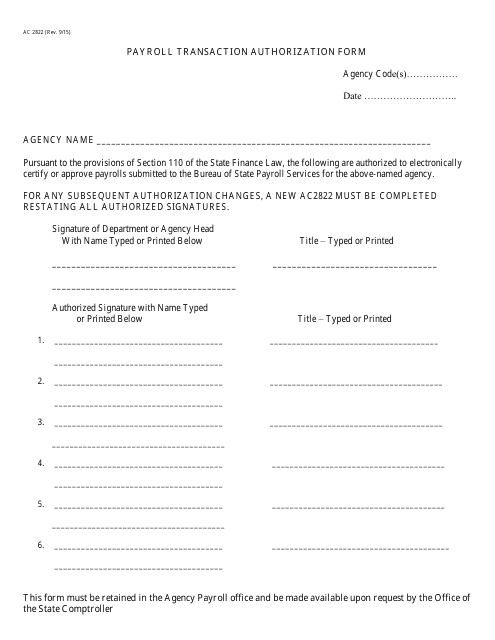

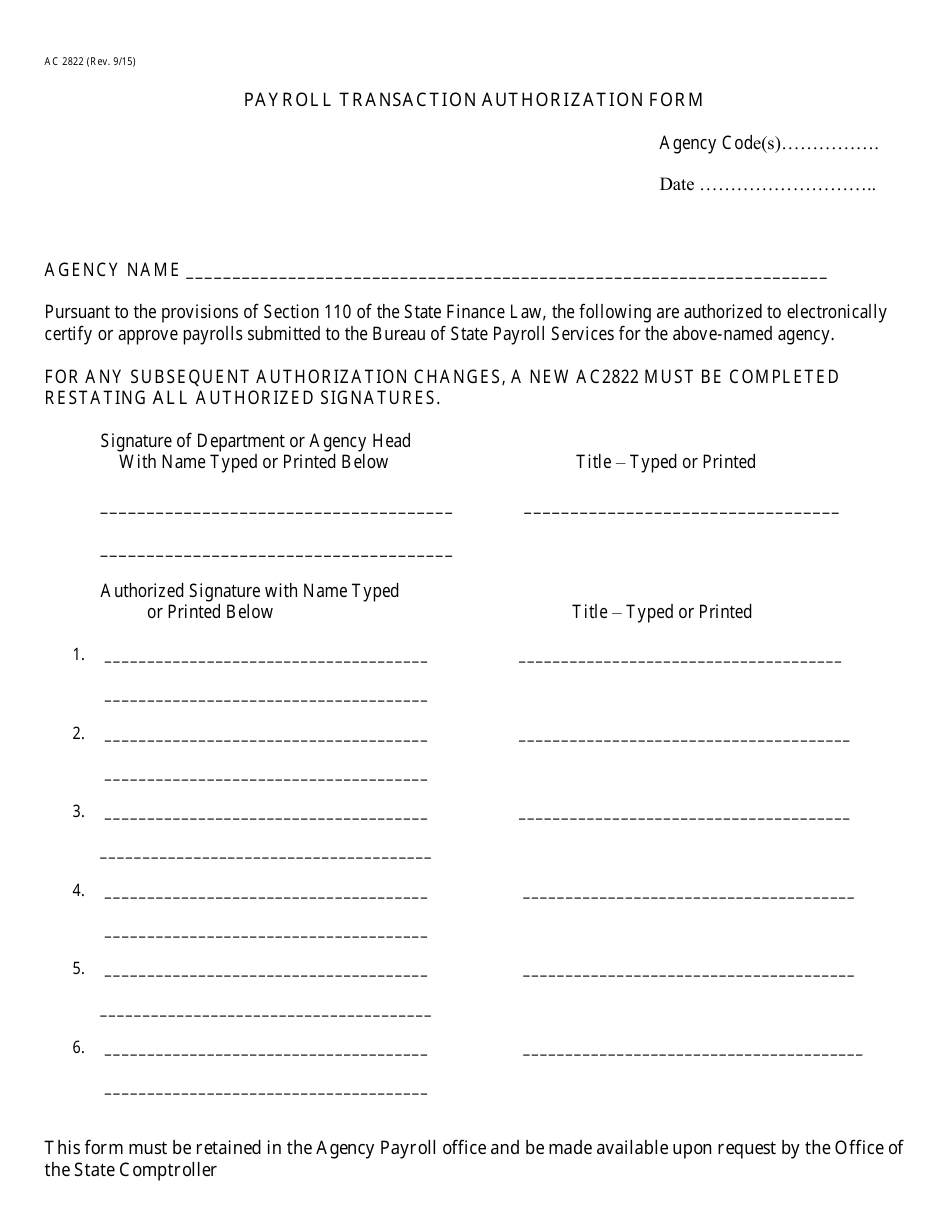

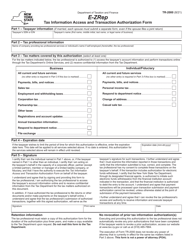

Form AC2822 Payroll Transaction Authorization Form - New York

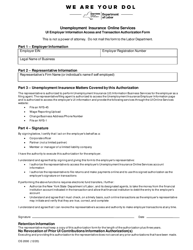

What Is Form AC2822?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AC2822?

A: The Form AC2822 is the Payroll Transaction Authorization Form.

Q: What is the purpose of the Form AC2822?

A: The purpose of the Form AC2822 is to authorize payroll transactions in New York.

Q: Who needs to use the Form AC2822?

A: Anyone who needs to authorize payroll transactions in New York needs to use the Form AC2822.

Q: Is the Form AC2822 specific to New York?

A: Yes, the Form AC2822 is specific to New York.

Q: What information is required on the Form AC2822?

A: The Form AC2822 requires information such as employee details, pay period, earnings, deductions, and authorization signature.

Q: Can I submit the Form AC2822 electronically?

A: The submission method for the Form AC2822 may vary depending on your employer's policies. It's best to check with your employer.

Q: Is the Form AC2822 for employees or employers?

A: The Form AC2822 is typically used by employers to authorize payroll transactions for their employees.

Q: What happens after I submit the Form AC2822?

A: After you submit the Form AC2822, your employer will process the payroll transactions according to the information provided.

Q: Can I make changes to the Form AC2822 after submission?

A: You may need to contact your employer if you need to make changes to the Form AC2822 after submission.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AC2822 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.