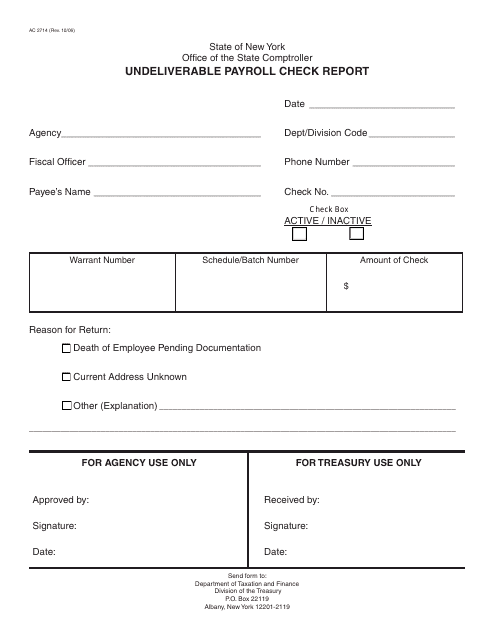

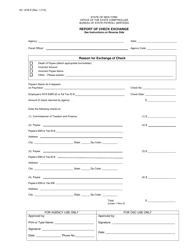

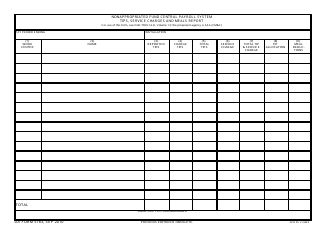

Form AC2714 Undeliverable Payroll Check Report - New York

What Is Form AC2714?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AC2714?

A: Form AC2714 is the Undeliverable Payroll Check Report.

Q: What is the purpose of Form AC2714?

A: The purpose of Form AC2714 is to report undeliverable payroll checks in the state of New York.

Q: Who needs to file Form AC2714?

A: Employers in New York who have undeliverable payroll checks need to file Form AC2714.

Q: How often do I need to file Form AC2714?

A: Form AC2714 needs to be filed annually.

Q: What information is required on Form AC2714?

A: Form AC2714 requires information about the employer, employee, and the undeliverable payroll checks.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AC2714 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.