This version of the form is not currently in use and is provided for reference only. Download this version of

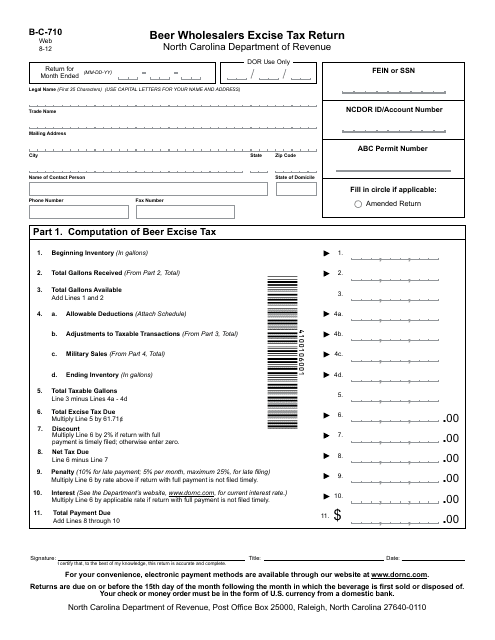

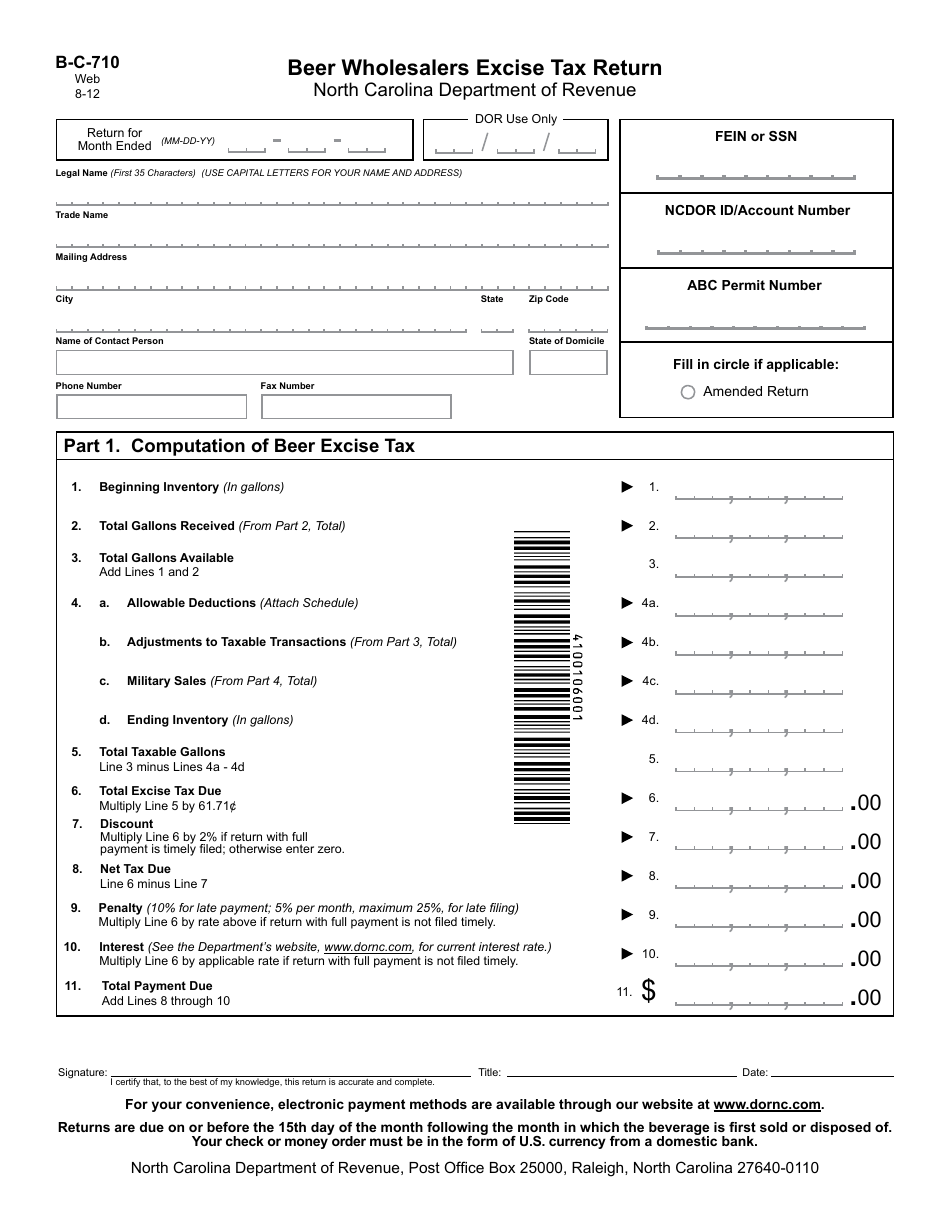

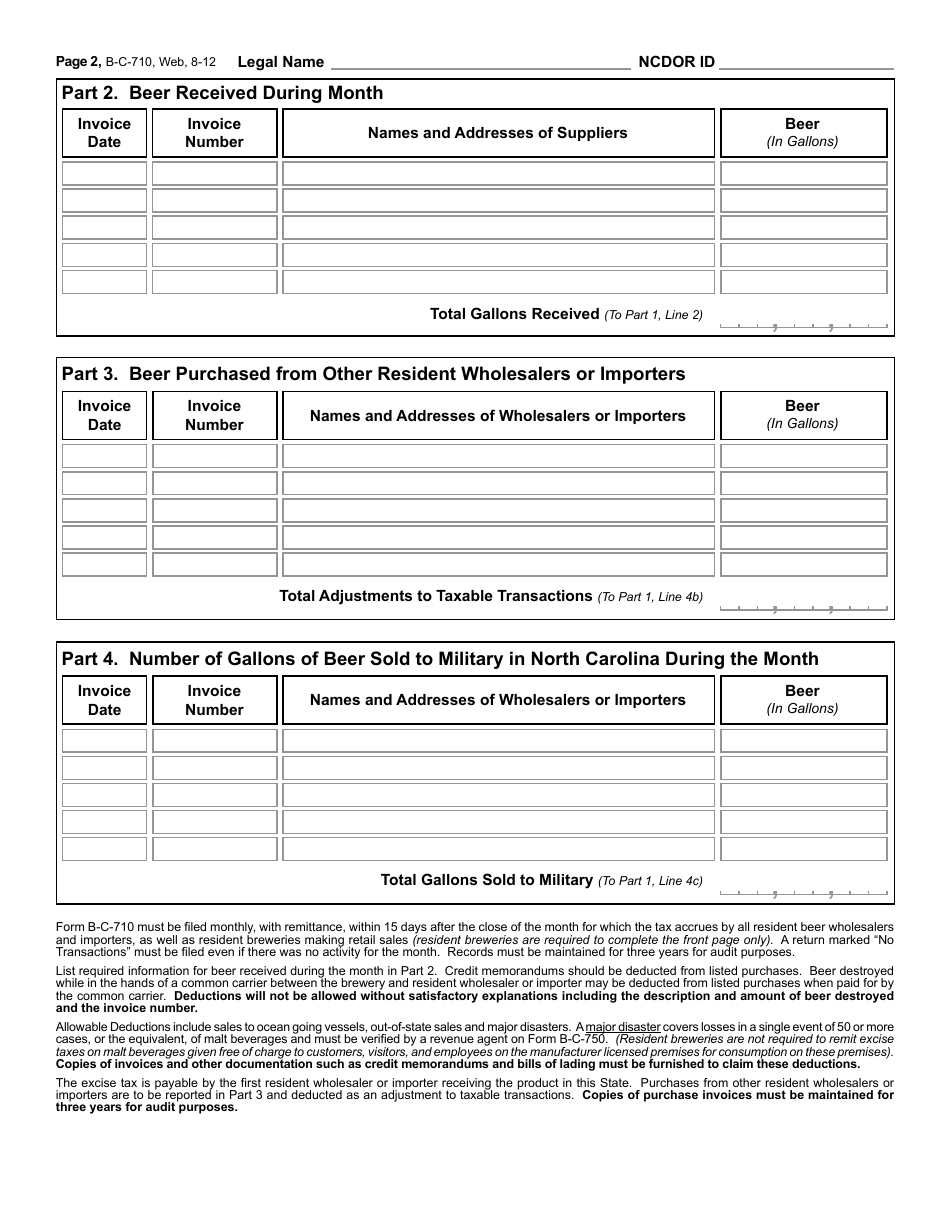

Form B-C-710

for the current year.

Form B-C-710 Beer Wholesalers Excise Tax Return - North Carolina

What Is Form B-C-710?

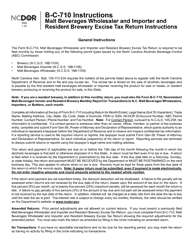

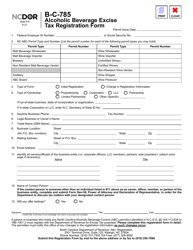

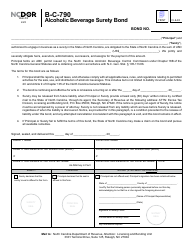

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B-C-710?

A: Form B-C-710 is the Beer WholesalersExcise Tax Return for North Carolina.

Q: Who needs to file Form B-C-710?

A: Beer wholesalers in North Carolina need to file Form B-C-710.

Q: What is the purpose of Form B-C-710?

A: The purpose of Form B-C-710 is to report and pay excise tax on beer sales by wholesalers in North Carolina.

Q: How often do I need to file Form B-C-710?

A: Form B-C-710 needs to be filed on a monthly basis.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-C-710 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.