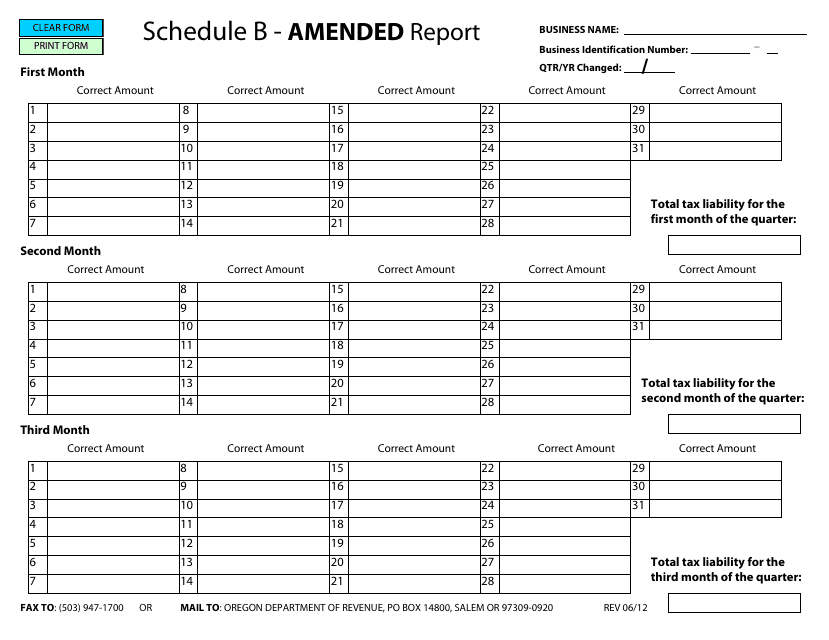

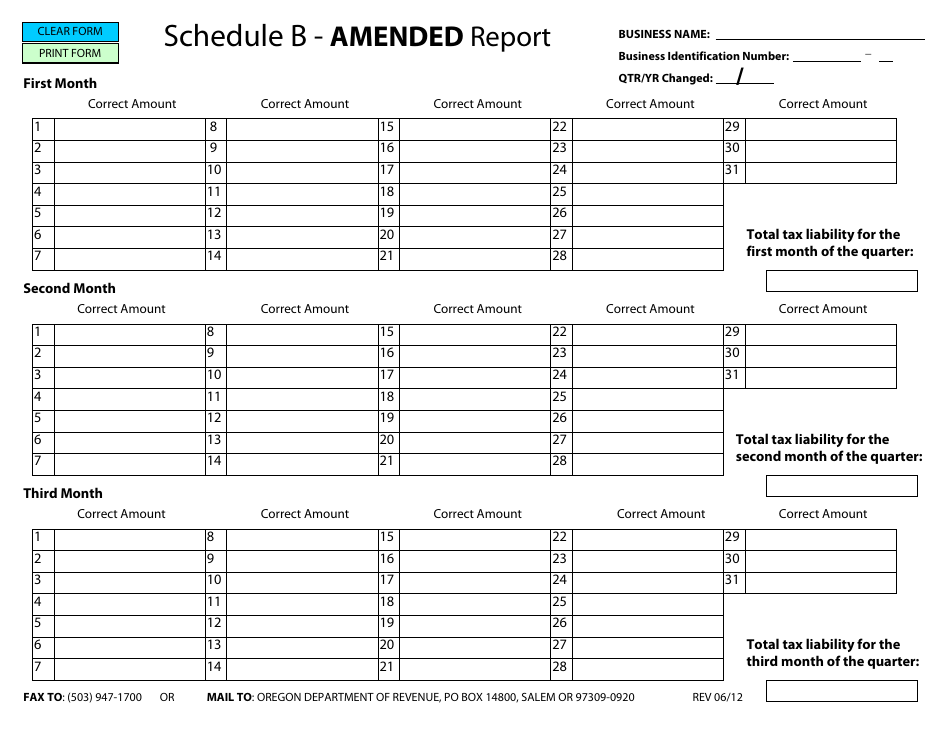

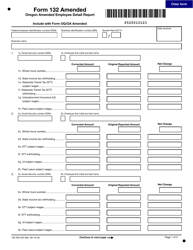

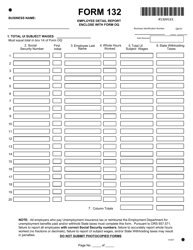

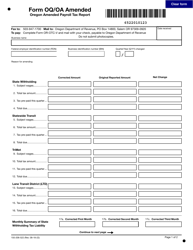

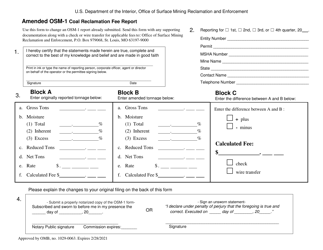

Schedule B Amended Report - Oregon

What Is Schedule B?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule B?

A: Schedule B is a form used to report certain types of income or deductions on your tax return.

Q: What is an amended report?

A: An amended report is a revision of a previously filed tax return.

Q: When should I file an amended report?

A: You should file an amended report if you need to correct errors or update information on a previously filed tax return.

Q: How do I file an amended report in Oregon?

A: To file an amended report in Oregon, you will need to complete and mail a Schedule B form to the Oregon Department of Revenue.

Q: What information do I need to include on Schedule B?

A: You will need to include information about the changes you are making, as well as any supporting documentation.

Q: Is there a deadline to file an amended report?

A: Yes, you generally have three years from the original due date of the tax return to file an amended report.

Q: Are there any penalties for filing an amended report?

A: Penalties may apply if you fail to file an amended report when required or if there are errors or omissions in the amended report.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule B by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.