This version of the form is not currently in use and is provided for reference only. Download this version of

Form SFN52923

for the current year.

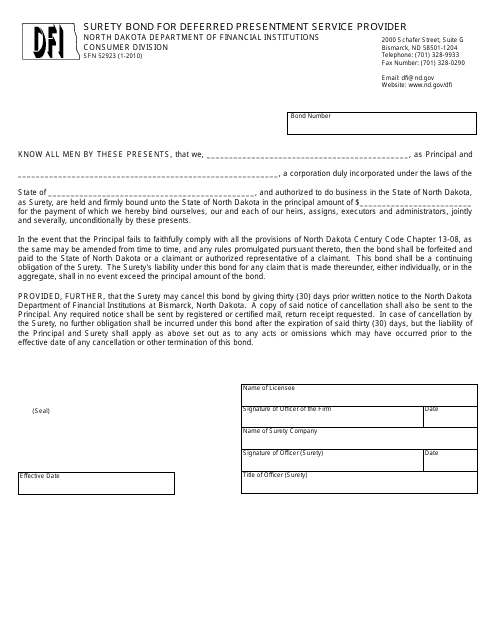

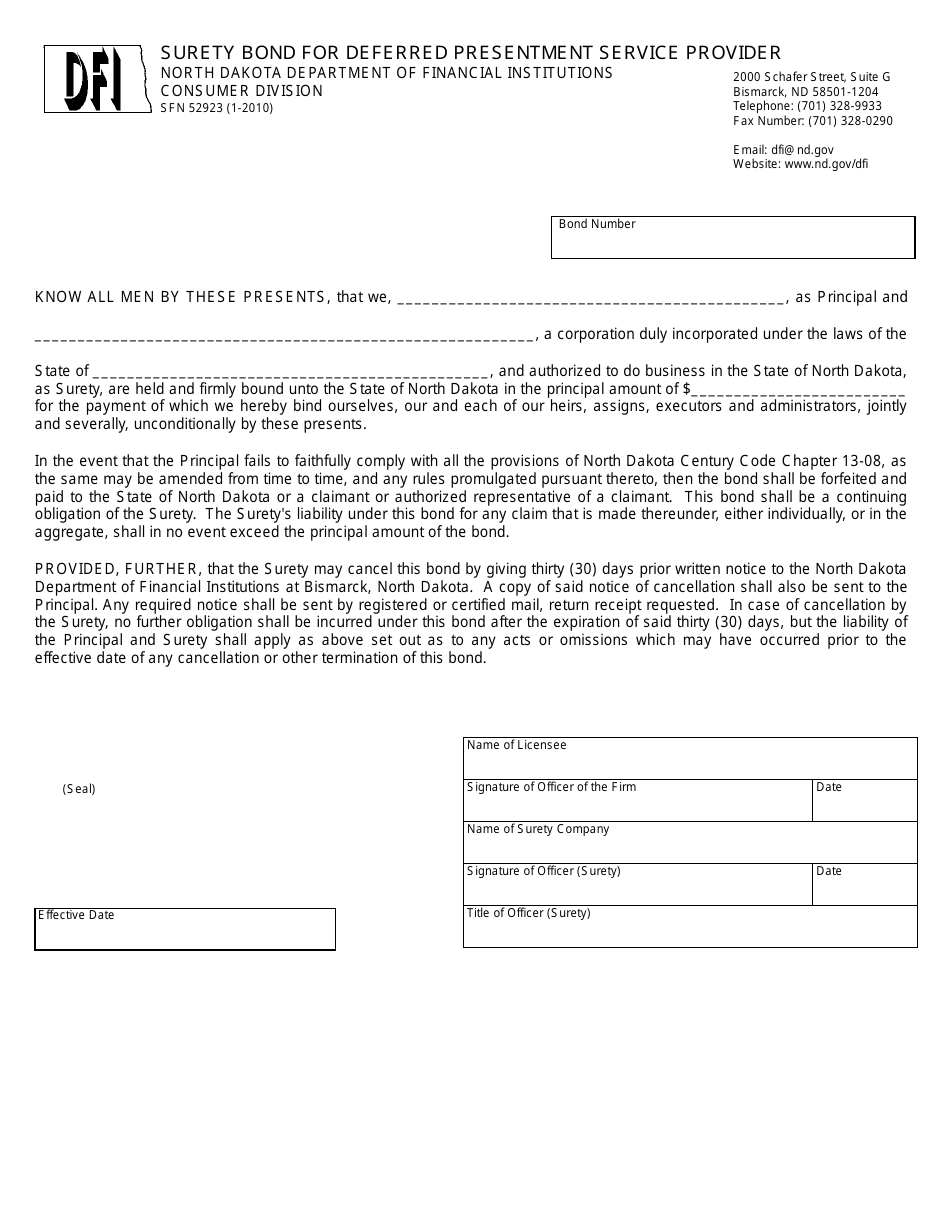

Form SFN52923 Surety Bond for Deferred Presentment Service Provider - North Dakota

What Is Form SFN52923?

This is a legal form that was released by the North Dakota Department of Financial Institutions - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN52923?

A: Form SFN52923 is a Surety Bond for Deferred Presentment Service Provider in North Dakota.

Q: What is a Surety Bond?

A: A surety bond is a type of insurance that provides financial protection to a party in case the other party fails to fulfill their obligations.

Q: What is a Deferred Presentment Service Provider?

A: A Deferred Presentment Service Provider is a business that provides short-term loans, commonly known as payday loans, to consumers.

Q: Why is a Surety Bond required for a Deferred Presentment Service Provider?

A: A Surety Bond is required to ensure that the Deferred Presentment Service Provider complies with North Dakota laws and regulations, and to protect consumers from potential financial harm.

Q: How do I obtain Form SFN52923?

A: You can obtain Form SFN52923 from the North Dakota Department of Financial Institutions.

Q: What information is required on Form SFN52923?

A: Form SFN52923 requires information about the Deferred Presentment Service Provider, including their name, address, and financial information.

Q: Is there a fee for submitting Form SFN52923?

A: Yes, there is a fee for submitting Form SFN52923. The fee amount is determined by the North Dakota Department of Financial Institutions.

Q: What happens after I submit Form SFN52923?

A: After submitting Form SFN52923, the North Dakota Department of Financial Institutions will review the application and notify the Deferred Presentment Service Provider of the bond approval or any additional requirements.

Q: How long is the Surety Bond valid for?

A: The Surety Bond is valid for one year and must be renewed annually.

Q: Can a Deferred Presentment Service Provider operate without a Surety Bond?

A: No, a Deferred Presentment Service Provider in North Dakota is required to have a valid Surety Bond in order to operate legally.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the North Dakota Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN52923 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Financial Institutions.