This version of the form is not currently in use and is provided for reference only. Download this version of

Form SFN19433

for the current year.

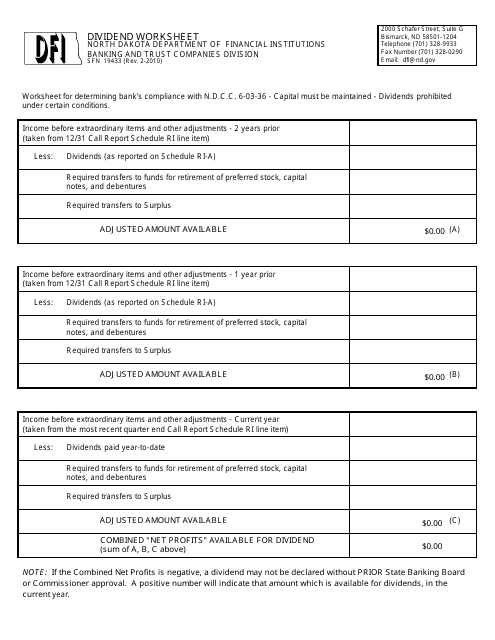

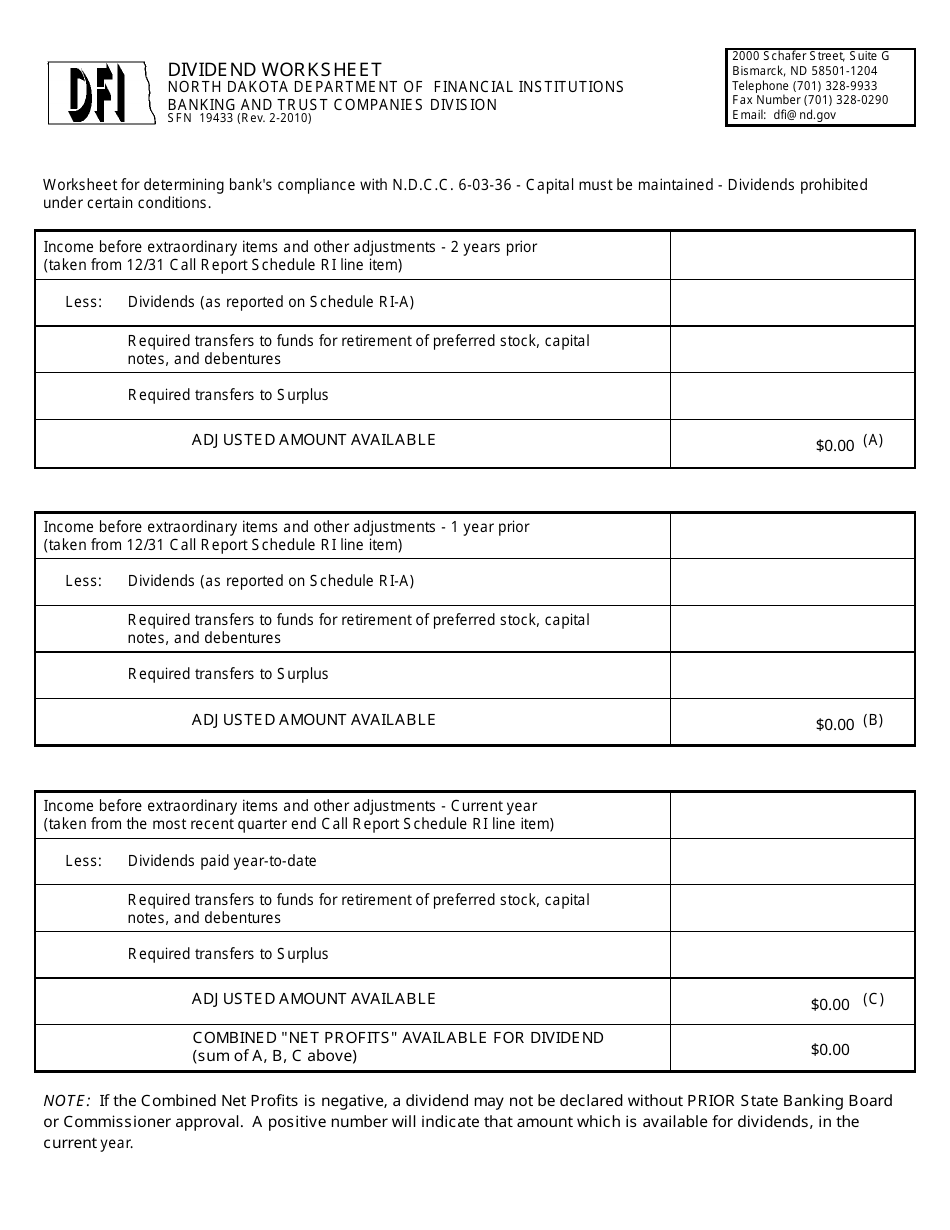

Form SFN19433 Dividend Worksheet - North Dakota

What Is Form SFN19433?

This is a legal form that was released by the North Dakota Department of Financial Institutions - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN19433?

A: Form SFN19433 is the Dividend Worksheet for North Dakota.

Q: What is the purpose of Form SFN19433?

A: The purpose of Form SFN19433 is to calculate and report dividend income in North Dakota.

Q: Who needs to file Form SFN19433?

A: Individuals or entities who received dividends in North Dakota need to file Form SFN19433.

Q: Is there a deadline for filing Form SFN19433?

A: Yes, the deadline for filing Form SFN19433 is generally April 15th of the following year.

Q: Are there any penalties for not filing Form SFN19433?

A: Yes, there may be penalties for not filing Form SFN19433 or inaccurately reporting dividend income.

Q: What information is required on Form SFN19433?

A: Form SFN19433 requires information about the taxpayer, the dividend income received, and any applicable deductions.

Q: Can I file Form SFN19433 electronically?

A: Yes, you can file Form SFN19433 electronically using the North Dakota Taxpayer Access Point (TAP) system.

Q: Do I need to keep a copy of Form SFN19433 for my records?

A: Yes, it is recommended to keep a copy of Form SFN19433 for your records in case of future inquiries or audits.

Form Details:

- Released on February 1, 2010;

- The latest edition provided by the North Dakota Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN19433 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Financial Institutions.