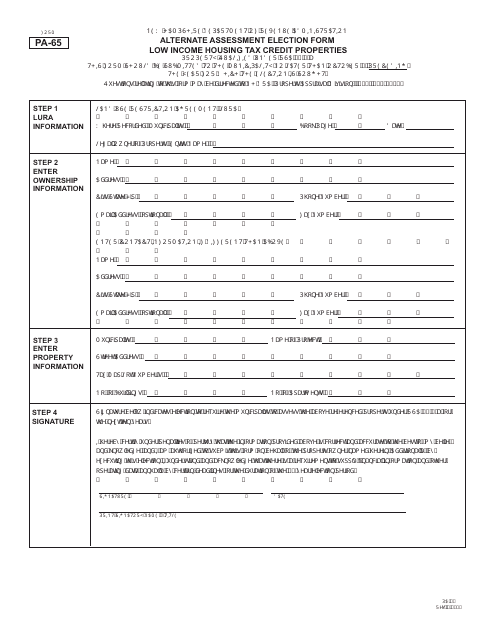

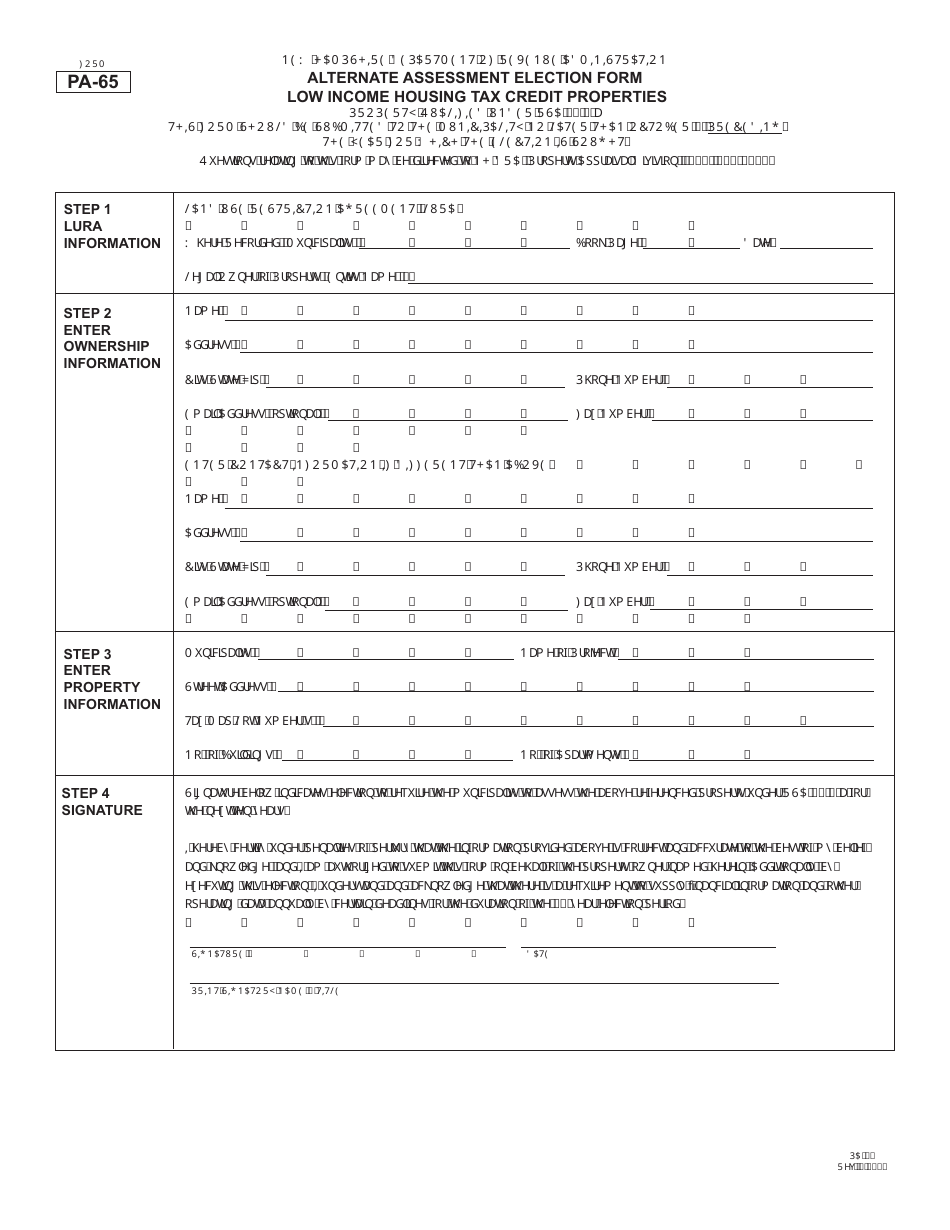

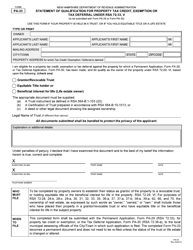

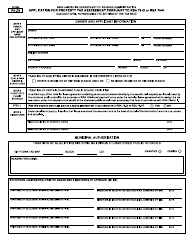

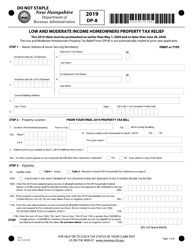

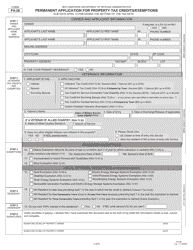

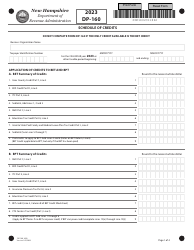

Form PA-65 Alternate Assessment Election Form Low Income Housing Tax Credit Properties - New Hampshire

What Is Form PA-65?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PA-65 Alternate Assessment Election Form?

A: The PA-65 Alternate Assessment Election Form is a tax form used in New Hampshire for low-income housing tax credit properties.

Q: What is the purpose of the PA-65 form?

A: The purpose of the PA-65 form is to elect to have the property assessed at its current use value rather than its market value for property tax purposes.

Q: Who needs to fill out the PA-65 form?

A: Owners of low-income housing tax credit properties in New Hampshire need to fill out the PA-65 form.

Q: What does the PA-65 form allow for?

A: The PA-65 form allows owners to apply for an alternate assessment method for their low-income housing tax credit properties.

Q: How does the alternate assessment method work?

A: The alternate assessment method assesses the property at its current use value, which is typically lower than its market value, resulting in lower property taxes.

Q: Are all low-income housing tax credit properties eligible for the alternate assessment method?

A: No, only properties that meet certain criteria, as outlined in the PA-65 form instructions, are eligible for the alternate assessment method.

Q: When is the deadline to file the PA-65 form?

A: The deadline to file the PA-65 form is typically April 15th of each year.

Q: Is there any fee associated with filing the PA-65 form?

A: No, there is no fee associated with filing the PA-65 form.

Q: What happens if I don't file the PA-65 form?

A: If you don't file the PA-65 form, your property will be assessed at its market value for property tax purposes.

Q: Can I appeal the assessment if I disagree with the market value?

A: Yes, you have the right to appeal the assessment if you disagree with the market value assigned to your property.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-65 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.