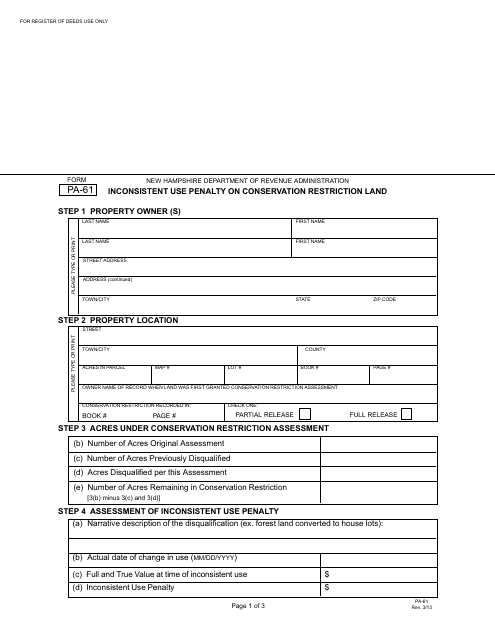

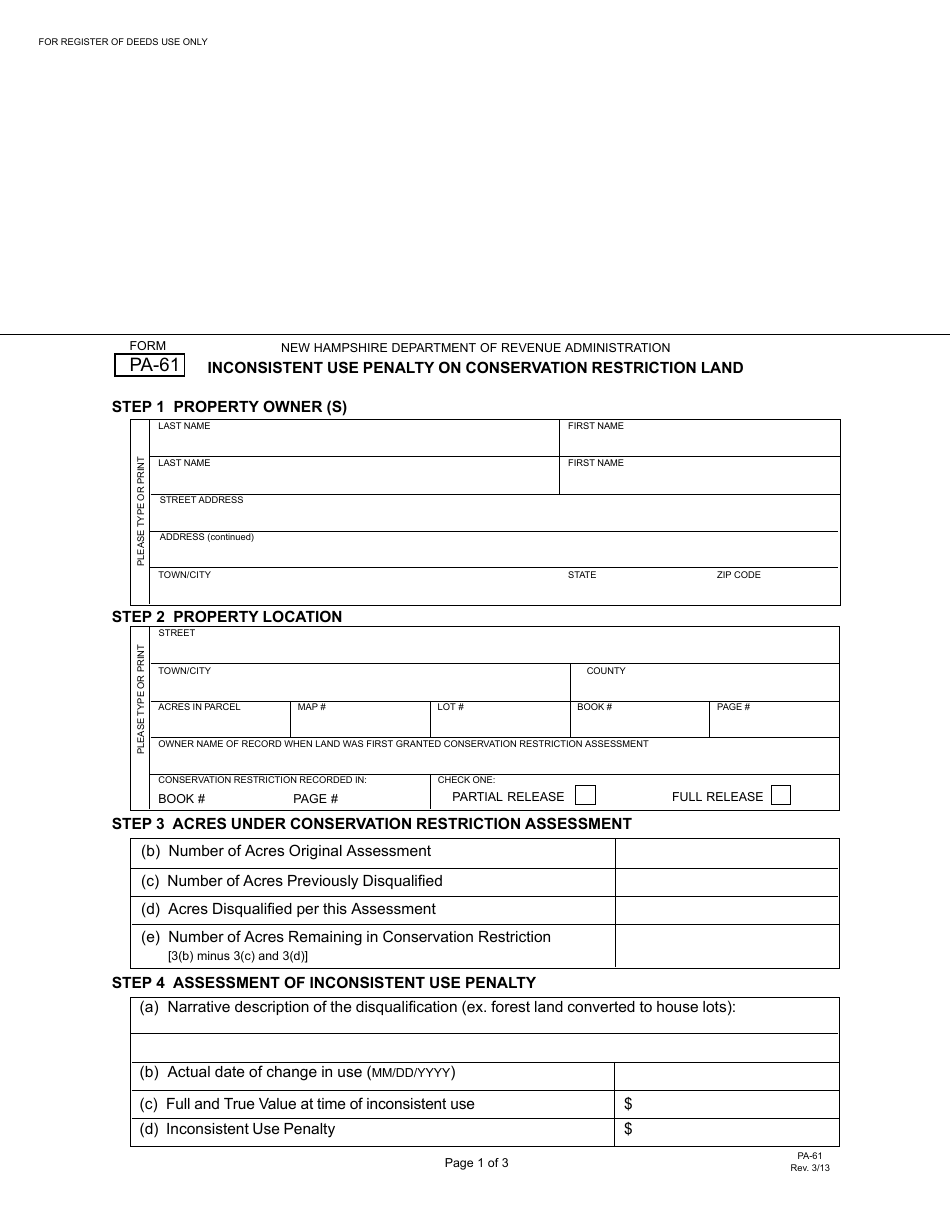

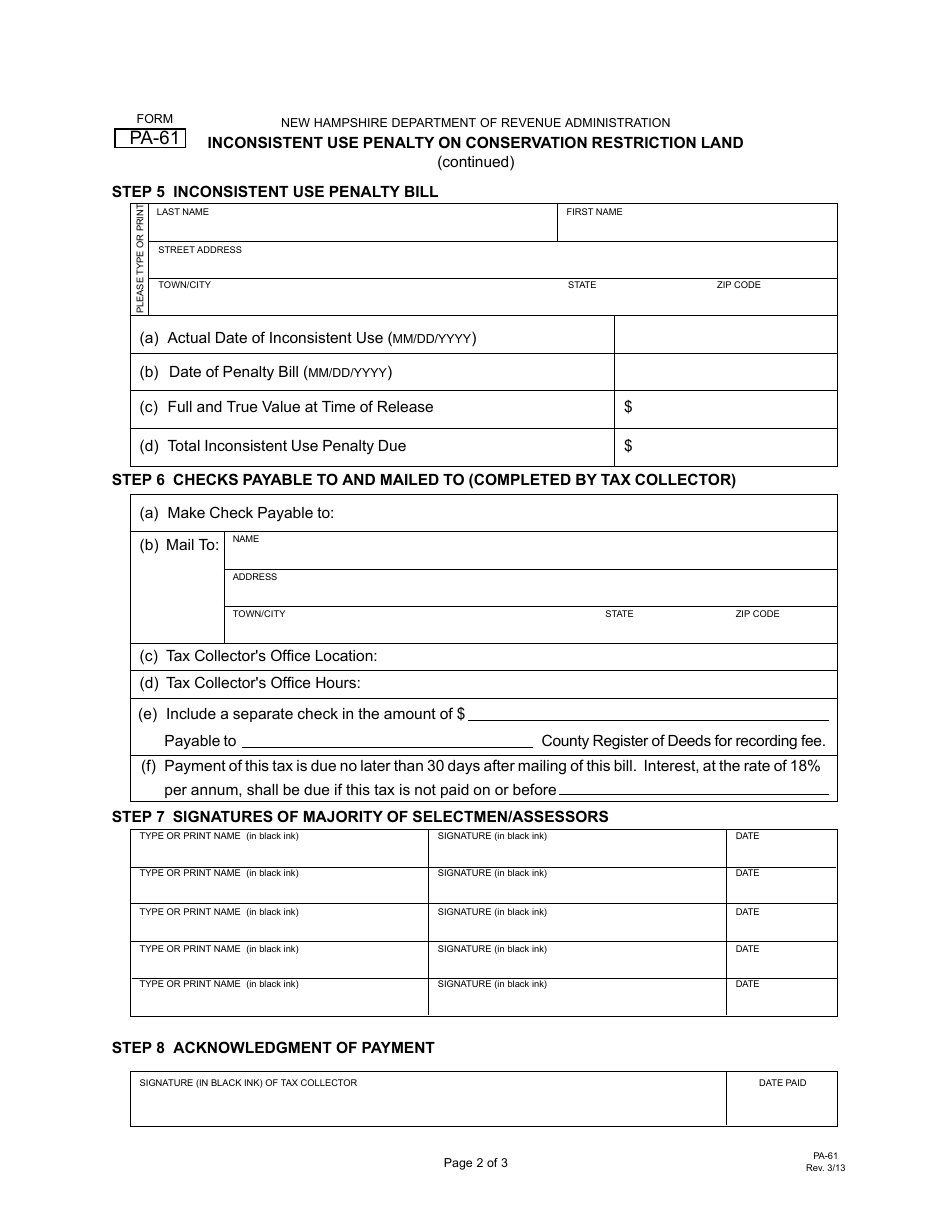

Form PA-61 Inconsistent Use Penalty on Conservation Restriction Land - New Hampshire

What Is Form PA-61?

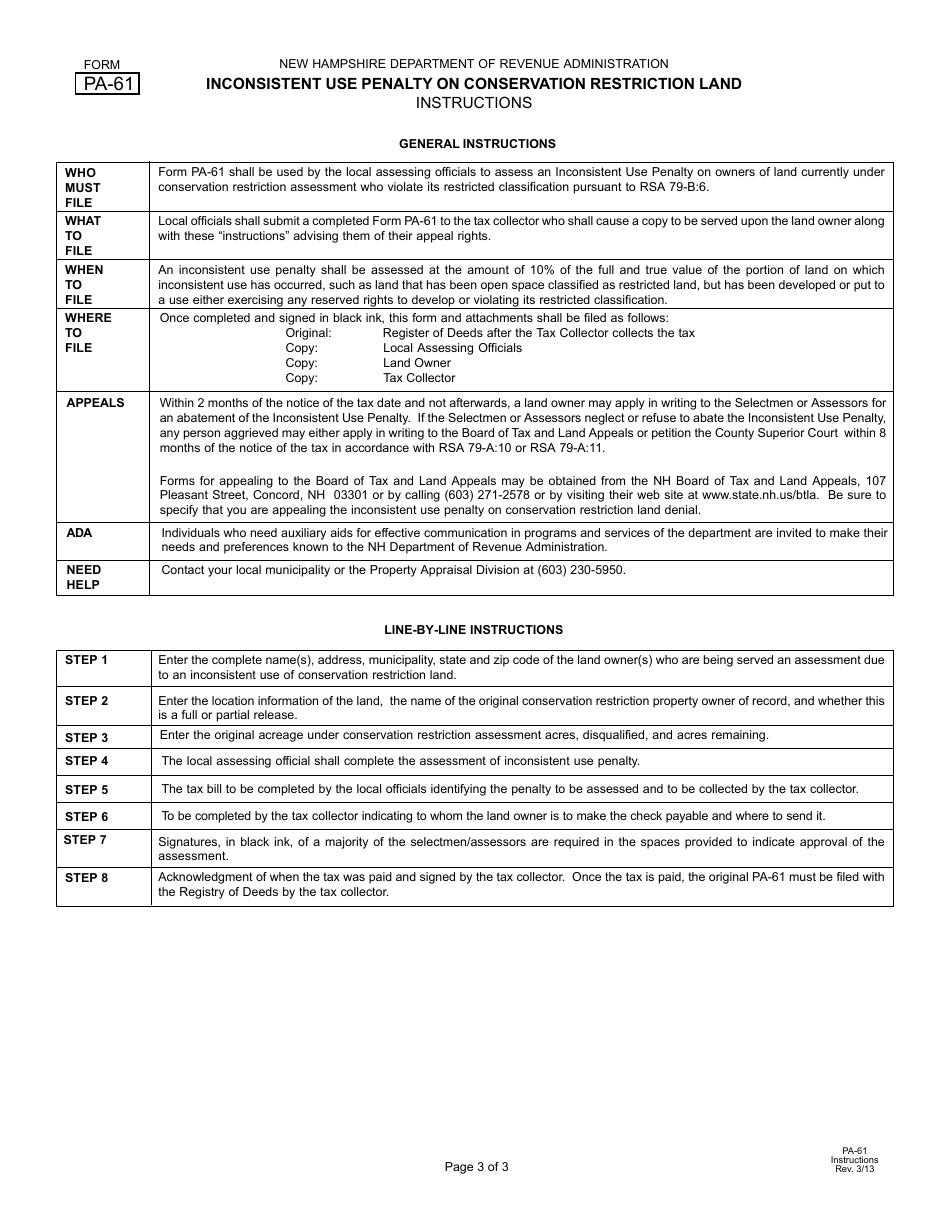

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-61?

A: Form PA-61 is a form used in New Hampshire to report inconsistent use penalty on conservation restriction land.

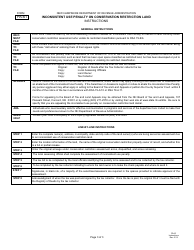

Q: What is an inconsistent use penalty?

A: An inconsistent use penalty is a penalty imposed on land that is subject to a conservation restriction when the land is not used consistently with the terms of the restriction.

Q: What is conservation restriction land?

A: Conservation restriction land is land that is subject to a legal agreement or deed that restricts certain uses of the land in order to protect its natural, scenic, or open space values.

Q: Who needs to file Form PA-61?

A: Landowners who have been assessed an inconsistent use penalty on their conservation restriction land need to file Form PA-61.

Q: What information is required on Form PA-61?

A: Form PA-61 requires the landowner to provide their name, contact information, a description of the land, and details about the inconsistent use penalty.

Q: When is Form PA-61 due?

A: Form PA-61 is due on or before April 15th of the year following the year in which the inconsistent use penalty was assessed.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-61 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.