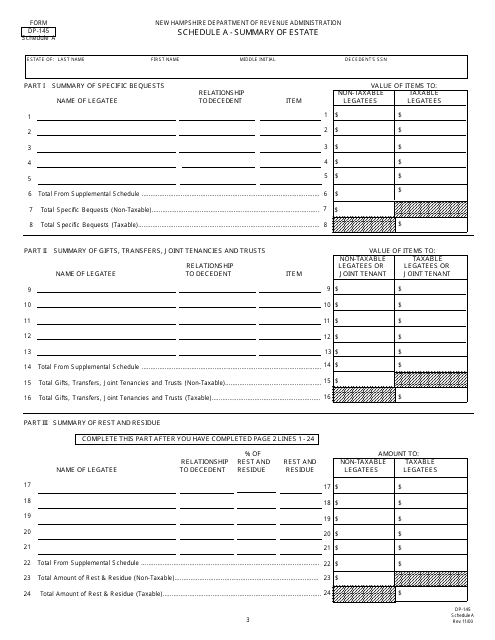

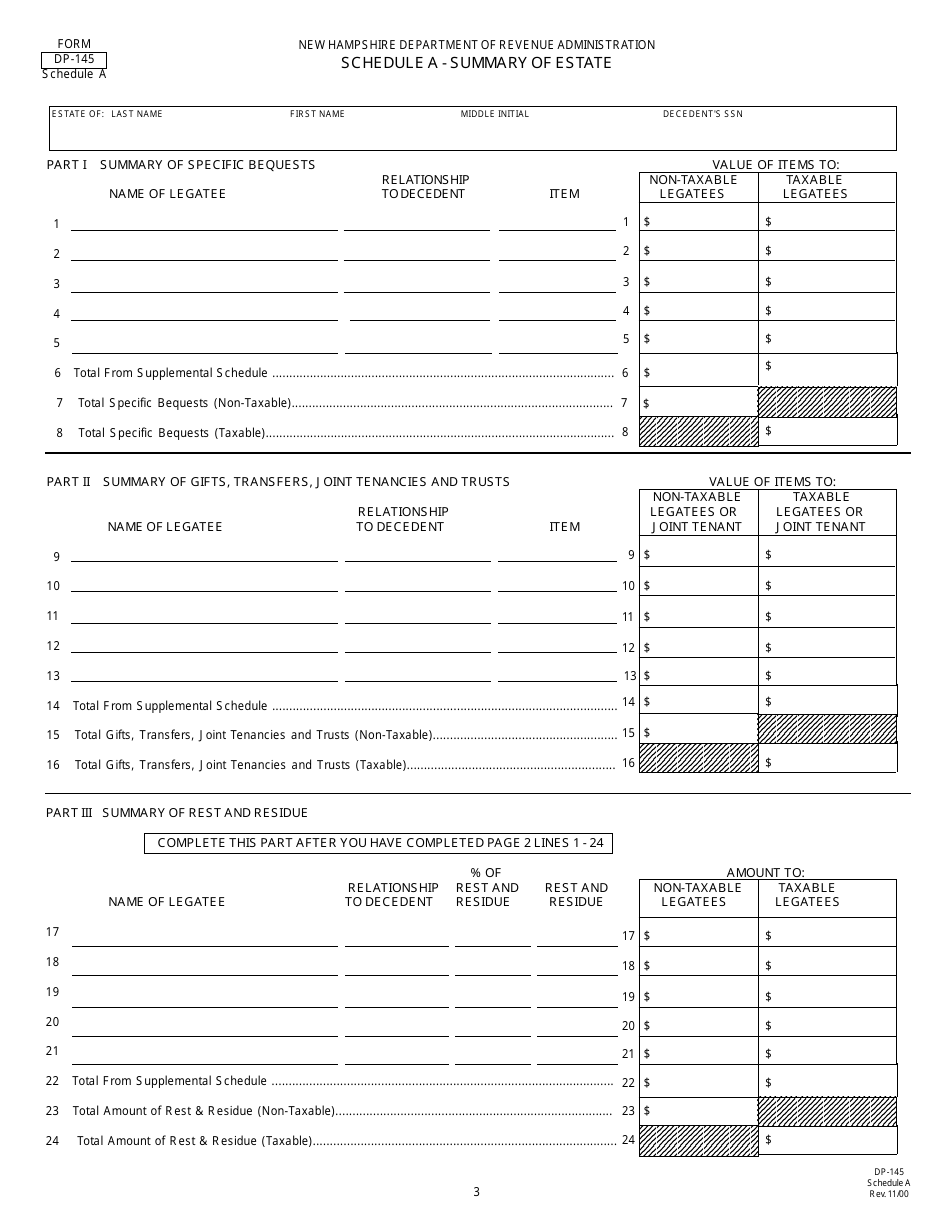

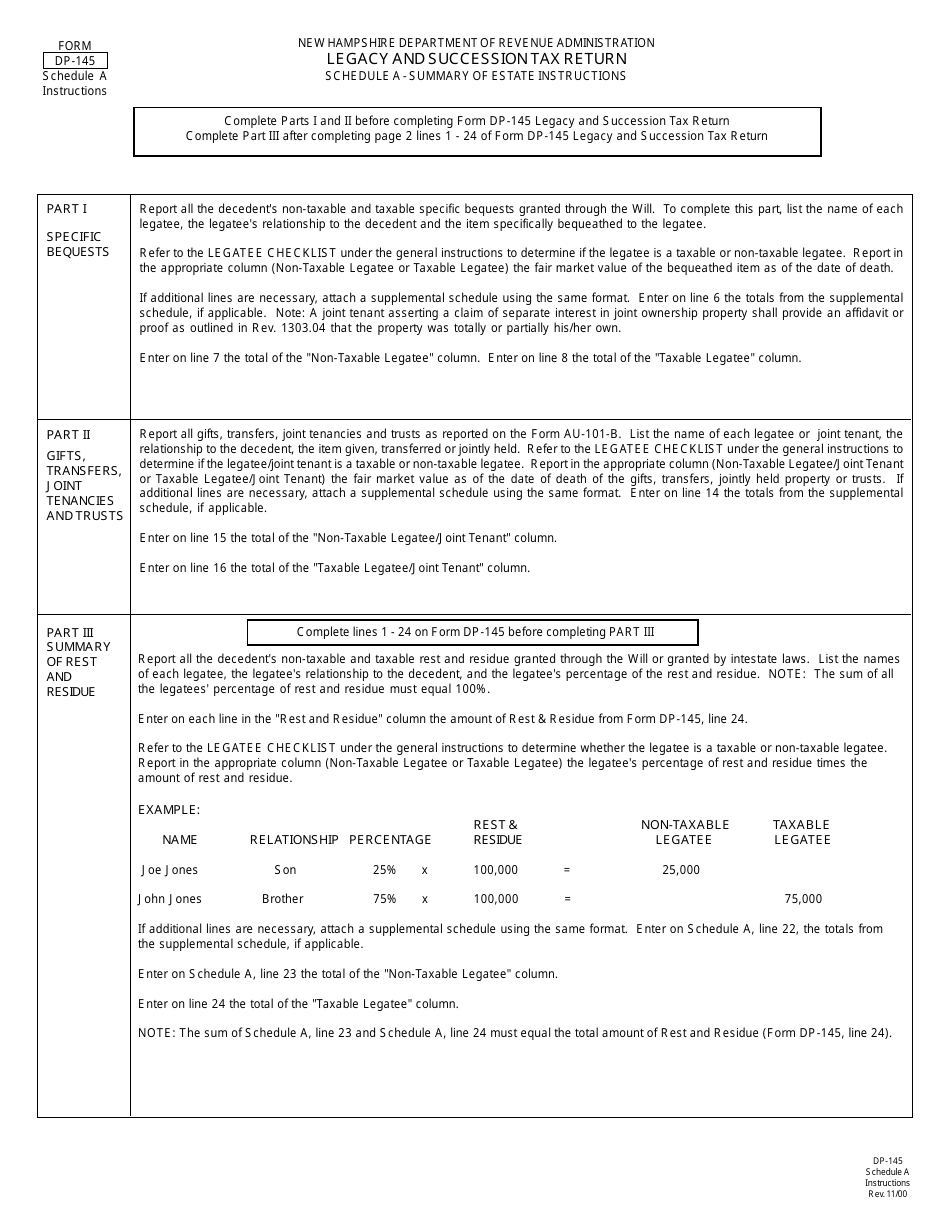

Form DP-145 Schedule A Summary of Estate - New Hampshire

What Is Form DP-145 Schedule A?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire.The document is a supplement to Form DP-145, Legacy and Succession Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-145?

A: Form DP-145 is a form used in New Hampshire to provide a summary of an estate.

Q: What is Schedule A?

A: Schedule A is a section of Form DP-145 that requires information about the assets and liabilities of the estate.

Q: What does Schedule A include?

A: Schedule A includes details of the assets and liabilities such as real estate, bank accounts, investments, debts, and taxes owed.

Q: Who needs to fill out Form DP-145?

A: The executor or personal representative of the estate needs to fill out Form DP-145.

Q: Are there any filing fees for Form DP-145?

A: There are no filing fees for Form DP-145 in New Hampshire.

Q: Is Form DP-145 required for all estates in New Hampshire?

A: Form DP-145 is required for estates with a value of $2 million or more in New Hampshire.

Form Details:

- Released on November 1, 2000;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DP-145 Schedule A by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.