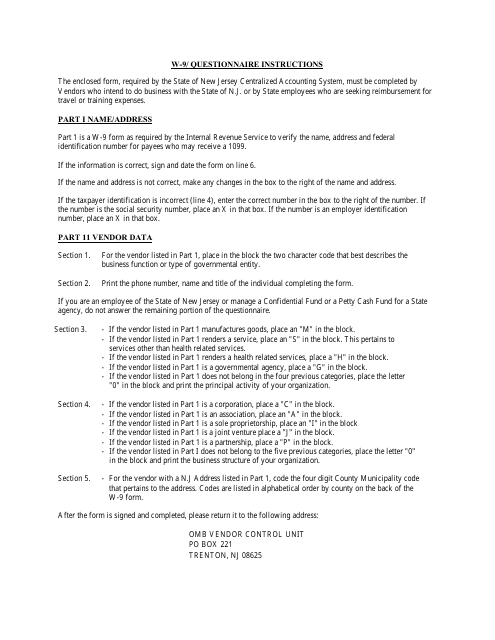

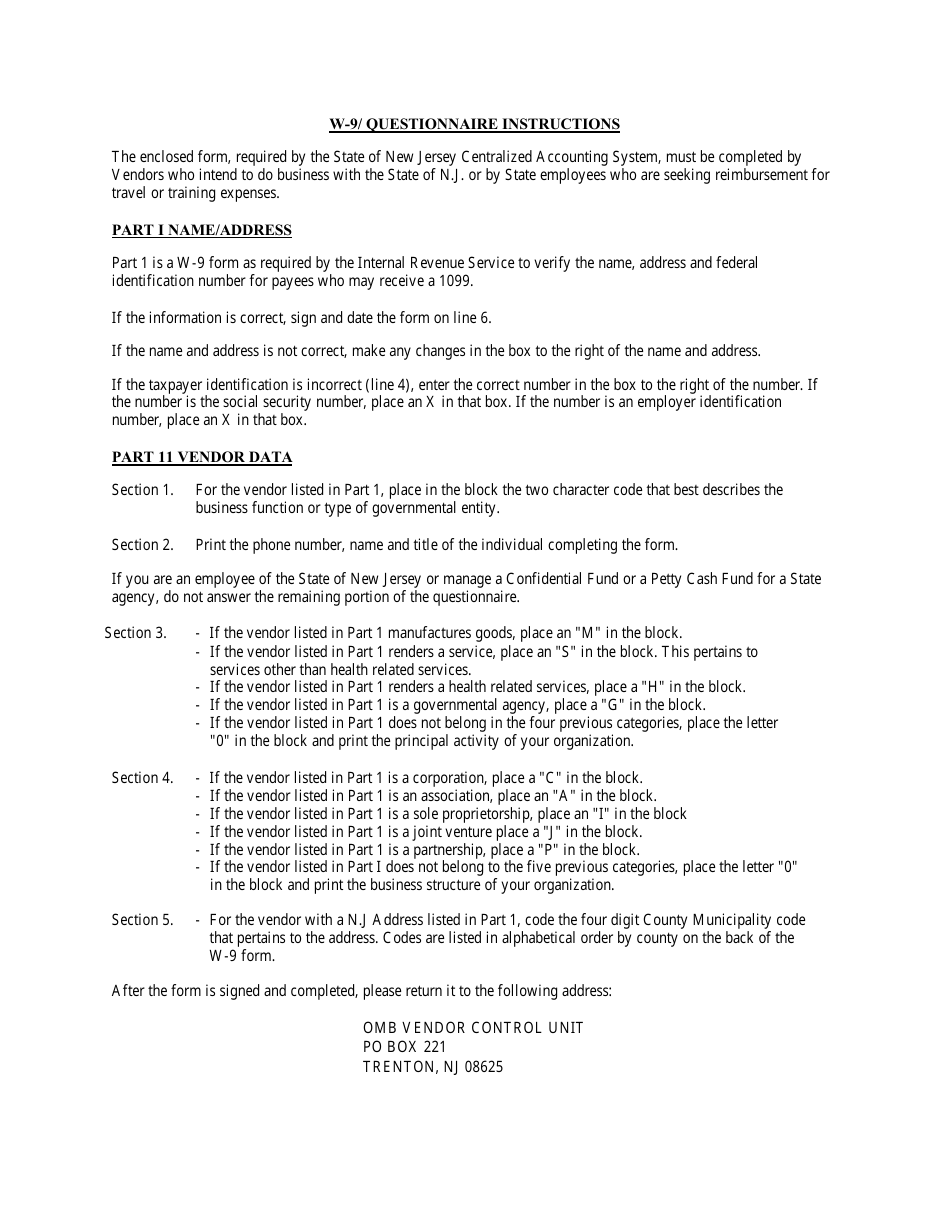

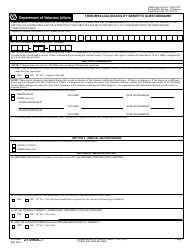

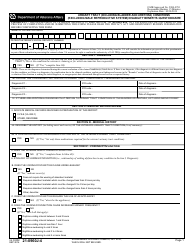

Form W-9 Questionnaire - New Jersey

What Is Form W-9?

This is a legal form that was released by the New Jersey Department of Health - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

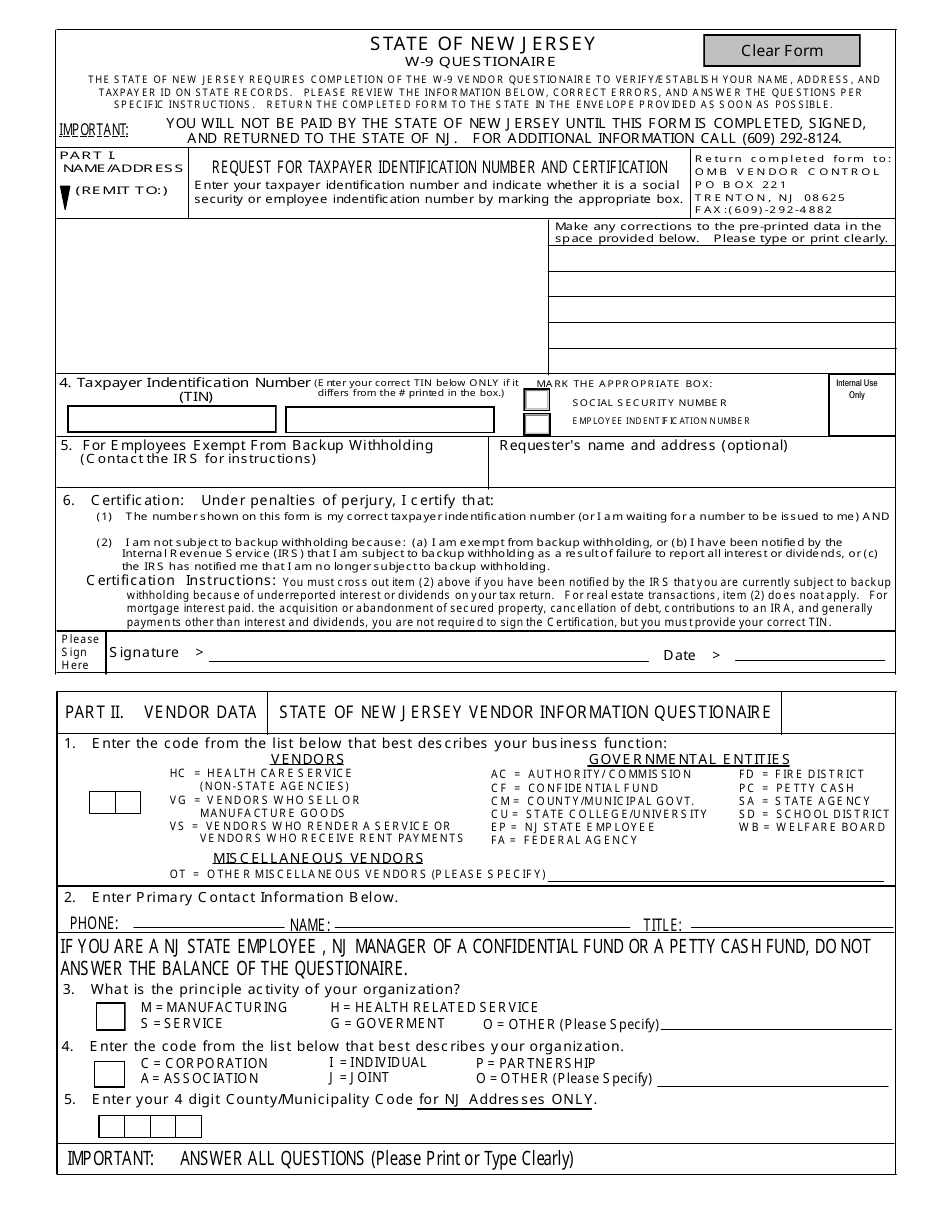

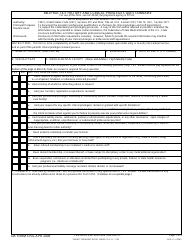

Q: What is Form W-9?

A: Form W-9 is an IRS form that individuals and businesses use to provide their taxpayer identification number (TIN) to requesters for various tax-related purposes.

Q: Who needs to fill out Form W-9?

A: Form W-9 is typically filled out by individuals or businesses that are being asked to provide their TIN to a requester, such as a company or organization that needs it for tax reporting purposes.

Q: Why do I need to fill out Form W-9?

A: You may need to fill out Form W-9 if a company or organization needs your TIN for tax reporting purposes, such as when you are providing services as an independent contractor or receiving certain types of income.

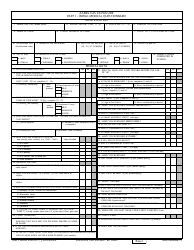

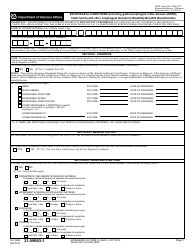

Q: What information is required on Form W-9?

A: Form W-9 asks for your name, business name (if applicable), address, taxpayer identification number (Social Security Number or Employer Identification Number), and certification that you are not subject to backup withholding.

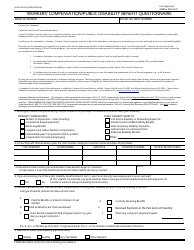

Q: Is Form W-9 specific to New Jersey?

A: No, Form W-9 is a federal form that is used nationwide and is not specific to any particular state. However, it may be requested by entities operating in New Jersey for tax reporting purposes.

Q: Do I need to include my Social Security Number on Form W-9?

A: Yes, if you are an individual, you will need to provide your Social Security Number (SSN) on Form W-9. If you are a business, you will need to provide your Employer Identification Number (EIN).

Q: Can I refuse to fill out Form W-9?

A: While you have the right to refuse to provide your taxpayer identification number, the requester may be required to withhold a percentage of your payments for tax purposes if you do not provide the necessary information.

Q: What is backup withholding?

A: Backup withholding is a withholding tax on certain payments that is required by the IRS. It is typically imposed when a taxpayer fails to provide their correct TIN, refuses to provide it, or if the IRS notifies the requester to withhold taxes.

Q: Can I use a substitute form instead of Form W-9?

A: No, if a requester specifically asks for a Form W-9, you must provide the requested information on the official Form W-9. Using a substitute form may result in your TIN not being accepted or processed correctly.

Form Details:

- The latest edition provided by the New Jersey Department of Health;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-9 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Health.