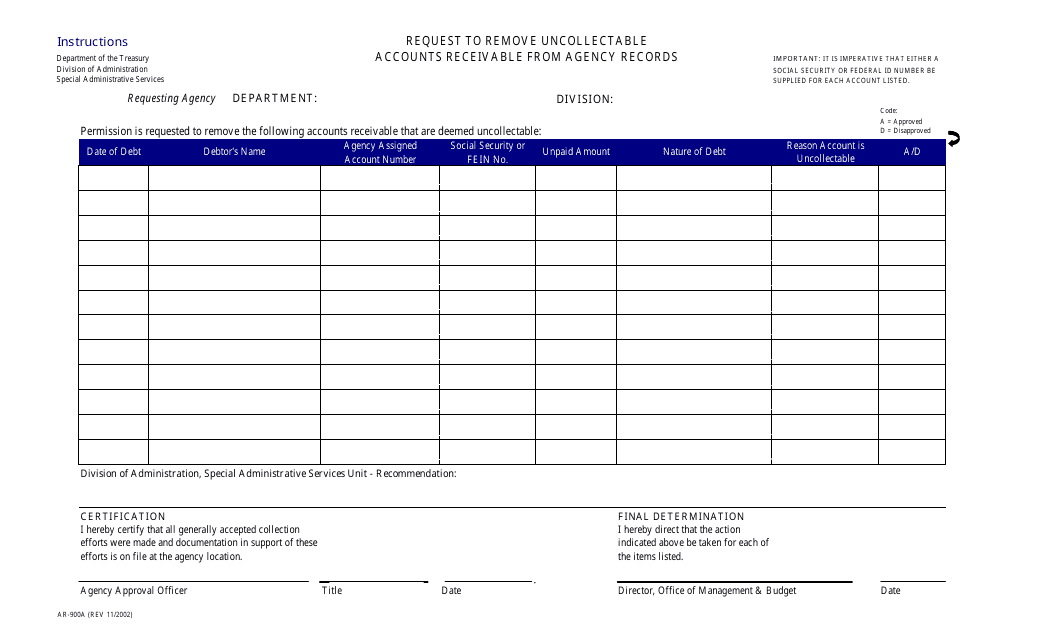

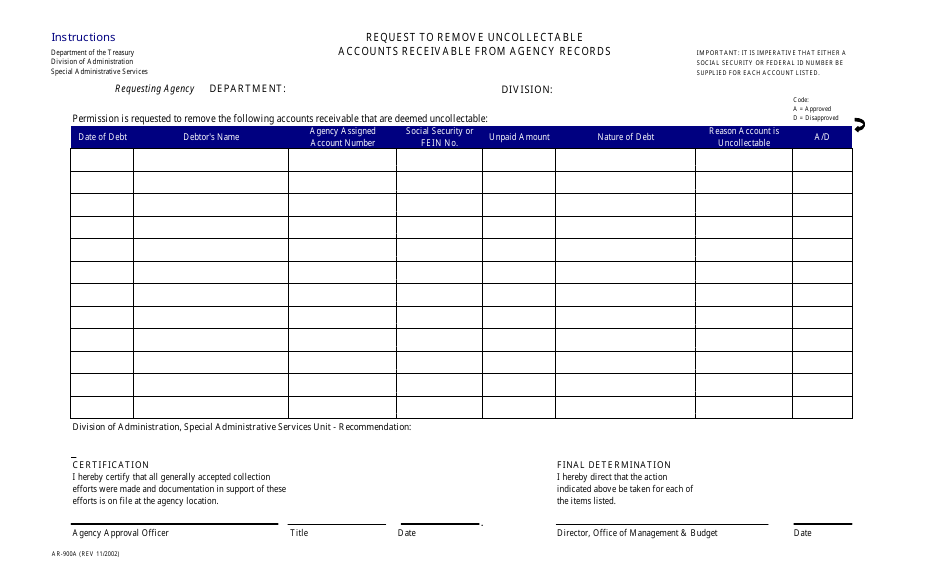

Form AR-900A Request to Remove Uncollectable Accounts Receivable From Agency Records - New Jersey

What Is Form AR-900A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR-900A?

A: Form AR-900A is a request to remove uncollectable accounts receivable from agency records in New Jersey.

Q: What is the purpose of Form AR-900A?

A: The purpose of Form AR-900A is to request the removal of uncollectable accounts receivable from agency records.

Q: Who can use Form AR-900A?

A: Any individual or business in New Jersey with uncollectable accounts receivable can use Form AR-900A.

Q: How do I obtain Form AR-900A?

A: You can obtain Form AR-900A by contacting the agency responsible for maintaining the accounts receivable records in New Jersey.

Q: What information is required on Form AR-900A?

A: Form AR-900A requires information such as the name and address of the debtor, the amount of the debt, and supporting documentation.

Q: Can I submit Form AR-900A electronically?

A: Electronic submission options may be available, but it is best to check with the specific agency for their accepted methods of submission.

Q: What happens after I submit Form AR-900A?

A: After submitting Form AR-900A, the agency will review the request and determine if the accounts receivable should be removed from their records.

Q: Is there a fee to submit Form AR-900A?

A: There may be a fee associated with submitting Form AR-900A, depending on the agency's policies. It is recommended to check with them for any applicable fees.

Q: Can I appeal a decision to remove accounts receivable?

A: Yes, if your request to remove accounts receivable is denied, you may have the option to appeal the decision. Contact the agency for more information on their appeal process.

Q: Are there any time limitations for using Form AR-900A?

A: Each agency may have specific time limitations for using Form AR-900A. It is important to check with the agency to ensure you submit the form within the designated timeframe.

Form Details:

- Released on November 1, 2002;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-900A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.