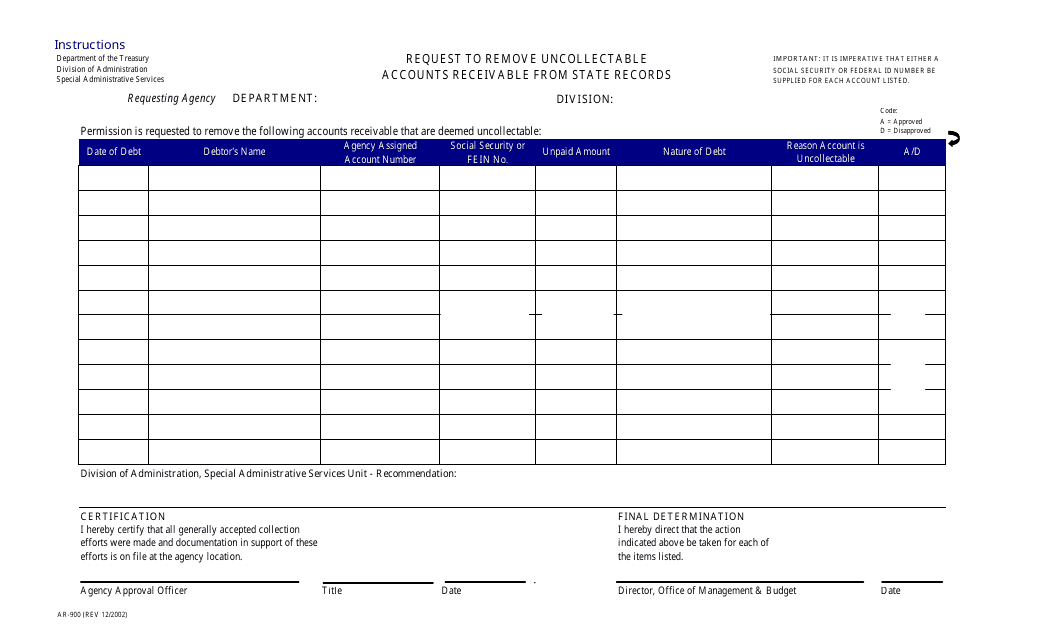

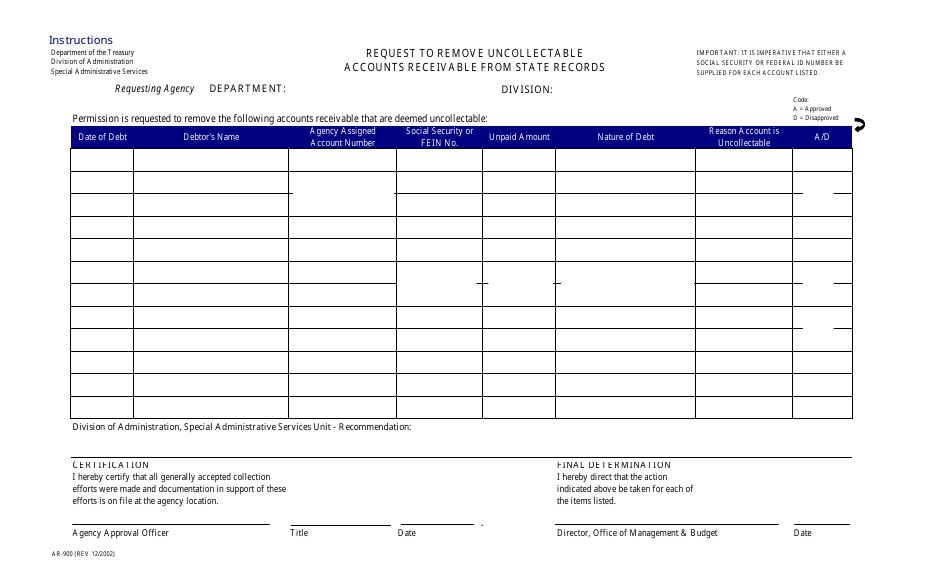

Form AR-900 Request to Remove Uncollectable Accounts Receivable From State Records - New Jersey

What Is Form AR-900?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR-900 for?

A: Form AR-900 is used to request the removal of uncollectible accounts receivable from state records in New Jersey.

Q: Who can use Form AR-900?

A: Any individual or business that has uncollectible accounts receivable in the state of New Jersey can use Form AR-900.

Q: Are there any fees associated with submitting Form AR-900?

A: No, there are no fees associated with submitting Form AR-900.

Q: What information is required on Form AR-900?

A: Form AR-900 requires information about the debtor, the amount owed, and efforts made to collect the debt.

Q: What happens after submitting Form AR-900?

A: After submitting Form AR-900, the New Jersey Department of the Treasury will review the request and determine whether the accounts receivable can be removed from state records.

Form Details:

- Released on December 1, 2002;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-900 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.