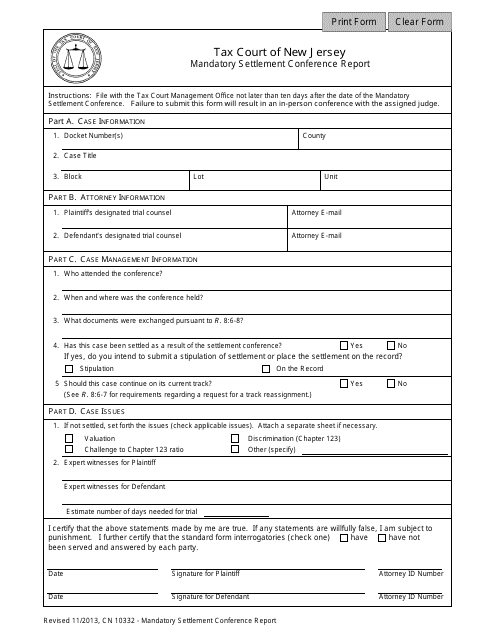

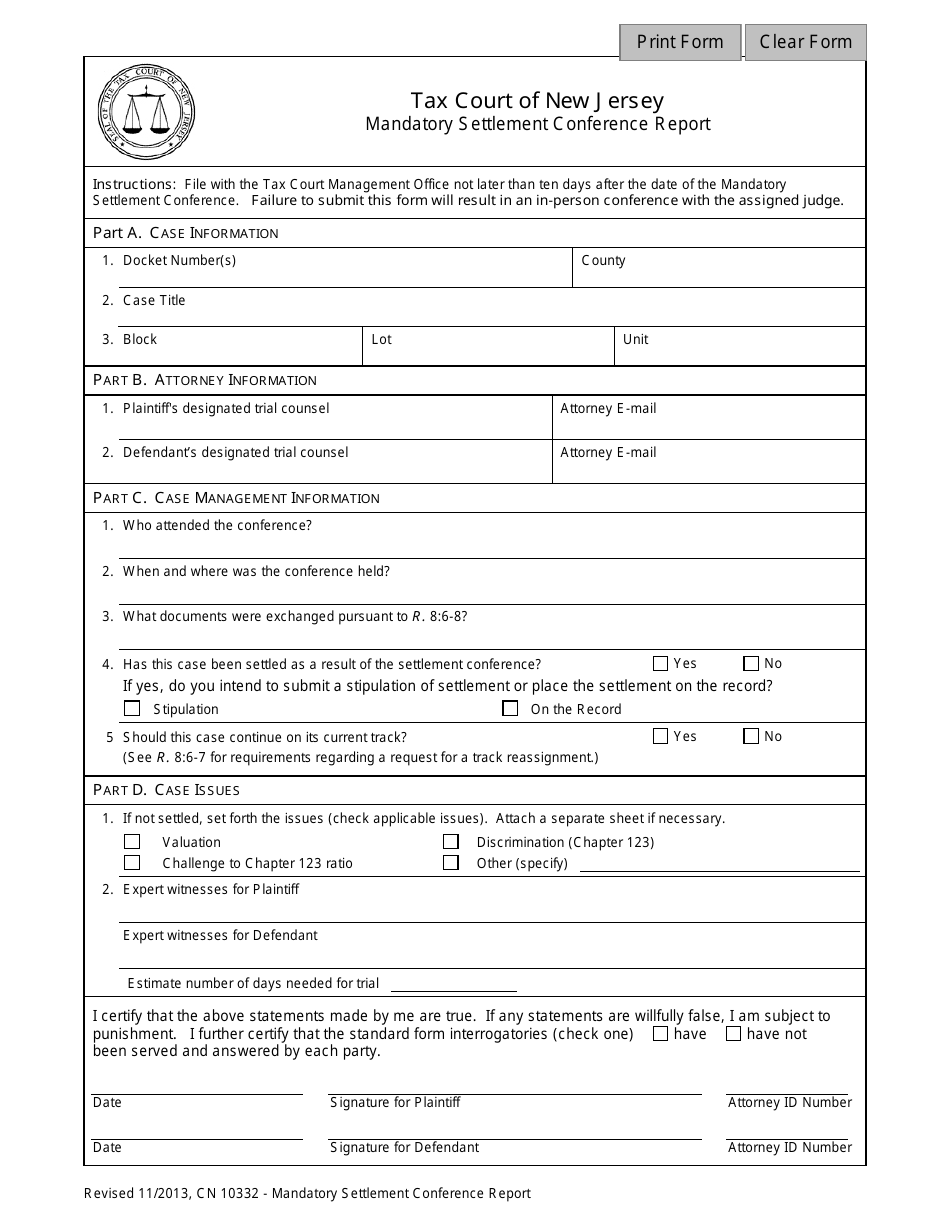

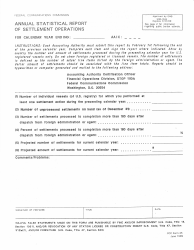

Form 10332 Mandatory Settlement Conference Report - New Jersey

What Is Form 10332?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10332?

A: Form 10332 is the Mandatory Settlement Conference Report used in New Jersey.

Q: When is Form 10332 used?

A: Form 10332 is used for mandatory settlement conferences in New Jersey.

Q: What is a mandatory settlement conference?

A: A mandatory settlement conference is a meeting between parties in a legal case to try and reach an agreement before going to trial.

Q: Who should complete Form 10332?

A: Form 10332 should be completed by the parties involved in the legal case and their attorneys.

Q: What information is required on Form 10332?

A: Form 10332 includes questions about the case, the parties involved, and settlement options.

Q: Is Form 10332 mandatory?

A: Yes, Form 10332 is mandatory for settlement conferences in New Jersey.

Q: What happens after Form 10332 is completed?

A: After Form 10332 is completed, it is submitted to the court and a settlement conference may be scheduled.

Q: Can Form 10332 be amended?

A: Yes, Form 10332 can be amended if there are changes to the case or settlement options.

Q: Are settlement conferences binding?

A: Settlement conferences are not binding, but the parties may reach a voluntary agreement that can be submitted to the court for approval.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10332 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.