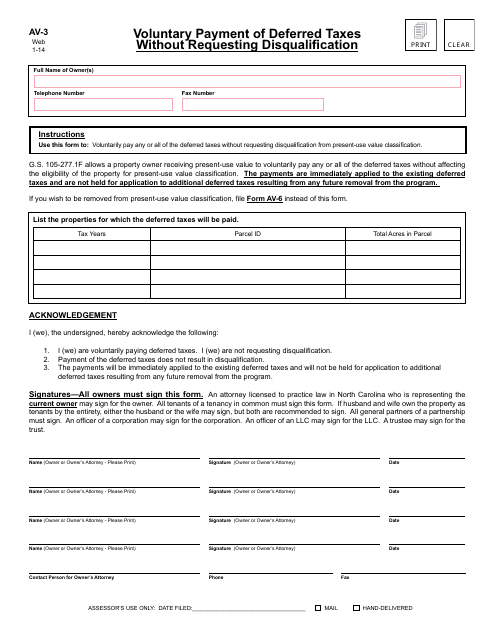

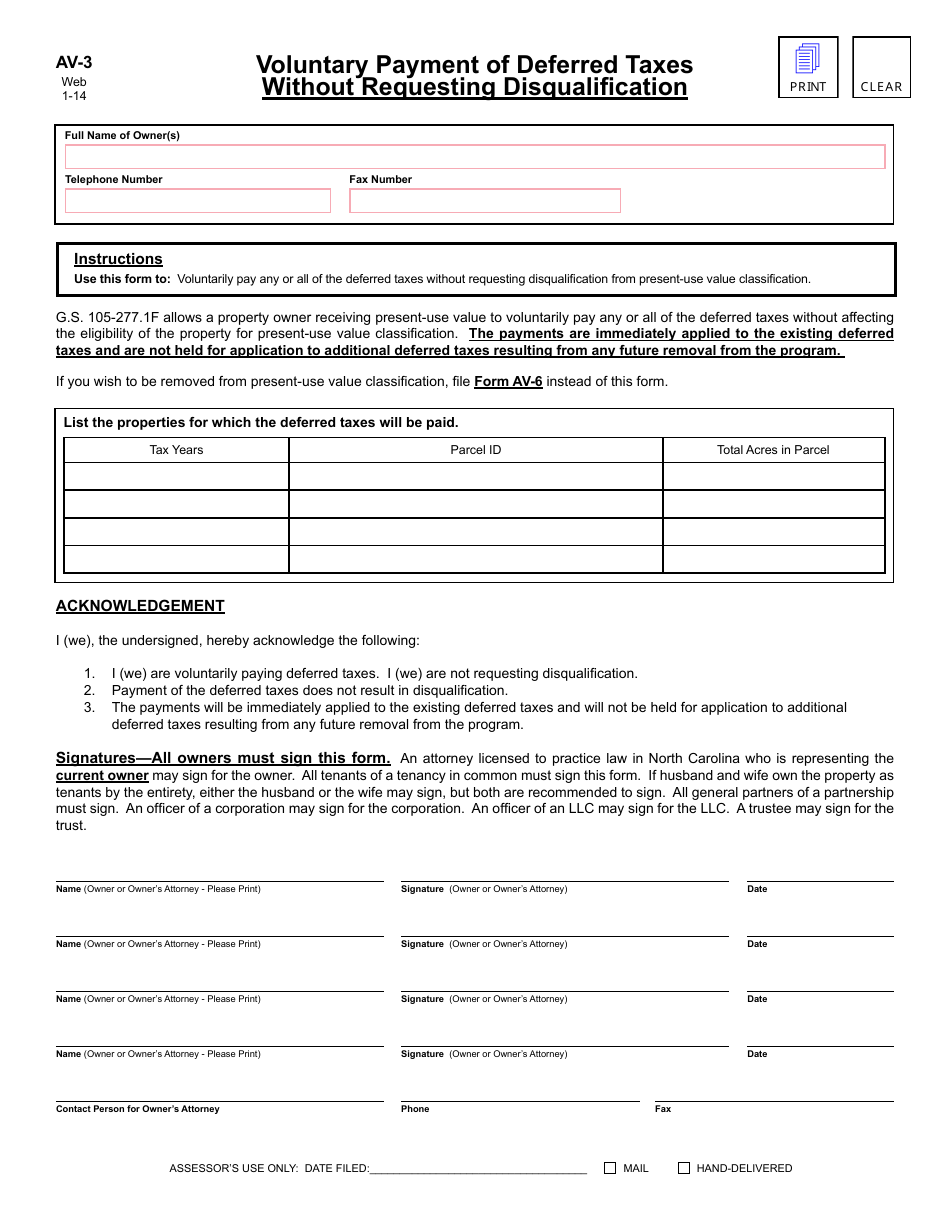

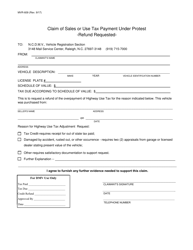

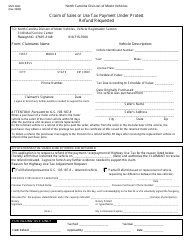

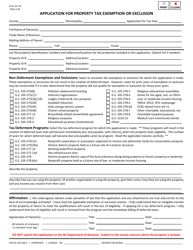

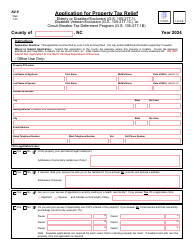

Form AV-3 Voluntary Payment of Deferred Taxes Without Requesting Disqualification - North Carolina

What Is Form AV-3?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AV-3?

A: Form AV-3 is a tax form used in North Carolina.

Q: What is the purpose of Form AV-3?

A: The purpose of Form AV-3 is to make voluntary payment of deferred taxes without requesting disqualification.

Q: Who can use Form AV-3?

A: Any taxpayer in North Carolina who wants to make voluntary payment of deferred taxes without requesting disqualification can use Form AV-3.

Q: What are deferred taxes?

A: Deferred taxes are taxes that have been postponed or delayed and are still owed at a later date.

Q: What is disqualification in relation to Form AV-3?

A: Disqualification in relation to Form AV-3 refers to the removal of eligibility or exclusion from a particular tax program or benefit.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-3 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.