This version of the form is not currently in use and is provided for reference only. Download this version of

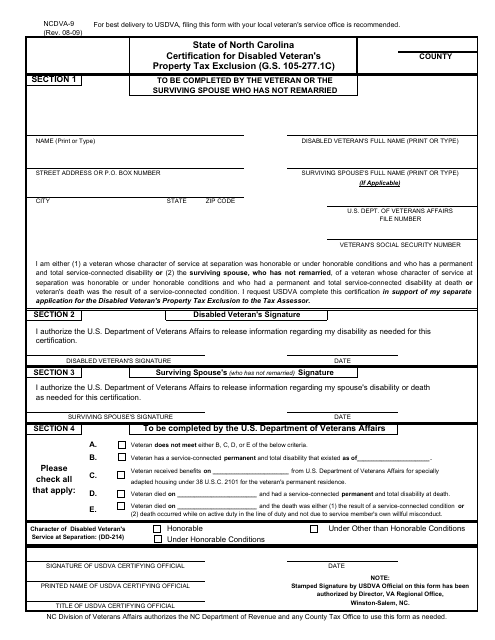

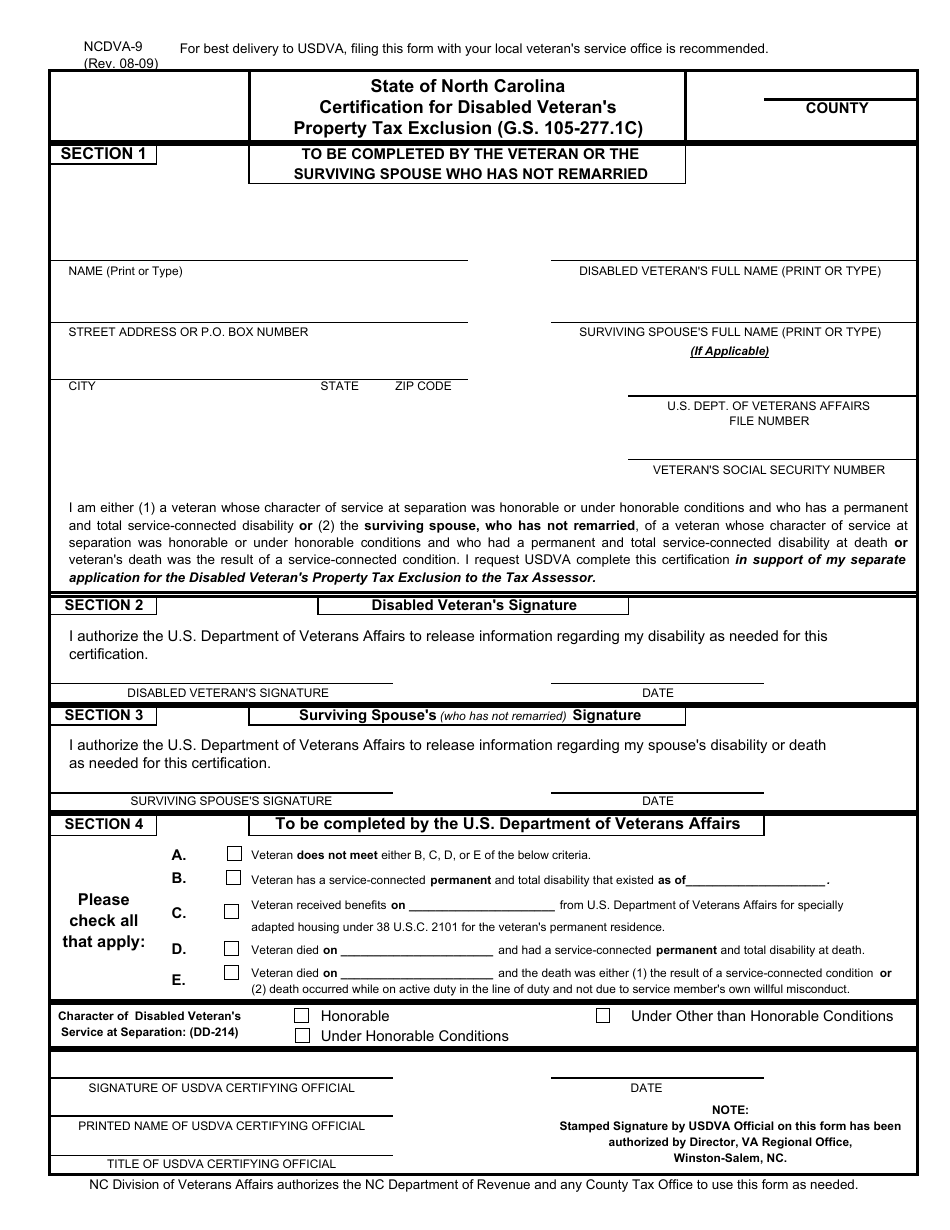

Form NCDVA-9

for the current year.

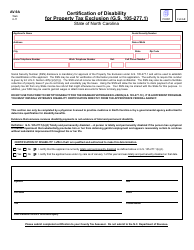

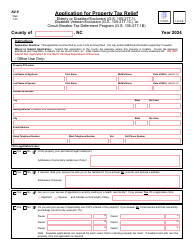

Form NCDVA-9 Certification of Disabled Veteran's for Property Tax Exclusion - North Carolina

What Is Form NCDVA-9?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NCDVA-9?

A: Form NCDVA-9 is the document used to certify disabled veterans for property tax exclusion in North Carolina.

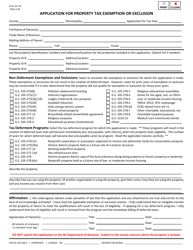

Q: Who is eligible for property tax exclusion in North Carolina?

A: Disabled veterans are eligible for property tax exclusion in North Carolina.

Q: What is the purpose of Form NCDVA-9?

A: Form NCDVA-9 is used to certify a disabled veteran's eligibility for property tax exclusion in North Carolina.

Q: How do I fill out Form NCDVA-9?

A: You need to provide your personal information as a disabled veteran and provide necessary supporting documentation.

Q: What documents do I need to submit with Form NCDVA-9?

A: You will need to submit documentation such as proof of disability and proof of service.

Q: Are there any deadlines for submitting Form NCDVA-9?

A: The deadline for submitting Form NCDVA-9 varies, so it is important to check with the North Carolina Department of Veterans Affairs.

Q: What are the benefits of property tax exclusion for disabled veterans?

A: Property tax exclusion can significantly reduce the tax burden for disabled veterans in North Carolina.

Q: Can I apply for property tax exclusion if I am not a disabled veteran?

A: No, property tax exclusion is only available for disabled veterans in North Carolina.

Q: Does property tax exclusion apply to all properties owned by a disabled veteran?

A: Property tax exclusion may apply to a primary residence and limited additional properties owned by a disabled veteran in North Carolina.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NCDVA-9 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.