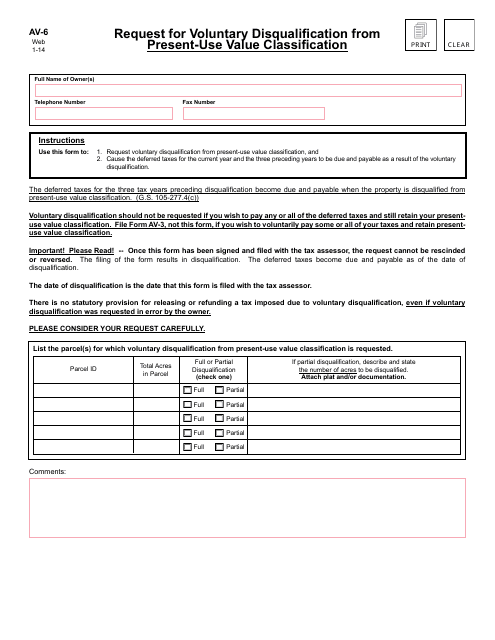

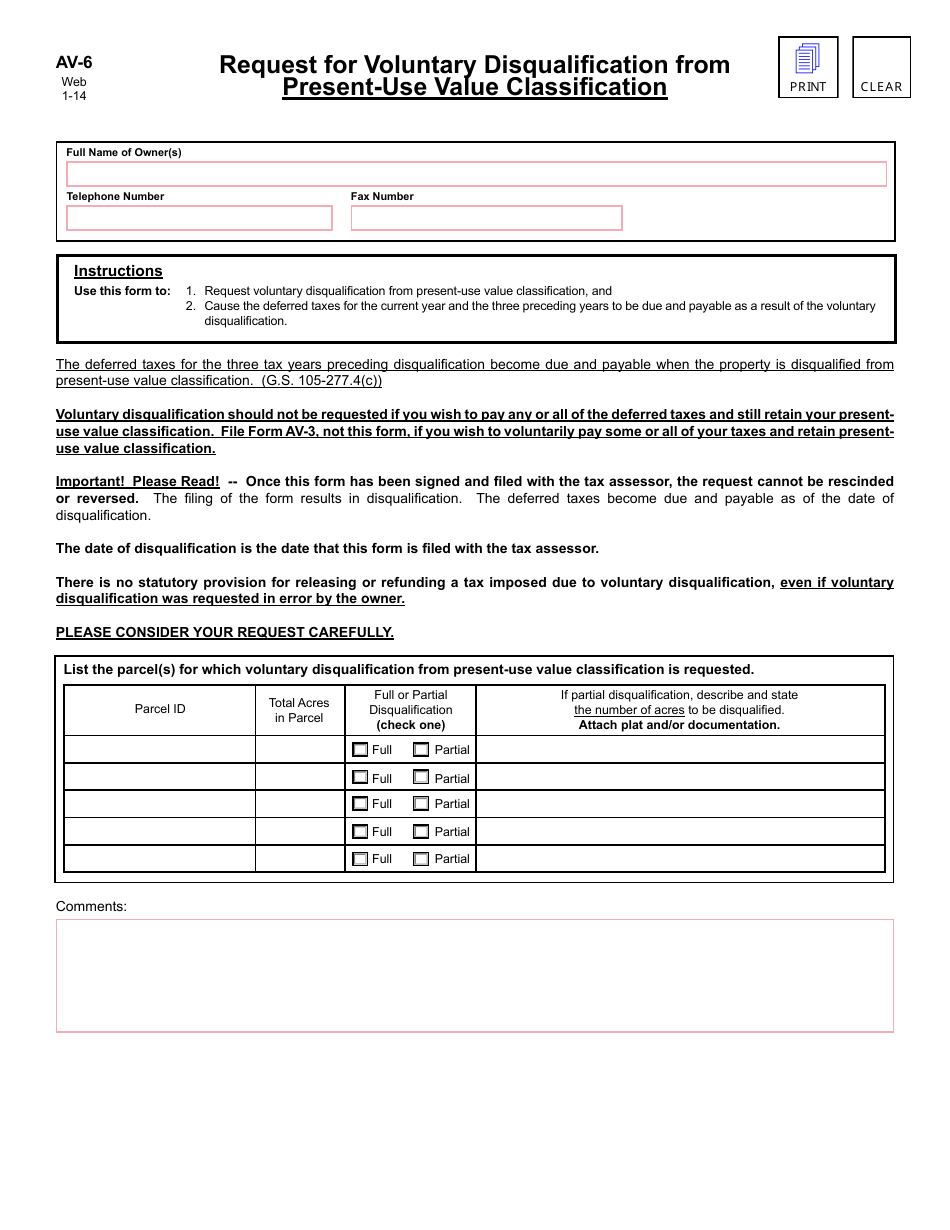

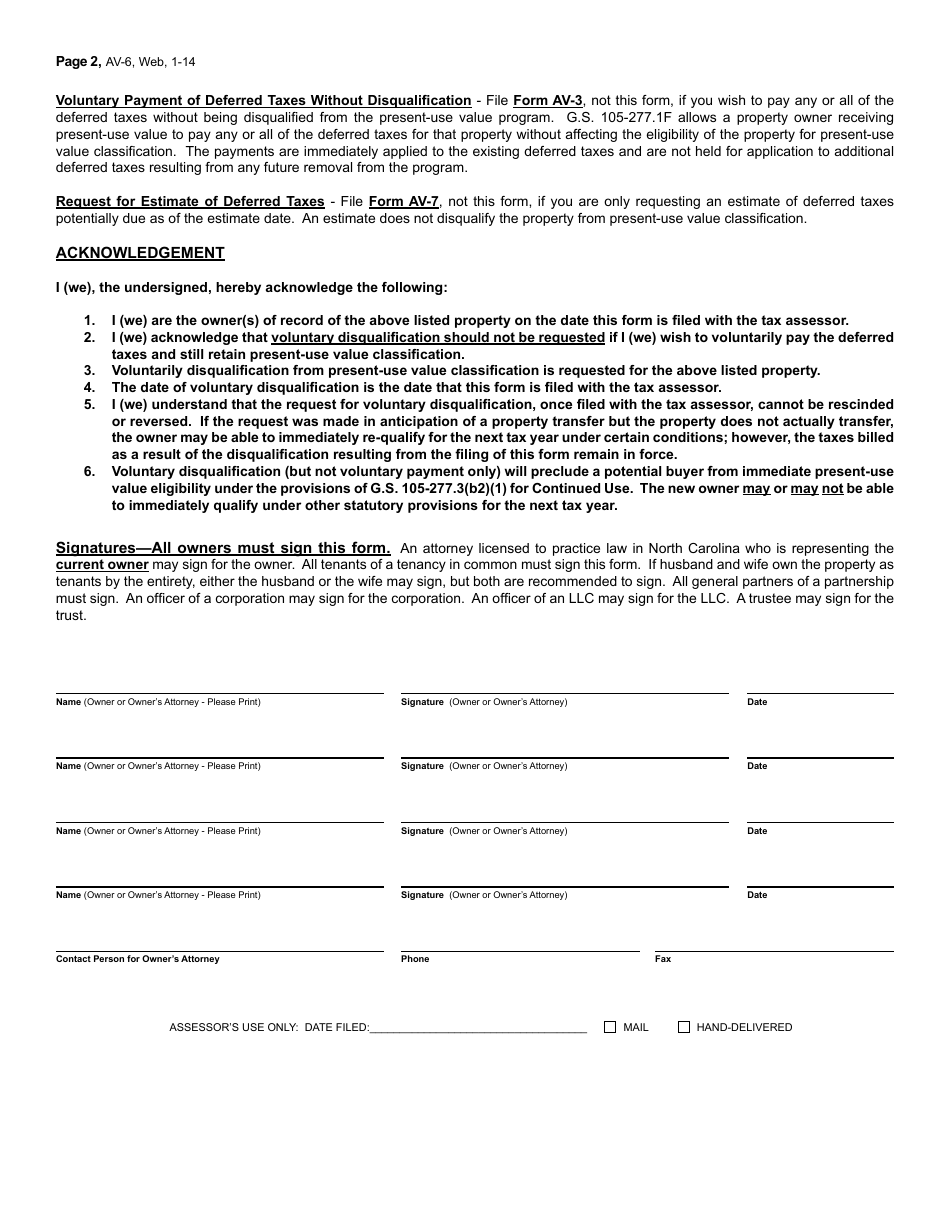

Form AV-6 Request for Voluntary Disqualification From Present-Use Value Classification - North Carolina

What Is Form AV-6?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AV-6?

A: Form AV-6 is a document used in North Carolina to request voluntary disqualification from present-use value classification.

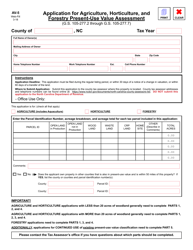

Q: What is present-use value classification?

A: Present-use value classification is a program in North Carolina that allows certain agricultural, horticultural, and forestry properties to be assessed at a lower tax value.

Q: Who can use Form AV-6?

A: Anyone who is currently receiving present-use value classification for their property in North Carolina can use Form AV-6 to request voluntary disqualification.

Q: Why would someone want to request voluntary disqualification?

A: Someone may want to request voluntary disqualification if they no longer meet the eligibility requirements for present-use value classification or if they want to discontinue the program.

Q: What information is required on Form AV-6?

A: Form AV-6 requires information about the property, the owner, and the reasons for requesting voluntary disqualification.

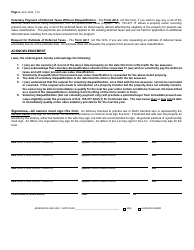

Q: Is there a deadline to submit Form AV-6?

A: Yes, Form AV-6 must be submitted to the county tax office no later than January 31st of the year for which disqualification is requested.

Q: Are there any fees associated with requesting voluntary disqualification?

A: There may be fees associated with processing the request, which vary by county. It is best to contact the county tax office for information on fees.

Q: What happens after submitting Form AV-6?

A: After submitting Form AV-6, the county tax office will review the request and make a determination on whether to approve or deny the voluntary disqualification.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-6 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.