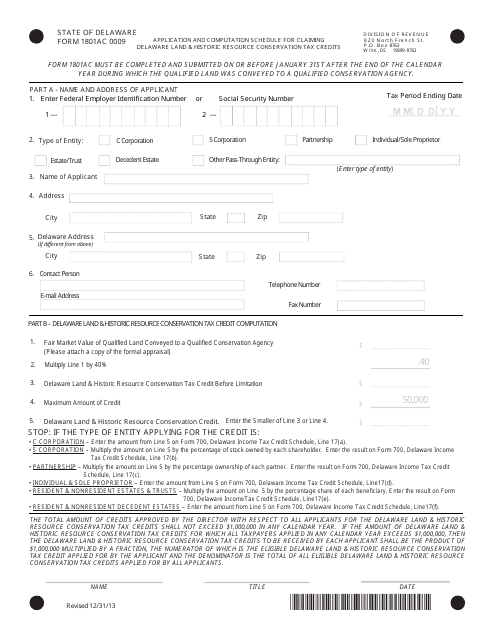

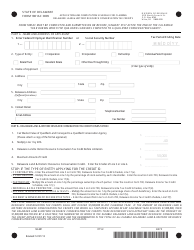

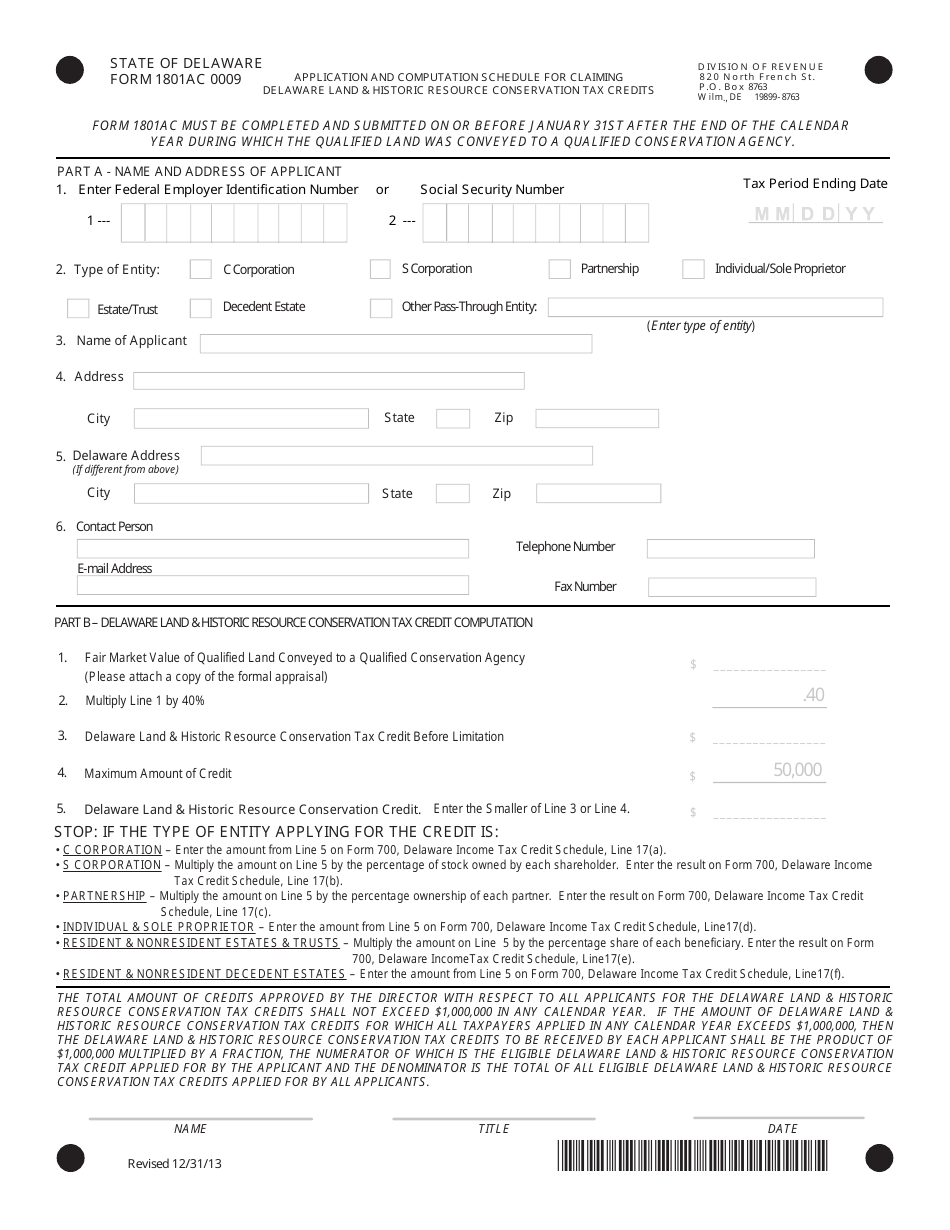

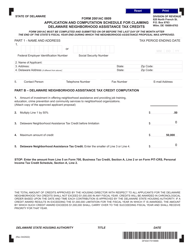

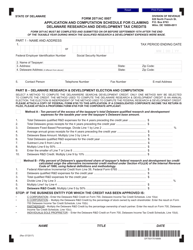

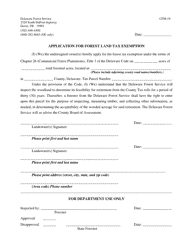

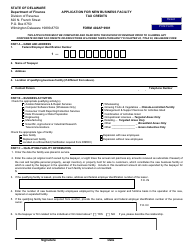

Form 1801AC 0009 Application and Computation Schedule for Claiming Delaware Land & Historic Resource Conservation Tax Credits - Delaware

What Is Form 1801AC 0009?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1801AC 0009?

A: Form 1801AC 0009 is the Application and Computation Schedule for Claiming Delaware Land & Historic Resource Conservation Tax Credits.

Q: What are Delaware Land & Historic Resource Conservation Tax Credits?

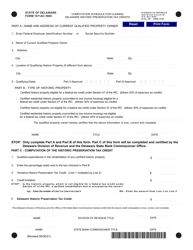

A: Delaware Land & Historic Resource Conservation Tax Credits are tax credits provided by the state of Delaware for preserving land and historic resources.

Q: Who can use Form 1801AC 0009?

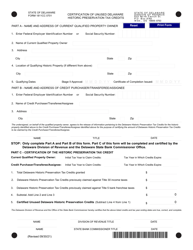

A: Individuals or organizations who are eligible for Delaware Land & Historic Resource Conservation Tax Credits can use Form 1801AC 0009 to apply for and calculate their tax credits.

Q: How do I fill out Form 1801AC 0009?

A: You need to provide information about the land or historic resource you are conserving, the value of the tax credits you are claiming, and other required details.

Q: What supporting documents do I need to include with Form 1801AC 0009?

A: You may need to include documents such as appraisals, photographs, deeds, or other evidence of the property or resource being conserved.

Q: When is the deadline to submit Form 1801AC 0009?

A: The deadline to submit Form 1801AC 0009 varies each year, so you should check the instructions or contact the Delaware Division of Revenue for the current deadline.

Q: Can I claim Delaware Land & Historic Resource Conservation Tax Credits for multiple properties?

A: Yes, you can claim these tax credits for multiple properties as long as they meet the eligibility criteria.

Q: Can I carry forward unused Delaware Land & Historic Resource Conservation Tax Credits?

A: Yes, any unused tax credits can be carried forward for up to 5 years.

Form Details:

- Released on December 31, 2013;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1801AC 0009 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.