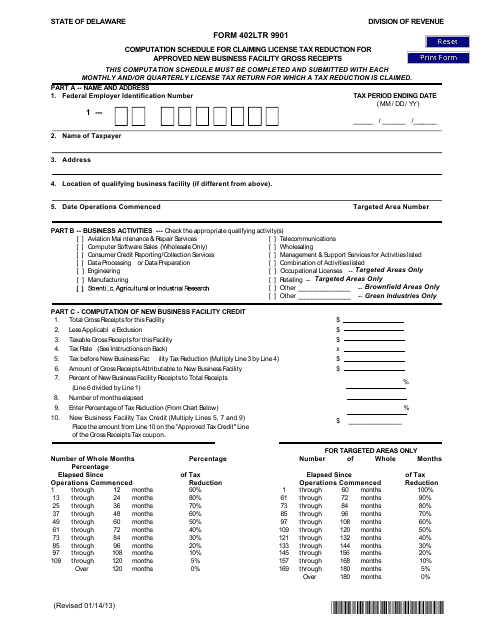

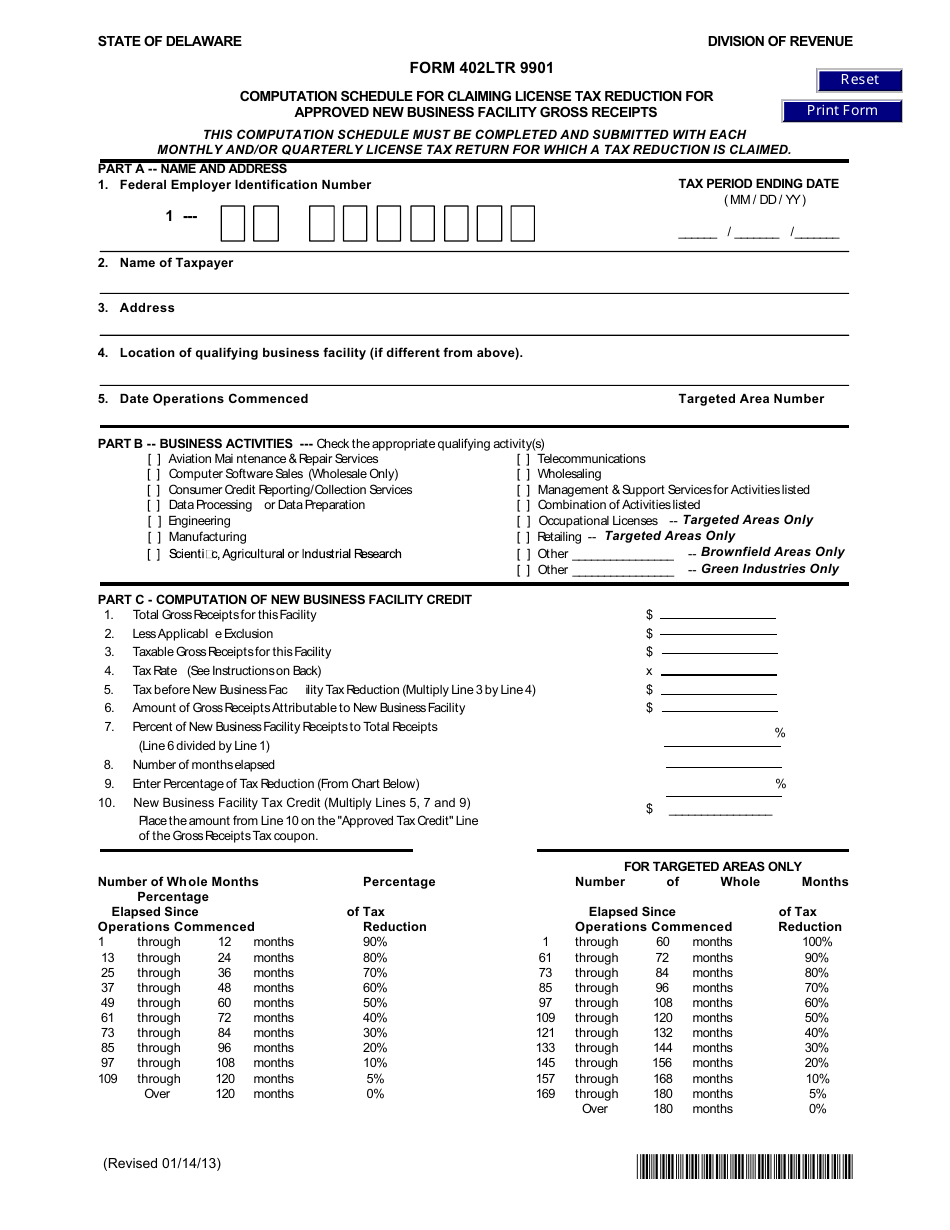

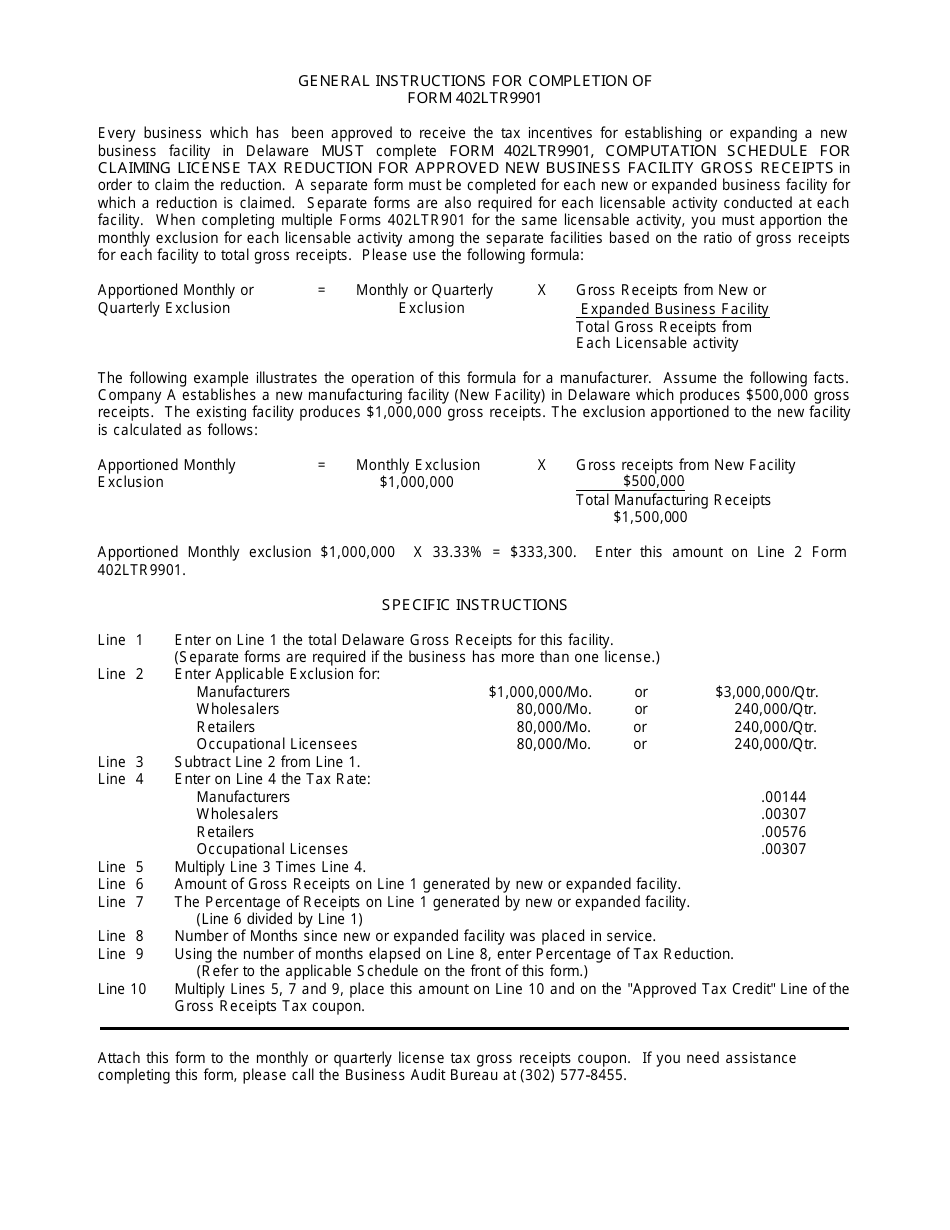

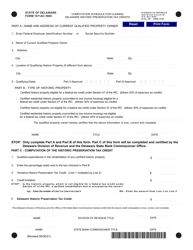

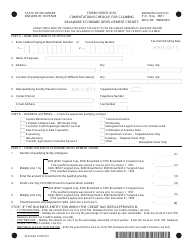

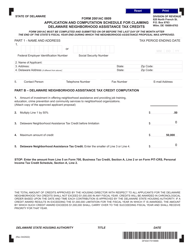

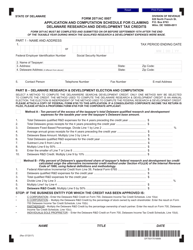

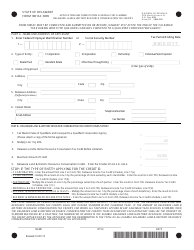

Form 402LTR 9901 Computation Schedule for Claiming License Tax Reduction for Approved New Business Facility Gross Receipts - Delaware

What Is Form 402LTR 9901?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 402LTR 9901?

A: Form 402LTR 9901 is the Computation Schedule for Claiming License Tax Reduction for Approved New Business Facility Gross Receipts in Delaware.

Q: What is the purpose of Form 402LTR 9901?

A: The purpose of Form 402LTR 9901 is to calculate and claim a license tax reduction for approved new business facility gross receipts in Delaware.

Q: Who needs to fill out Form 402LTR 9901?

A: Individuals or businesses that have an approved new business facility in Delaware and want to claim a license tax reduction for their gross receipts need to fill out this form.

Q: Are there any eligibility requirements for claiming the license tax reduction?

A: Yes, there are eligibility requirements for claiming the license tax reduction. These requirements generally involve having an approved new business facility and meeting certain investment and employment criteria.

Q: What should I include on Form 402LTR 9901?

A: On Form 402LTR 9901, you should include information about your approved new business facility, gross receipts, and any other required details as specified in the instructions.

Form Details:

- Released on January 14, 2013;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 402LTR 9901 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.