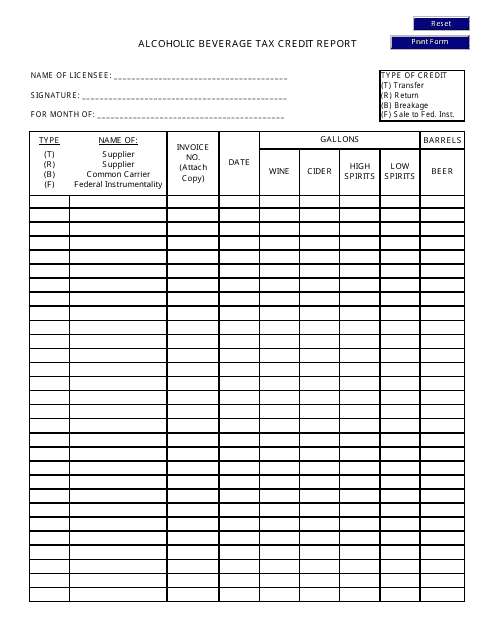

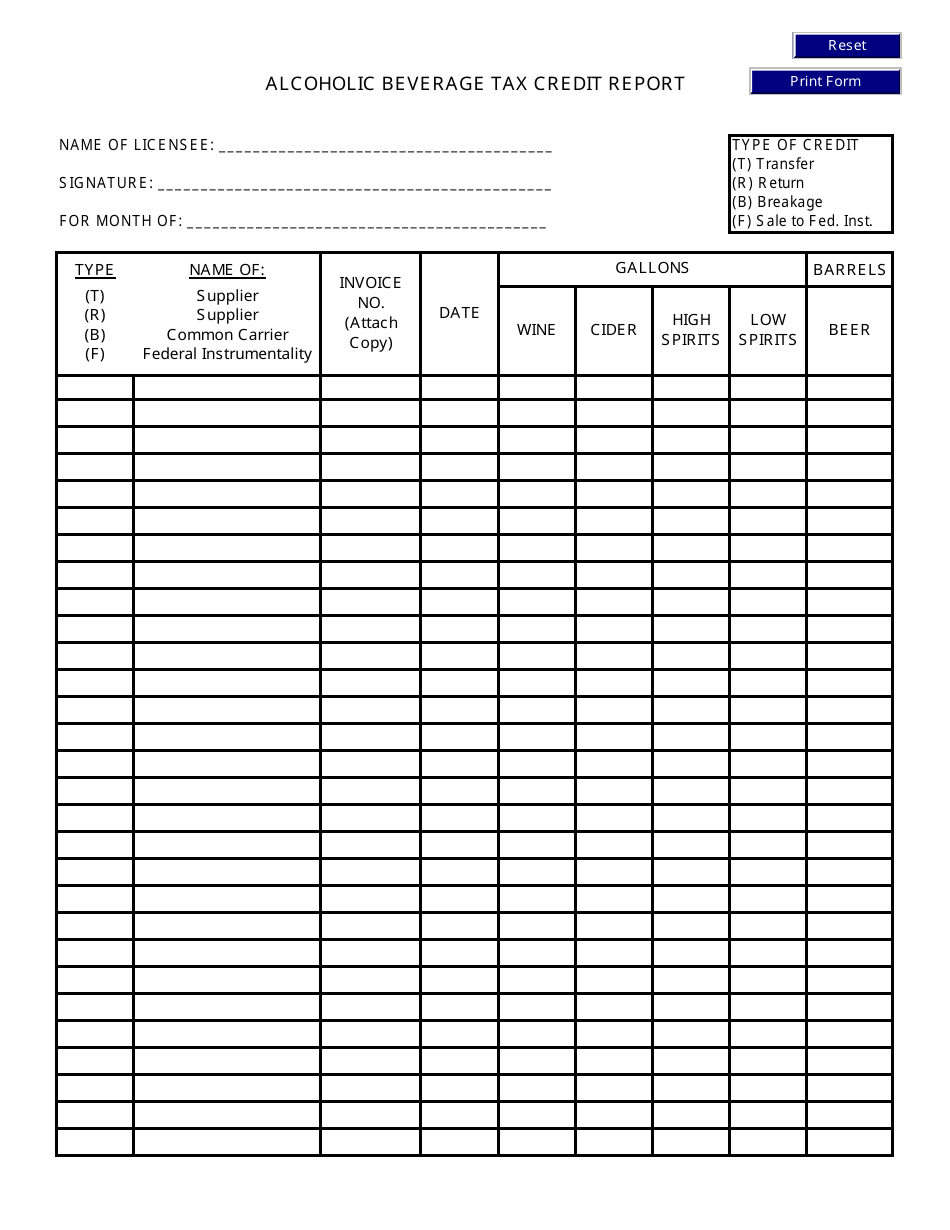

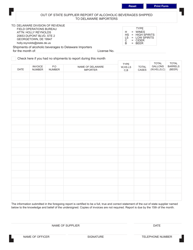

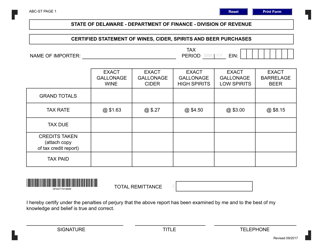

Alcoholic Beverage Tax Credit Report - Delaware

Alcoholic Beverage Tax Credit Report is a legal document that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware.

FAQ

Q: What is the Alcoholic Beverage Tax Credit Report?

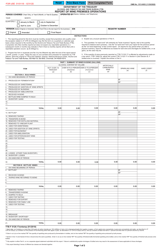

A: The Alcoholic Beverage Tax Credit Report is a report specific to Delaware that pertains to the tax credits available for alcoholic beverage manufacturers, wholesalers, and retailers.

Q: Who is eligible for the Alcoholic Beverage Tax Credit?

A: Manufacturers, wholesalers, and retailers of alcoholic beverages in Delaware may be eligible for the Alcoholic Beverage Tax Credit.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to incentivize the growth and success of the alcoholic beverage industry in Delaware.

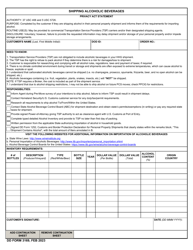

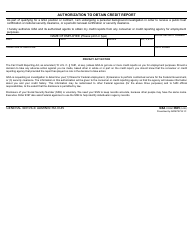

Q: How can one claim the Alcoholic Beverage Tax Credit?

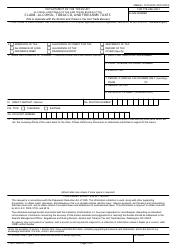

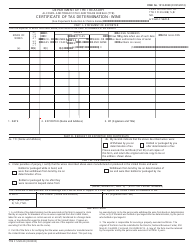

A: To claim the tax credit, eligible businesses must file the Alcoholic Beverage Tax Credit Report with the Delaware Division of Revenue.

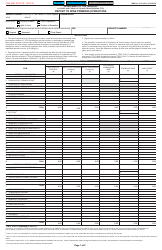

Form Details:

- The latest edition currently provided by the Delaware Department of Finance - Division of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.