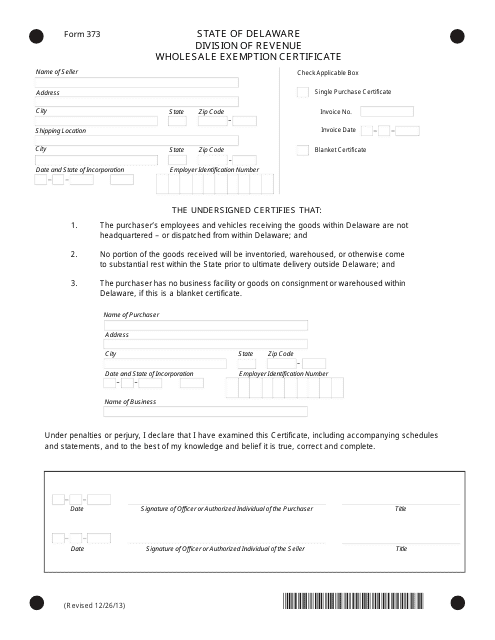

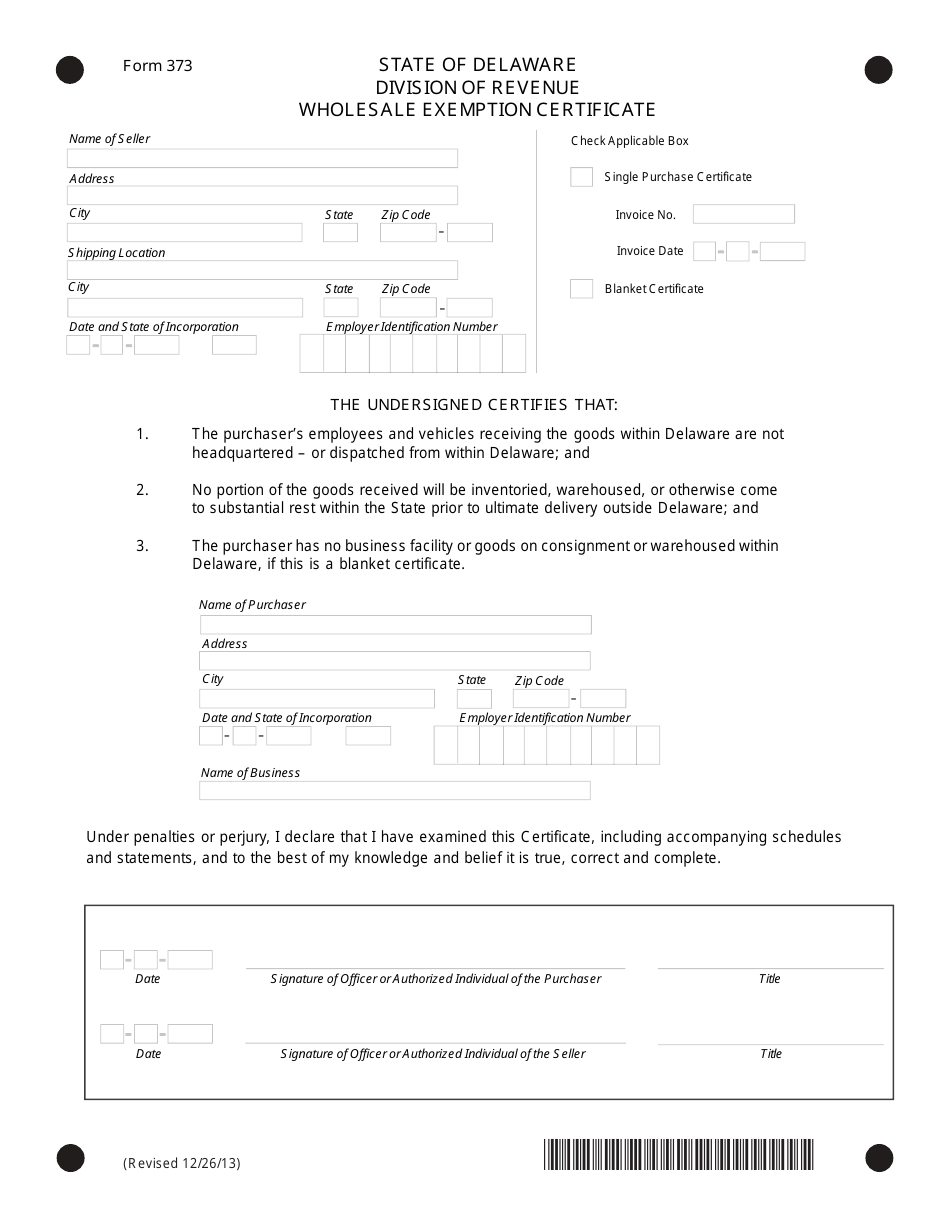

Form 373 Wholesale Exemption Certificate - Delaware

What Is Form 373?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 373 Wholesale Exemption Certificate?

A: Form 373 Wholesale Exemption Certificate is a document used in Delaware for applying for a wholesale exemption.

Q: What is the purpose of Form 373?

A: The purpose of Form 373 is to claim an exemption from paying sales tax on wholesale purchases.

Q: Who is eligible to use Form 373?

A: Wholesalers who purchase goods for resale and meet the requirements set by the state of Delaware are eligible to use Form 373.

Q: What information do I need to fill out Form 373?

A: You will need to provide your business information, including your EIN or SSN, and details about your wholesale business.

Q: Do I need to renew Form 373?

A: No, Form 373 does not need to be renewed as long as your wholesale business continues to meet the eligibility criteria.

Q: Is there a fee for submitting Form 373?

A: No, there is no fee for submitting Form 373 in Delaware.

Q: What should I do with the completed Form 373?

A: You should keep a copy of the completed Form 373 for your records and provide it to wholesalers when making tax-exempt purchases.

Q: Can I use Form 373 in other states?

A: No, Form 373 is specific to Delaware and cannot be used for claiming sales tax exemptions in other states.

Form Details:

- Released on December 26, 2013;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 373 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.