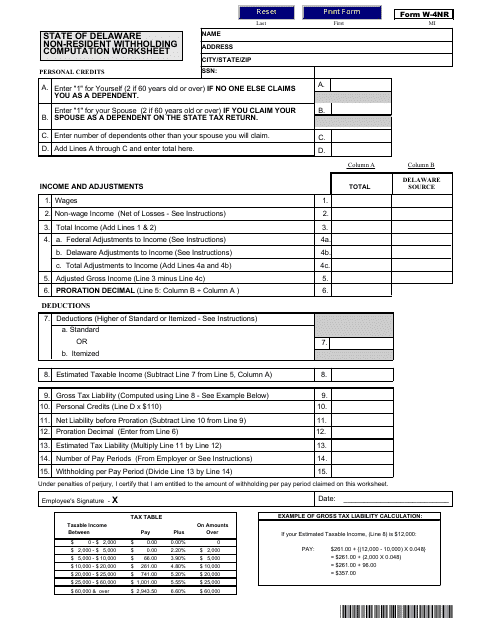

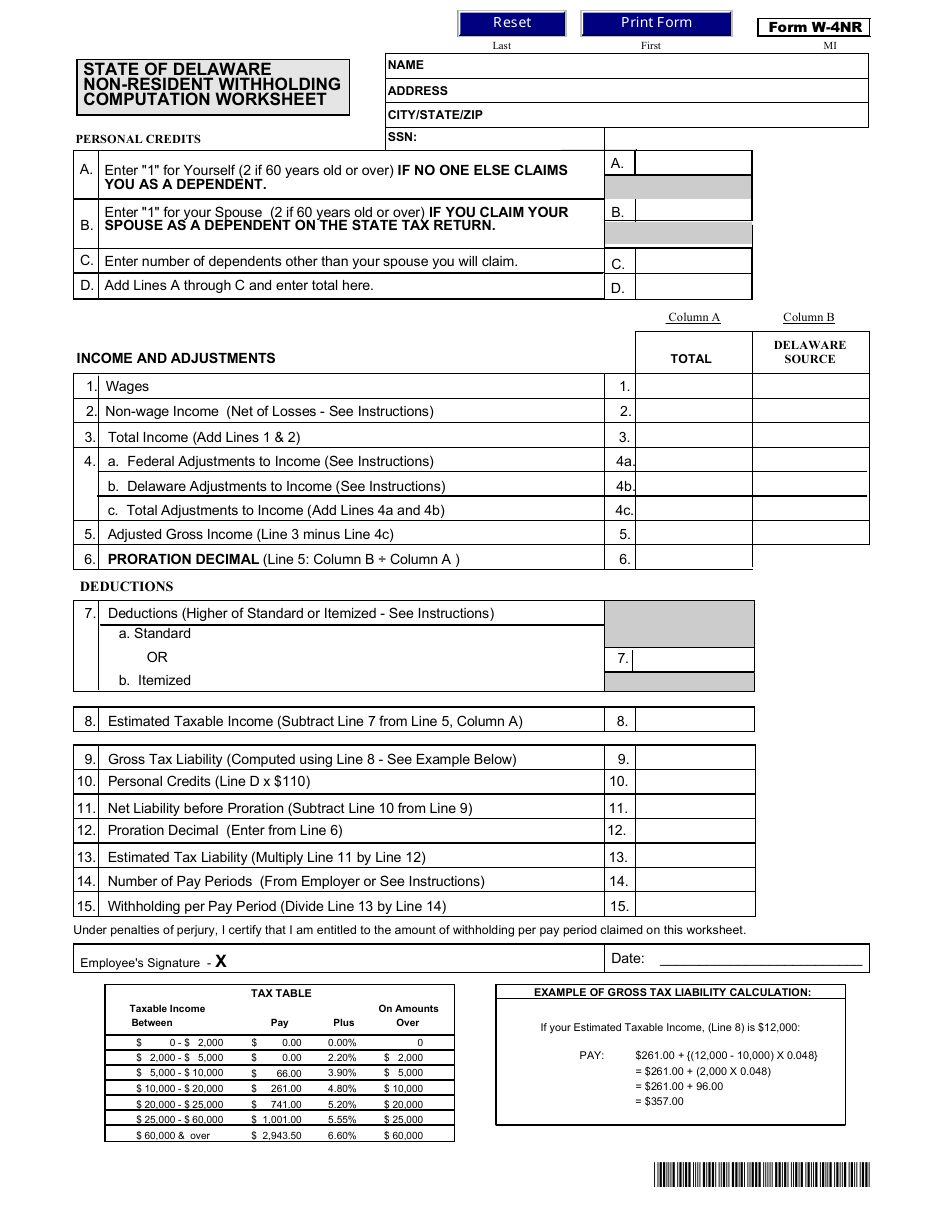

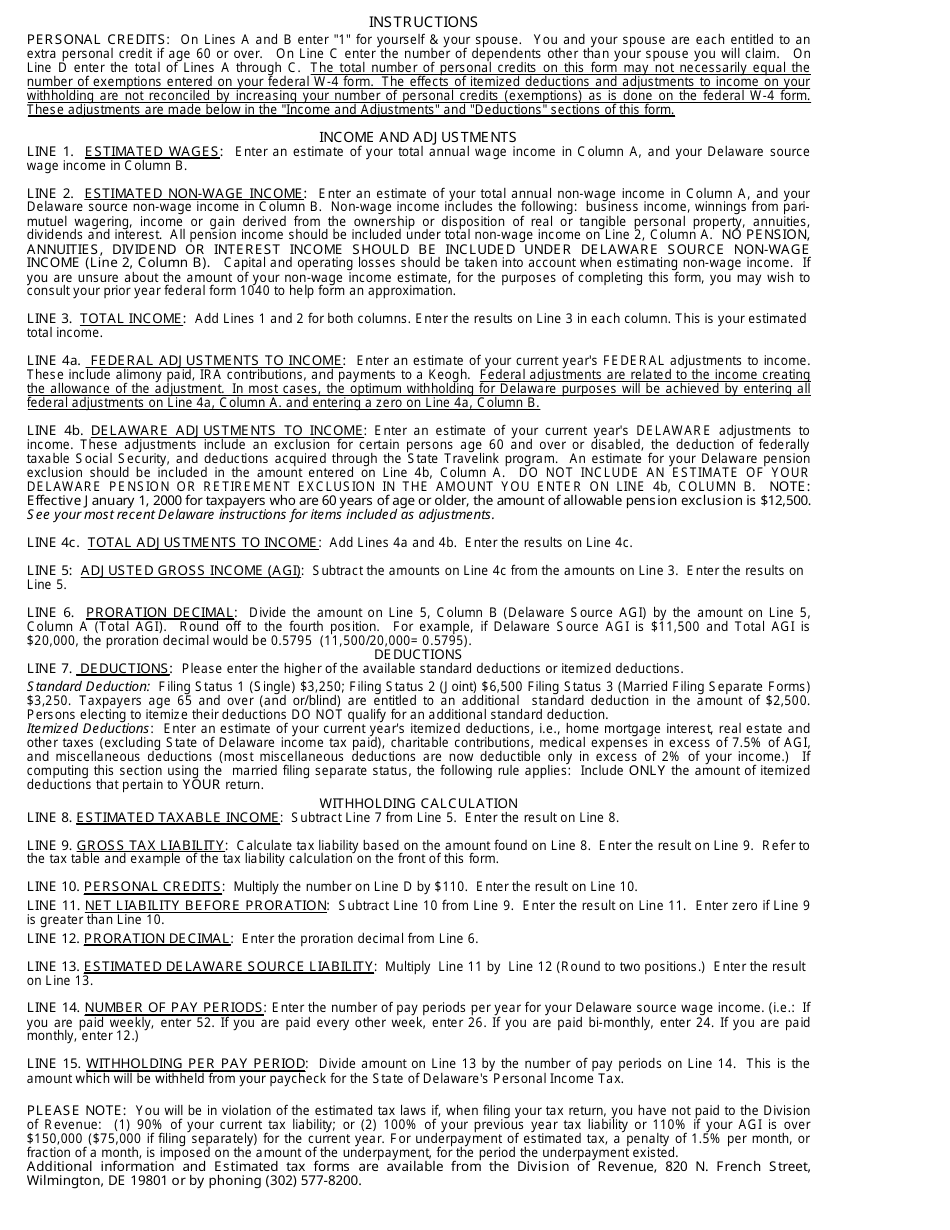

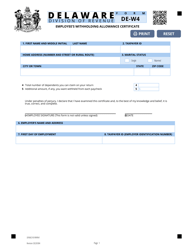

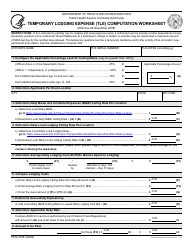

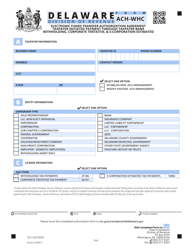

Form W-4NR Non-resident Withholding Computation Worksheet - Delaware

What Is Form W-4NR?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-4NR?

A: Form W-4NR is a tax form used by non-resident aliens to calculate withholding allowances.

Q: Who should use Form W-4NR?

A: Non-resident aliens who work in the United States should use Form W-4NR to determine the amount of tax to be withheld from their paycheck.

Q: What is the purpose of the Non-resident Withholding Computation Worksheet?

A: The Non-resident Withholding Computation Worksheet helps non-resident aliens calculate their withholding allowances based on their individual circumstances.

Q: Is Form W-4NR specific to Delaware?

A: No, Form W-4NR is a federal tax form and is not specific to any state.

Q: Can I use Form W-4NR if I am a US citizen or resident?

A: No, Form W-4NR is only for non-resident aliens. US citizens and residents should use Form W-4 to calculate their withholding allowances.

Q: How often should I update my Form W-4NR?

A: You should update your Form W-4NR whenever there is a change in your tax status or personal circumstances that may affect your withholding allowances.

Q: What happens if I do not submit a Form W-4NR?

A: If you do not submit a Form W-4NR, your employer will withhold taxes based on the default withholding rates for non-resident aliens.

Q: Can I claim exemptions on Form W-4NR?

A: Non-resident aliens generally cannot claim exemptions on Form W-4NR. However, there are certain situations where exemptions may be allowed, such as tax treaty benefits.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-4NR by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.