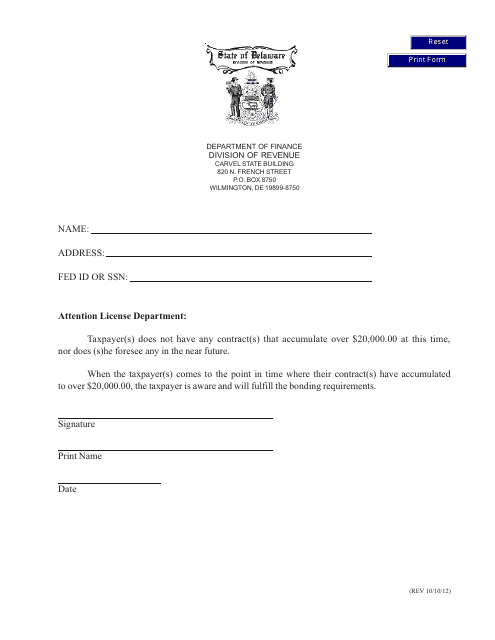

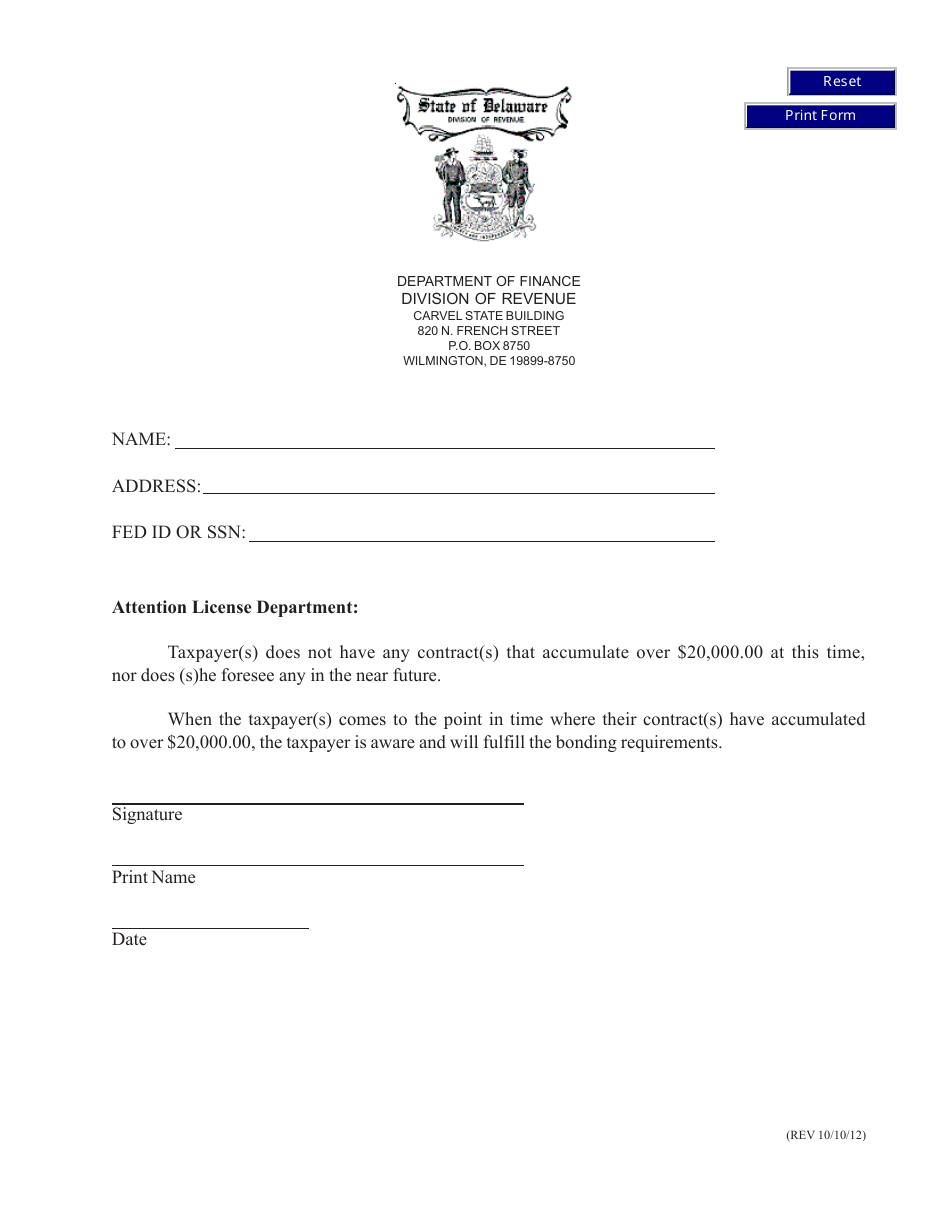

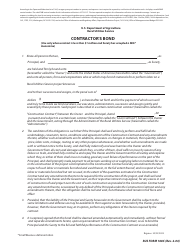

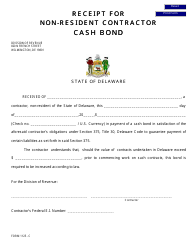

Non-resident Contractor - Letter for Contract Under $20,000 - Delaware

Non-resident Contractor - Letter for Contract Under $20,000 is a legal document that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware.

FAQ

Q: What is a non-resident contractor?

A: A non-resident contractor is a contractor who is not a resident of the state in which they are performing contract work.

Q: What is a letter for a contract under $20,000?

A: A letter for a contract under $20,000 is a written agreement between a contractor and a client for a project that is valued at less than $20,000.

Q: What is the purpose of the letter?

A: The purpose of the letter is to outline the terms and conditions of the contract, including the scope of work, payment terms, and other relevant details.

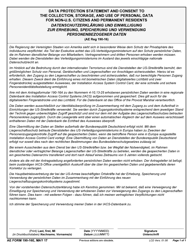

Q: Is the letter legally binding?

A: Yes, the letter is legally binding once both parties have signed it.

Q: What should be included in the letter?

A: The letter should include the names and contact information of both parties, a description of the work to be performed, the timeline for completion, the payment terms, and any other important details.

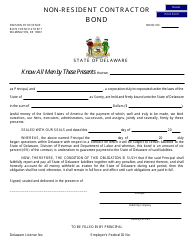

Q: What are the requirements for a non-resident contractor in Delaware?

A: Non-resident contractors in Delaware are required to obtain a business license and register with the Division of Revenue.

Q: Are there any exemptions for non-resident contractors in Delaware?

A: Yes, there are some exemptions for non-resident contractors in Delaware, such as those who are performing work for the federal government or are covered under reciprocal agreements with other states.

Q: Are non-resident contractors subject to taxes in Delaware?

A: Yes, non-resident contractors are subject to taxes in Delaware and must pay income tax on any income earned from work performed in the state.

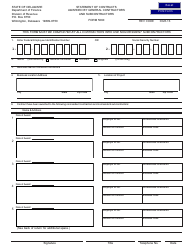

Form Details:

- Released on October 10, 2012;

- The latest edition currently provided by the Delaware Department of Finance - Division of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.