This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

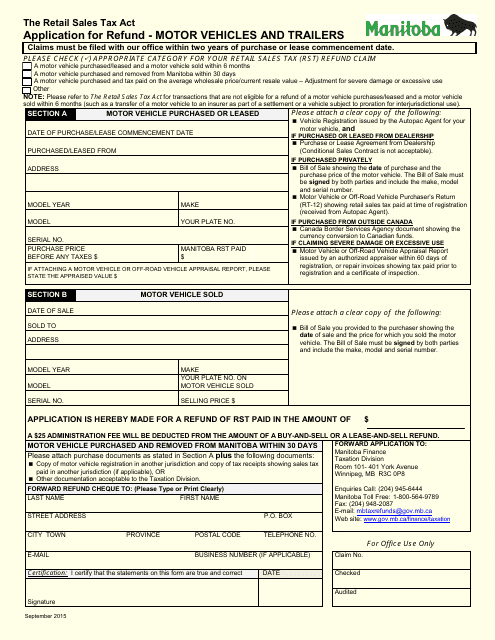

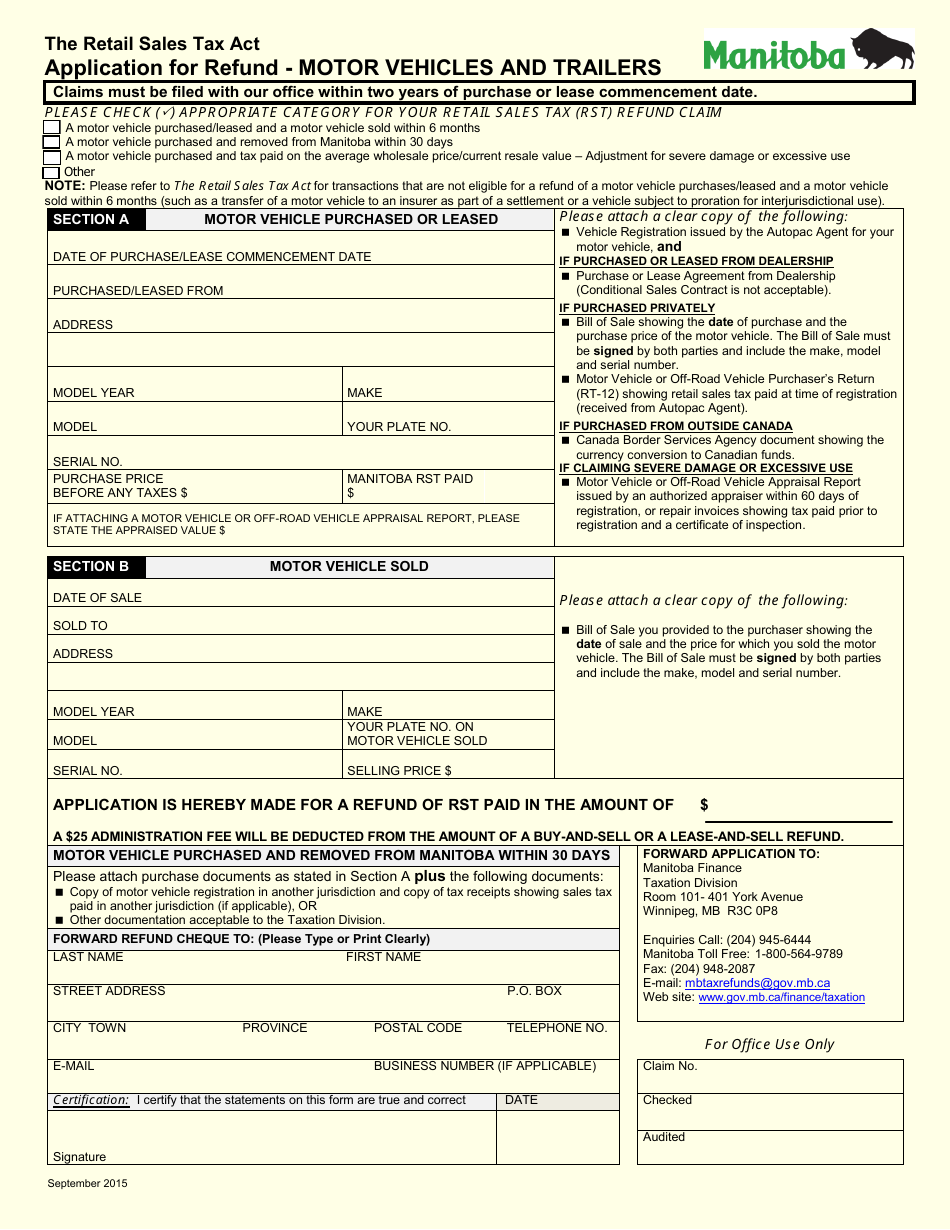

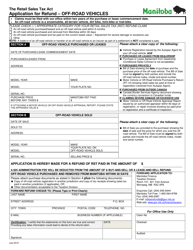

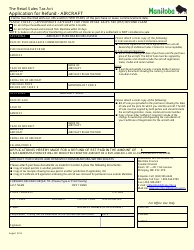

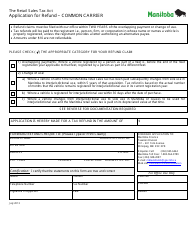

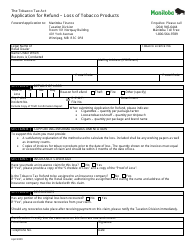

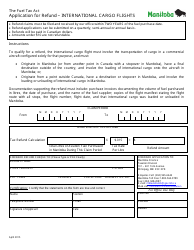

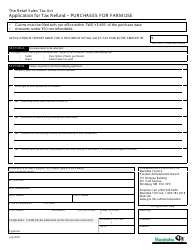

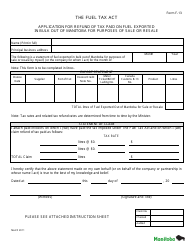

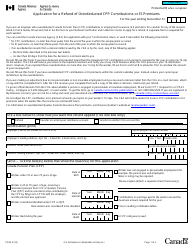

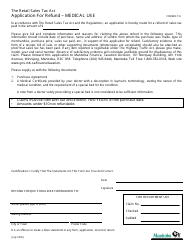

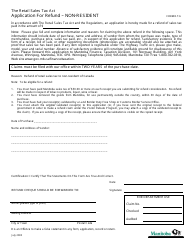

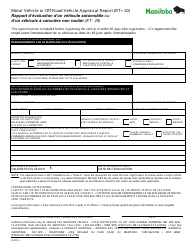

Application for Refund - Motor Vehicles and Trailers - Manitoba, Canada

This " Application For Refund - Motor Vehicles And Trailers " is a document issued by the Manitoba Department of Finance specifically for Manitoba residents with its latest version released on September 1, 2015.

Download the up-to-date fillable PDF by clicking the link below or find it on the forms website of the Manitoba Department of Finance.

FAQ

Q: Who can apply for a refund for motor vehicles and trailers in Manitoba?

A: Any person who has paid tax on a motor vehicle or trailer in Manitoba can apply for a refund.

Q: What is the deadline for applying for a refund?

A: The application for refund must be made within 18 months from the date of tax payment.

Q: What documents are required for the refund application?

A: The refund application must be accompanied with the original certificate of registration and the original sales receipt.

Q: How can I submit the refund application?

A: The refund application can be submitted by mail or in person at a Manitoba Public Insurance Service Centre.

Q: What is the processing time for the refund application?

A: The processing time for the refund application is approximately 4 to 6 weeks.

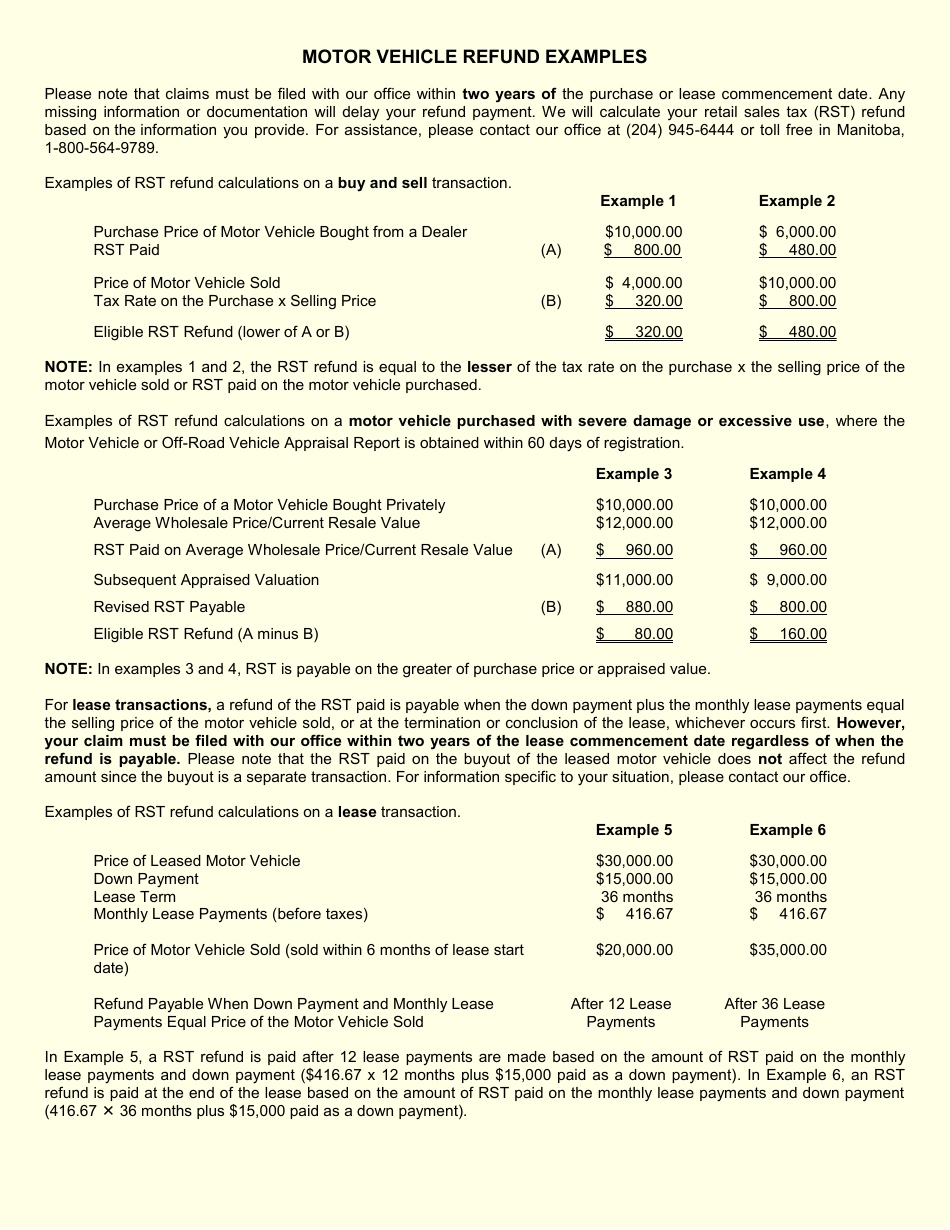

Q: What is the refund amount?

A: The refund amount is calculated based on the unused portion of the tax paid for the motor vehicle or trailer.

Q: Can I apply for a refund if I have sold the motor vehicle or trailer?

A: Yes, if you have sold the motor vehicle or trailer, you can apply for a refund.

Q: Is there a fee for processing the refund application?

A: No, there is no fee for processing the refund application.

Q: Can I apply for a refund if I am no longer a resident of Manitoba?

A: Yes, even if you are no longer a resident of Manitoba, you can still apply for a refund.