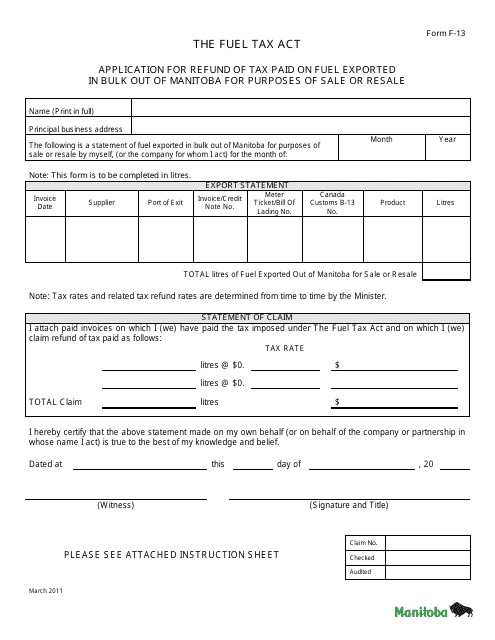

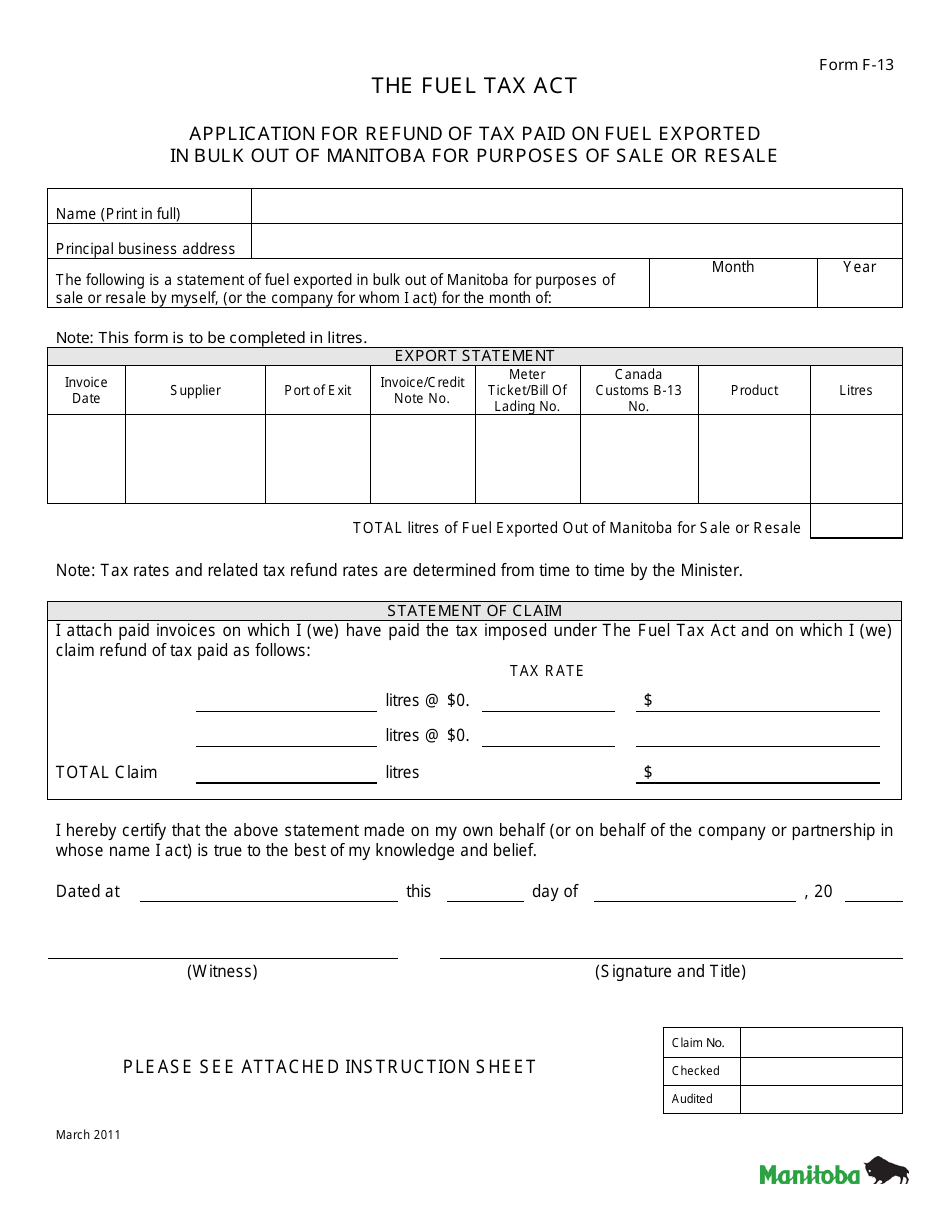

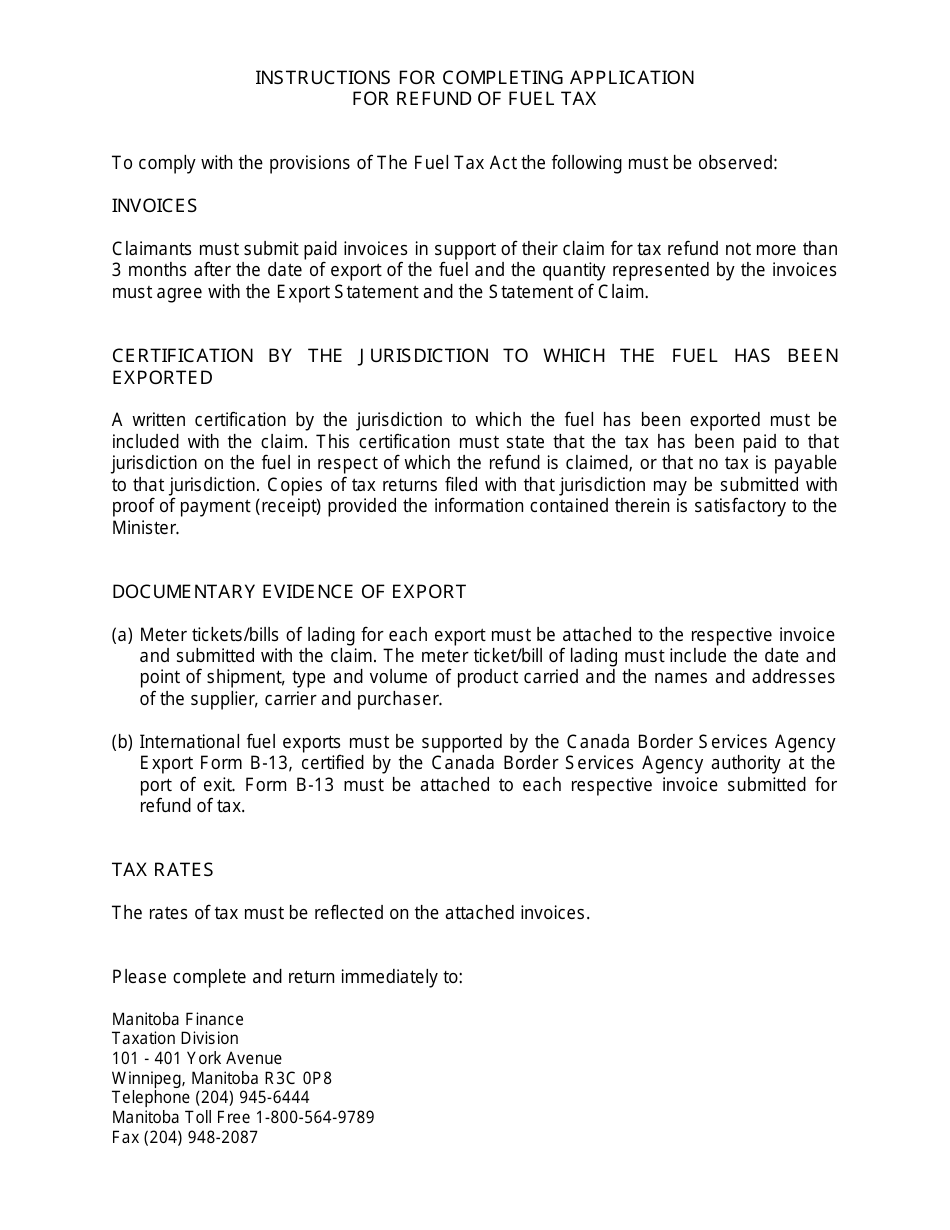

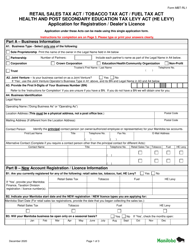

Form F-13 Application for Refund of Tax Paid on Fuel Exported in Bulk out of Manitoba for Purposes of Sale or Resale - Manitoba, Canada

Form F-13 or the "Form F-13 "application For Refund Of Tax Paid On Fuel Exported In Bulk Out Of Manitoba For Purposes Of Sale Or Resale" - Manitoba, Canada" is a form issued by the Manitoba Department of Finance .

The form was last revised in March 1, 2011 and is available for digital filing. Download an up-to-date Form F-13 in PDF-format down below or look it up on the Manitoba Department of Finance Forms website.

FAQ

Q: What is Form F-13?

A: Form F-13 is an application for refund of tax paid on fuel exported in bulk out of Manitoba for purposes of sale or resale.

Q: What is the purpose of Form F-13?

A: The purpose of Form F-13 is to claim a refund of tax paid on fuel that was exported in bulk out of Manitoba for sale or resale.

Q: Who can use Form F-13?

A: Anyone who has paid tax on fuel that was exported in bulk out of Manitoba for sale or resale can use Form F-13.

Q: How do I complete Form F-13?

A: Form F-13 must be completed by providing required information, including details of the fuel exported and proof of payment.

Q: What documents do I need to submit with Form F-13?

A: You need to submit proof of payment for the fuel, such as fuel invoices or receipts, along with Form F-13.

Q: When should I submit Form F-13?

A: Form F-13 should be submitted within one year from the date of export of the fuel.

Q: Will I get a refund if my application is approved?

A: Yes, if your application is approved, you will be eligible for a refund of the tax paid on the exported fuel.

Q: Is there a fee for submitting Form F-13?

A: No, there is no fee for submitting Form F-13.