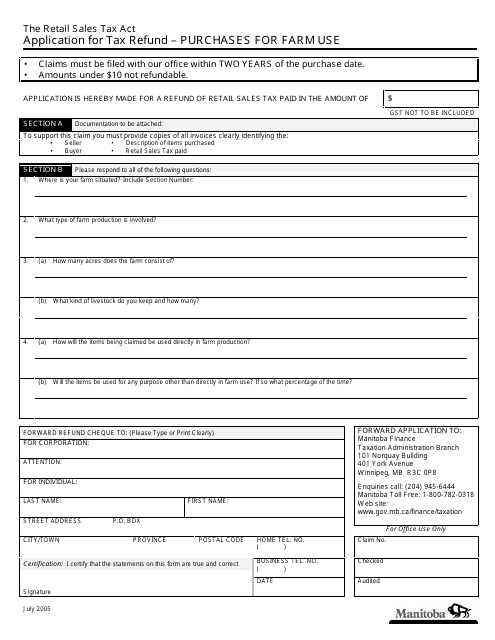

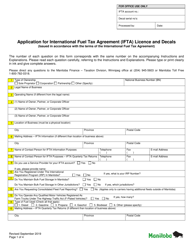

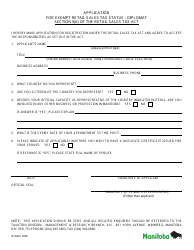

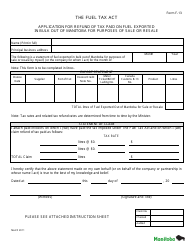

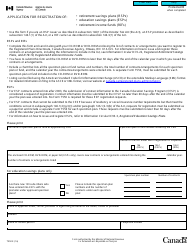

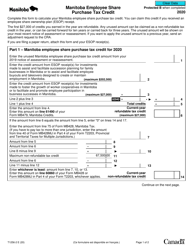

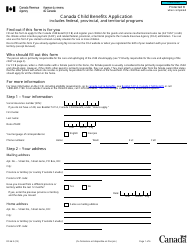

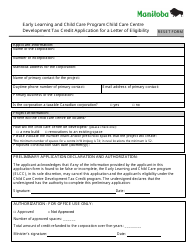

Application for Tax Refund - Purchases for Farm Use - Manitoba, Canada

This " Application For Tax Refund - Purchases For Farm Use " is a part of the paperwork released by the Manitoba Department of Finance specifically for Manitoba residents.

The latest fillable version of the document was released on July 1, 2005 and can be downloaded through the link below or found through the department's forms library.

FAQ

Q: Can I get a tax refund for purchases made for farm use in Manitoba, Canada?

A: Yes, you may be eligible for a tax refund for purchases made for farm use in Manitoba, Canada.

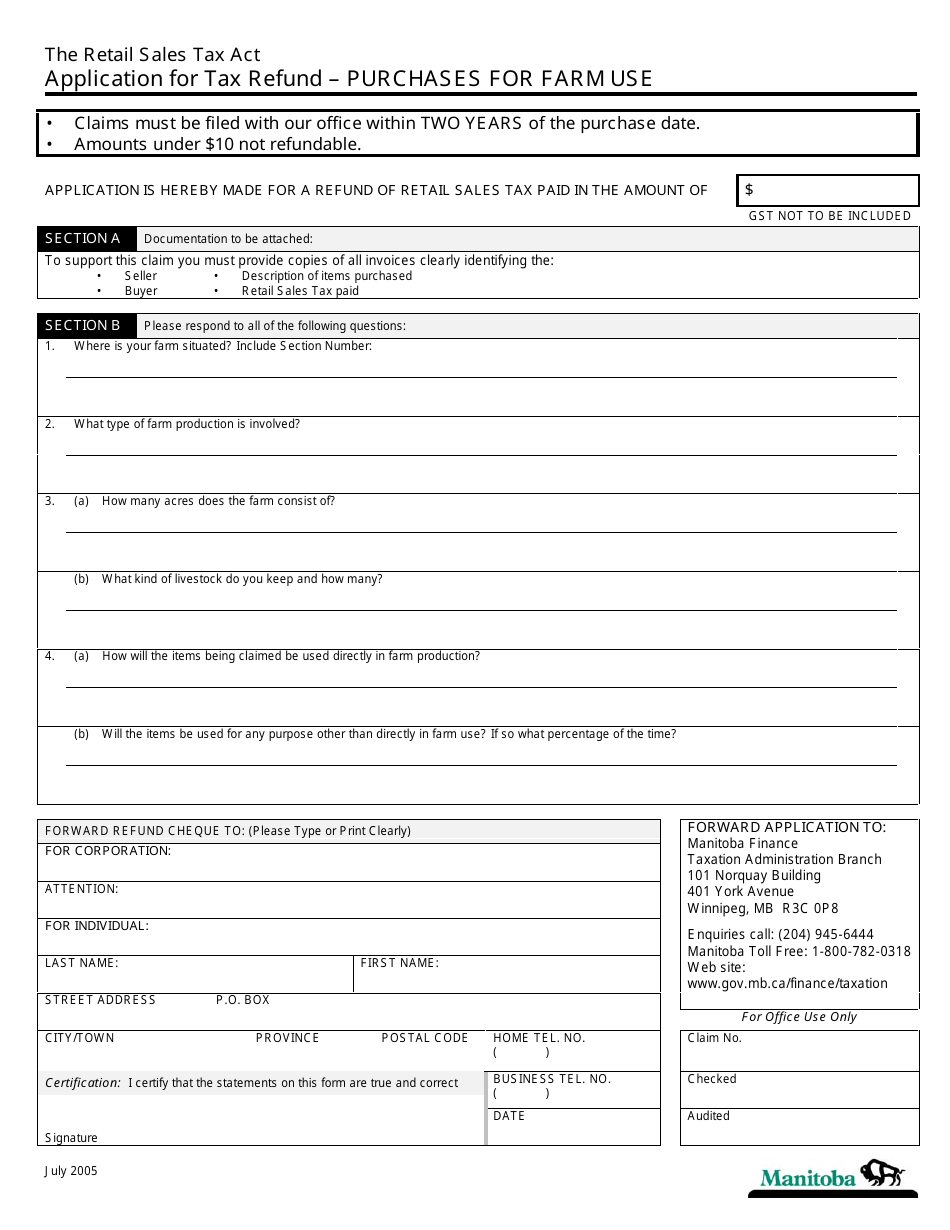

Q: What types of purchases are eligible for a tax refund?

A: Purchases such as machinery, equipment, and supplies that are used exclusively for farming purposes may be eligible for a tax refund.

Q: How can I apply for a tax refund for farm use purchases?

A: To apply for a tax refund for farm use purchases, you will need to complete and submit the appropriate application form to the relevant tax authorities in Manitoba, Canada.

Q: Are there any specific requirements or documentation needed to support my tax refund application?

A: Yes, you may be required to provide documentation such as invoices, receipts, and proof of farm ownership or operation to support your tax refund application.

Q: When can I expect to receive my tax refund for farm use purchases?

A: The processing time for tax refund applications can vary, but you can expect to receive your refund within a reasonable period of time after your application is submitted and approved.

Q: Is there a deadline to apply for a tax refund for farm use purchases?

A: There may be specific deadlines for submitting tax refund applications for farm use purchases in Manitoba, so it is important to check with the relevant tax authorities or consult with a tax professional for the most up-to-date information.