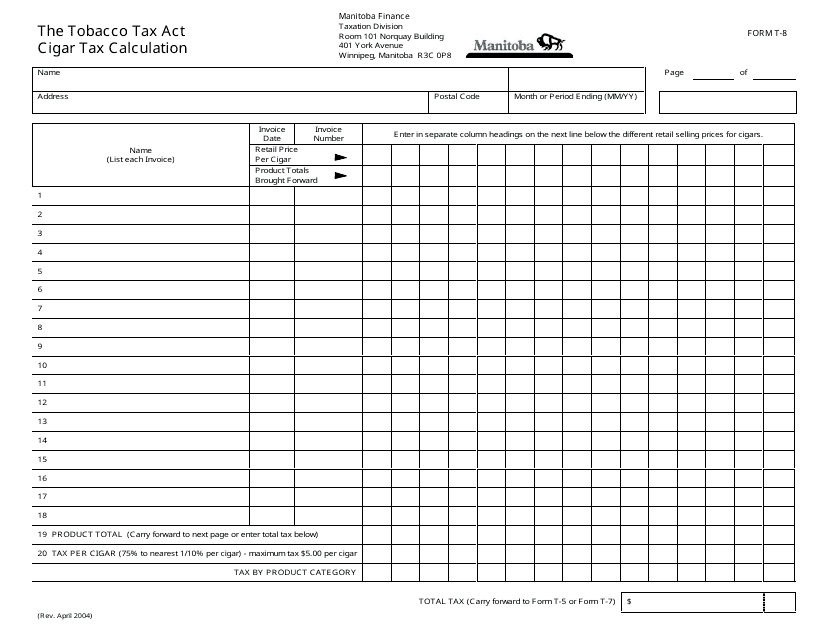

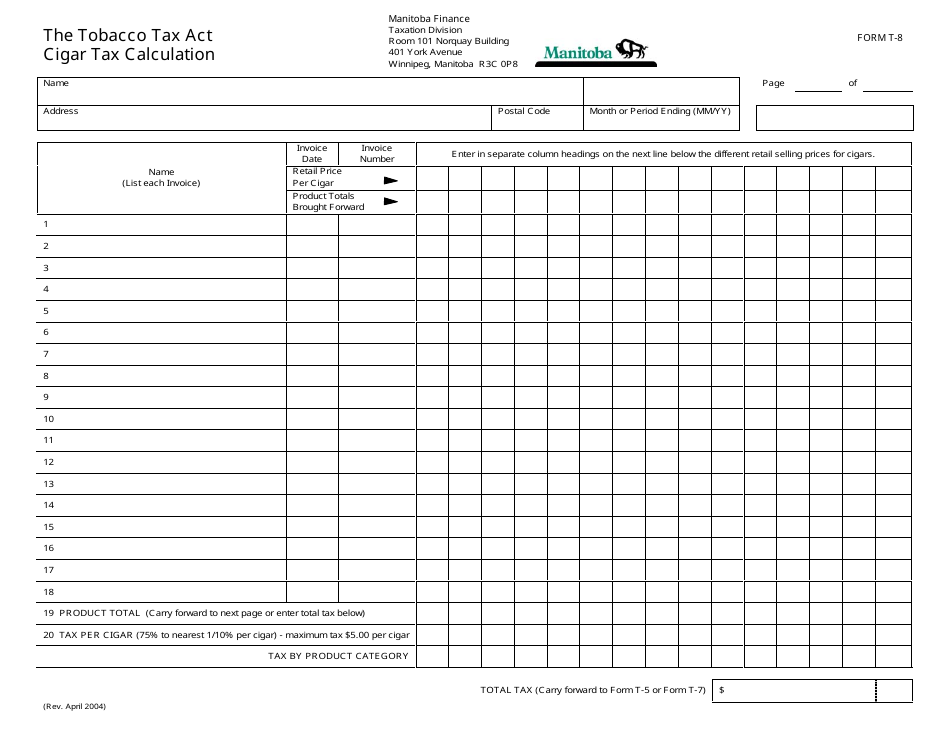

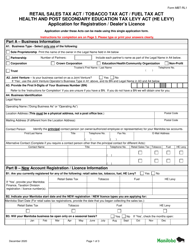

Form T-8 Cigar Tax Calculation - Manitoba, Canada

Form T-8 or the "Form T-8 "cigar Tax Calculation" - Manitoba, Canada" is a form issued by the Manitoba Department of Finance .

The form was last revised in April 1, 2004 and is available for digital filing. Download an up-to-date Form T-8 in PDF-format down below or look it up on the Manitoba Department of Finance Forms website.

FAQ

Q: What is Form T-8?

A: Form T-8 is a tax form used for calculating cigar tax in Manitoba, Canada.

Q: What is cigar tax?

A: Cigar tax is a tax imposed on the sale of cigars in Manitoba.

Q: Who needs to fill out Form T-8?

A: Any individual or business selling cigars in Manitoba needs to fill out Form T-8.

Q: How do I calculate cigar tax using Form T-8?

A: Form T-8 provides instructions on how to calculate cigar tax based on the number of cigars sold and their selling price.

Q: Can I use Form T-8 for other provinces in Canada?

A: No, Form T-8 is specifically for calculating cigar tax in Manitoba. Other provinces may have their own forms and tax rates.