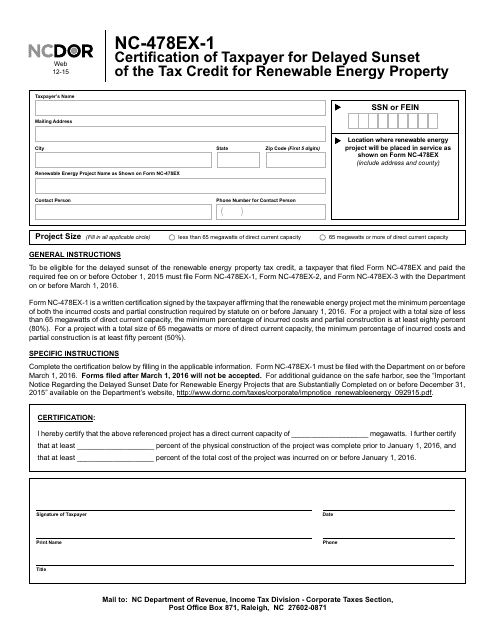

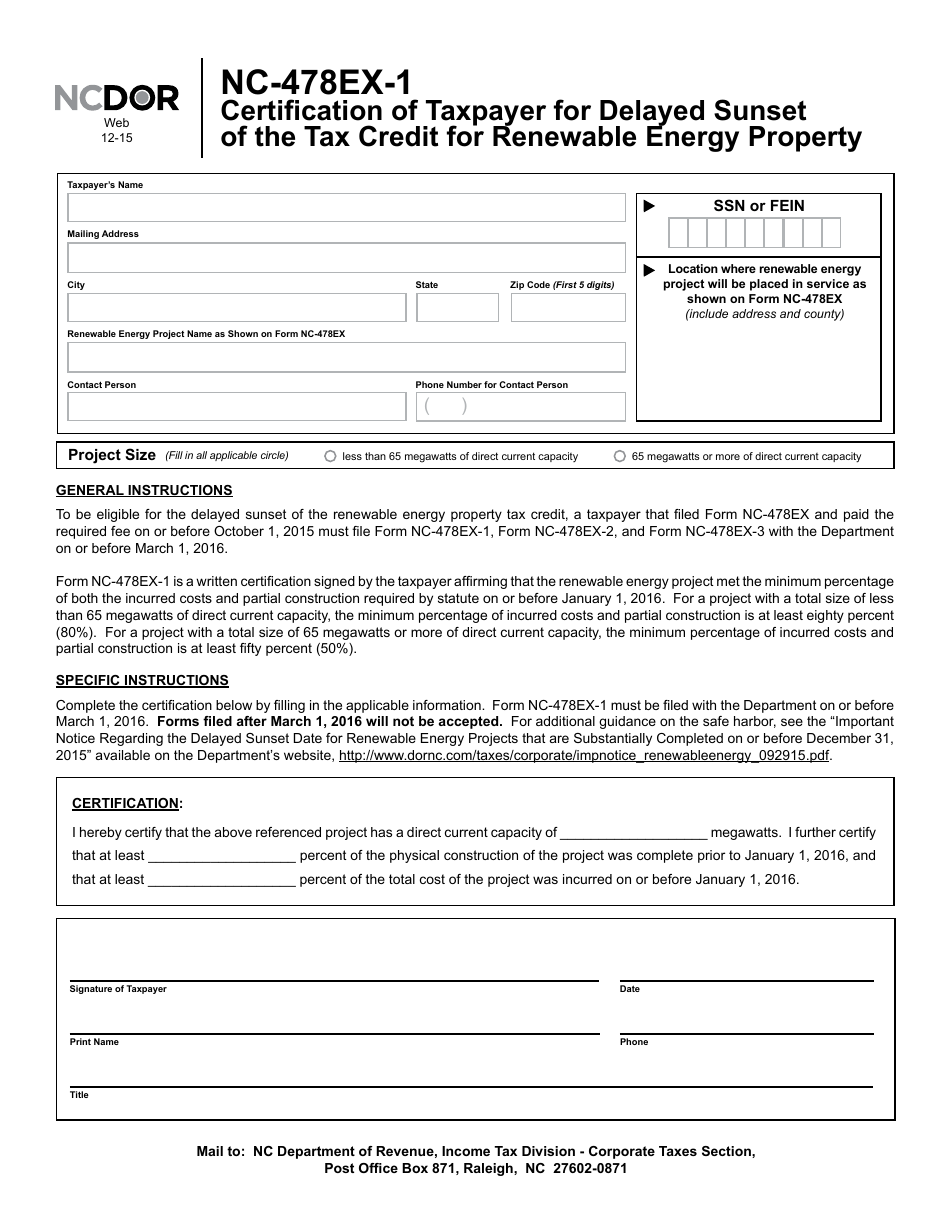

Form NC-478EX-1 Certification of Taxpayer for Delayed Sunset of the Tax Credit for Renewable Energy Property - North Carolina

What Is Form NC-478EX-1?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-478EX-1?

A: Form NC-478EX-1 is a certification form for taxpayers in North Carolina to claim the delayed sunset of the tax credit for renewable energy property.

Q: What is the purpose of Form NC-478EX-1?

A: The purpose of Form NC-478EX-1 is to certify that a taxpayer is eligible to claim the delayed sunset of the tax credit for renewable energy property in North Carolina.

Q: Who needs to fill out Form NC-478EX-1?

A: Taxpayers in North Carolina who want to claim the delayed sunset of the tax credit for renewable energy property need to fill out Form NC-478EX-1.

Q: What information do I need to fill out Form NC-478EX-1?

A: You will need to provide information such as your name, address, Social Security number, and details about the renewable energy property for which you are claiming the tax credit.

Q: When is the deadline for filing Form NC-478EX-1?

A: The deadline for filing Form NC-478EX-1 is typically the same as the deadline for your North Carolina state tax return.

Q: Is there a fee to file Form NC-478EX-1?

A: No, there is no fee to file Form NC-478EX-1.

Q: Can I e-file Form NC-478EX-1?

A: Yes, you can e-file Form NC-478EX-1 if you are using an approved tax preparation software or service that supports North Carolina state tax returns.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478EX-1 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.