This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-632-BK

for the current year.

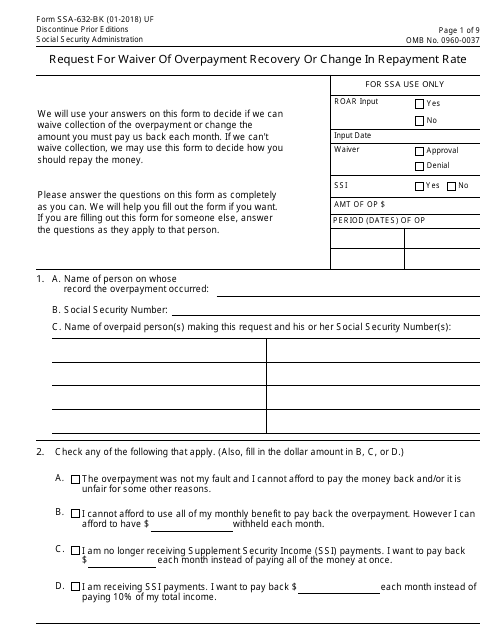

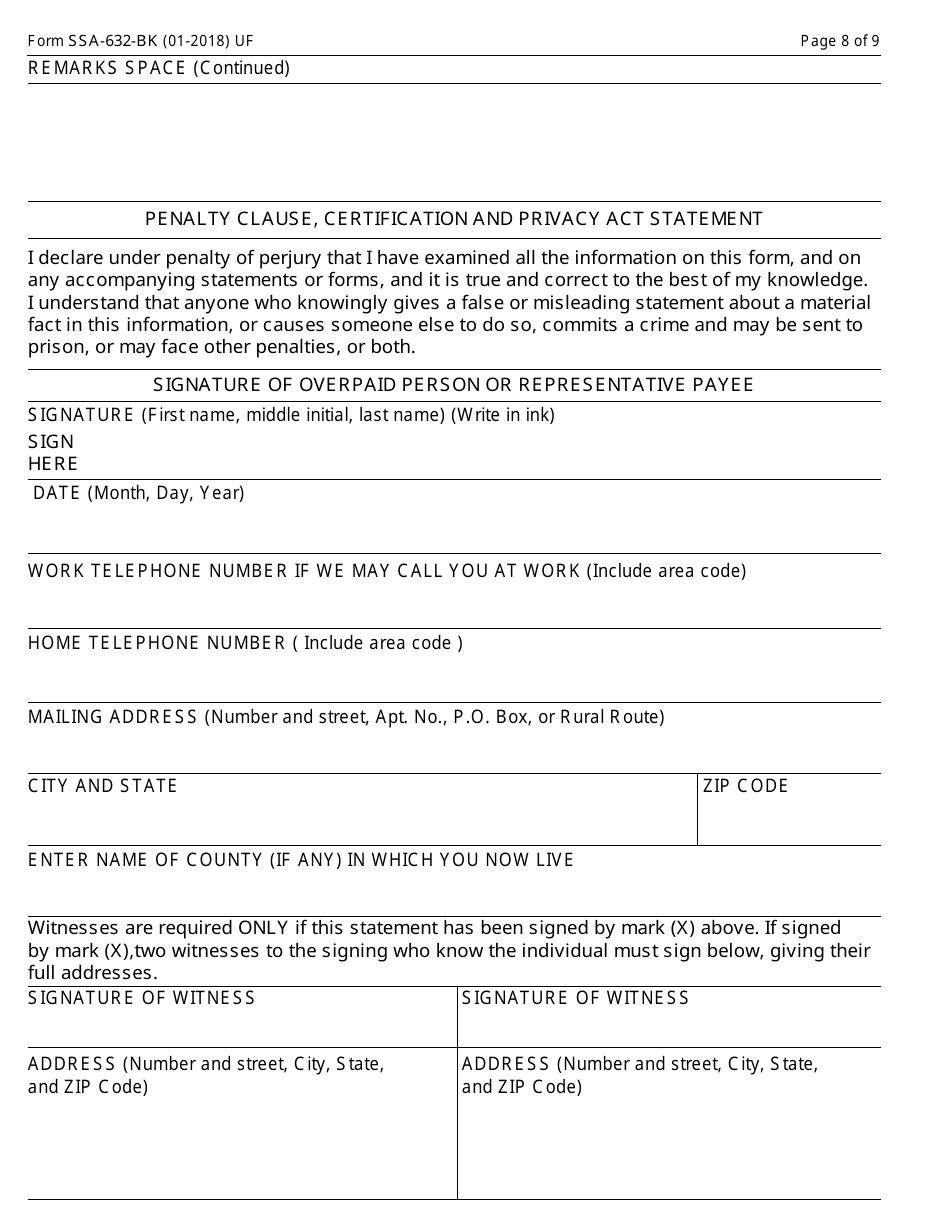

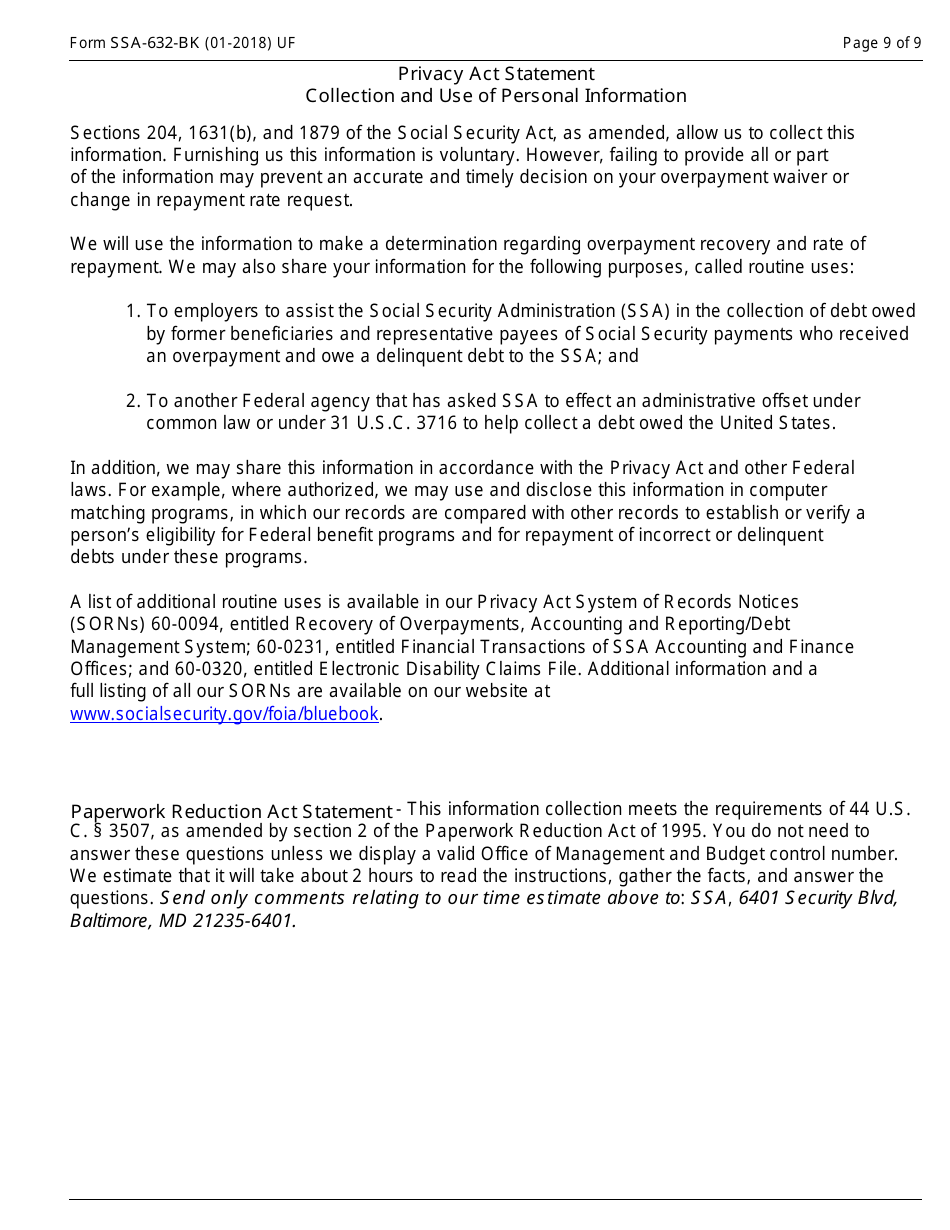

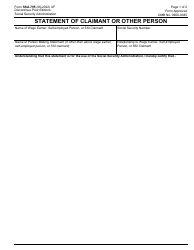

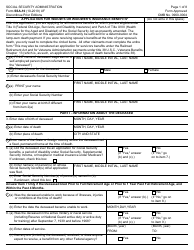

Form SSA-632-BK Request for Waiver of Overpayment Recovery or Change in Repayment Rate

What Is Form SSA-632?

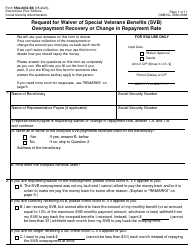

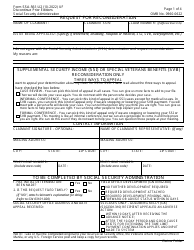

Form SSA-632-BK, Overpayment Recovery or Change in Repayment Rate , is a form used for wavering overpayments. The latest version of the form was released on January 1, 2018 , with all previous editions obsolete. An SSA-632 fillable form is available for download and digital filing below.

Alternate Names:

- SSA Form 632-BK;

- Form SSA-632.

An overpayment occurs when the U.S. Social Security Administration (SSA) pays you more than you should have been paid. The SSA will notify you about it and inform you why an overpayment happened and how you will be able to pay them back. The SSA will also let you know how to ask them to reconsider their decision, to let you pay the money back at a different rate, or to waive the overpayment. If you agree that the overpayment happened and you are willing to pay the money back, but for some reason cannot afford to pay it back at the rate the SSA asks of you, or you feel you should not pay it back because the overpayment was not your mistake, you should file the SSA-632 Form.

Form SSA-632 FAQ

Q: Where to mail the SSA-632-BK Form?

A: When you download, print, and complete a paper version of the form you can send it to your local social security office. If you have any additional questions, you can call the SSA at +1 (800) 772-1213.

Q: What does "Readily Available" mean on Form SSA-632-BK?

A: When you answer Question 14 in the section titled "Assets - Things You Have and Own," you are required to state how much money do you and person(s) indicated in Question 13 have as cash on hand, in a checking account, or readily available. In this context readily available means funds that are easily and promptly accessible for immediate use.

Q: How long does Form SSA-632 averagely take to be processed by the SSA?

A: Generally, it takes the SSA about six weeks to process your Social Security Appeal Form SSA-632 and get back to you.

How to Fill Out SSA-632-BK?

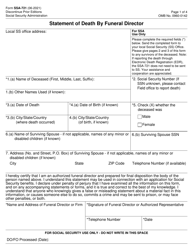

- Name the individual on whose record the overpayment occurred, their Social Security Number (SSN), and the names of overpaid persons making this request along with their SSNs.

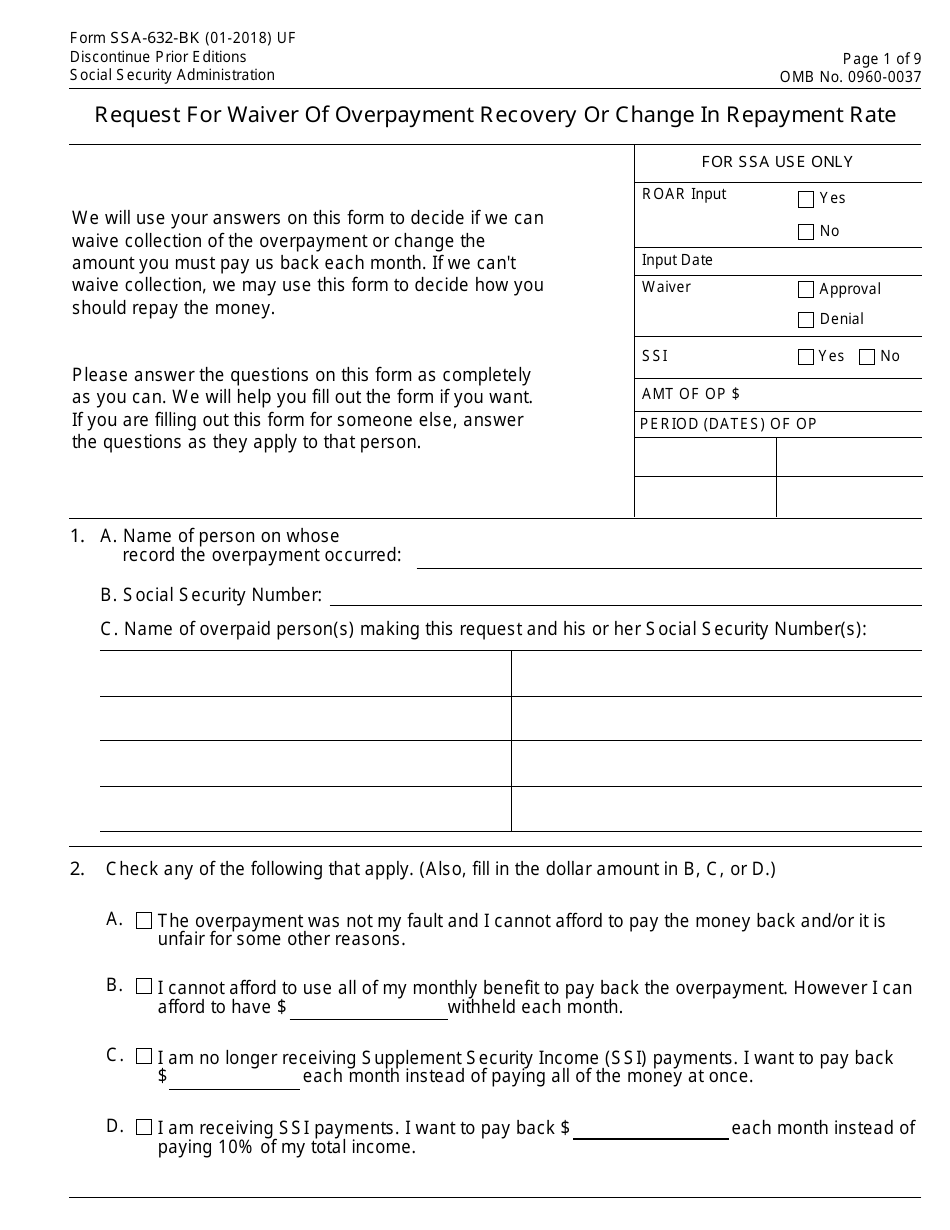

- Check all boxes applicable to the reason why you cannot pay the money back. State if you receive the overpaid benefits as a representative payee to use it for the beneficiary. Write down the beneficiary's name and current address and state how the overpaid benefits were used.

- If the SSA is asking you to repay someone else's overpayment, state if the overpaid person was living with you when the overpayment occurred, if you received the overpaid money, and explain what you know about the overpayment and why it was not your fault.

- Answer why you think you were due to the overpaid money and explain why you did not tell the SSA about the overpayment. If you did, state when and where you did and if you contacted the SSA again.

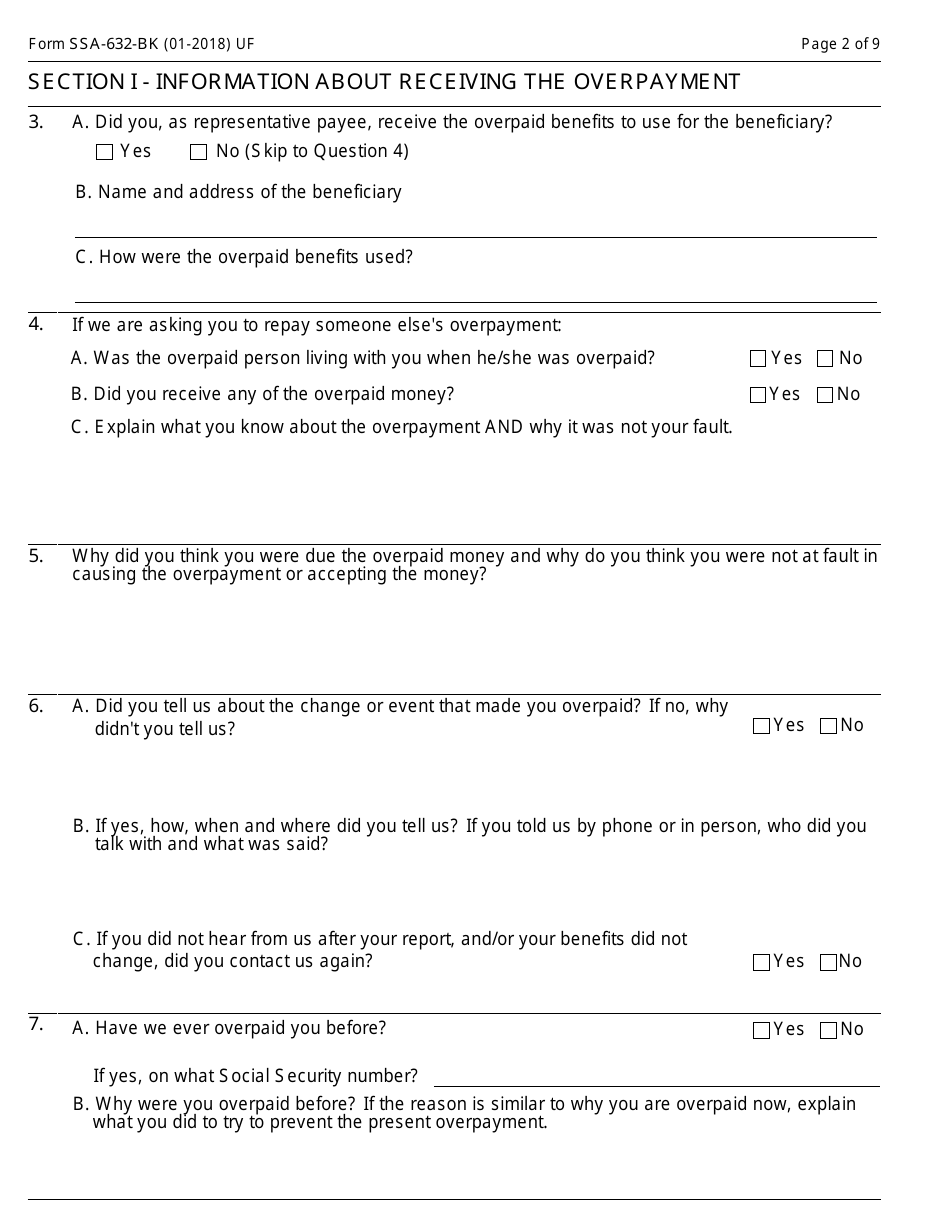

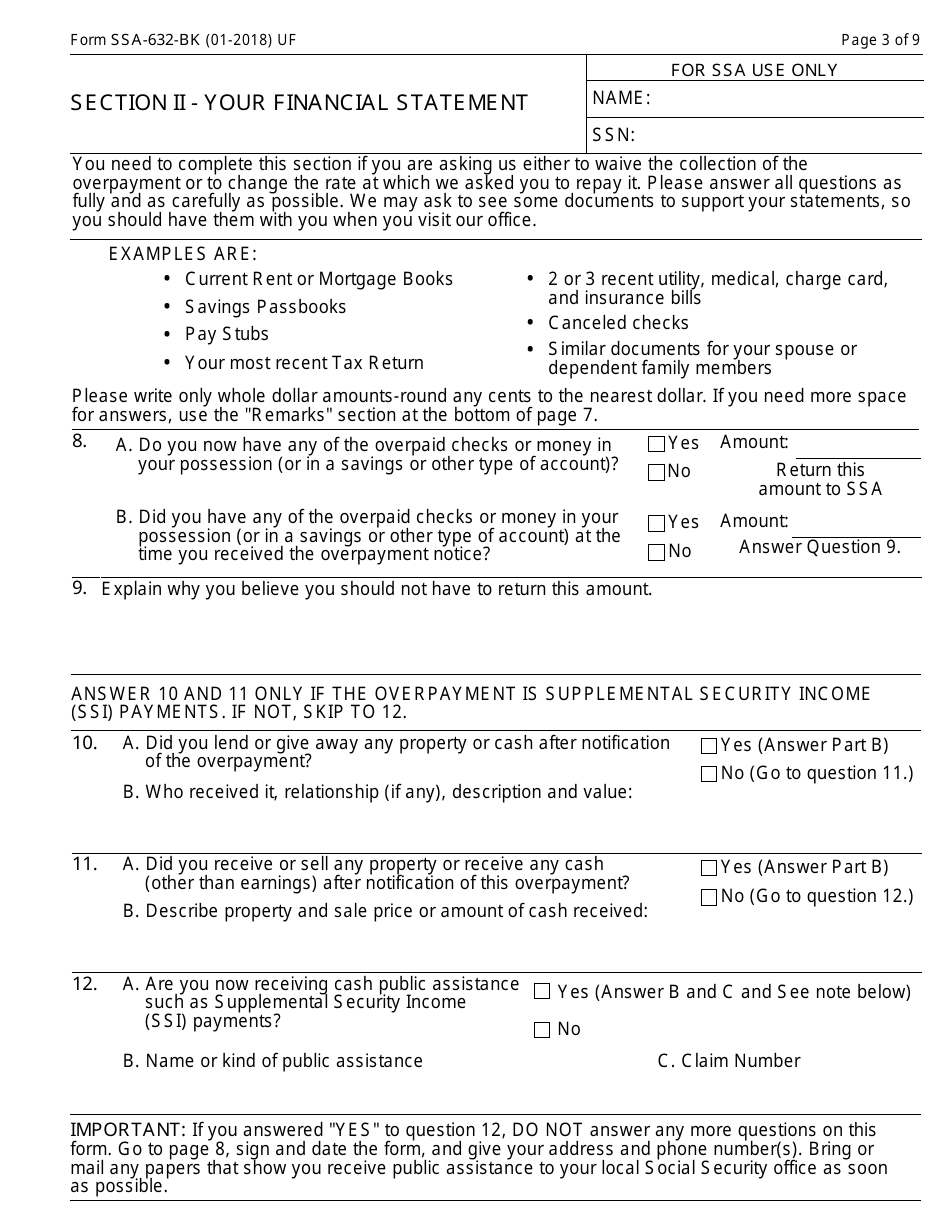

- If the overpayment happened before, indicate the SSN it happened on and the reason for it. State if you have any overpaid checks or money in your possession now or if you had any when you received the overpayment notice. Explain why you believe you do not have to return this money.

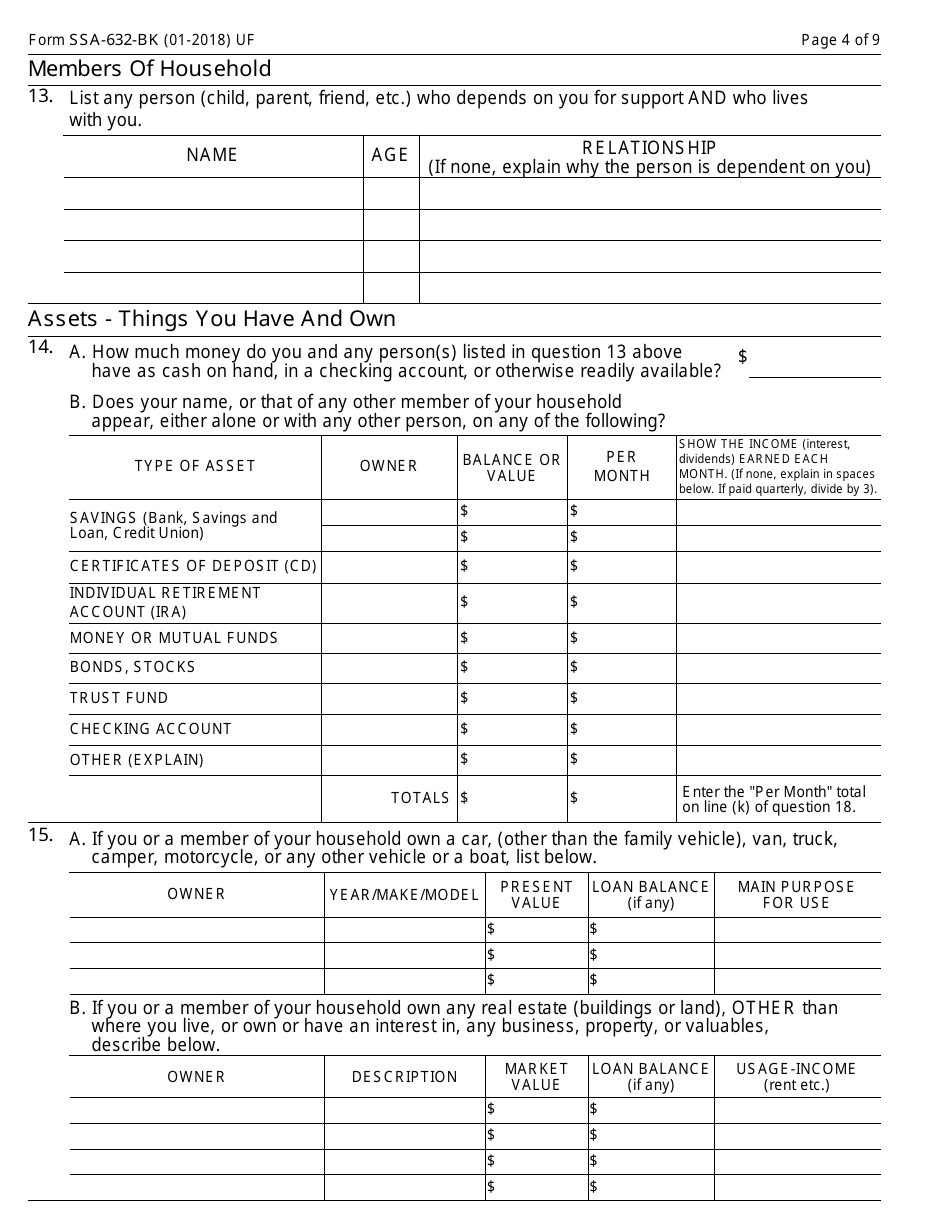

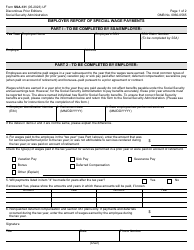

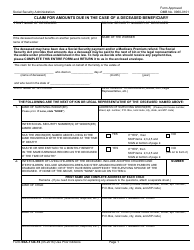

- Answer if you lent, gave away, received, or sold any property or cash after receiving the overpayment notice and describe it. State if you are now receiving cash public assistance. List people who depend on you for financial support and live with you.

- Indicate how much money you have readily available and describe every type of asset. Show the income earned each month and list vehicles and real estate you and your household members have in possession.

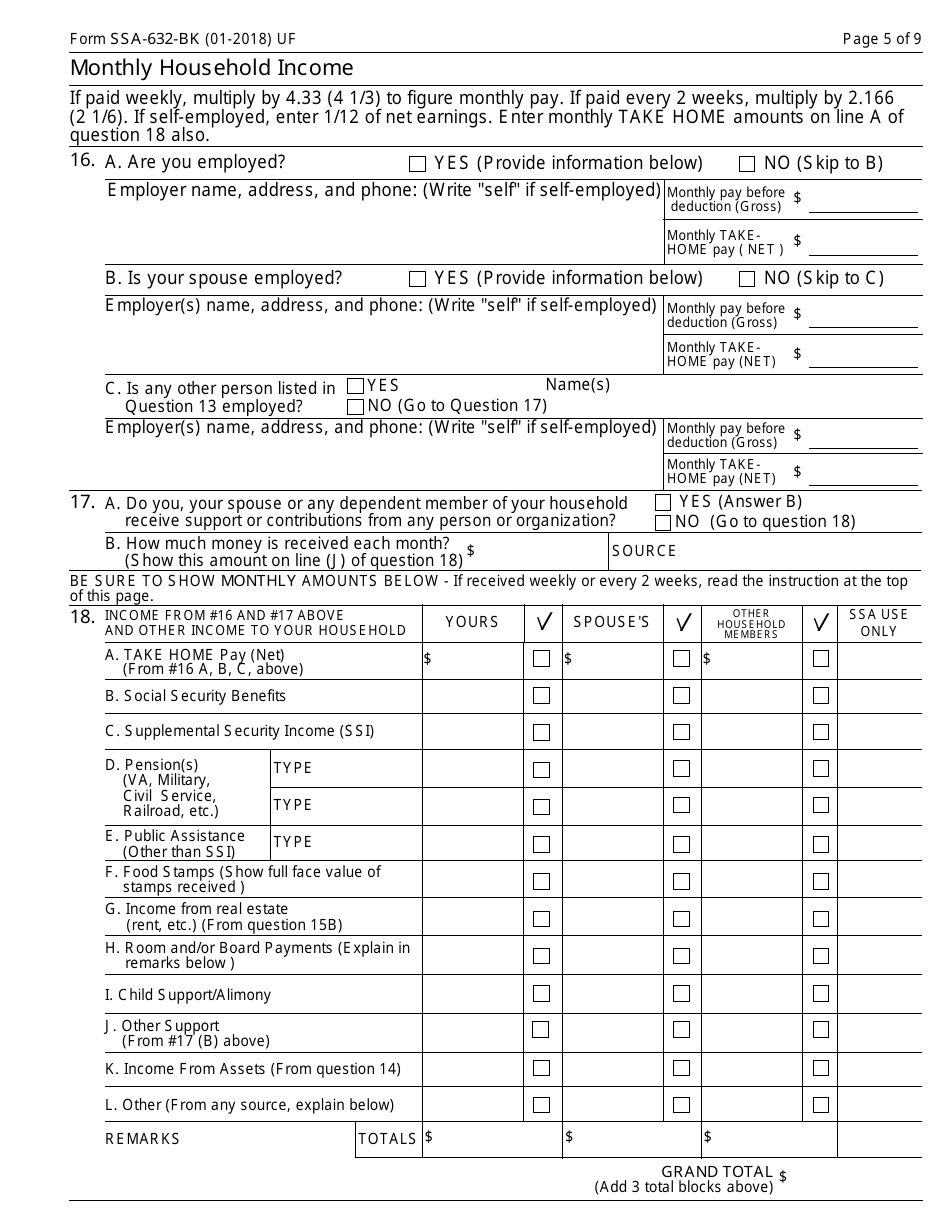

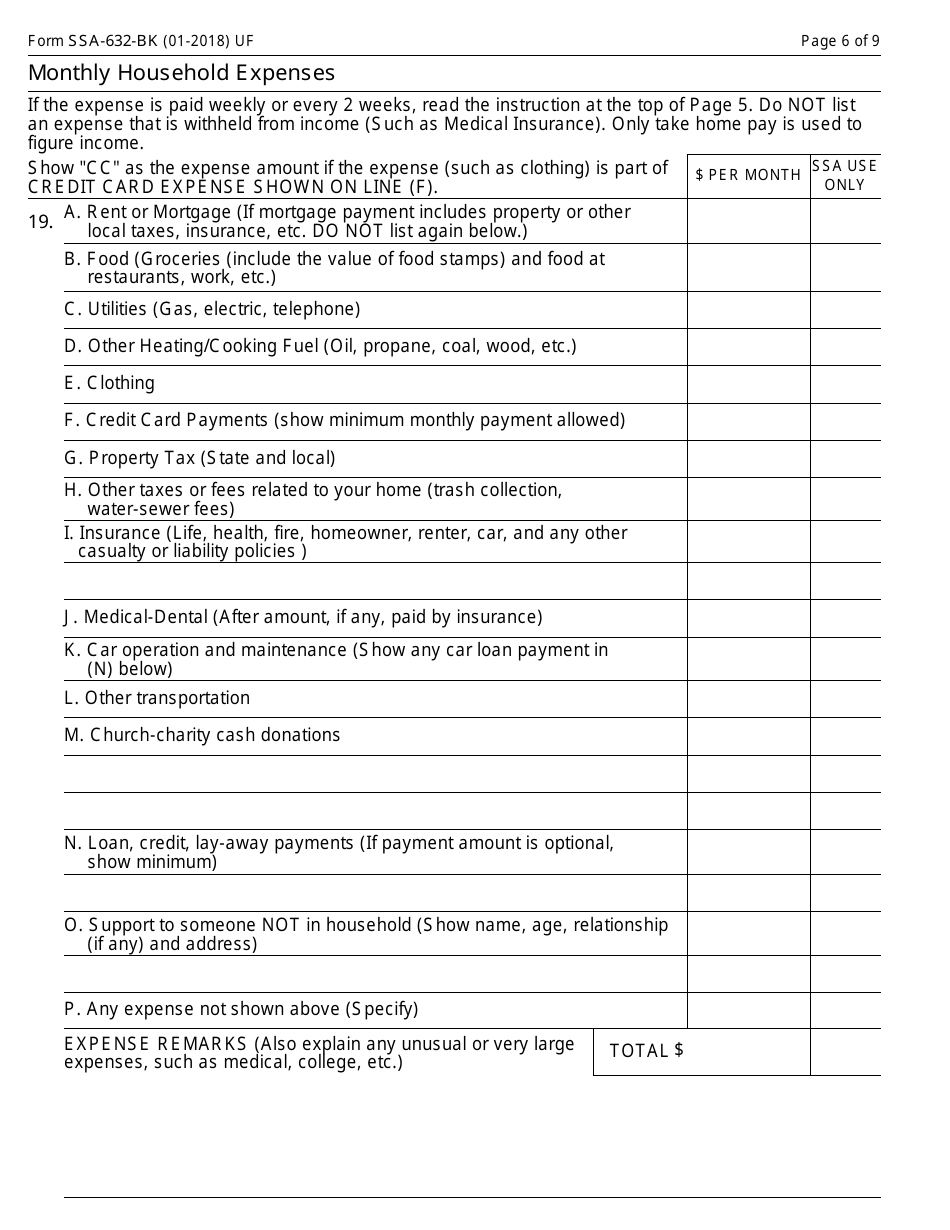

- Provide your own and your household members' employment information, write down the employer's name, address, and phone. State if you or any other household member receive contribution or support from any organization or individual. Fully describe all the income to your household. Identify all monthly household expenses.

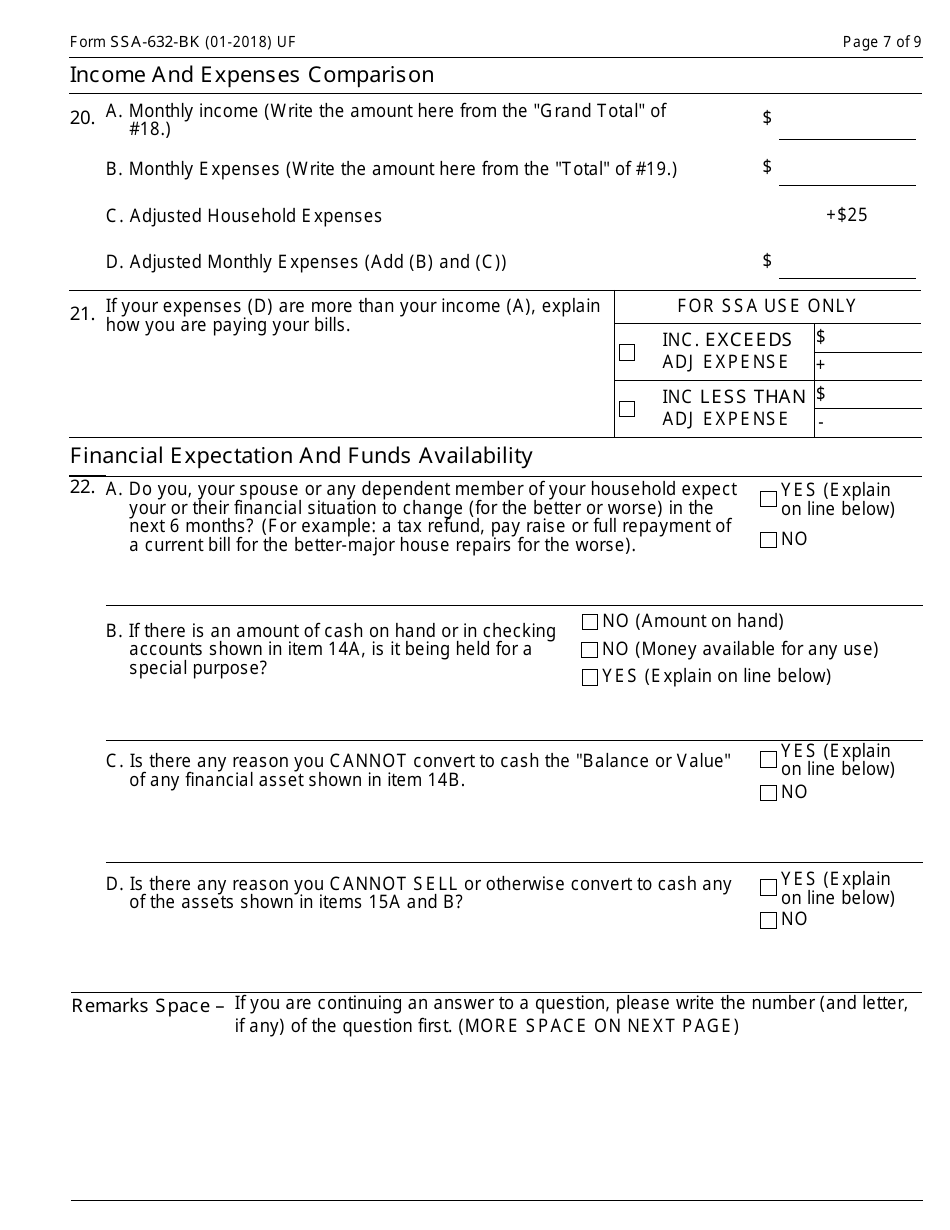

- Compare your monthly income and monthly expenses and explain how you are paying your bills if your expenses are more than your income.

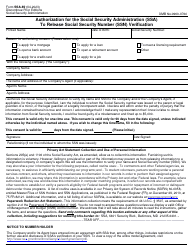

- Tell the SSA about your available funds and financial expectations if you expect your financial situation to change for the better or worse in the next 6 months.

Form SSA-632-BK Instructions

Instructions for Form SSA-632-BK are as follows:

- Answer all the questions as fully and carefully as you can;

- If you are completing this form for someone else, answer the questions as they apply to that individual;

- You are required to complete the section concerning your financial statement if you want the SSA either to change the rate at which they asked you to repay the money or to waive the collection of the overpayment;

- Prepare documents and their copies to support your statements and money amounts in the form;

- If you need to add any information, you can use the "Remarks" section on page 7;

- If you do not understand the questions on the form, take the form to your local social security office and ask them to explain it to you.