This version of the form is not currently in use and is provided for reference only. Download this version of

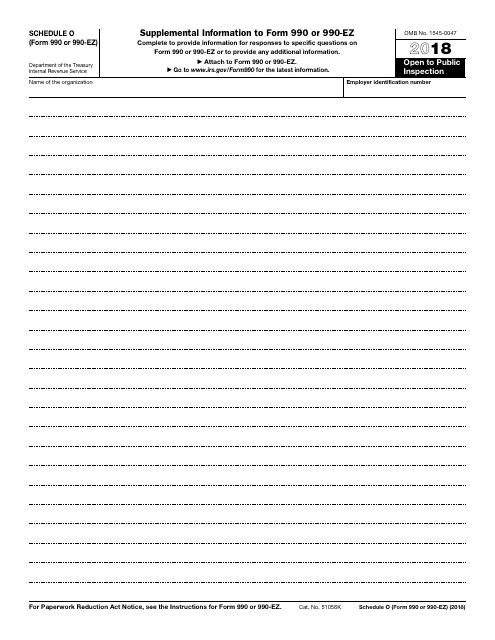

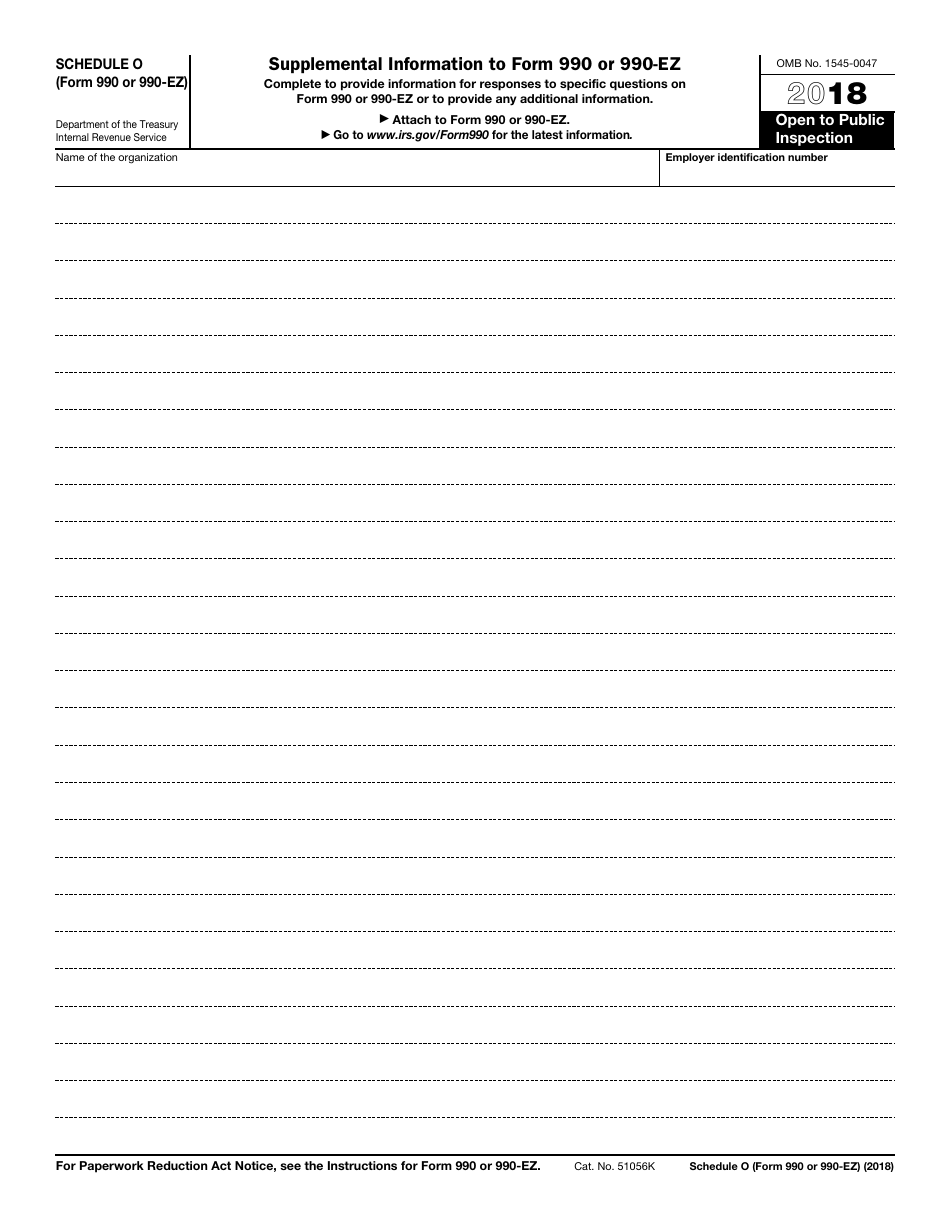

IRS Form 990 Schedule O

for the current year.

IRS Form 990 Schedule O Supplemental Information to Form 990 or 990-ez

What Is IRS Form 990 Schedule O?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990 Schedule O?

A: IRS Form 990 Schedule O is a supplemental information form to be filed with Form 990 or Form 990-EZ.

Q: What is the purpose of IRS Form 990 Schedule O?

A: The purpose of Form 990 Schedule O is to provide additional details and explanations regarding certain items reported on Form 990 or Form 990-EZ.

Q: Who is required to file IRS Form 990 Schedule O?

A: Nonprofit organizations that file Form 990 or Form 990-EZ are required to file Schedule O if applicable.

Q: What type of information is included in IRS Form 990 Schedule O?

A: Schedule O includes information on specific transactions, compensation of officers, relationships with other organizations, and other supplemental details.

Q: When is IRS Form 990 Schedule O due?

A: IRS Form 990 Schedule O is due on the same date as the corresponding Form 990 or Form 990-EZ.

Q: Can I file IRS Form 990 Schedule O electronically?

A: Yes, you can electronically file IRS Form 990 Schedule O if you are filing Form 990 or Form 990-EZ electronically.

Q: Are there any penalties for not filing or late filing IRS Form 990 Schedule O?

A: Yes, there can be penalties for not filing or late filing IRS Form 990 Schedule O. It is important to comply with all IRS filing requirements and deadlines.

Q: Do I need to hire a professional to complete IRS Form 990 Schedule O?

A: While you can complete IRS Form 990 Schedule O on your own, it is recommended to seek assistance from a tax professional or nonprofit expert to ensure accurate and compliant filing.

Q: Can I request an extension for filing IRS Form 990 Schedule O?

A: Yes, you can request an extension for filing IRS Form 990 Schedule O by filing Form 8868, Application for Extension of Time to File an Exempt Organization Return.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule O through the link below or browse more documents in our library of IRS Forms.