This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990 Schedule M

for the current year.

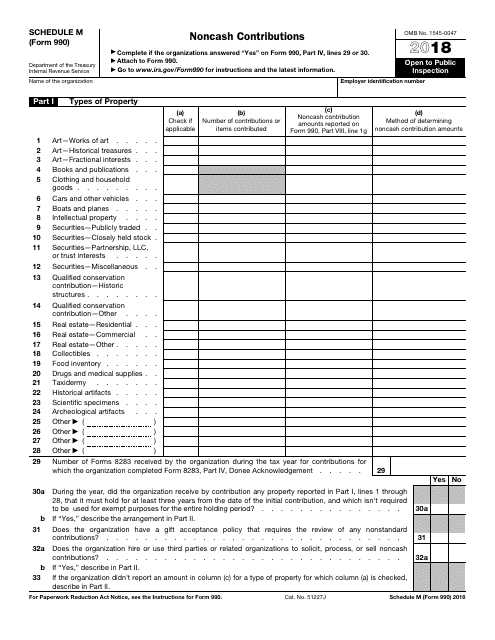

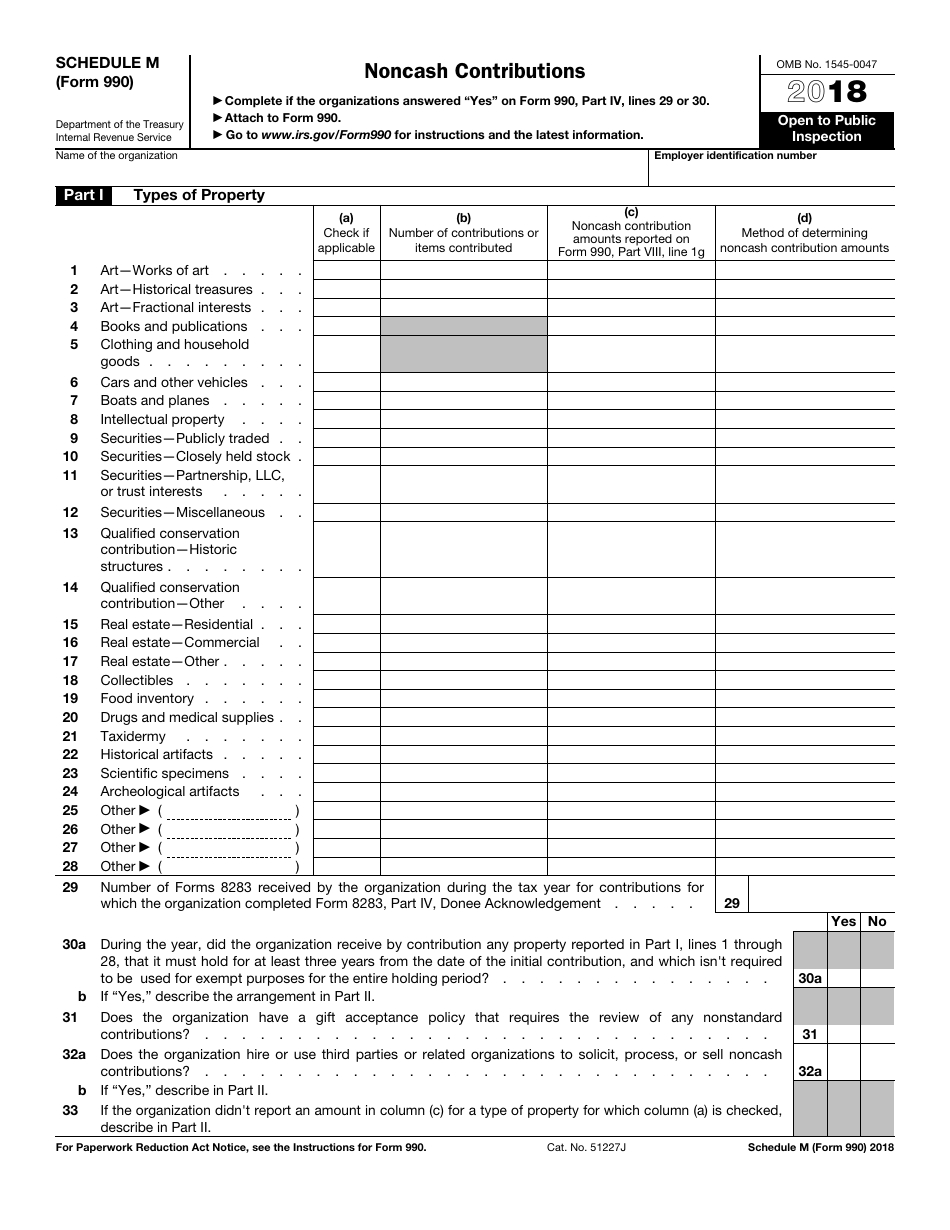

IRS Form 990 Schedule M Noncash Contributions

What Is IRS Form 990 Schedule M?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990 Schedule M?

A: IRS Form 990 Schedule M is a form used by tax-exempt organizations to report noncash contributions they received during the tax year.

Q: Who needs to file IRS Form 990 Schedule M?

A: Tax-exempt organizations that received noncash contributions during the tax year need to file IRS Form 990 Schedule M.

Q: What are noncash contributions?

A: Noncash contributions are donations of property or other assets other than cash. Examples include clothing, equipment, and securities.

Q: What information is required on IRS Form 990 Schedule M?

A: IRS Form 990 Schedule M requires the organization to provide details of the noncash contributions they received, including description, fair market value, and the donor's information.

Q: When is IRS Form 990 Schedule M due?

A: IRS Form 990 Schedule M is typically due along with the organization's annual Form 990, which is due on the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing IRS Form 990 Schedule M?

A: Yes, there can be penalties for not filing IRS Form 990 Schedule M or providing inaccurate information. It's important for tax-exempt organizations to comply with the filing requirements.

Q: Can I e-file IRS Form 990 Schedule M?

A: Yes, tax-exempt organizations can e-file IRS Form 990 Schedule M using approved tax software or through authorized e-file providers.

Q: Do I need to attach any documents to IRS Form 990 Schedule M?

A: Depending on the type and value of the noncash contributions, additional documentation, such as appraisals or acknowledgment letters, may need to be attached to IRS Form 990 Schedule M.

Q: Can I request an extension to file IRS Form 990 Schedule M?

A: Yes, tax-exempt organizations can request an extension to file IRS Form 990 Schedule M by filing Form 8868 before the original due date.

Form Details:

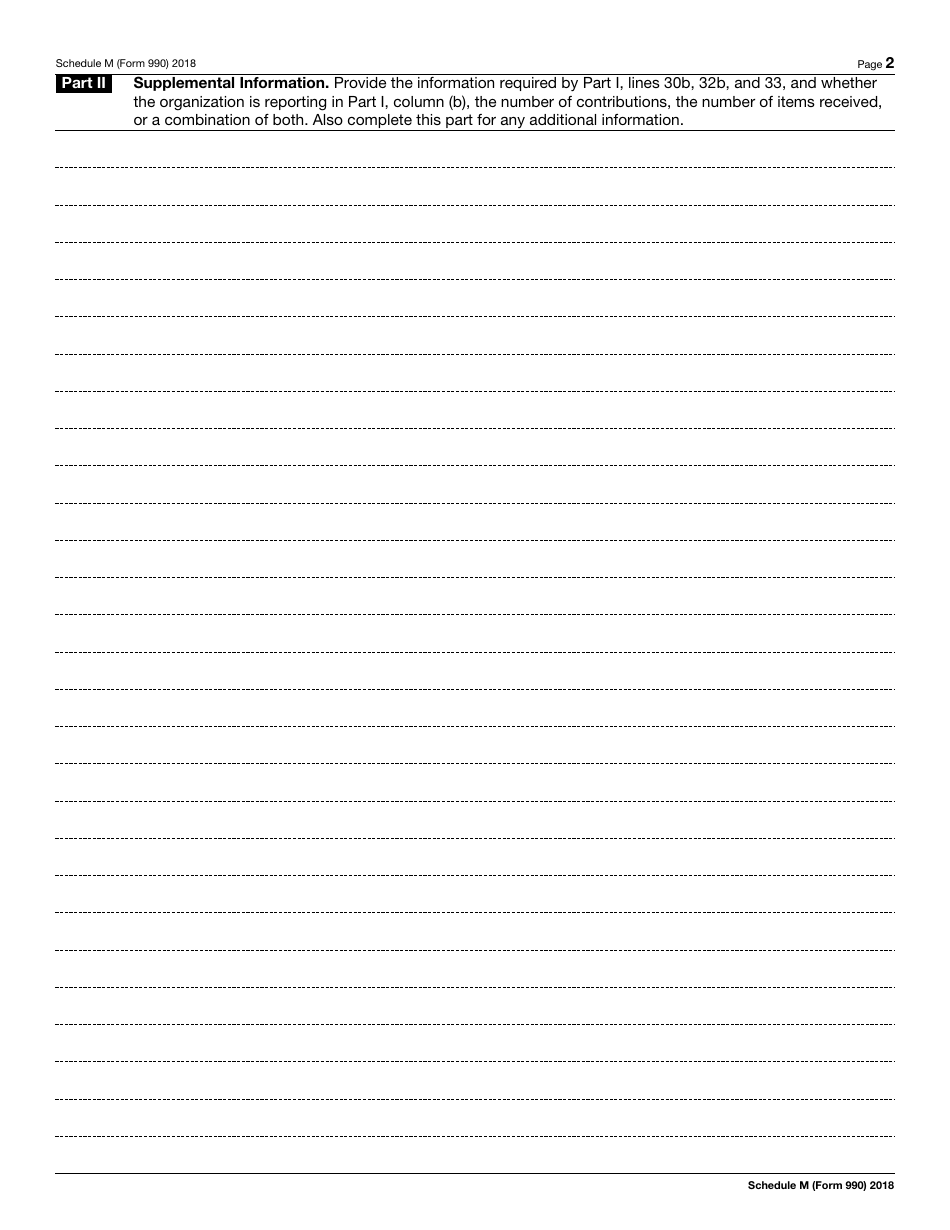

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule M through the link below or browse more documents in our library of IRS Forms.