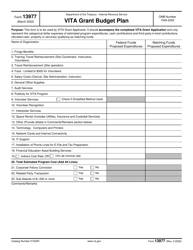

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990 Schedule I

for the current year.

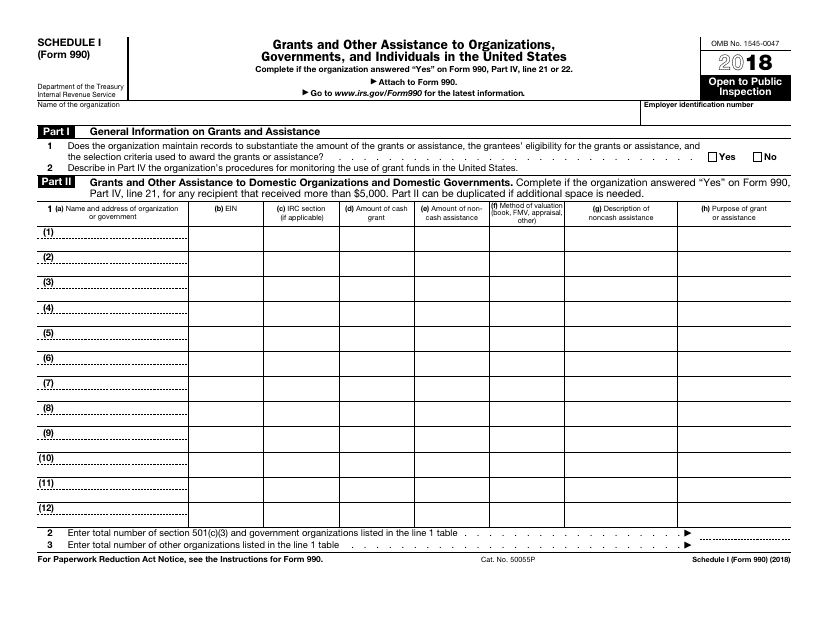

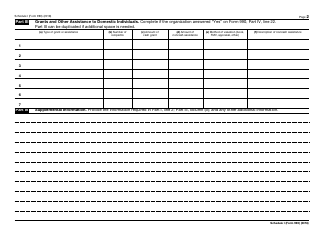

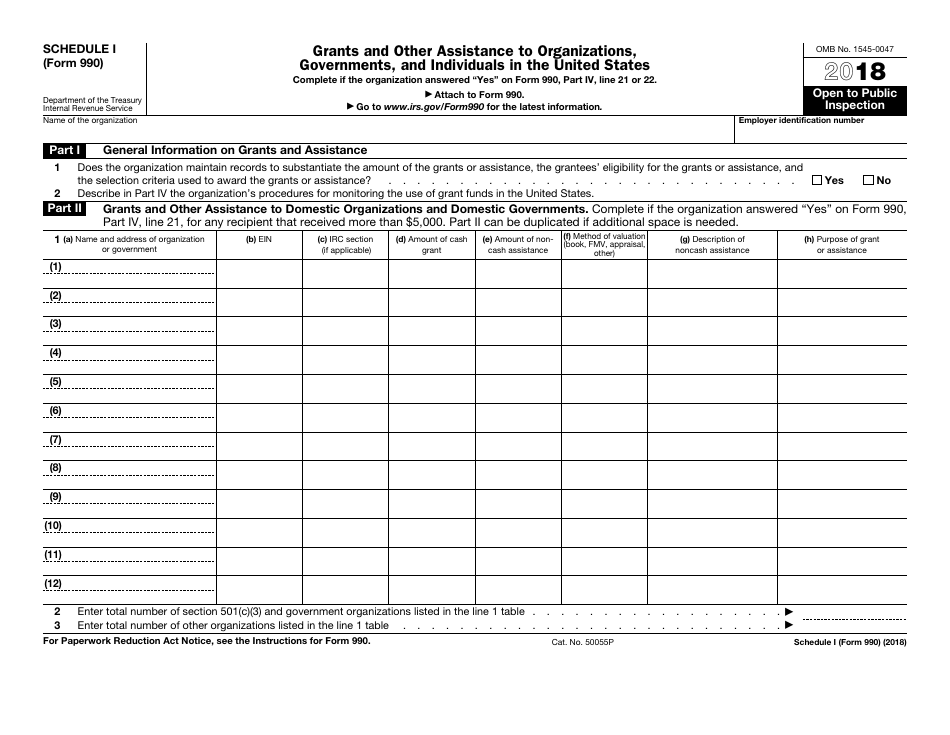

IRS Form 990 Schedule I Grants and Other Assistance to Organizations, Governments, and Individuals in the United States

What Is IRS Form 990 Schedule I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990 Schedule I?

A: IRS Form 990 Schedule I is a tax form used by tax-exempt organizations to report grants and other assistance provided to organizations, governments, and individuals in the United States.

Q: Who needs to file IRS Form 990 Schedule I?

A: Tax-exempt organizations who provide grants and other assistance to organizations, governments, and individuals in the United States need to file IRS Form 990 Schedule I.

Q: What information is reported on IRS Form 990 Schedule I?

A: IRS Form 990 Schedule I requires organizations to provide details about the grants and assistance they have provided, including the recipient's name, purpose of the grant, and amount given.

Q: Is IRS Form 990 Schedule I publicly available?

A: Yes, IRS Form 990 Schedule I is part of the annual tax return (Form 990) submitted by tax-exempt organizations and is available for public inspection.

Q: Are there any penalties for not filing IRS Form 990 Schedule I?

A: Yes, failure to file IRS Form 990 Schedule I or providing incomplete or inaccurate information may result in penalties for the tax-exempt organization.

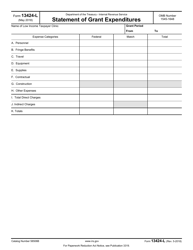

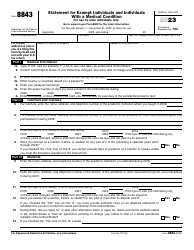

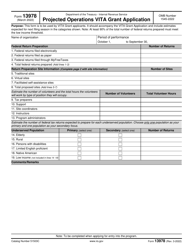

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule I through the link below or browse more documents in our library of IRS Forms.