This version of the form is not currently in use and is provided for reference only. Download this version of

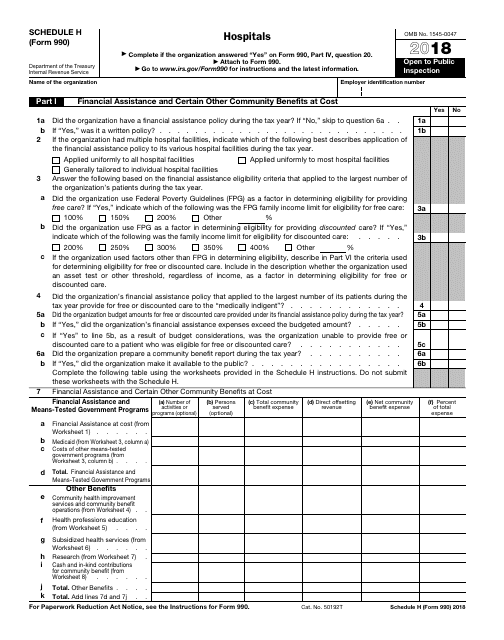

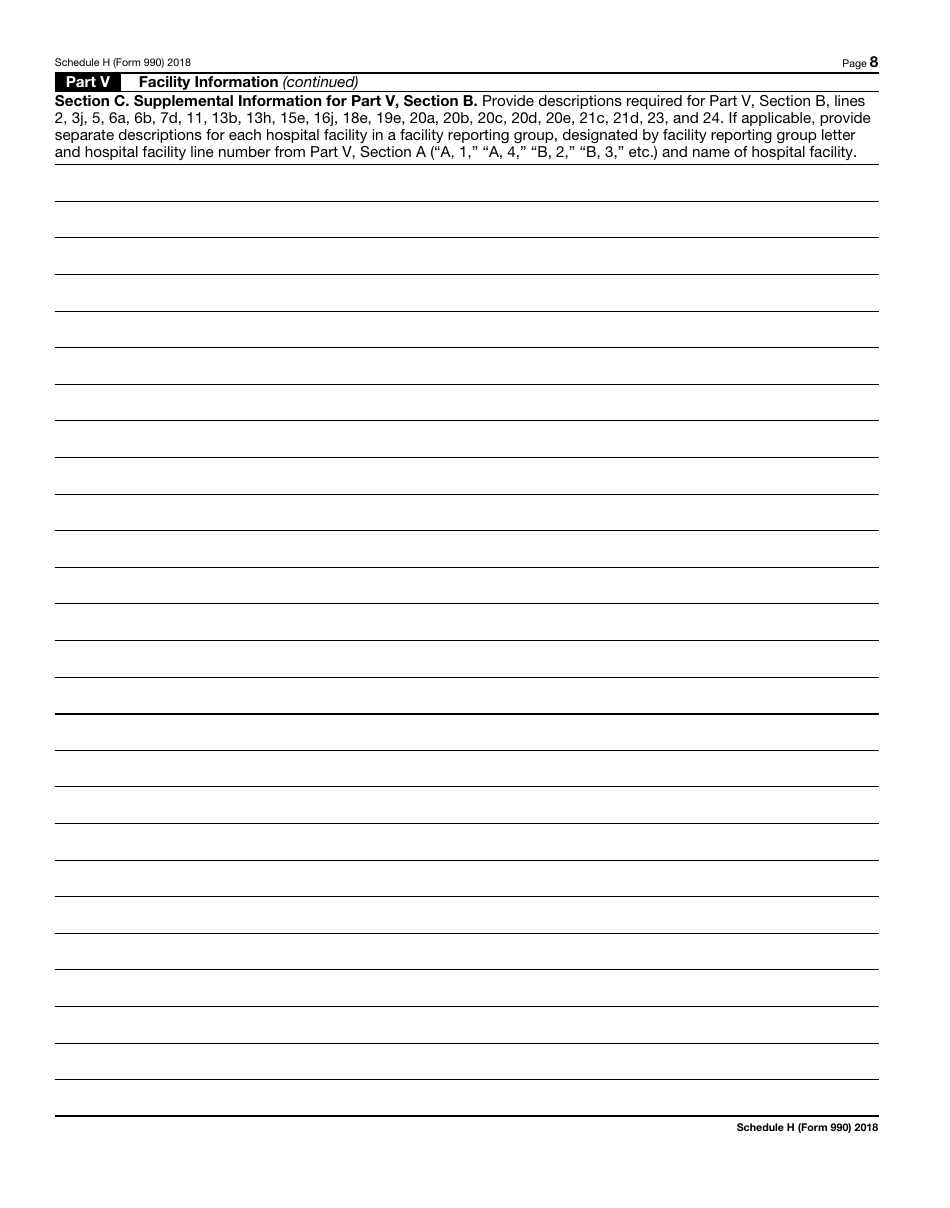

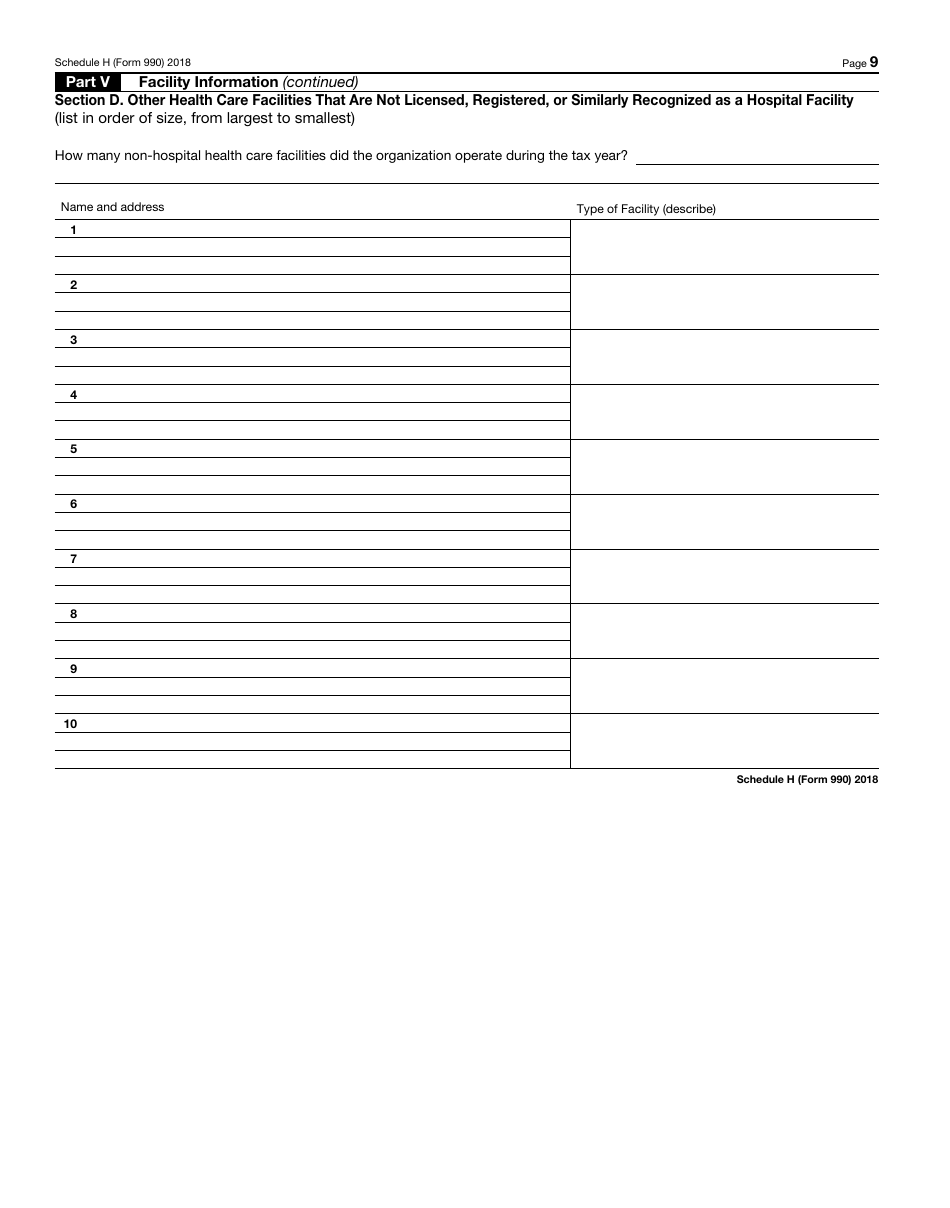

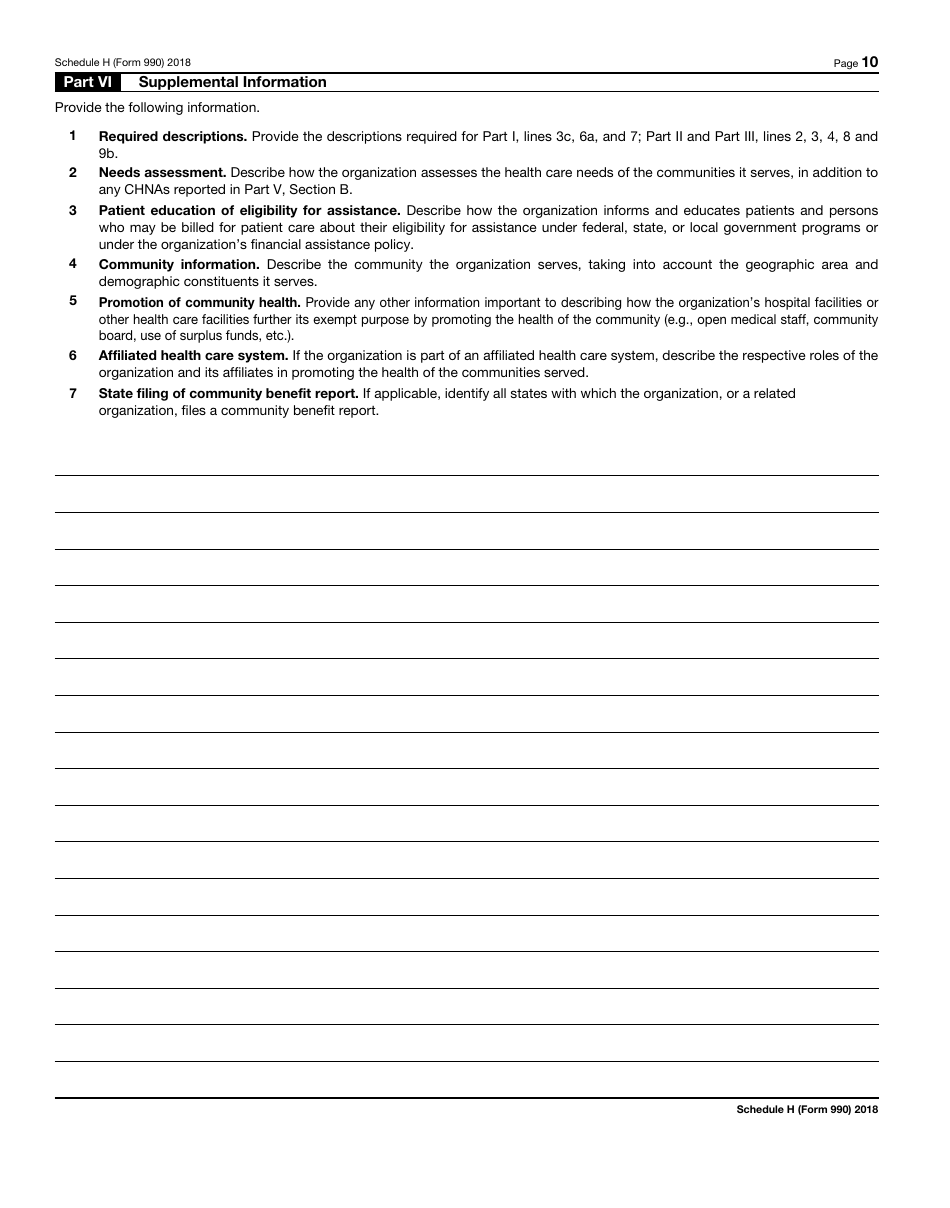

IRS Form 990 Schedule H

for the current year.

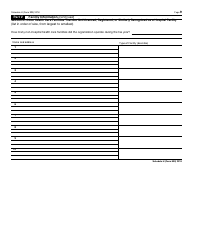

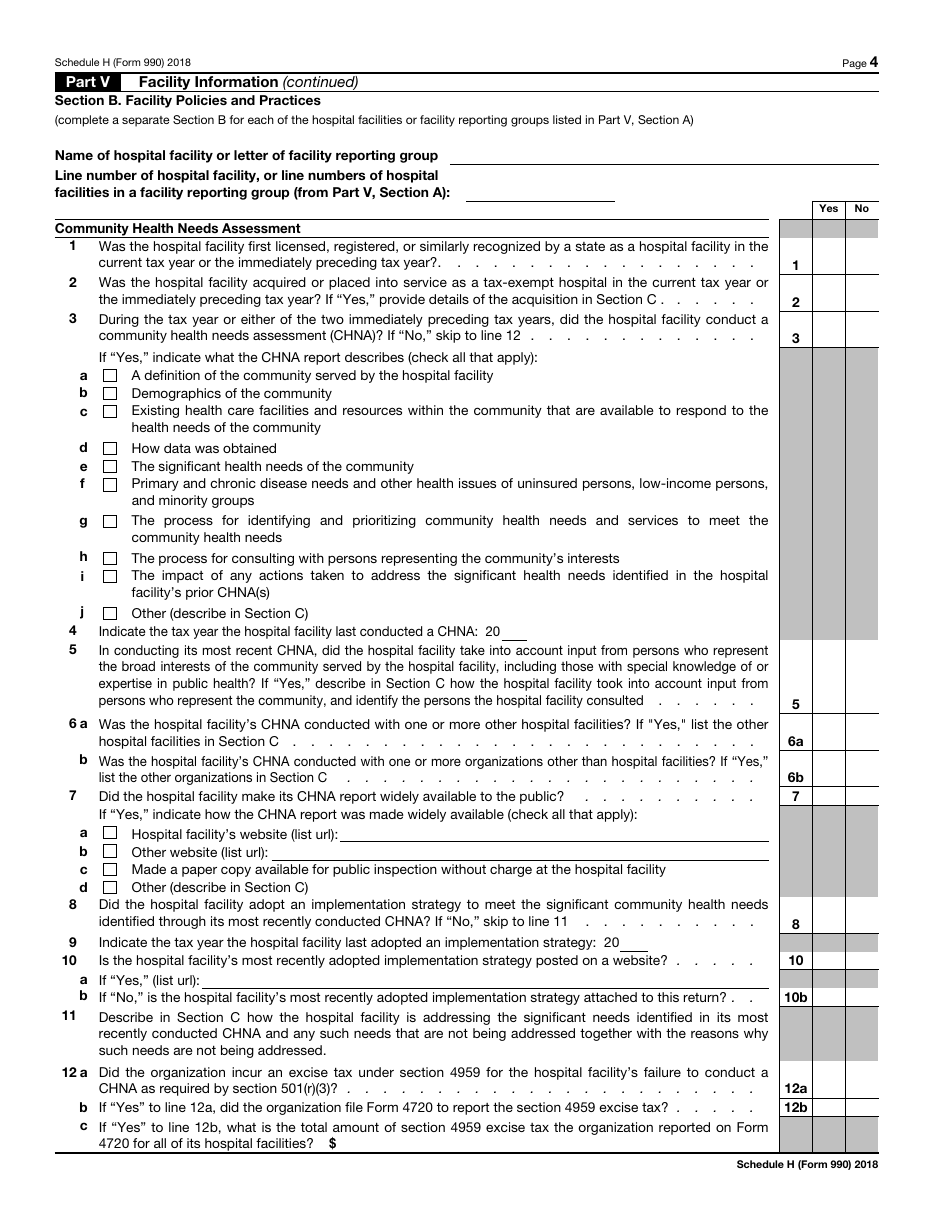

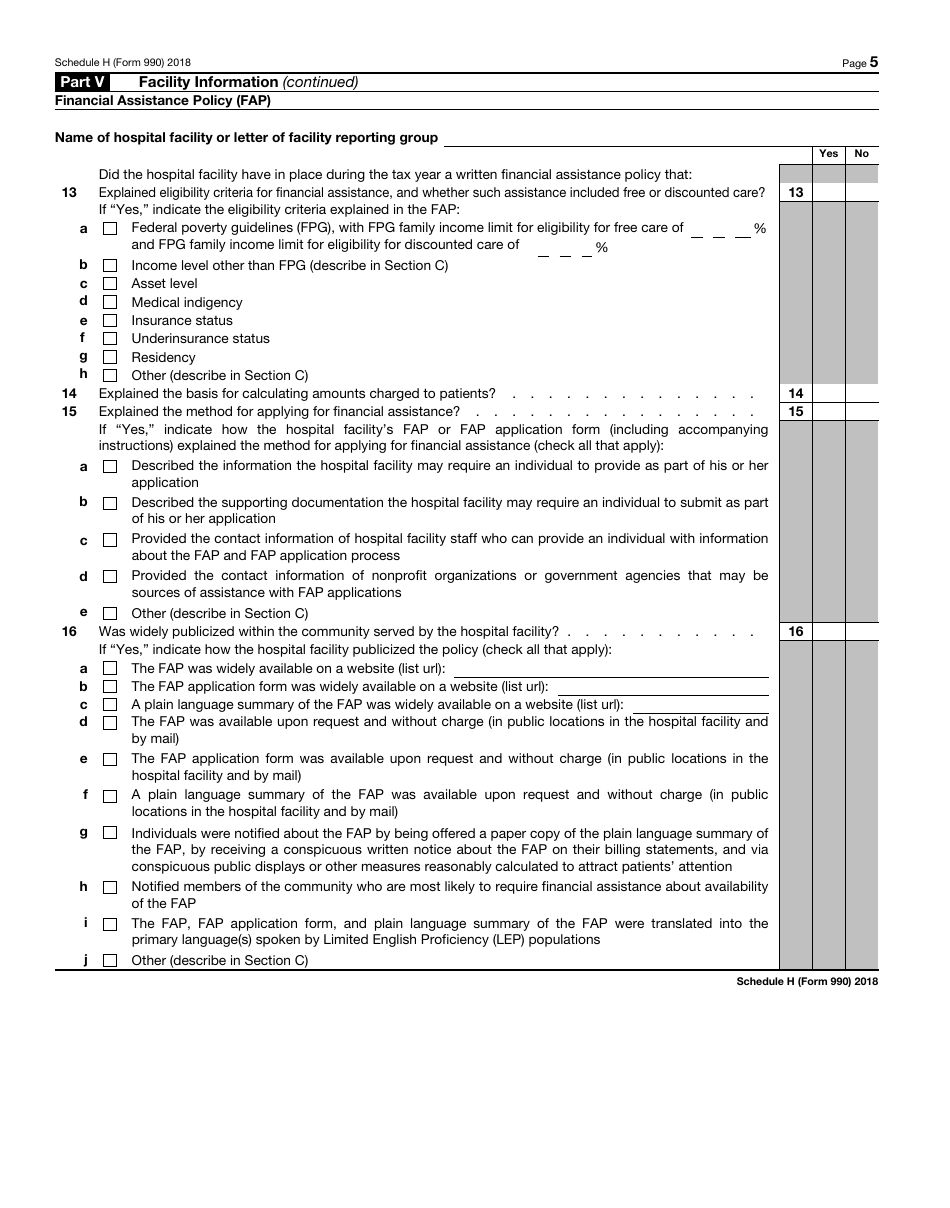

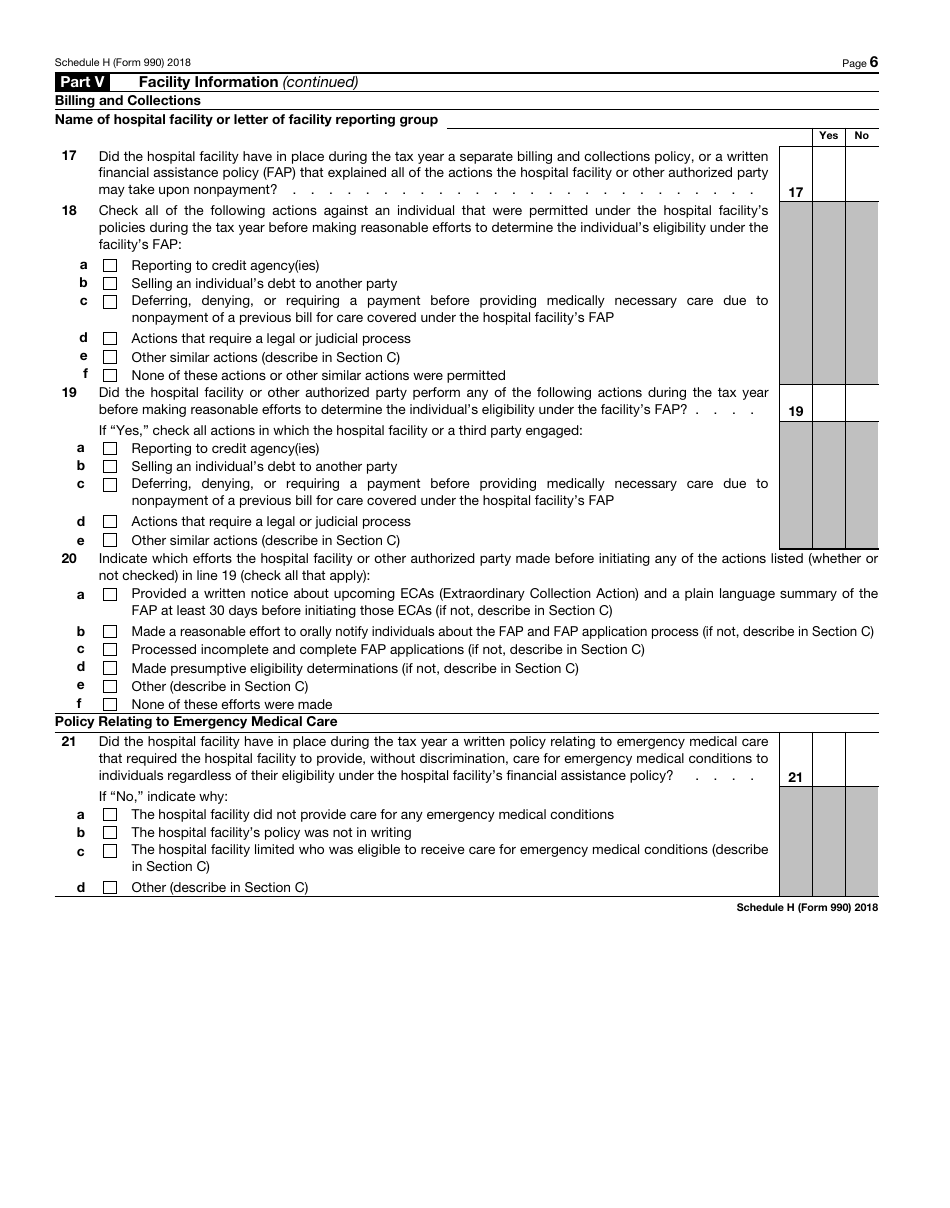

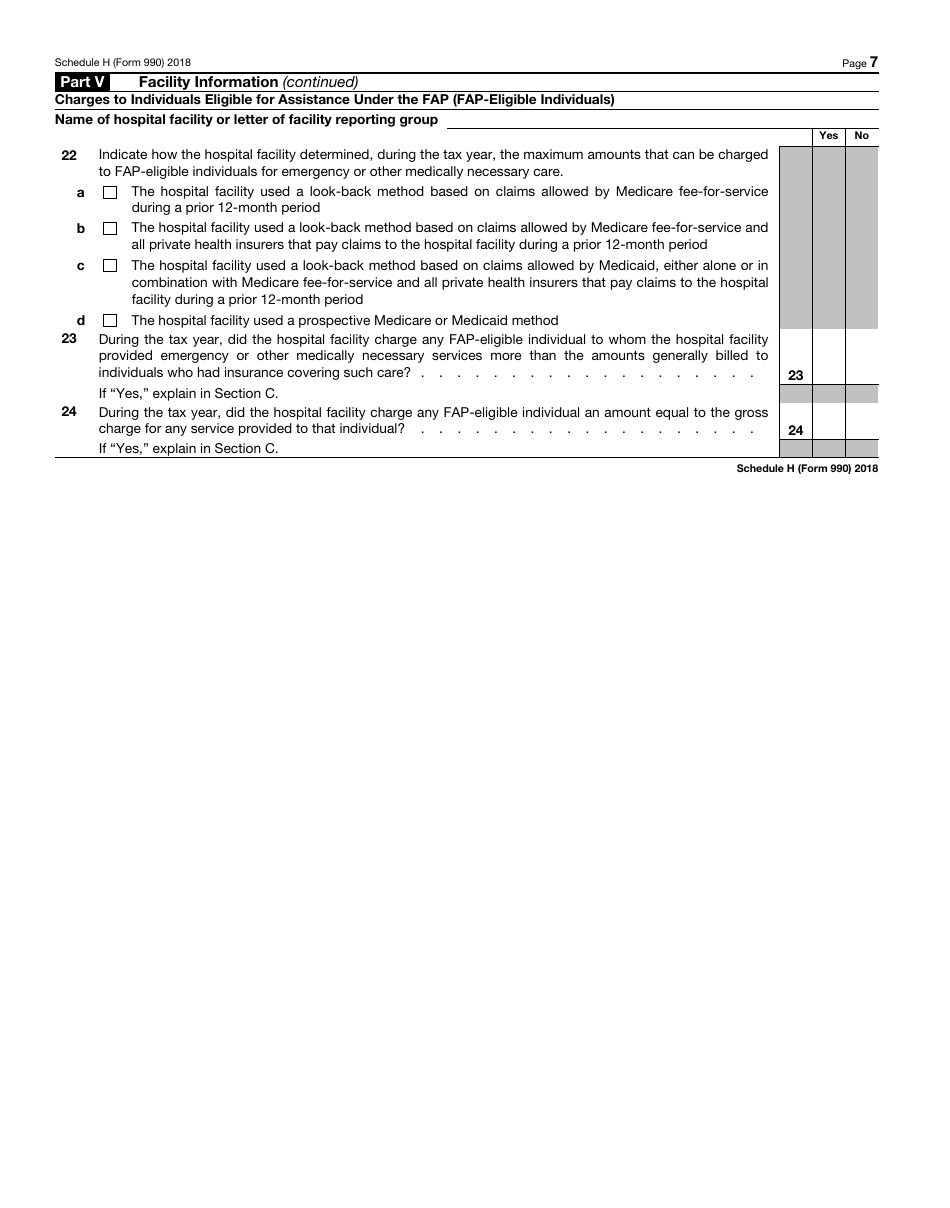

IRS Form 990 Schedule H Hospitals

What Is IRS Form 990 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H is a tax form used by hospitals to report information about their community benefit activities.

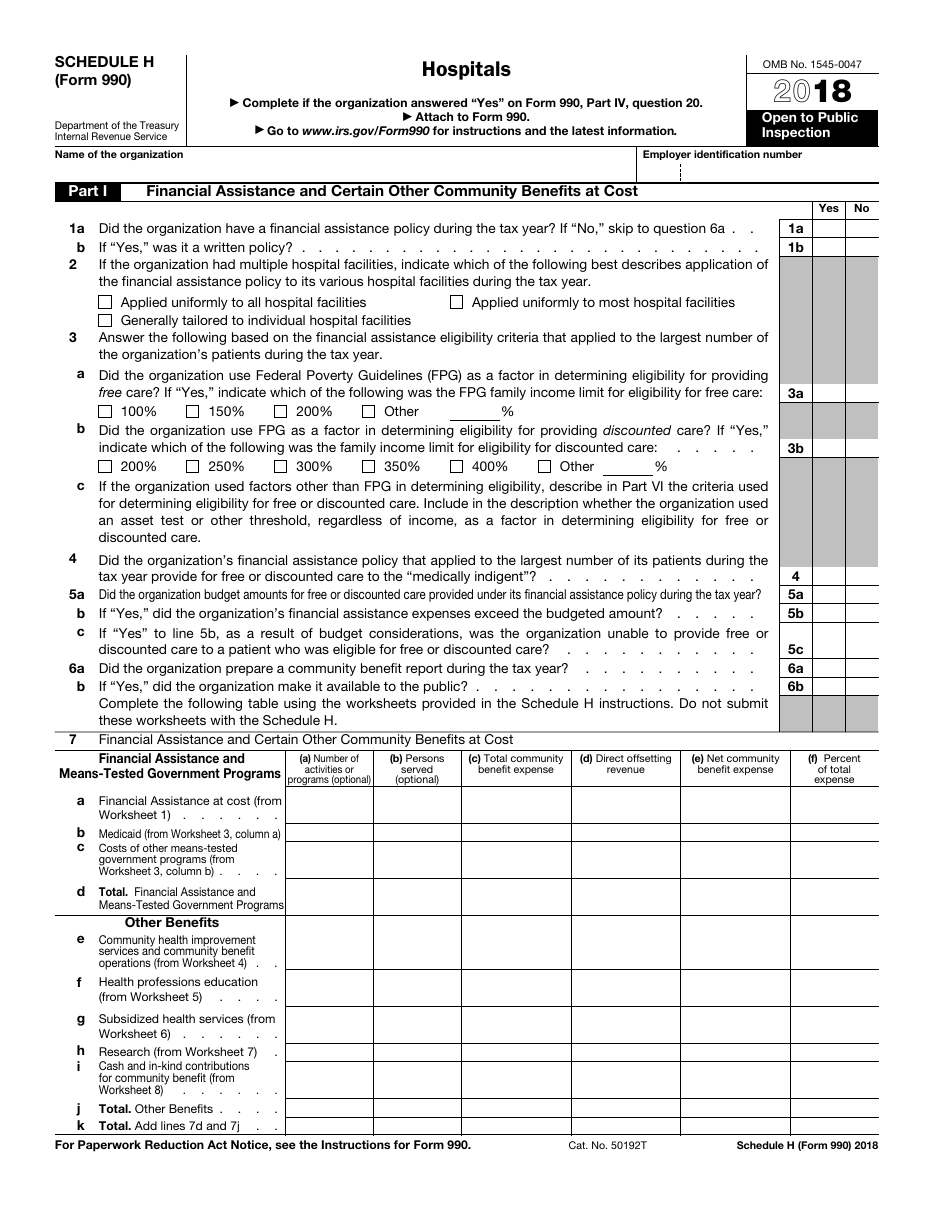

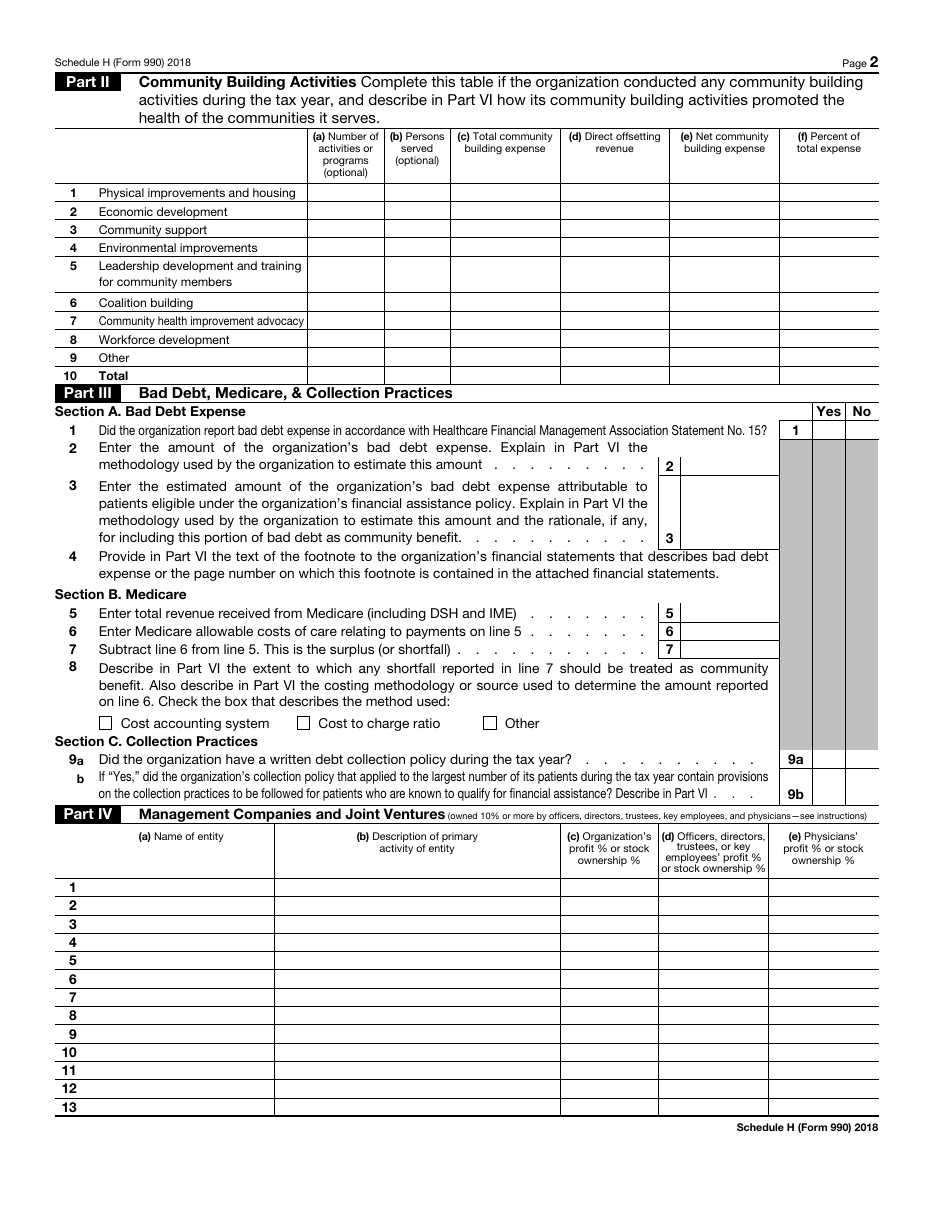

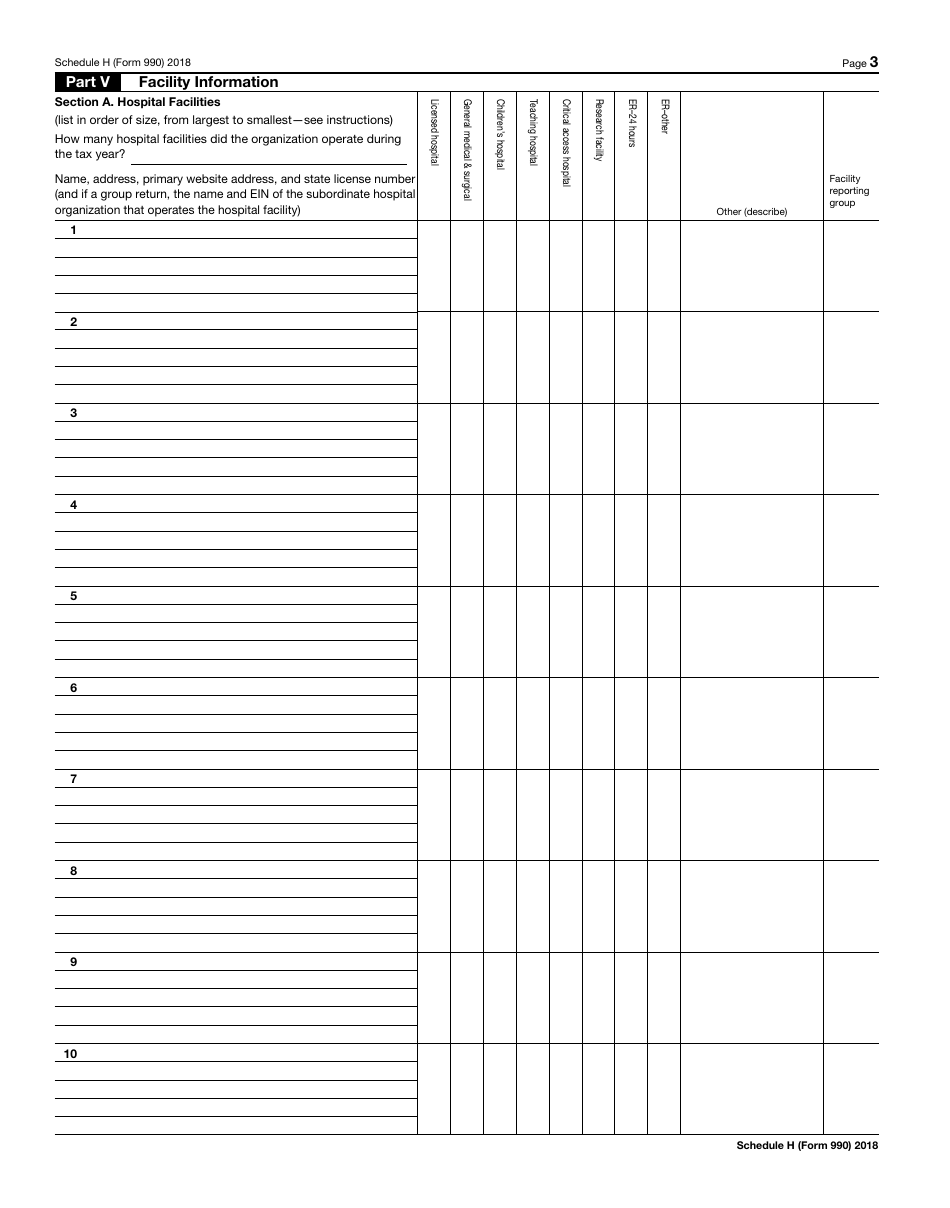

Q: What information does IRS Form 990 Schedule H require?

A: IRS Form 990 Schedule H requires hospitals to report details about their charity care, unreimbursed Medicaid costs, and other community benefit activities.

Q: Who needs to file IRS Form 990 Schedule H?

A: Nonprofit hospitals are required to file IRS Form 990 Schedule H.

Q: When is IRS Form 990 Schedule H due?

A: IRS Form 990 Schedule H is due with the hospital's annual Form 990 filing, which is typically due on the 15th day of the 5th month after the close of the hospital's fiscal year.

Q: Are there any penalties for not filing IRS Form 990 Schedule H?

A: Yes, there can be penalties for not filing IRS Form 990 Schedule H, including loss of tax-exempt status for the hospital.

Form Details:

- A 10-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule H through the link below or browse more documents in our library of IRS Forms.