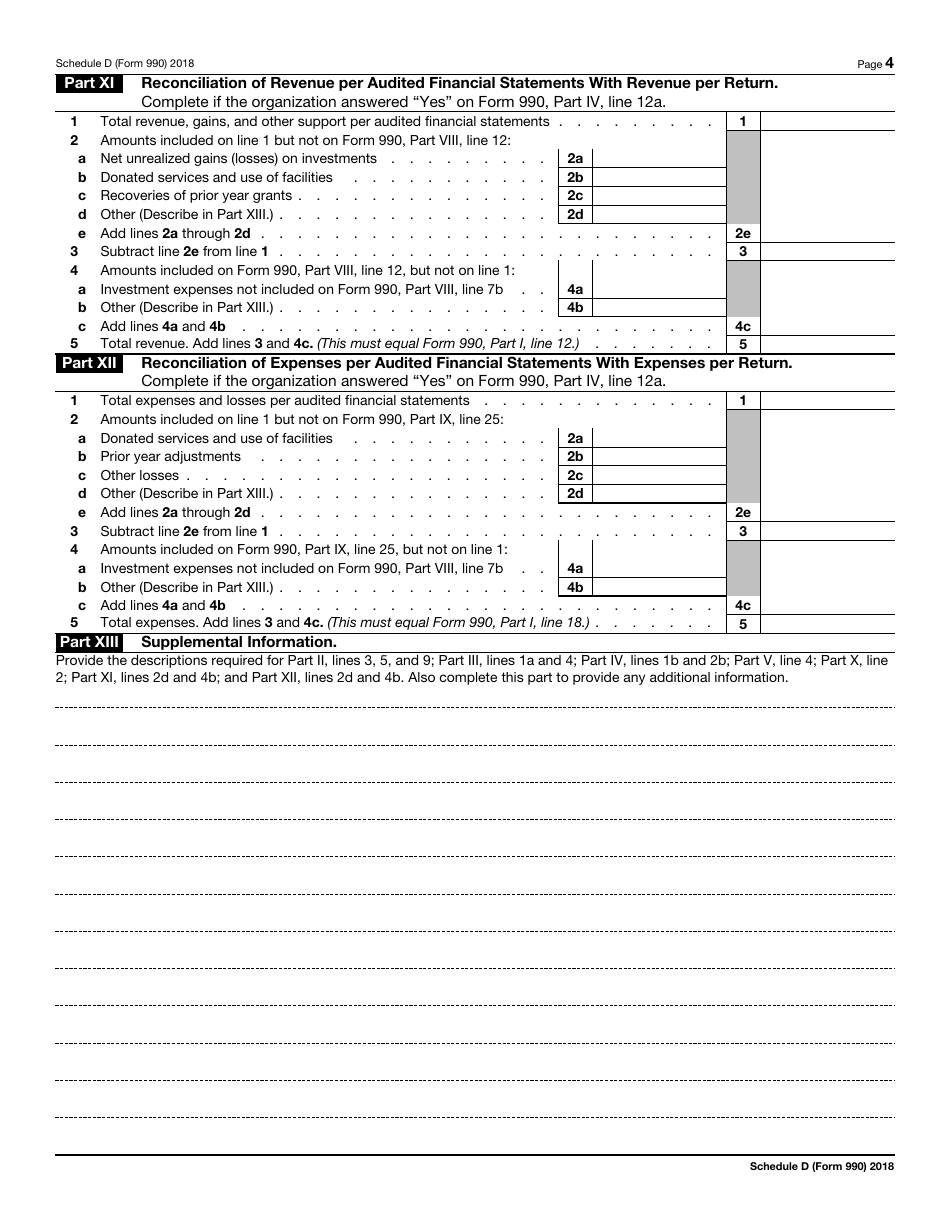

This version of the form is not currently in use and is provided for reference only. Download this version of

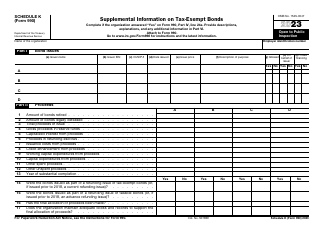

IRS Form 990 Schedule D

for the current year.

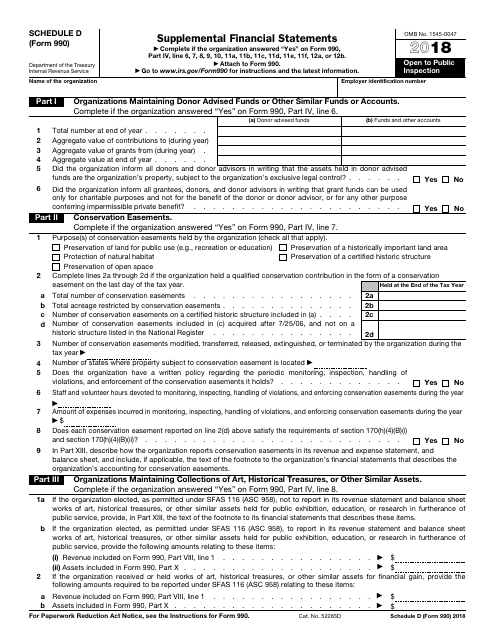

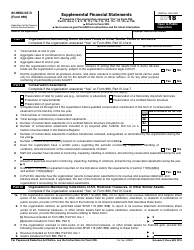

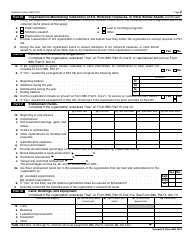

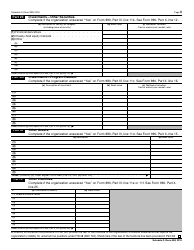

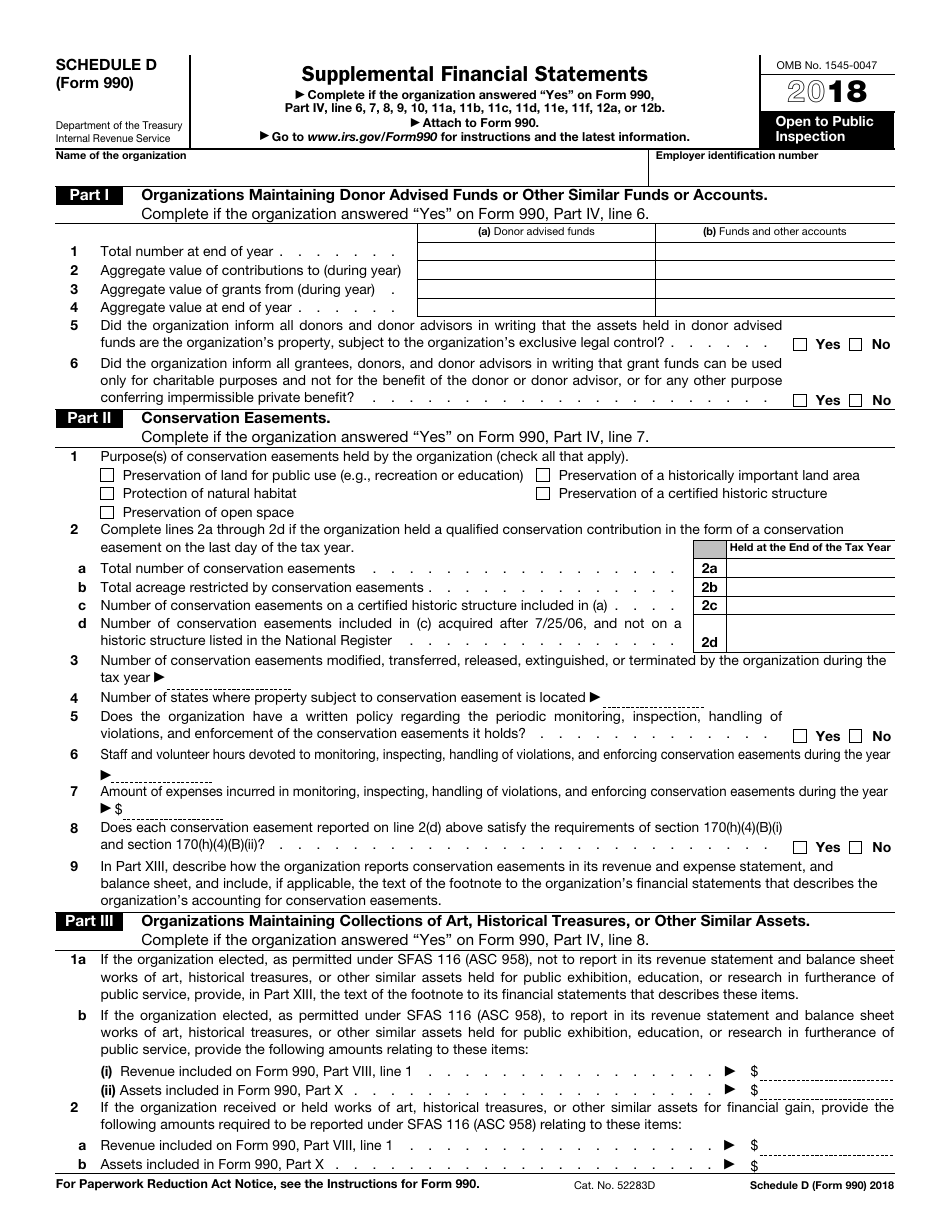

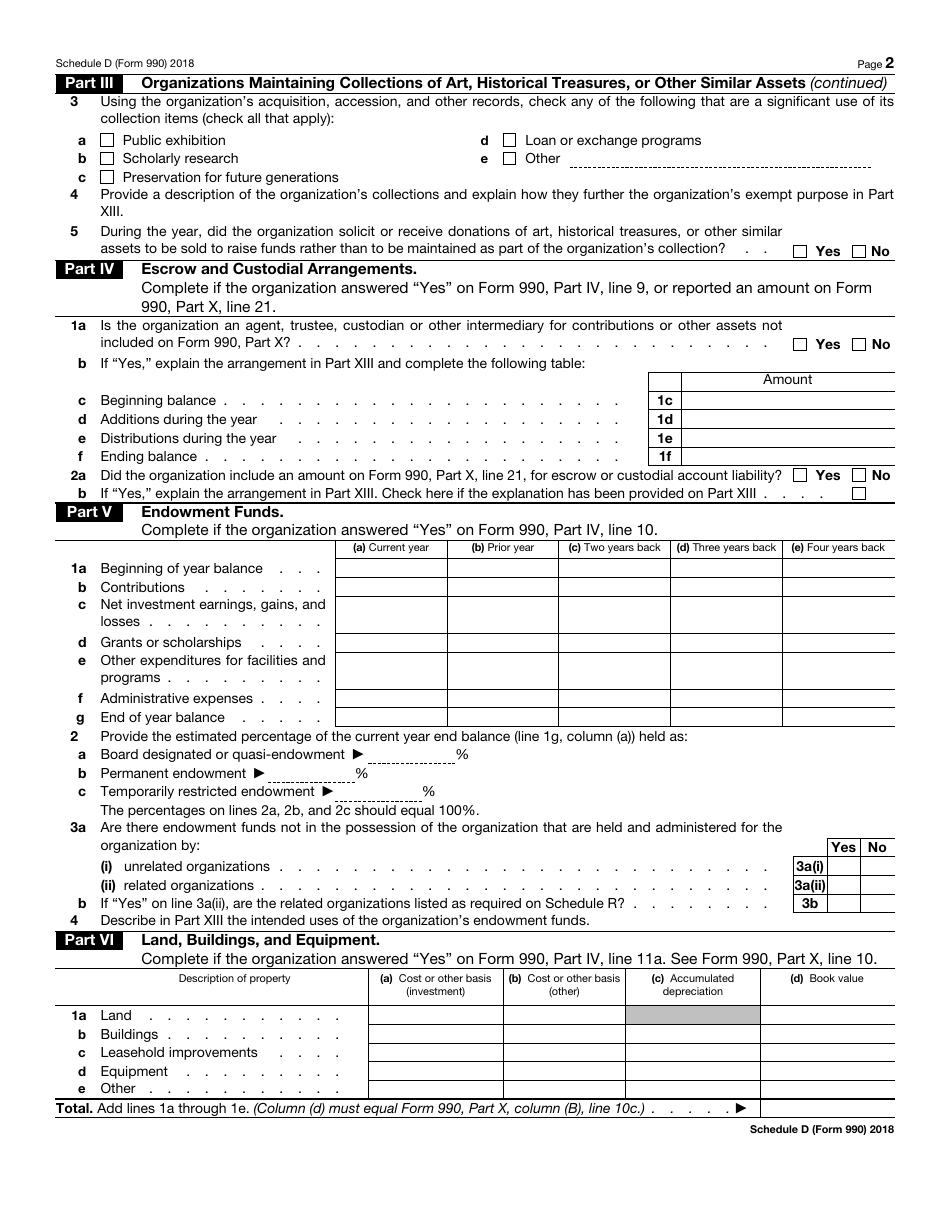

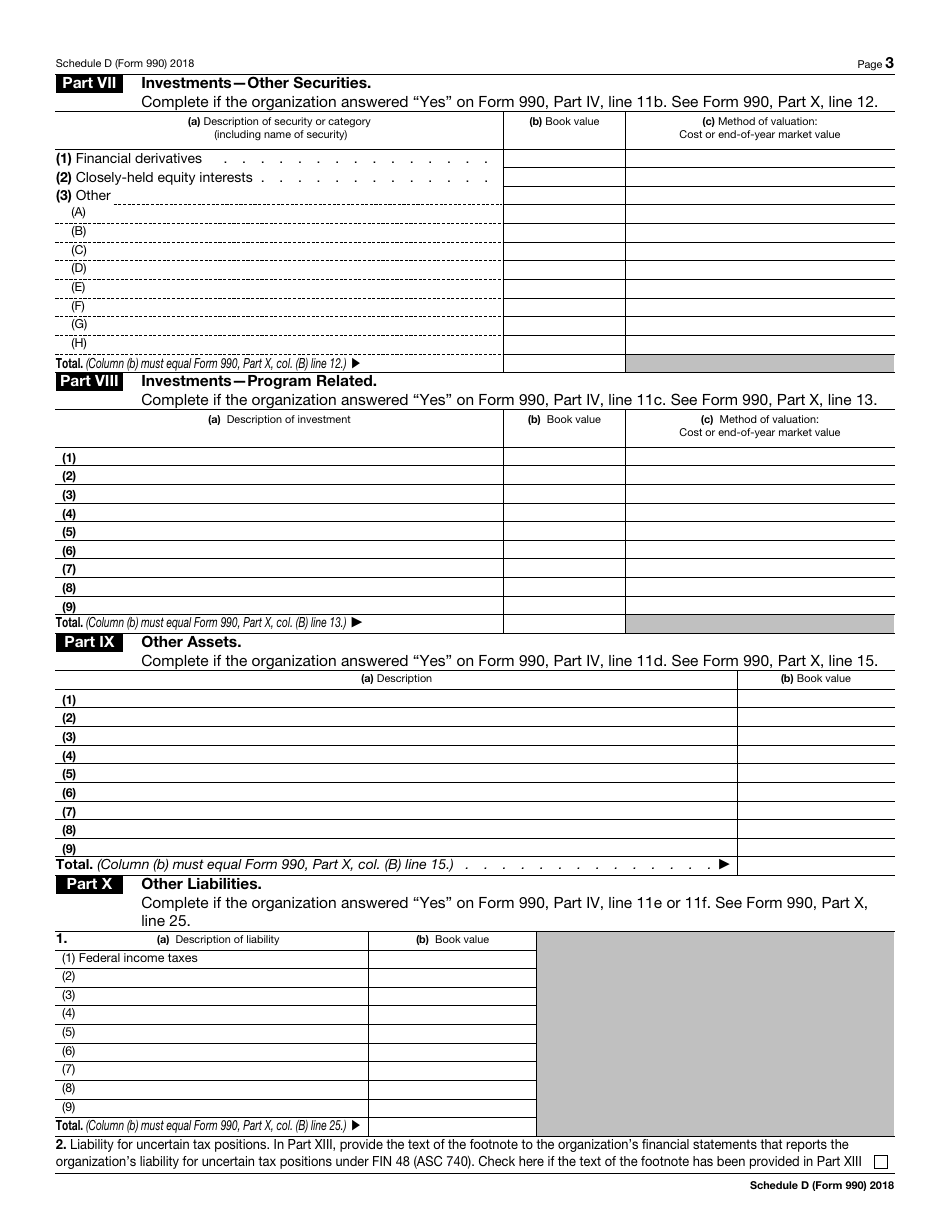

IRS Form 990 Schedule D Supplemental Financial Statements

What Is IRS Form 990 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule D?

A: IRS Form 990 Schedule D is a supplemental form that provides additional financial information for organizations filing Form 990.

Q: Who needs to file IRS Form 990 Schedule D?

A: Nonprofit organizations that are required to file Form 990 must also file Schedule D if they have certain financial transactions or relationships.

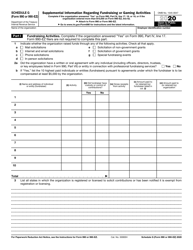

Q: What information does IRS Form 990 Schedule D require?

A: Schedule D requires organizations to provide details about certain financial activities, such as investments, grants, and business transactions.

Q: When is IRS Form 990 Schedule D due?

A: Schedule D is generally due at the same time as Form 990, which is generally due on the 15th day of the fifth month following the end of the organization's fiscal year.

Q: Is IRS Form 990 Schedule D required for all nonprofit organizations?

A: No, Schedule D is only required for nonprofit organizations that have certain financial transactions or relationships.

Q: What should I do if I have questions about IRS Form 990 Schedule D?

A: If you have questions about Schedule D, you can contact the Internal Revenue Service (IRS) or consult with a tax professional for guidance.

Form Details:

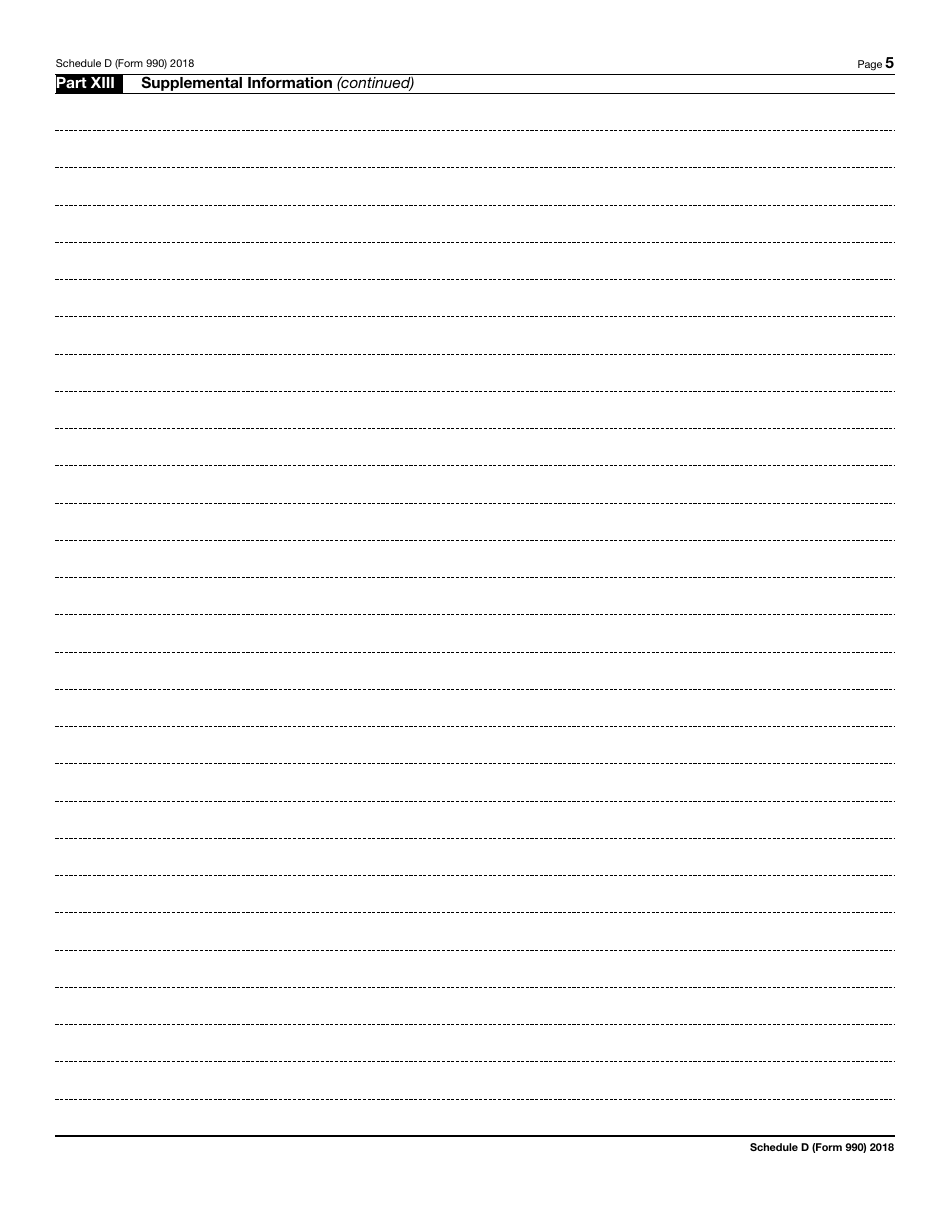

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule D through the link below or browse more documents in our library of IRS Forms.