This version of the form is not currently in use and is provided for reference only. Download this version of

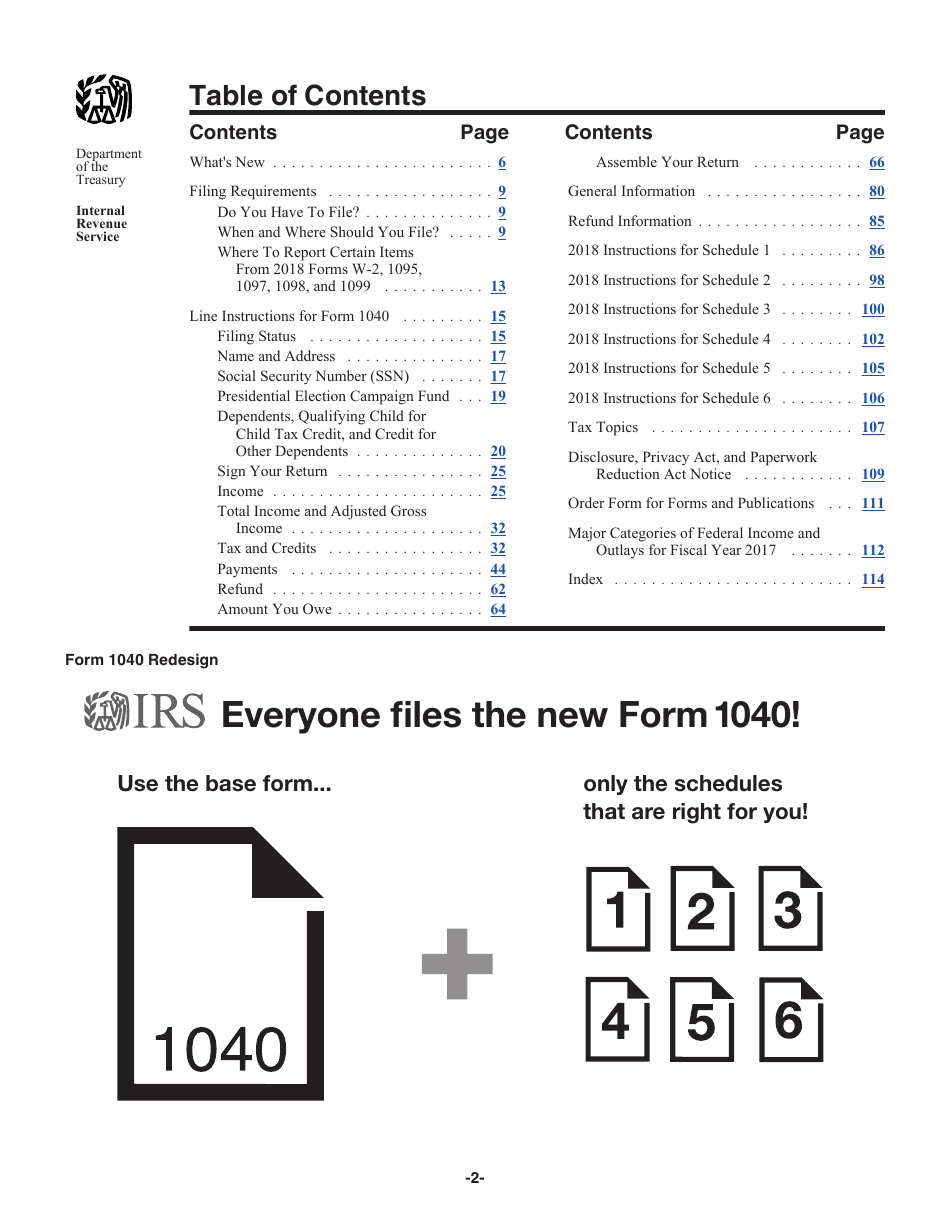

Instructions for IRS Form 1040

for the current year.

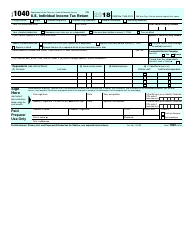

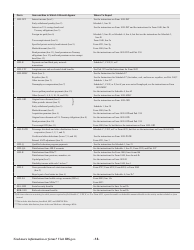

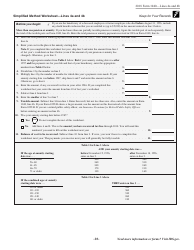

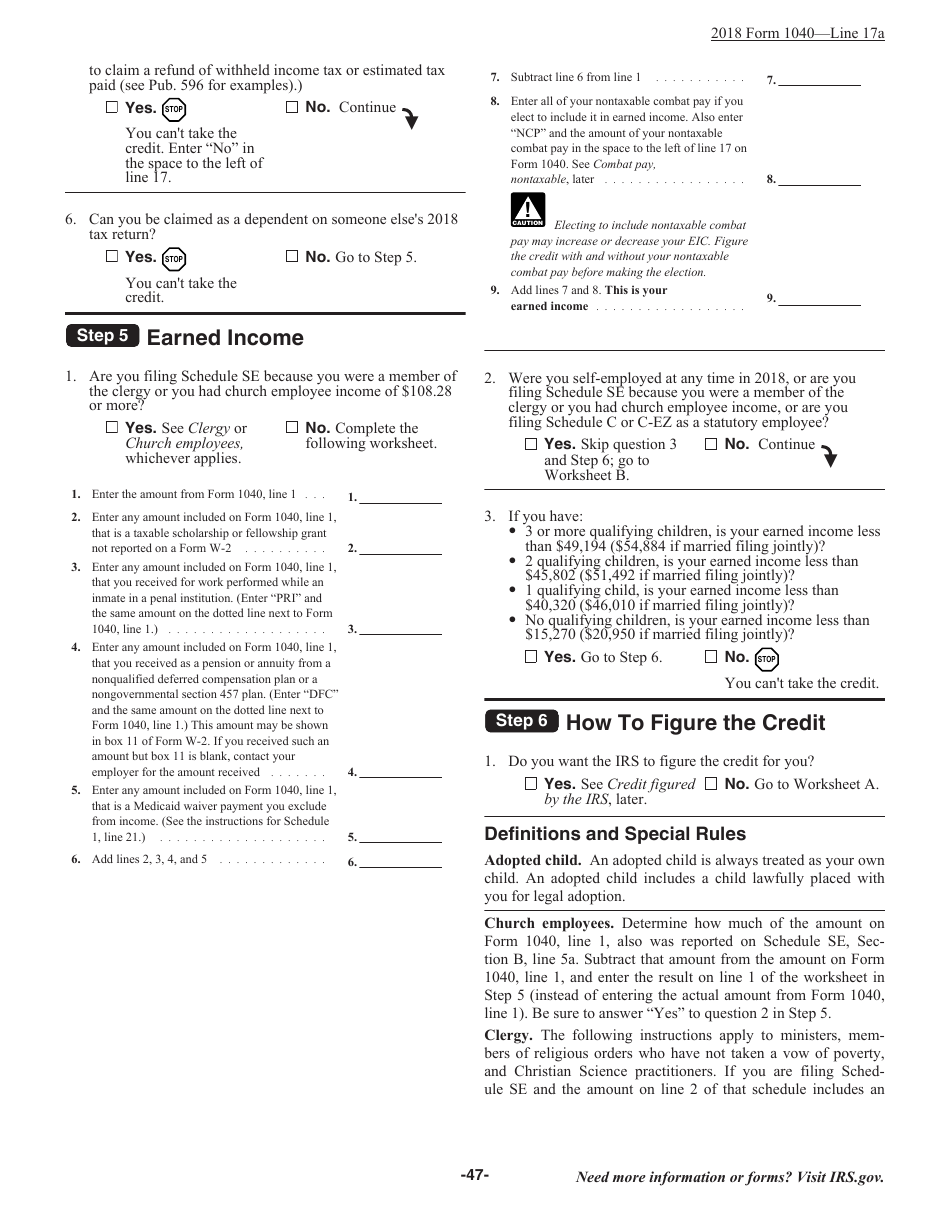

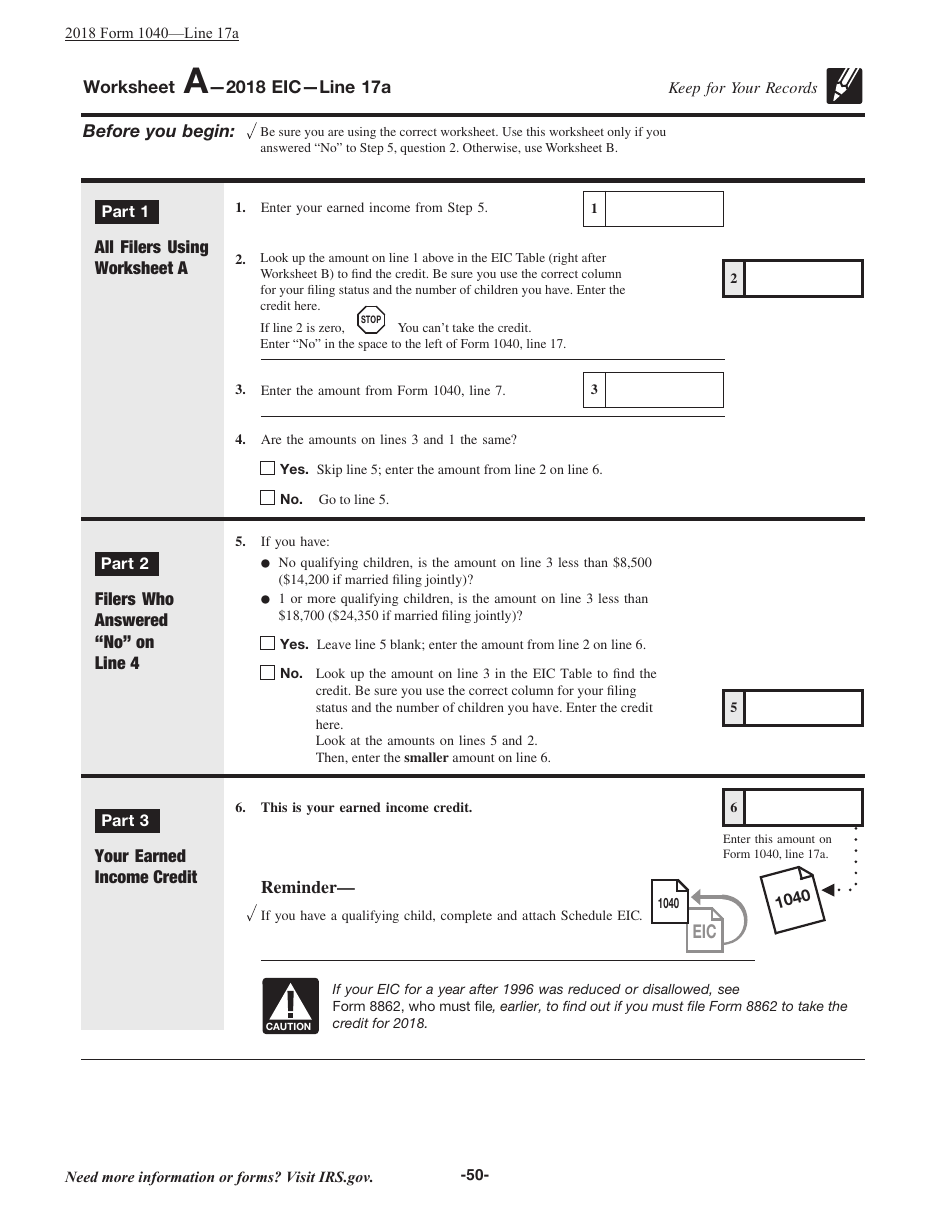

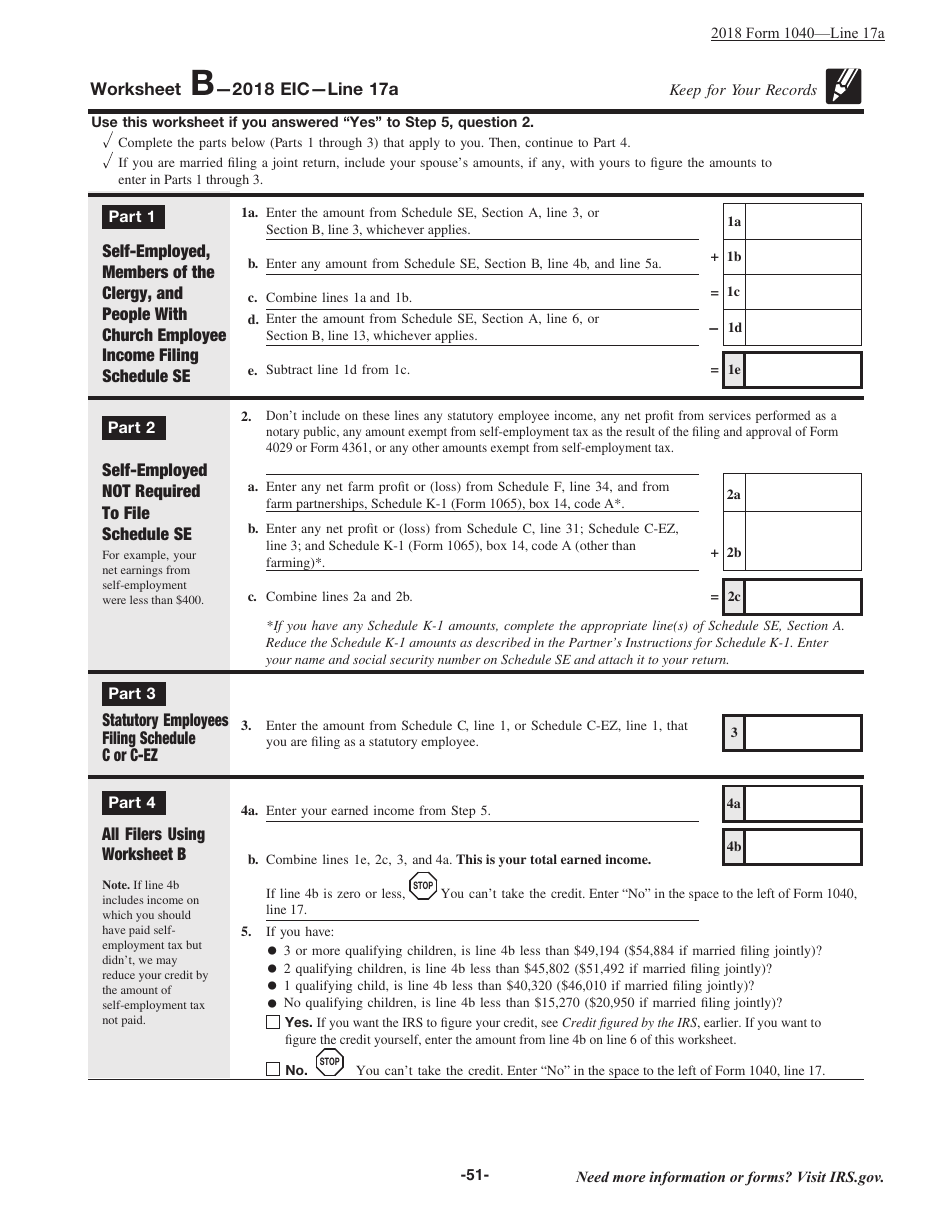

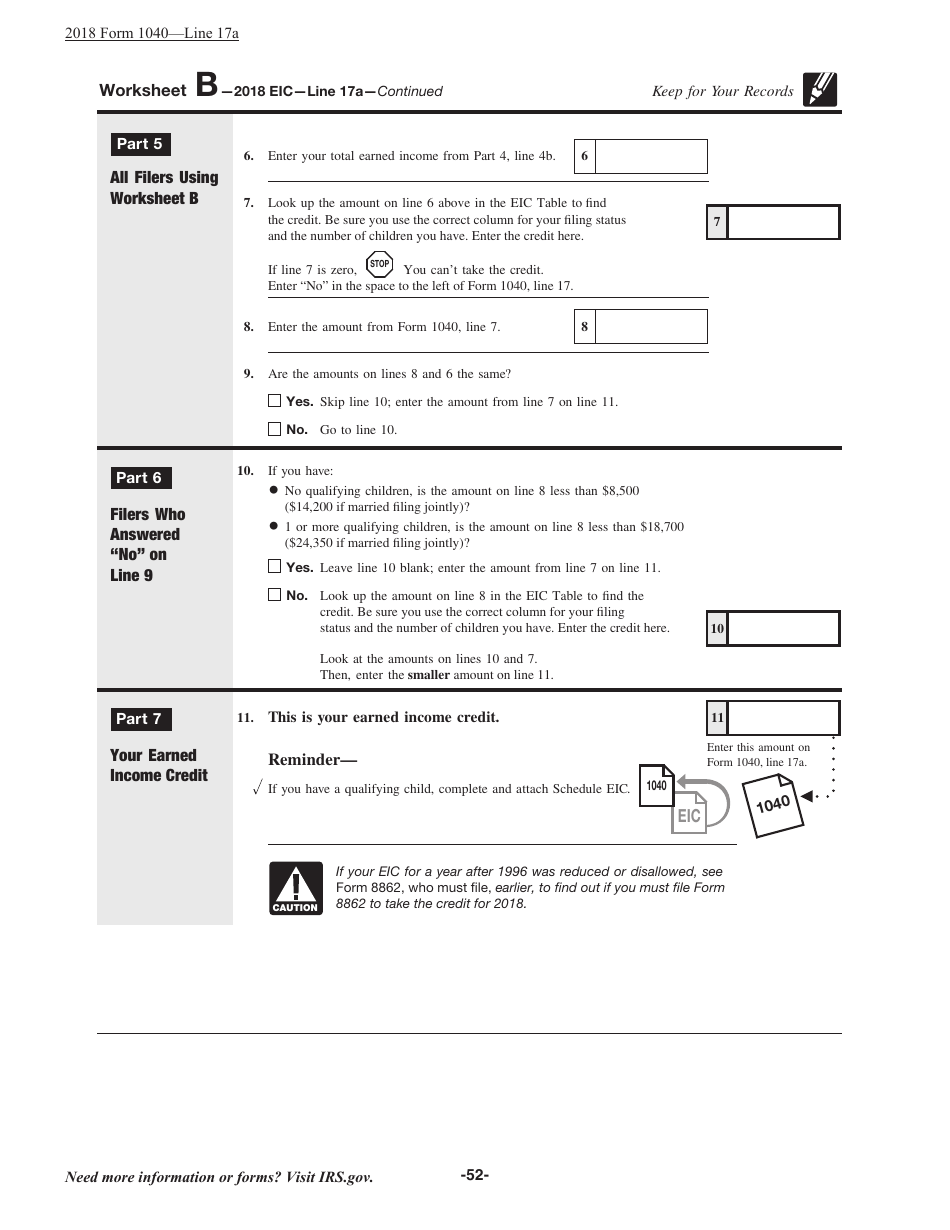

Instructions for IRS Form 1040 U.S. Individual Income Tax Return

This document contains official instructions for IRS Form 1040 , U.S. Individual Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the U.S. Individual Income Tax Return.

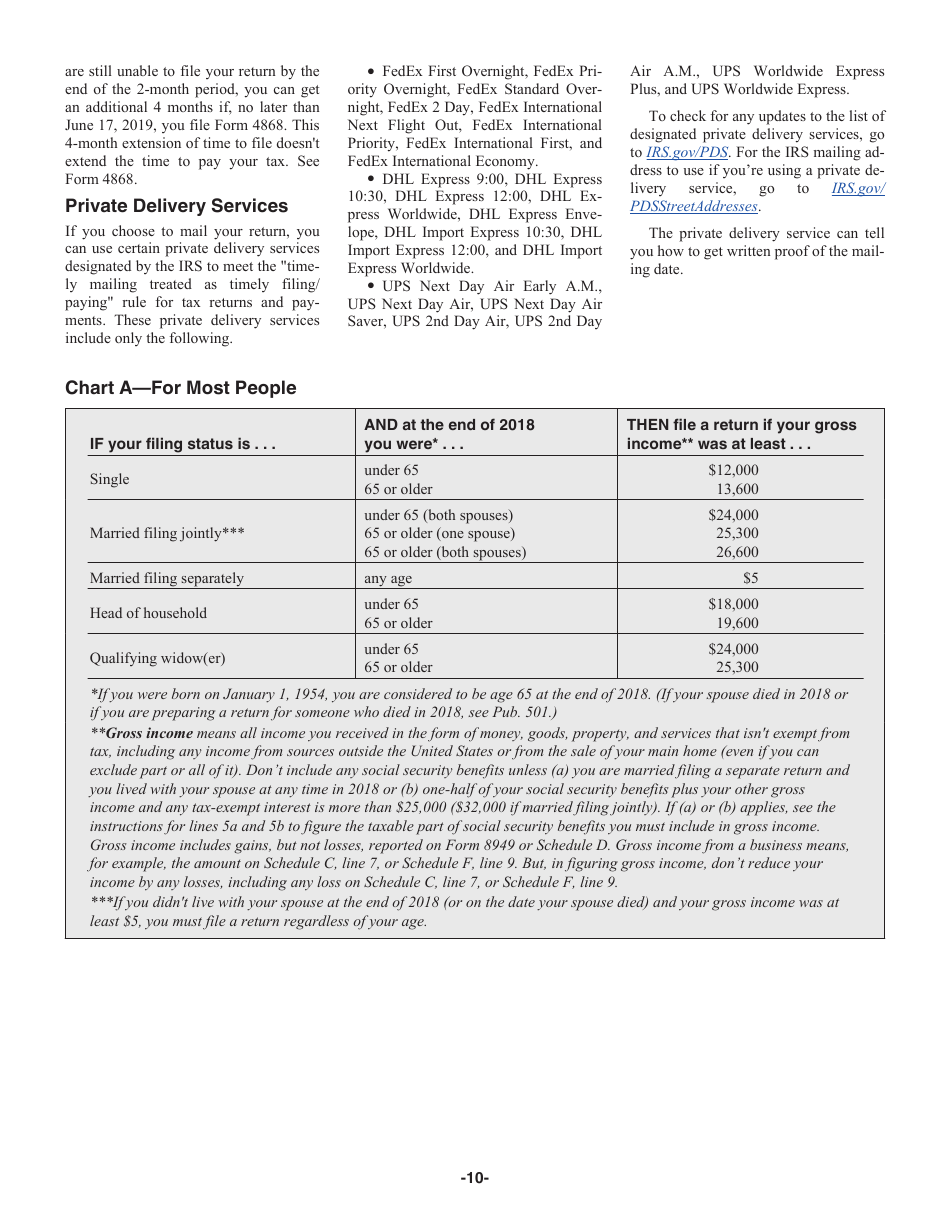

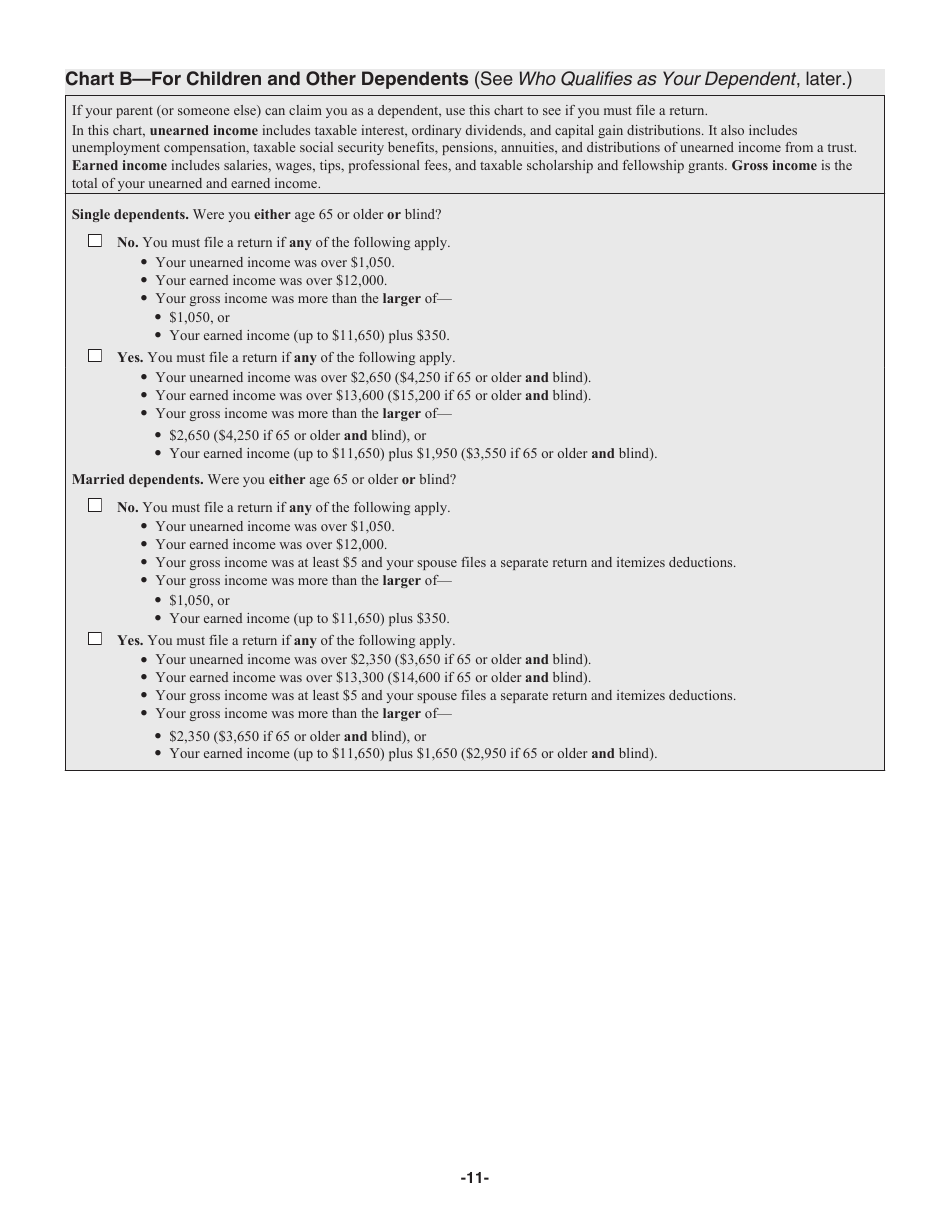

Q: Who needs to file Form 1040?

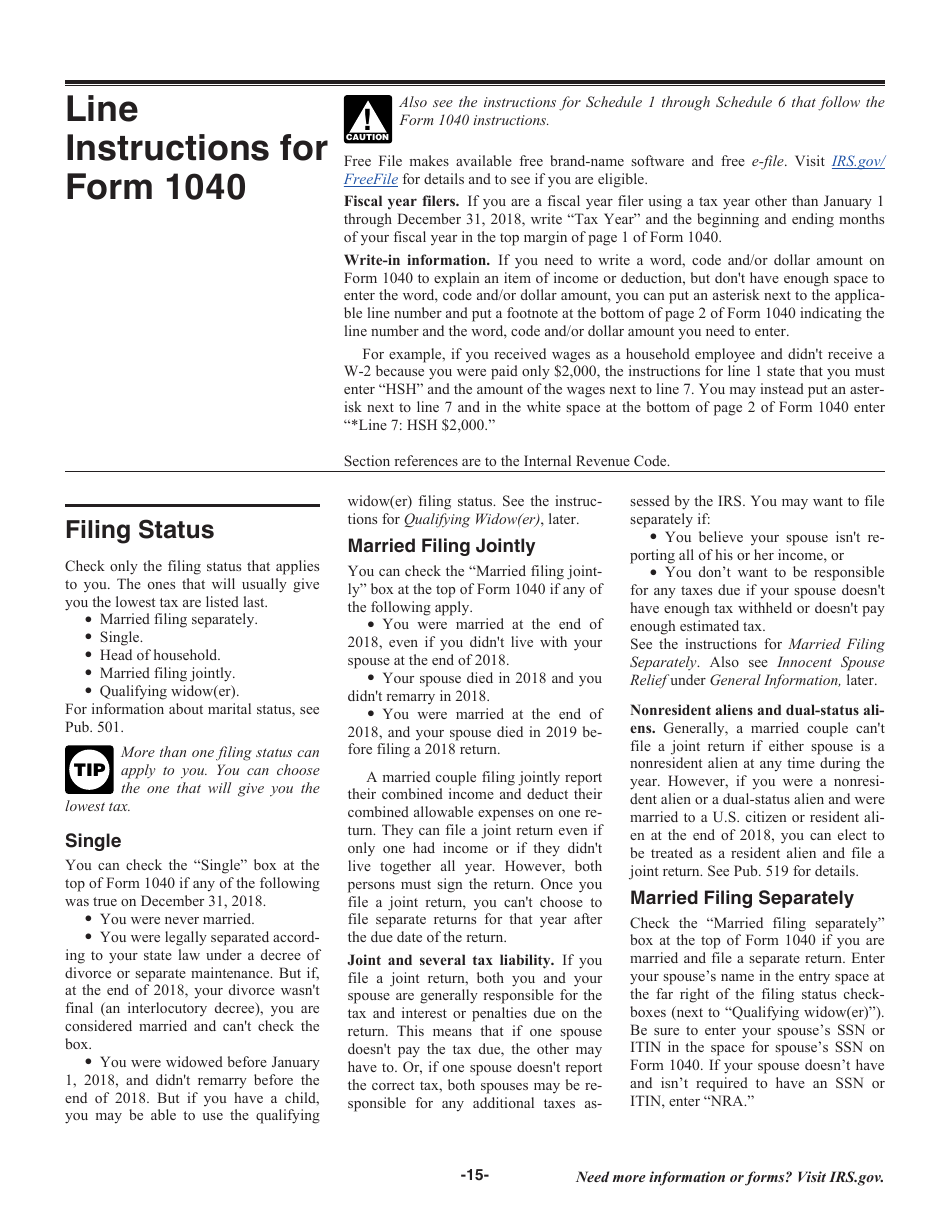

A: Any individual who has income above a certain threshold or specific circumstances must file Form 1040.

Q: When is the deadline to file Form 1040?

A: The deadline to file Form 1040 is typically April 15th, but it can vary depending on the year.

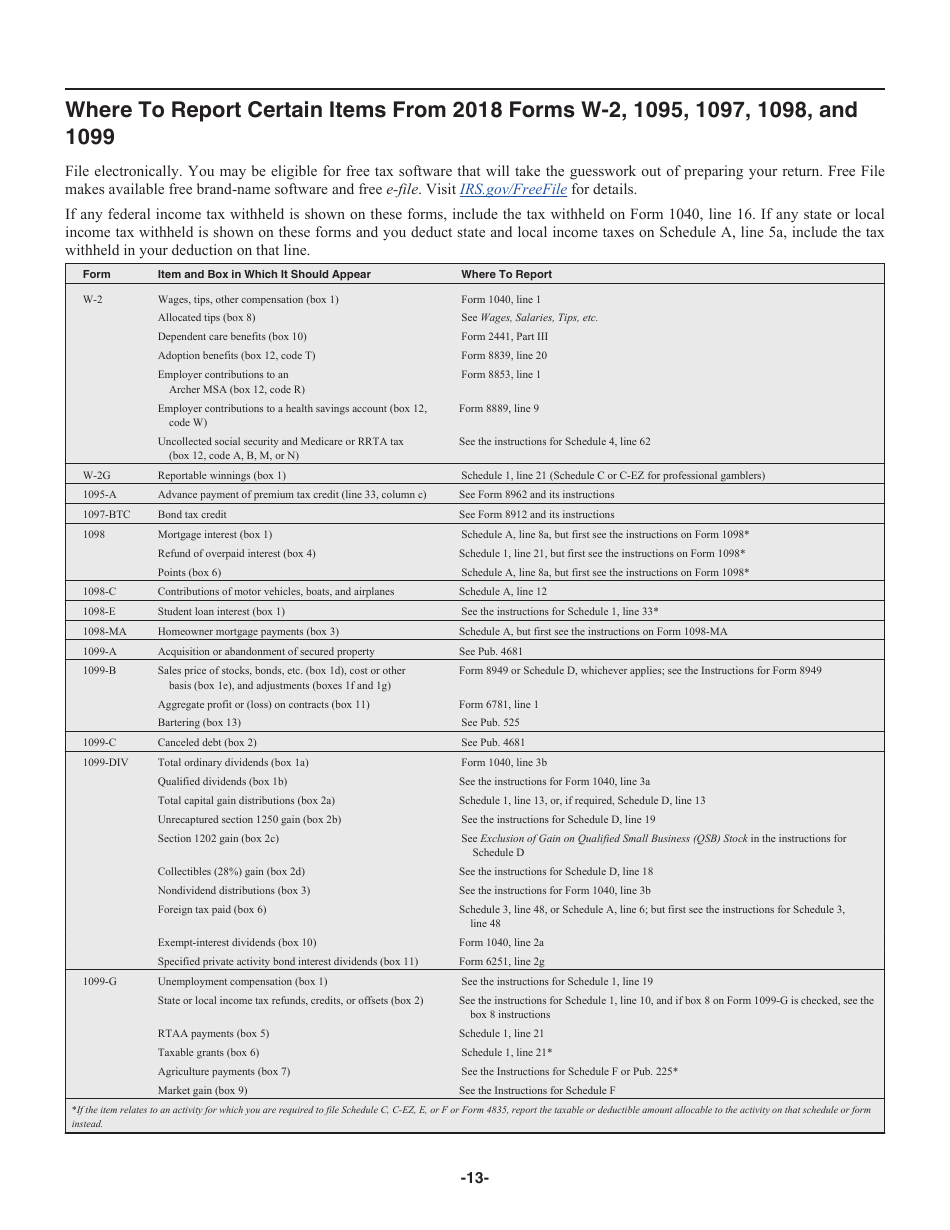

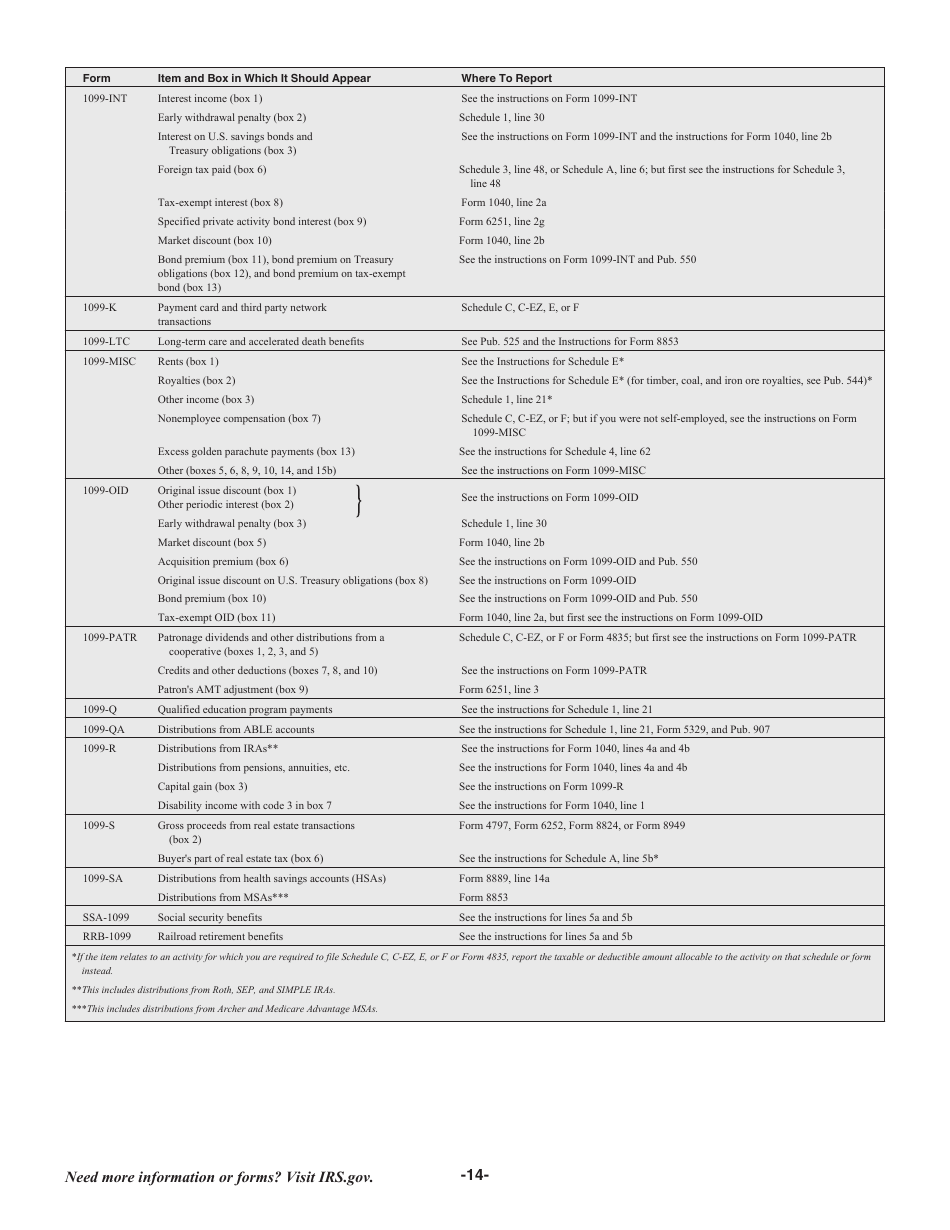

Q: What documents do I need to fill out Form 1040?

A: You'll generally need your W-2 forms, 1099 forms, and other income-related documents, as well as any deductions or credits you plan to claim.

Q: Can I get a refund if I file Form 1040?

A: Yes, if your total tax payments are more than your tax liability, you may be eligible for a refund.

Q: What if I can't pay the full amount of tax owed on Form 1040?

A: If you can't pay the full amount, you should still file your return and pay as much as you can to avoid penalties and interest.

Q: Are there any penalties for not filing Form 1040?

A: Yes, there are penalties for failing to file Form 1040 or pay your taxes on time. It's best to file even if you can't pay the full amount.

Instruction Details:

- This 117-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.