This version of the form is not currently in use and is provided for reference only. Download this version of

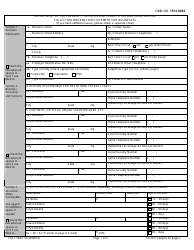

IRS Form 433-B

for the current year.

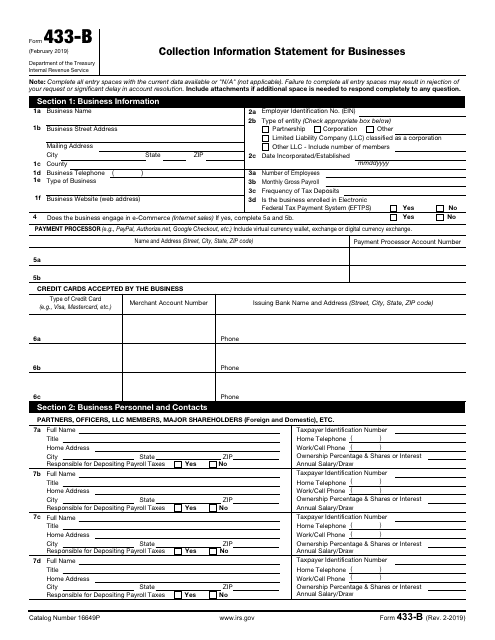

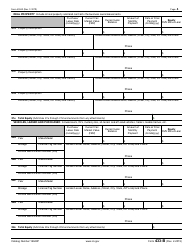

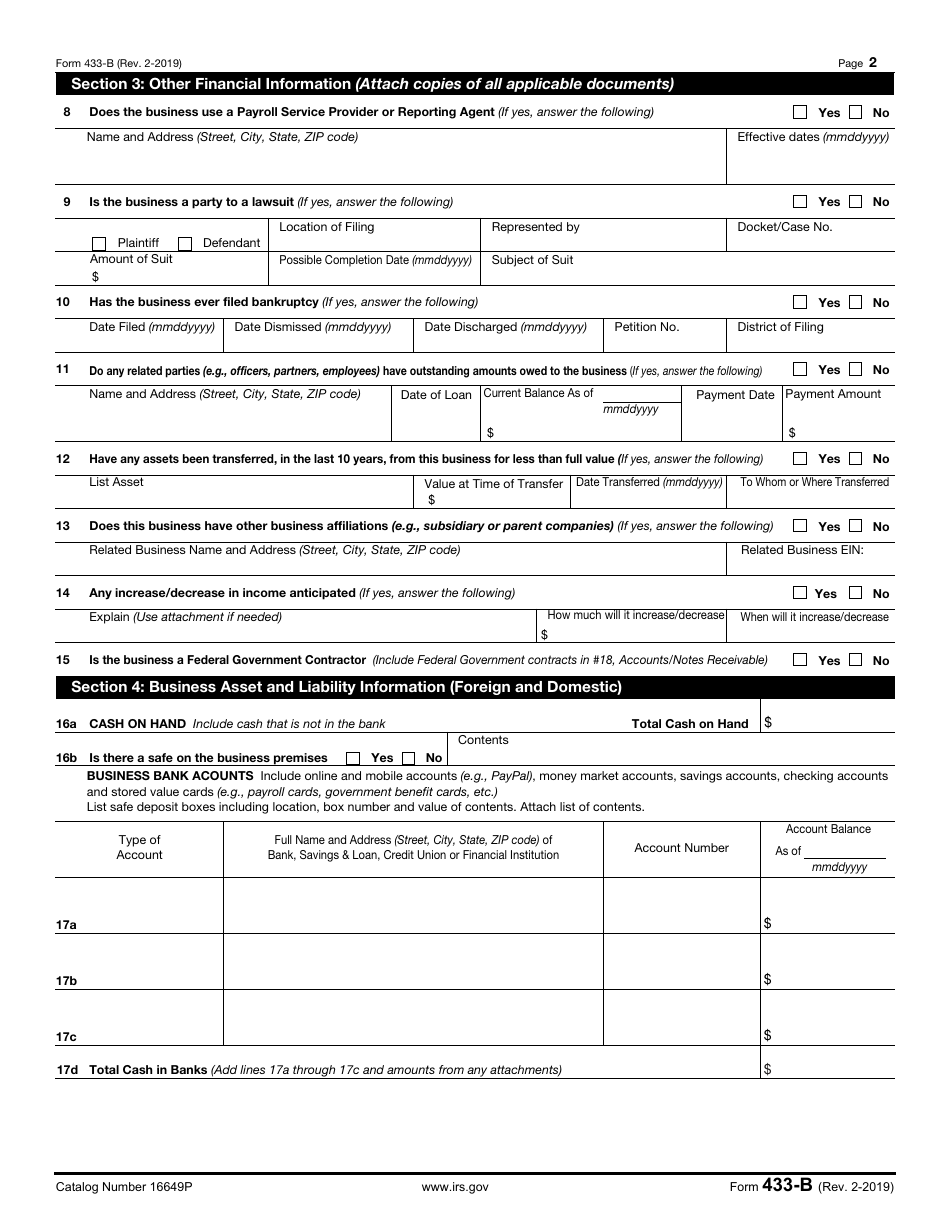

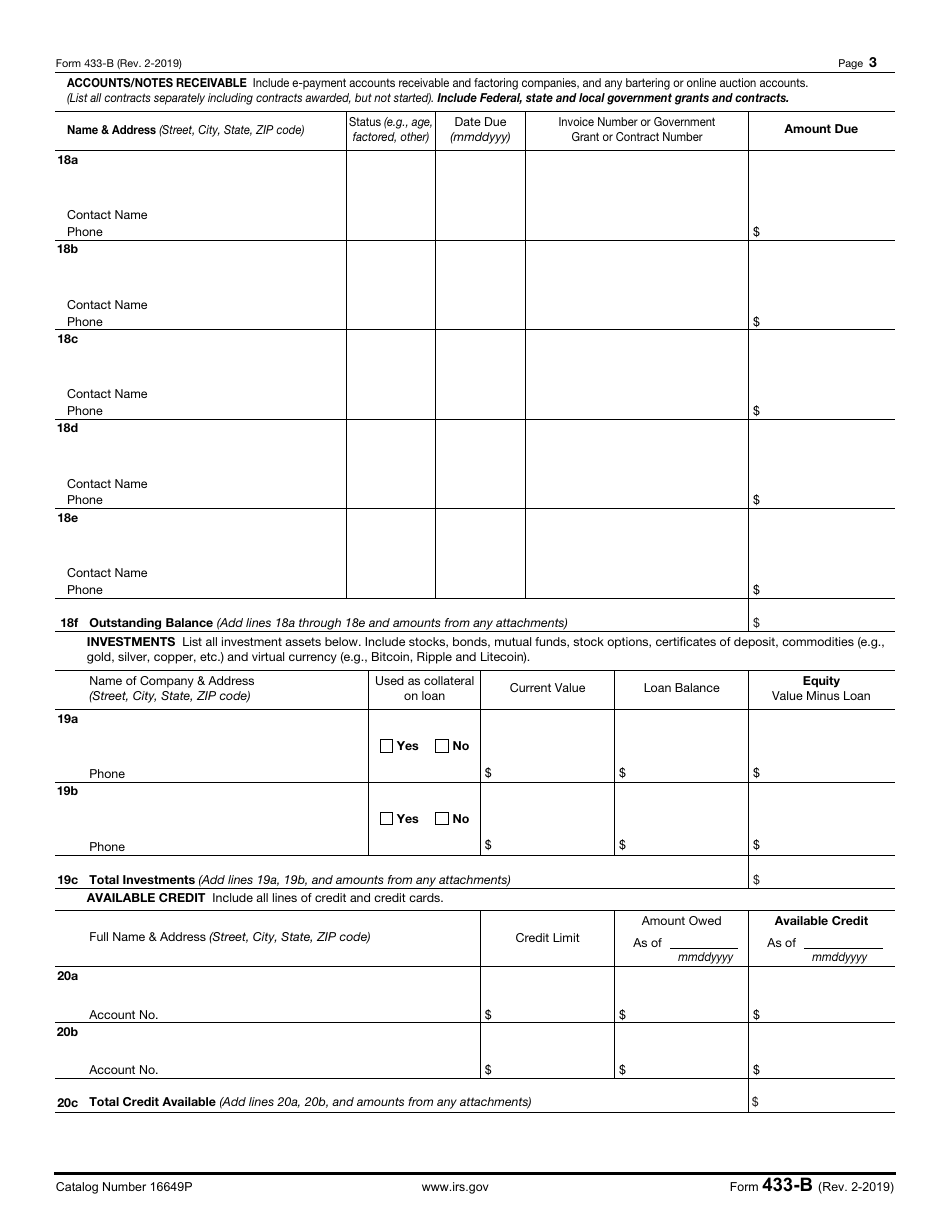

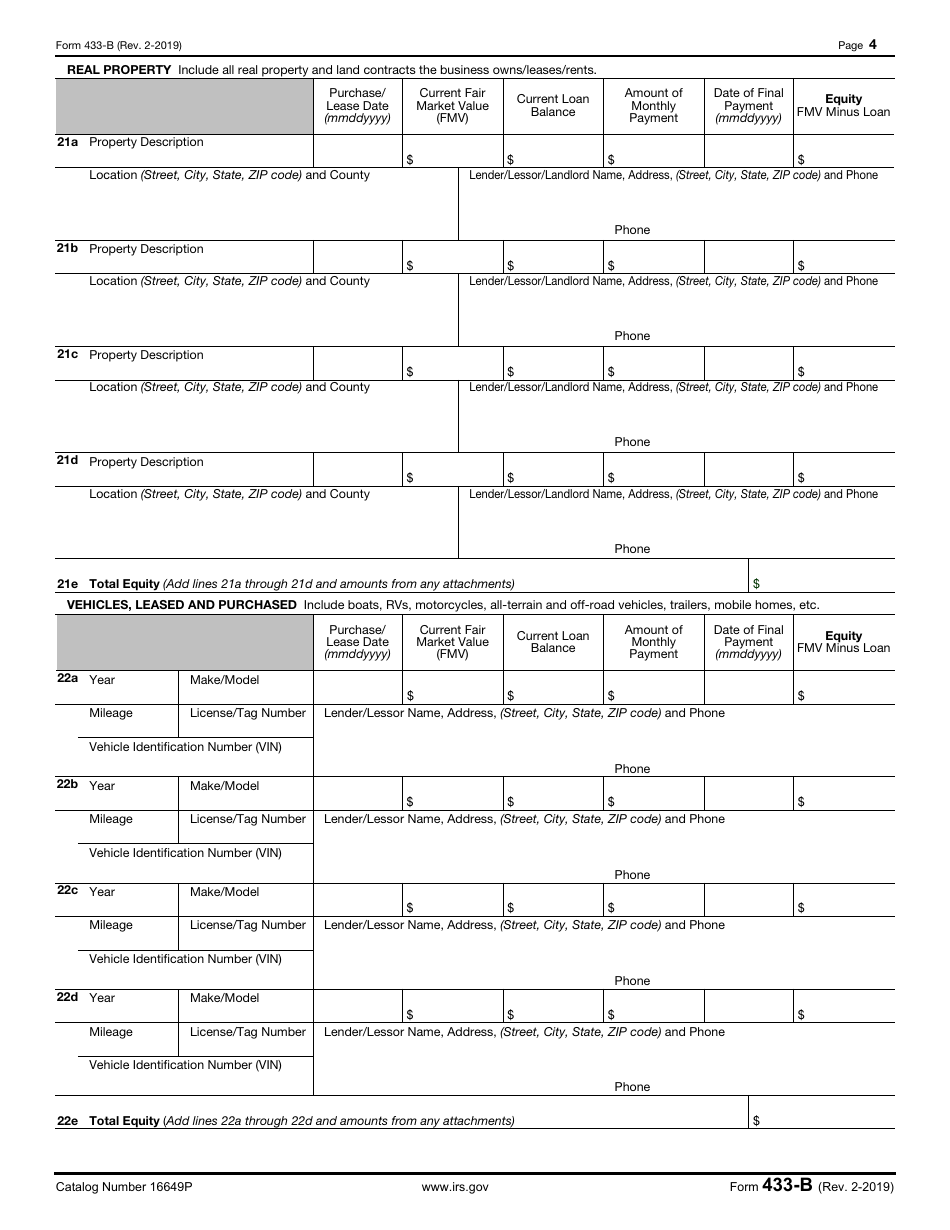

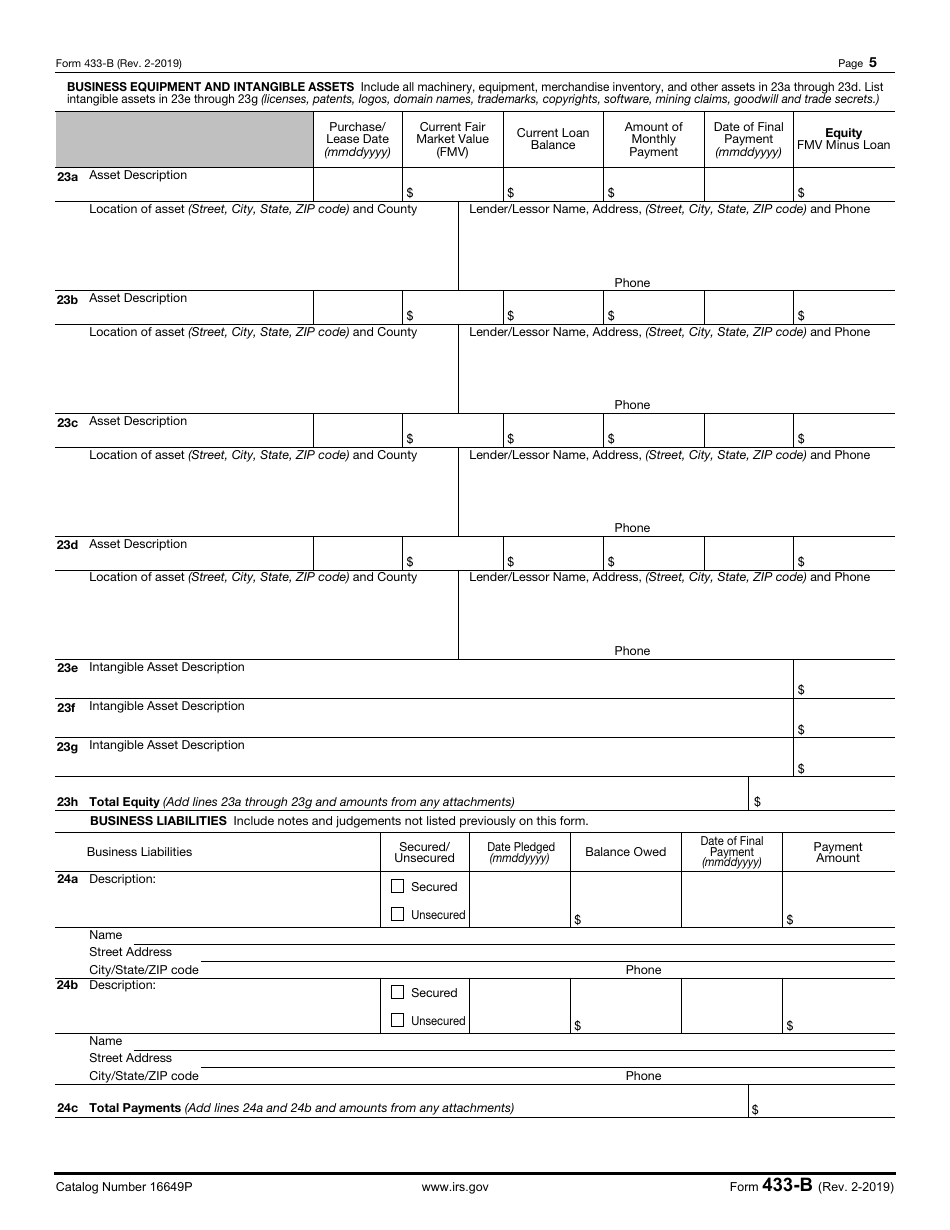

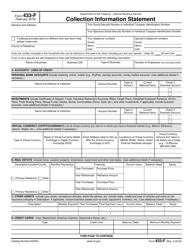

IRS Form 433-B Collection Information Statement for Businesses

What Is IRS Form 433-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-B?

A: IRS Form 433-B is a Collection Information Statement specifically designed for businesses.

Q: What is the purpose of IRS Form 433-B?

A: The purpose of IRS Form 433-B is to collect financial information from businesses to determine their ability to pay outstanding tax debts.

Q: Who needs to fill out IRS Form 433-B?

A: Businesses who have outstanding tax debts and are attempting to negotiate a payment plan or settlement with the IRS may be required to fill out IRS Form 433-B.

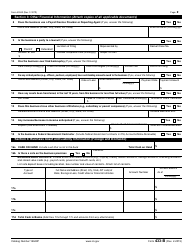

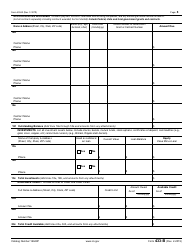

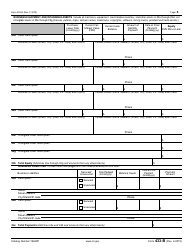

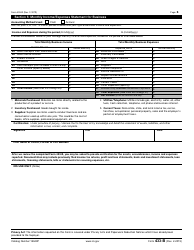

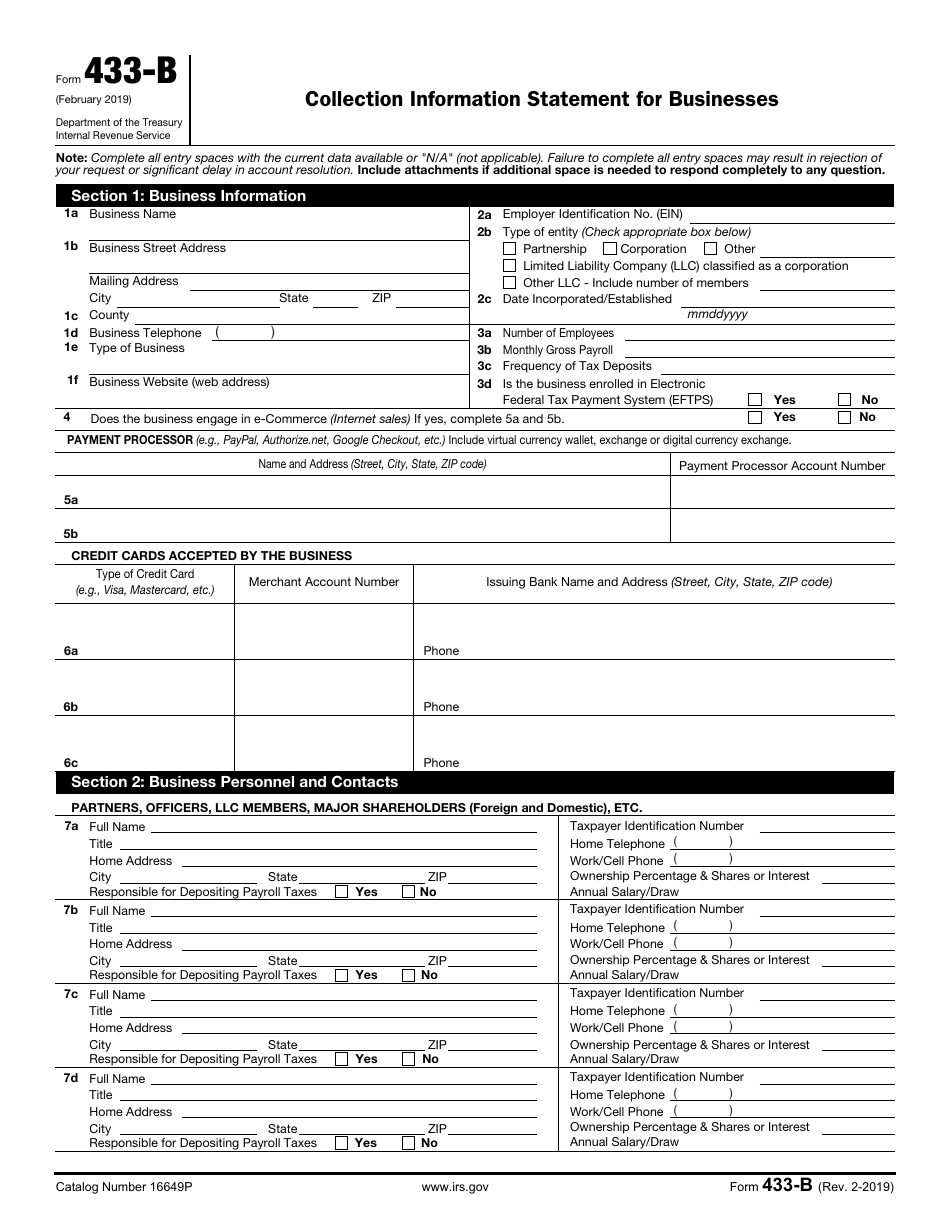

Q: What information is required on IRS Form 433-B?

A: IRS Form 433-B requires businesses to provide detailed financial information, including assets, liabilities, income, and expenses.

Q: Are there any fees associated with filing IRS Form 433-B?

A: There are no fees associated with filing IRS Form 433-B.

Q: What happens after I submit IRS Form 433-B?

A: After you submit IRS Form 433-B, the IRS will review your financial information to determine the best course of action for resolving your tax debt.

Q: Can I negotiate a payment plan with the IRS using IRS Form 433-B?

A: Yes, if you have outstanding tax debts, you can negotiate a payment plan with the IRS using IRS Form 433-B.

Q: Can I use IRS Form 433-B for personal tax debts?

A: No, IRS Form 433-B is specifically for businesses. For personal tax debts, you would need to use a different form, such as IRS Form 433-A.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-B through the link below or browse more documents in our library of IRS Forms.