This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8962

for the current year.

Instructions for IRS Form 8962 Premium Tax Credit (Ptc)

This document contains official instructions for IRS Form 8962 , Premium Tax Credit (Ptc) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8962 is available for download through this link.

FAQ

Q: What is Form 8962?

A: Form 8962 is used to reconcile the amount of premium tax credit you received with the actual amount you are eligible for.

Q: What is the Premium Tax Credit (PTC)?

A: The Premium Tax Credit is a subsidy provided to eligible individuals and families to help them afford health insurance purchased through the Health Insurance Marketplace.

Q: Who is eligible for the Premium Tax Credit?

A: You may be eligible for the Premium Tax Credit if you purchased health insurance through the Health Insurance Marketplace and meet certain income requirements.

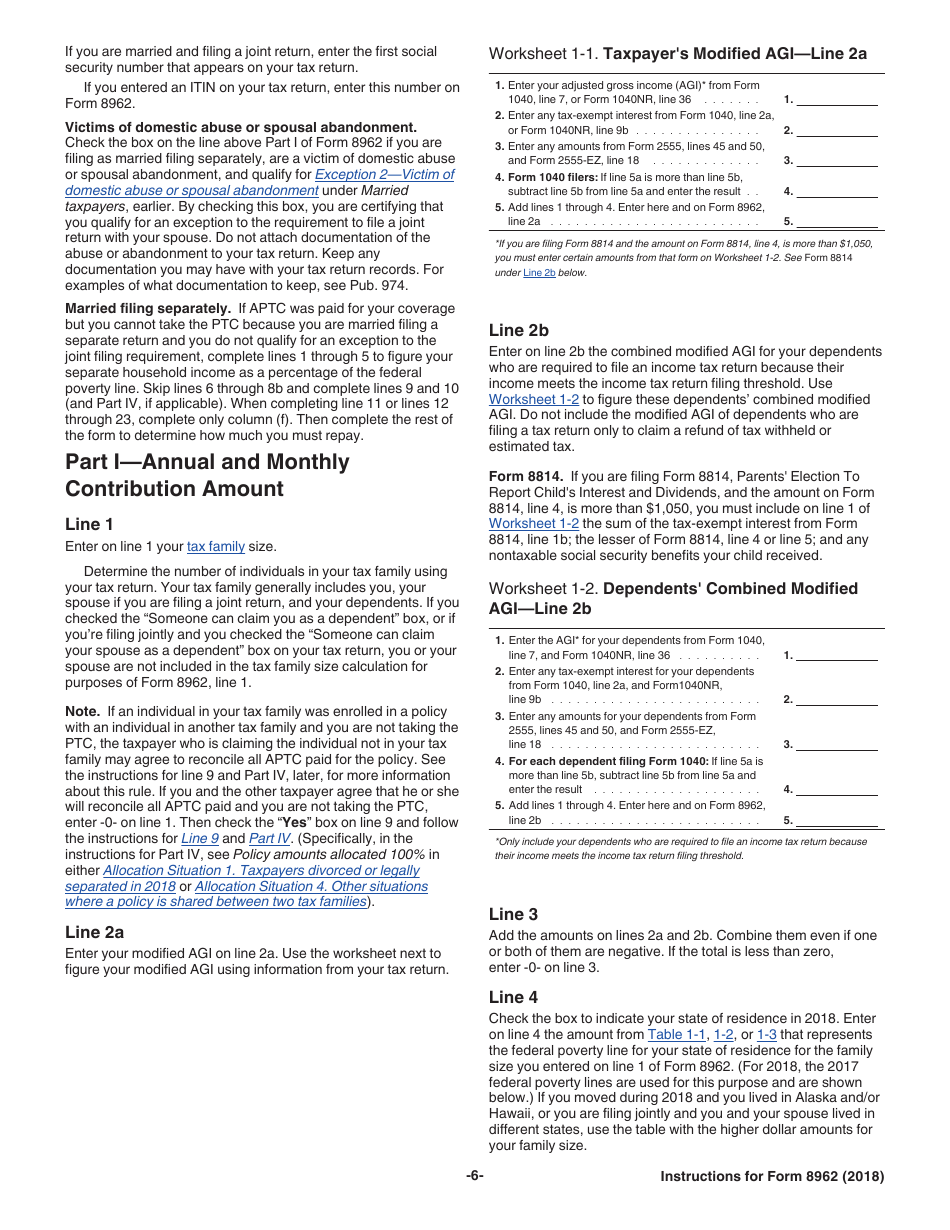

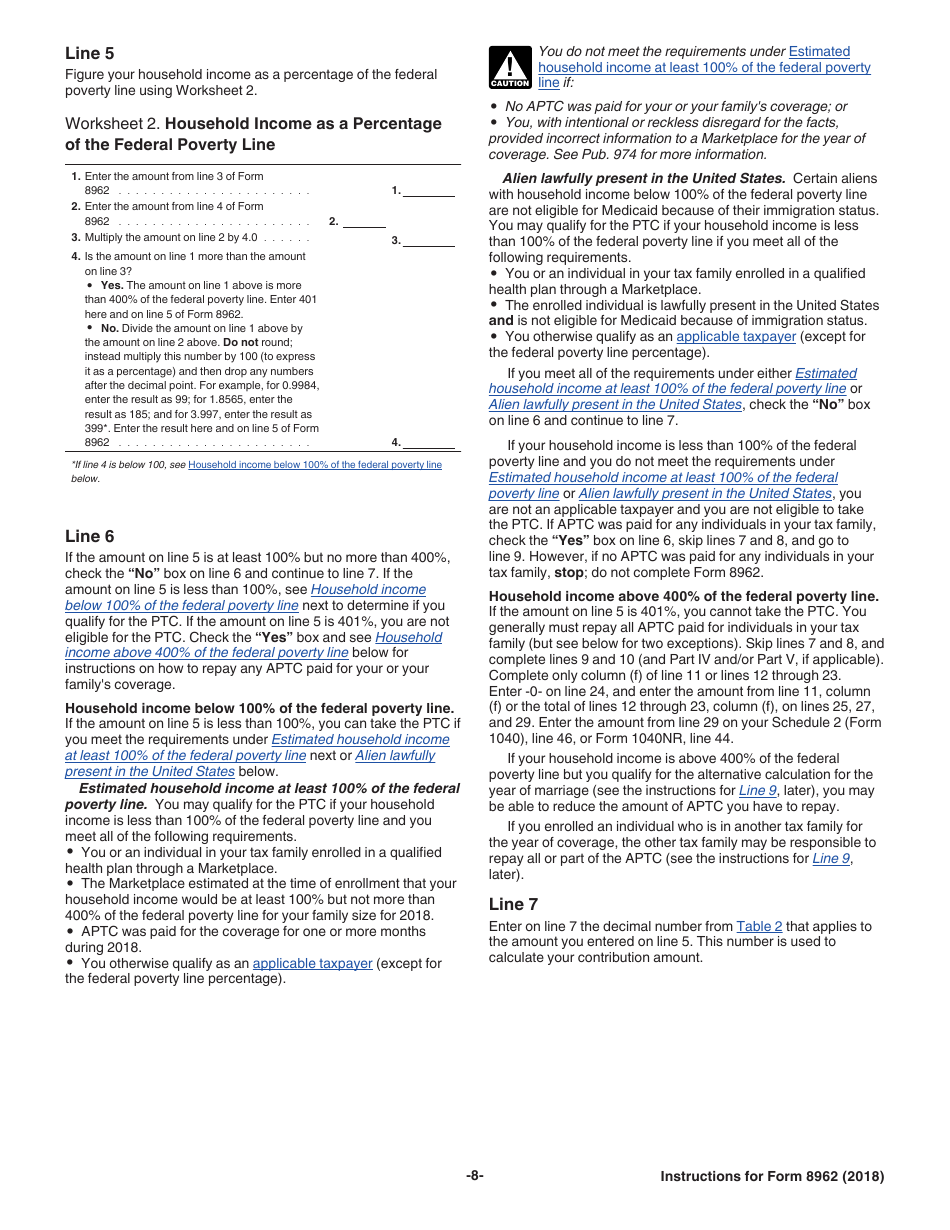

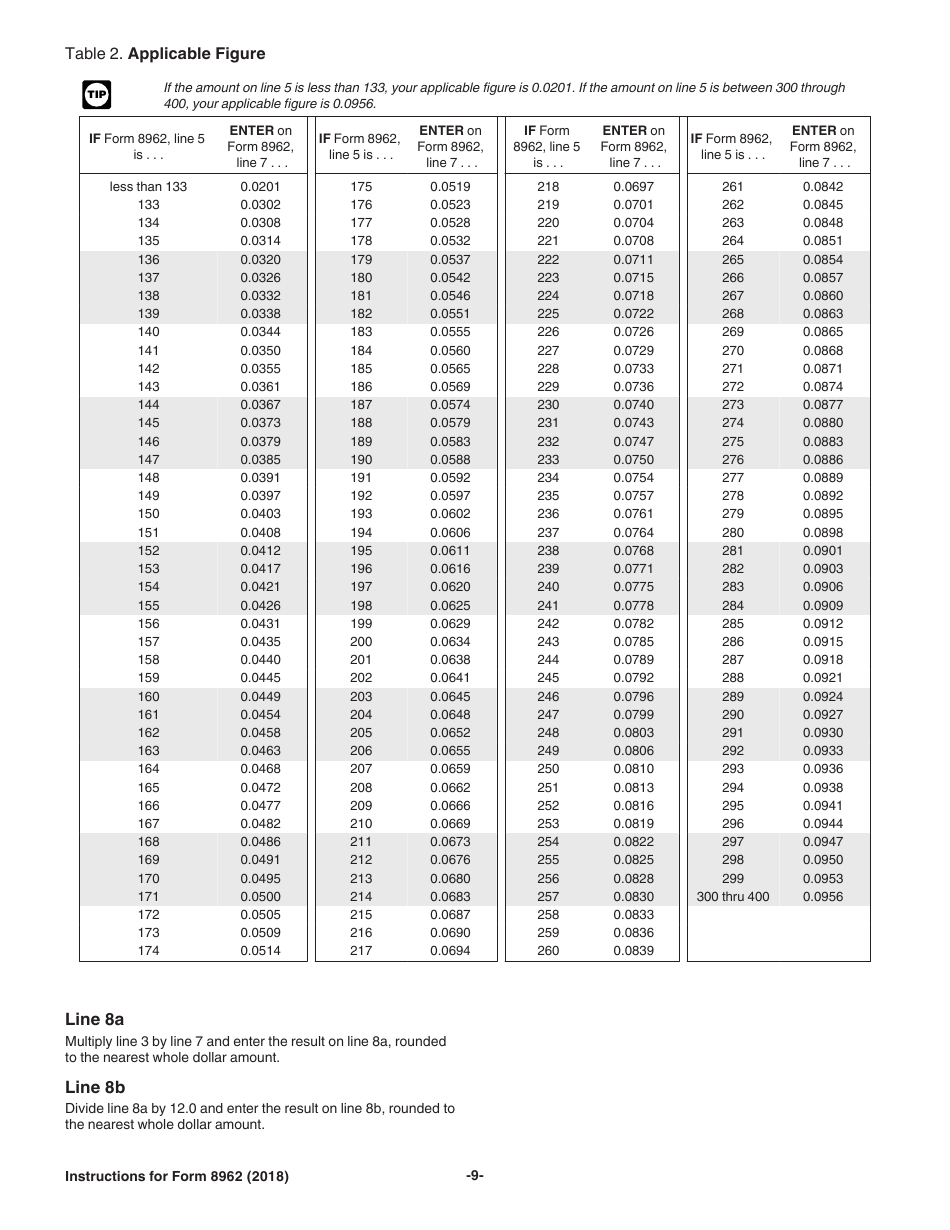

Q: How do I fill out Form 8962?

A: You should follow the instructions provided by the IRS and accurately report the required information, such as your household income, number of individuals covered under your insurance, and any advance payments of the Premium Tax Credit you received.

Q: What is the purpose of reconciling the Premium Tax Credit?

A: Reconciling the Premium Tax Credit helps determine if you received the correct amount of financial assistance throughout the year. It may result in a refund or additional tax owed.

Q: What happens if I don't file Form 8962?

A: If you received advance payments of the Premium Tax Credit and do not file Form 8962, you may not be eligible for future premium assistance or you may have to repay the full amount of the credit.

Q: Are there any limitations or requirements for claiming the Premium Tax Credit?

A: Yes, there are income limitations and other requirements that determine your eligibility for the Premium Tax Credit. It is important to carefully review the instructions and guidelines provided by the IRS.

Q: Can I claim the Premium Tax Credit if I have employer-sponsored insurance?

A: In general, if you have affordable employer-sponsored insurance, you may not be eligible for the Premium Tax Credit. However, there are exceptions based on the affordability and coverage of your employer's plan.

Q: What documents do I need to complete Form 8962?

A: To complete Form 8962, you will need your Form 1095-A, Health Insurance Marketplace Statement, which is provided by the Health Insurance Marketplace. You may also need other supporting documents related to your income and insurance coverage.

Instruction Details:

- This 20-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.