This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8949

for the current year.

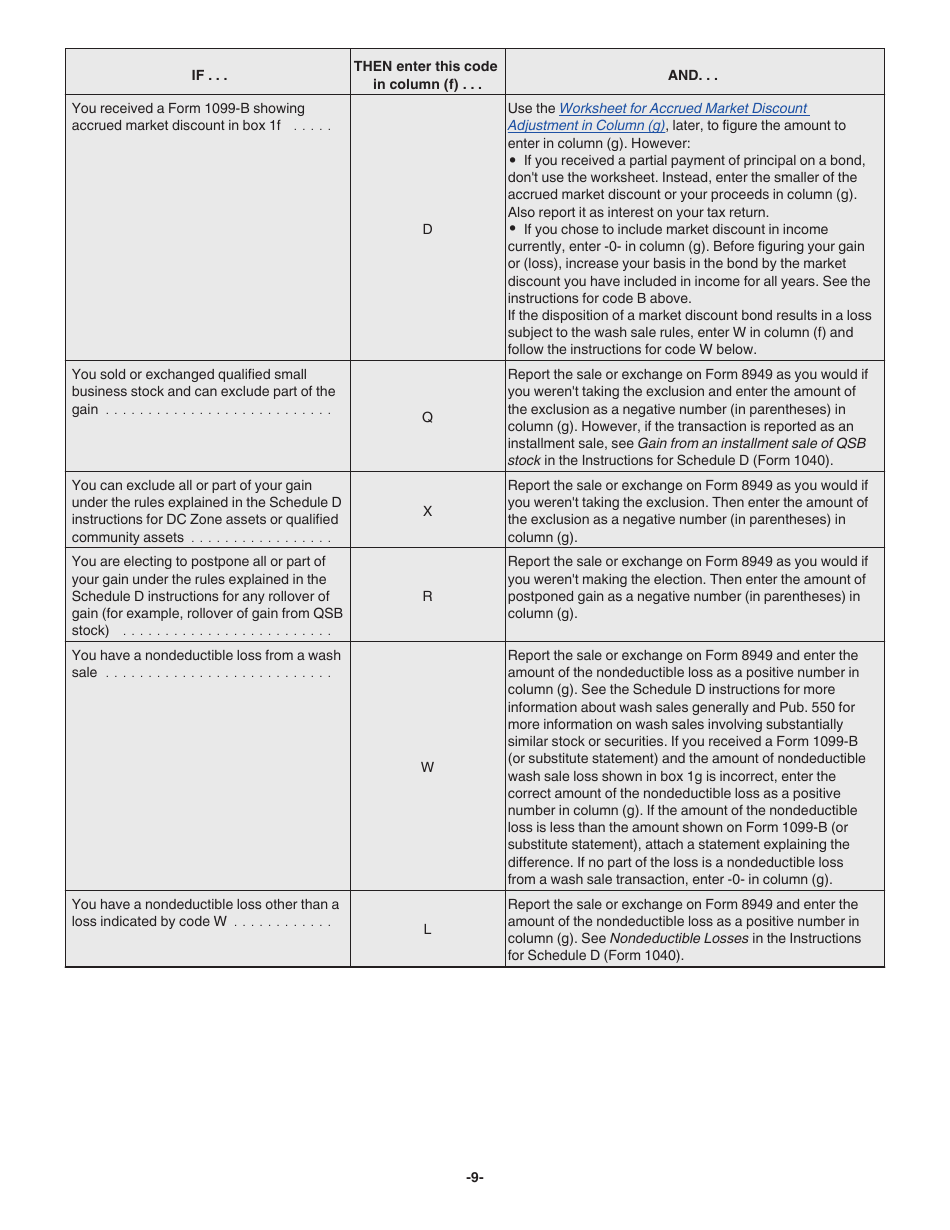

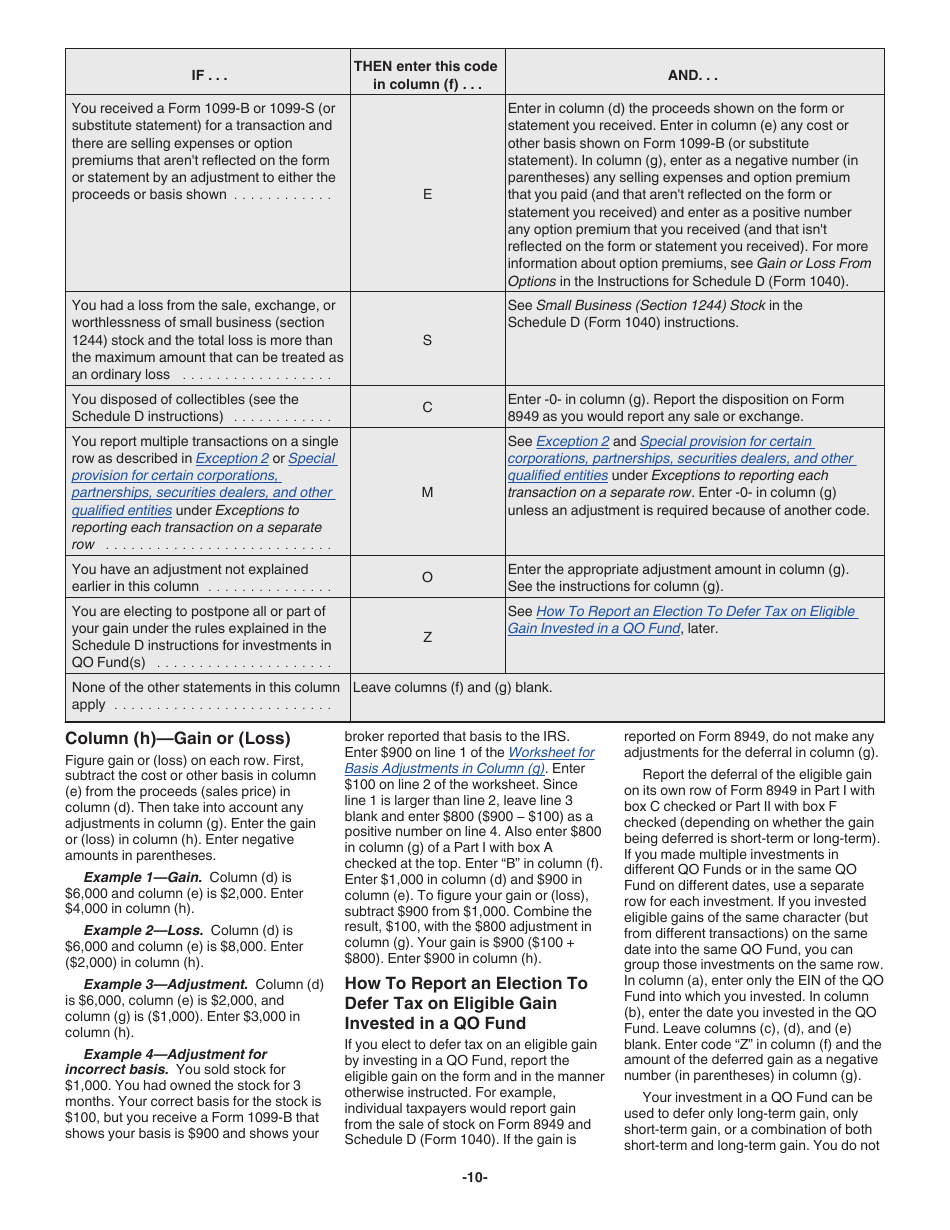

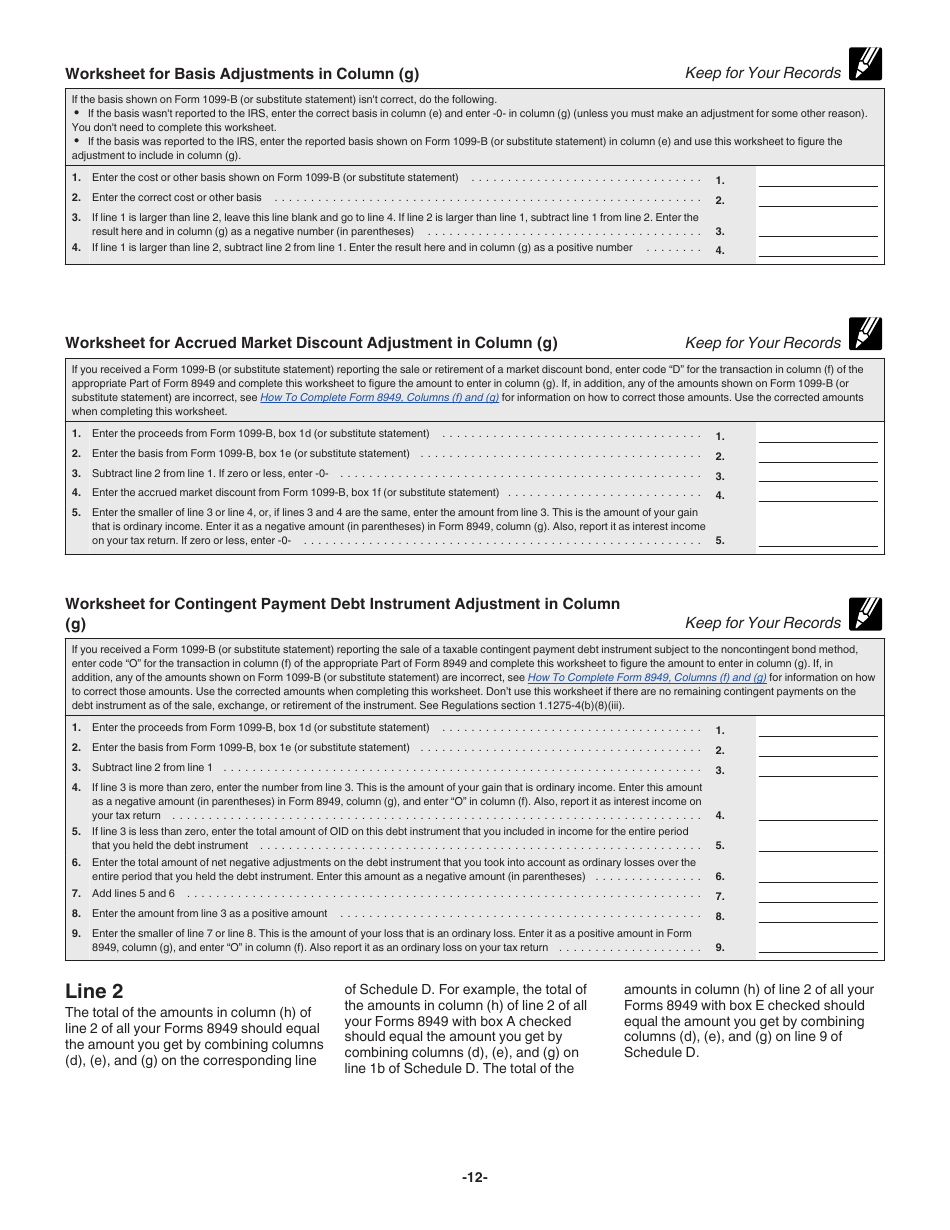

Instructions for IRS Form 8949 Sales and Other Dispositions of Capital Assets

This document contains official instructions for IRS Form 8949 , Sales and Other Dispositions of Capital Assets - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8949 is available for download through this link.

FAQ

Q: What is IRS Form 8949?

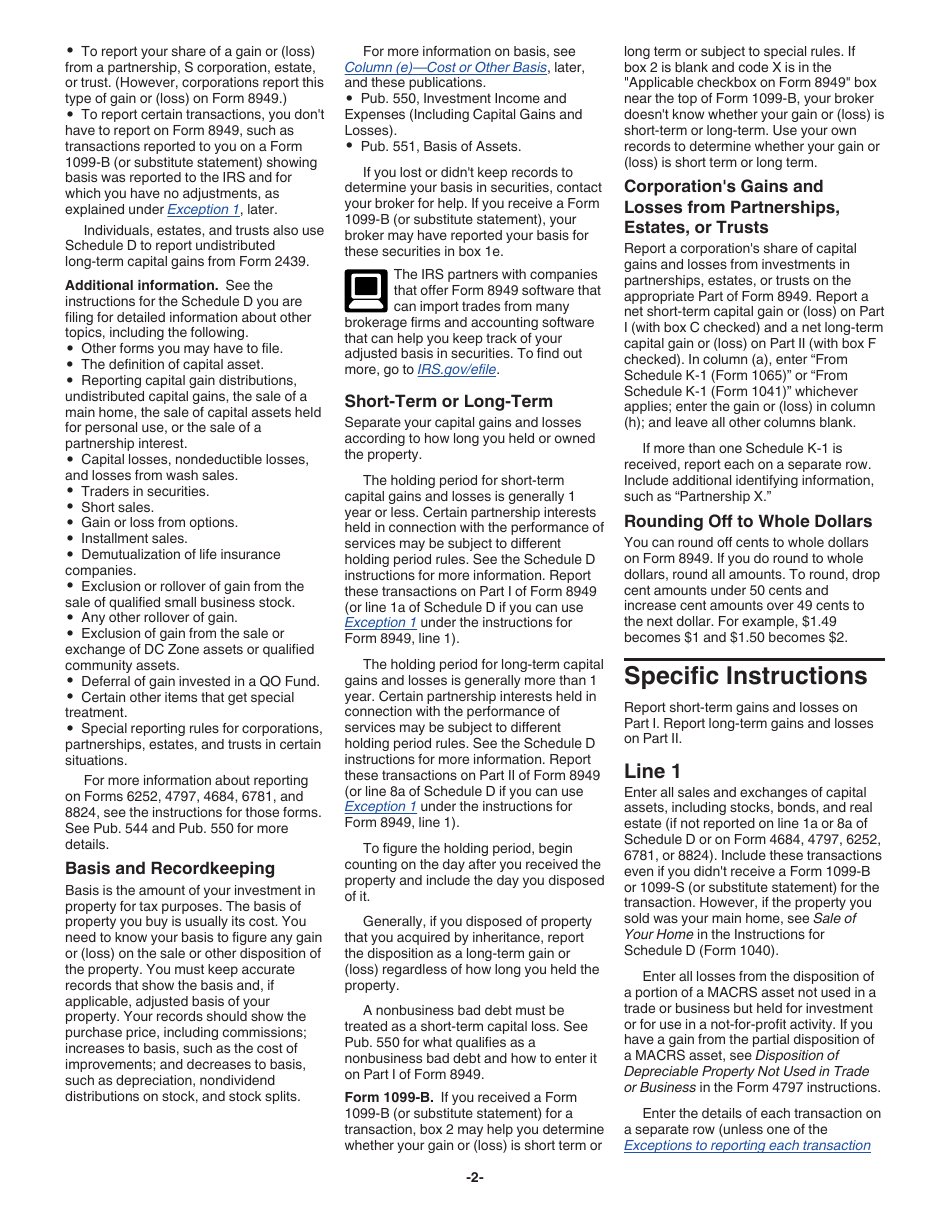

A: IRS Form 8949 is used to report sales and other dispositions of capital assets, such as stocks, bonds, and real estate.

Q: Why do I need to file IRS Form 8949?

A: You need to file IRS Form 8949 to report any capital gains or losses from the sale or disposal of capital assets.

Q: When is the deadline to file IRS Form 8949?

A: The deadline to file IRS Form 8949 is typically April 15th of the following year, unless an extension has been granted.

Q: How do I fill out IRS Form 8949?

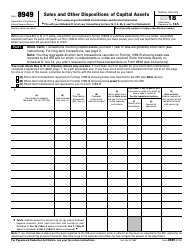

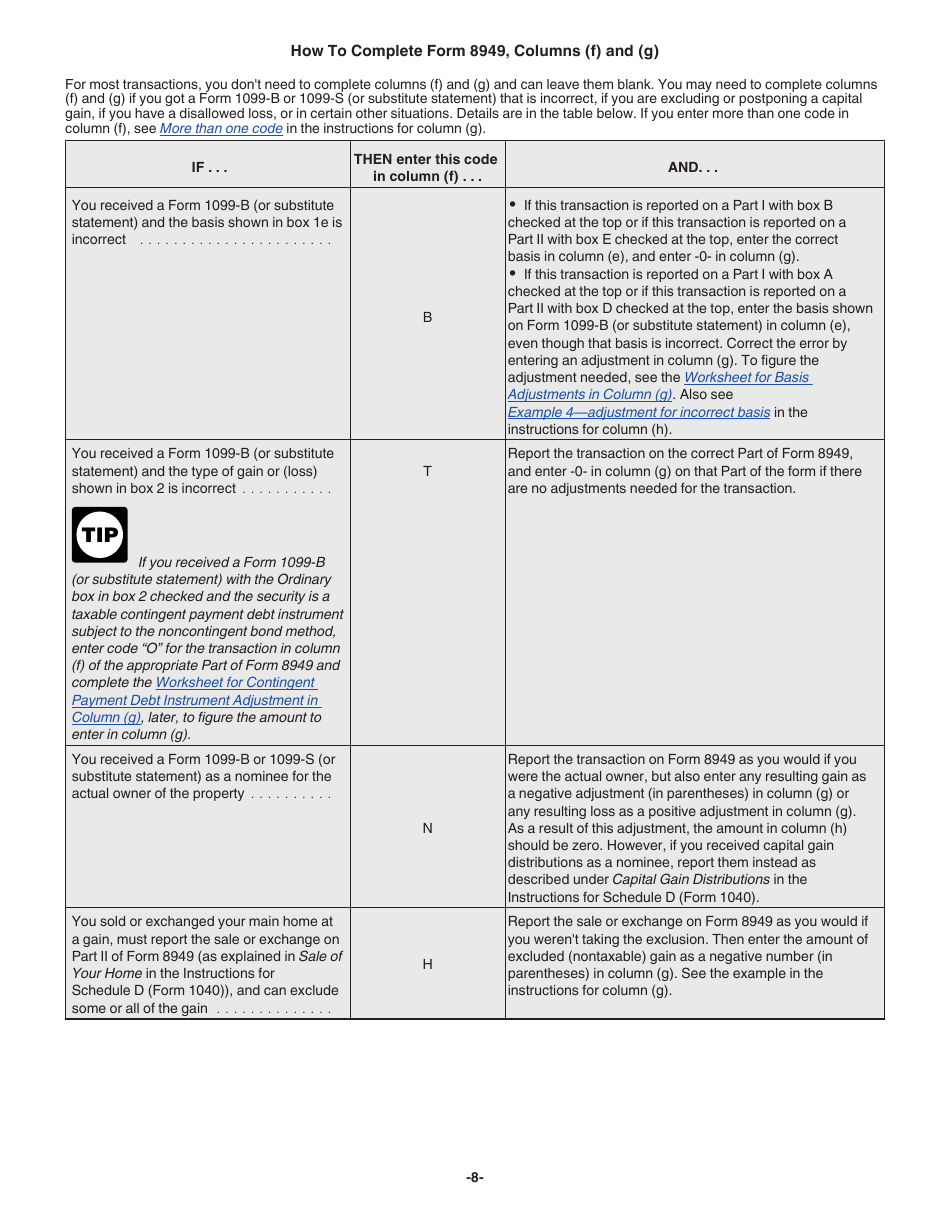

A: You fill out IRS Form 8949 by providing detailed information about each capital asset transaction, including the date of sale, the cost basis, the proceeds from the sale, and the resulting gain or loss.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.