This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8959

for the current year.

Instructions for IRS Form 8959 Additional Medicare Tax

This document contains official instructions for IRS Form 8959 , Additional Medicare Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8959 is available for download through this link.

FAQ

Q: What is Form 8959?

A: Form 8959 is a tax form used for reporting the Additional Medicare Tax.

Q: What is the Additional Medicare Tax?

A: The Additional Medicare Tax is a tax imposed on high-income earners to help fund Medicare.

Q: Who needs to file Form 8959?

A: Individuals who have received wages, self-employment income, or railroad retirement compensation that is subject to the Additional Medicare Tax need to file Form 8959.

Q: How do I know if I owe the Additional Medicare Tax?

A: You owe the Additional Medicare Tax if your wages, self-employment income, or railroad retirement compensation exceeds certain thresholds based on your filing status.

Q: Do all types of income count towards the Additional Medicare Tax?

A: No, only certain types of income, such as wages, self-employment income, and railroad retirement compensation, are subject to the Additional Medicare Tax.

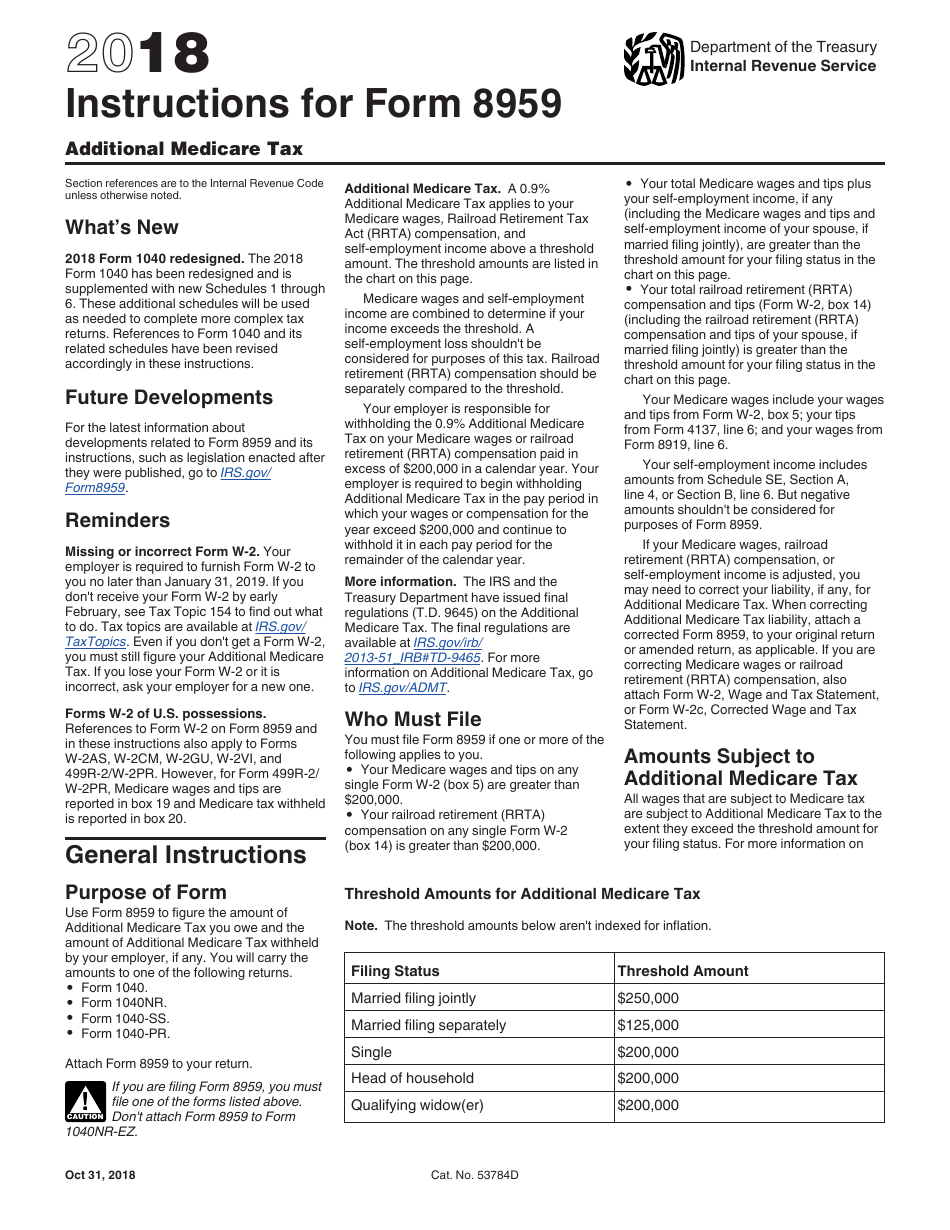

Q: What are the income thresholds for the Additional Medicare Tax?

A: The income thresholds for the Additional Medicare Tax are $200,000 for single filers, $250,000 for married couples filing jointly, and $125,000 for married individuals filing separately.

Q: How do I calculate the Additional Medicare Tax?

A: The Additional Medicare Tax is calculated as 0.9% of the amount of wages, self-employment income, or railroad retirement compensation that exceeds the applicable threshold.

Q: When do I need to file Form 8959?

A: Form 8959 must be filed along with your annual tax return, typically by April 15th of the following year.

Q: Are there any exceptions or special rules for the Additional Medicare Tax?

A: Yes, there are certain exceptions and special rules regarding the Additional Medicare Tax. It's best to consult the instructions for Form 8959 or seek advice from a tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.