This version of the form is not currently in use and is provided for reference only. Download this version of

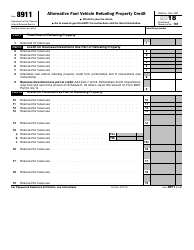

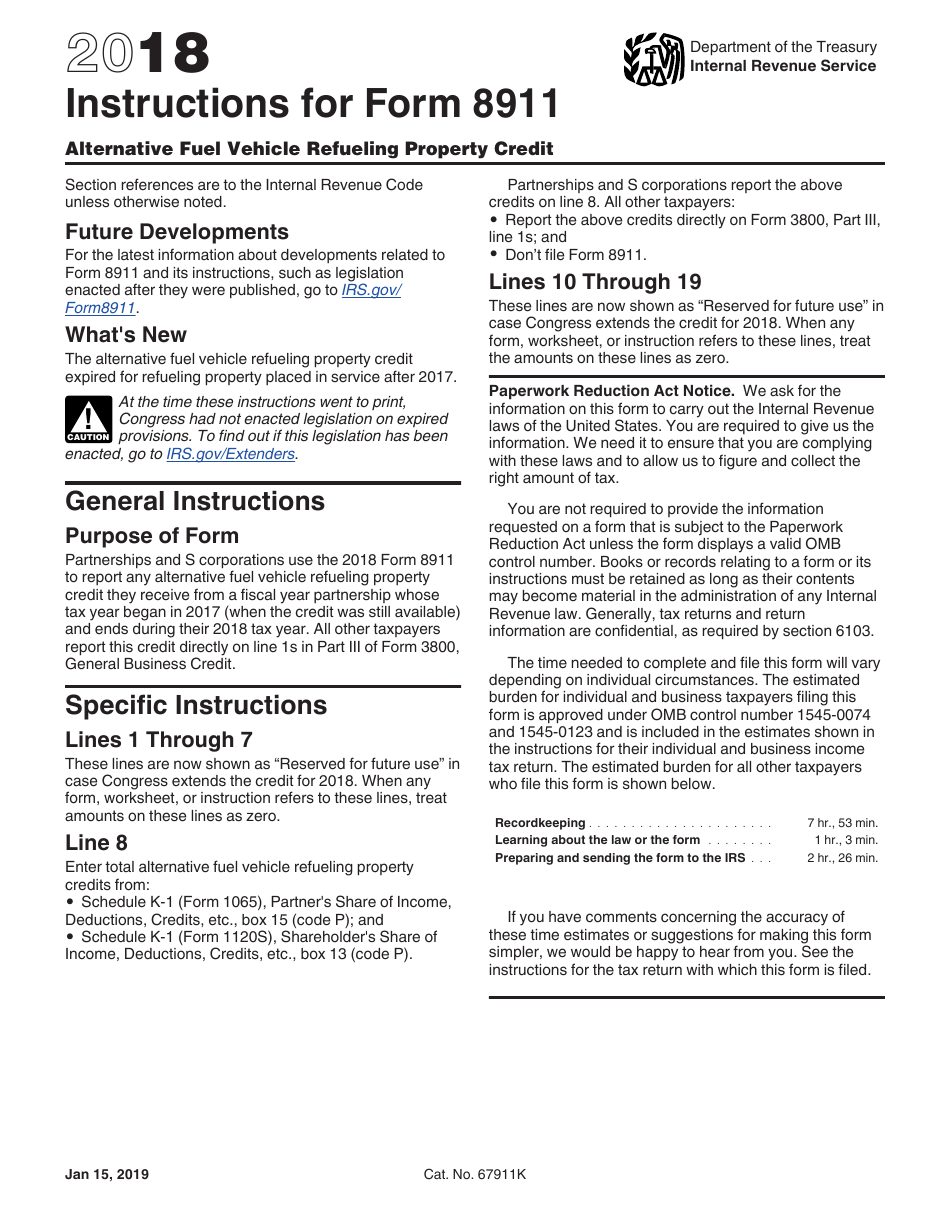

Instructions for IRS Form 8911

for the current year.

Instructions for IRS Form 8911 Alternative Fuel Vehicle Refueling Property Credit

This document contains official instructions for IRS Form 8911 , Alternative Fuel Vehicle Refueling Property Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8911 is available for download through this link.

FAQ

Q: What is Form 8911?

A: Form 8911 is a tax form used to claim the Alternative Fuel Vehicle Refueling Property Credit.

Q: What is the Alternative Fuel Vehicle Refueling Property Credit?

A: The Alternative Fuel Vehicle Refueling Property Credit is a tax credit available to individuals and businesses who install qualified alternative fuel vehicle refueling property.

Q: Who is eligible to claim the credit?

A: Individuals and businesses who install qualified alternative fuel vehicle refueling property, such as electric vehicle charging stations, are eligible to claim the credit.

Q: What type of refueling property qualifies for the credit?

A: Qualified alternative fuel vehicle refueling property includes electric vehicle charging stations, natural gas refueling equipment, and hydrogen refueling equipment.

Q: How much is the credit?

A: The credit is generally 30% of the cost of the qualified alternative fuel vehicle refueling property, up to a maximum credit of $30,000.

Q: How do I claim the credit?

A: To claim the credit, you must fill out Form 8911 and attach it to your annual tax return.

Q: Can I carry forward any unused credit?

A: Yes, any unused credit can be carried forward to future years.

Q: Is there a deadline to claim the credit?

A: Yes, the credit must be claimed in the same tax year that the qualified property was placed in service.

Instruction Details:

- This 1-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.