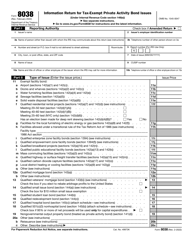

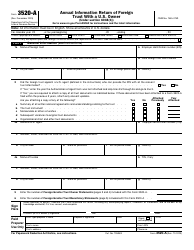

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8858

for the current year.

Instructions for IRS Form 8858 Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (Fdes) and Foreign Branches (Fbs)

This document contains official instructions for IRS Form 8858 , Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (Fdes) and Foreign Branches (Fbs) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8858 Schedule M is available for download through this link.

FAQ

Q: What is IRS Form 8858?

A: IRS Form 8858 is an information return used by U.S. persons with respect to their foreign disregarded entities (FDEs) and foreign branches (FBs).

Q: Who needs to file IRS Form 8858?

A: U.S. persons who have ownership or control of a foreign disregarded entity (FDE) or foreign branch (FB) need to file IRS Form 8858.

Q: What information is required on IRS Form 8858?

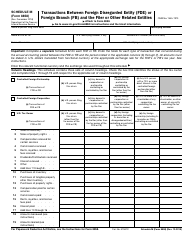

A: IRS Form 8858 requires information about the foreign disregarded entity (FDE) or foreign branch (FB), including ownership details, financial information, and transactions.

Q: When is the deadline to file IRS Form 8858?

A: The deadline to file IRS Form 8858 is usually the same as the deadline for the taxpayer's income tax return (typically April 15th).

Q: Are there any penalties for not filing IRS Form 8858?

A: Yes, there can be penalties for not filing IRS Form 8858, including monetary fines and potential criminal charges.

Q: Can IRS Form 8858 be filed electronically?

A: Yes, IRS Form 8858 can be filed electronically using tax software or through the IRS's e-file system.

Q: Is IRS Form 8858 also required for foreign corporations?

A: No, IRS Form 8858 is specifically for U.S. persons with foreign disregarded entities (FDEs) or foreign branches (FBs). Foreign corporations have different reporting requirements.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.