This version of the form is not currently in use and is provided for reference only. Download this version of

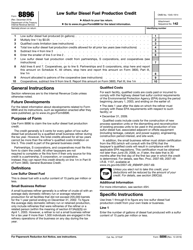

Instructions for IRS Form 8864

for the current year.

Instructions for IRS Form 8864 Biodiesel and Renewable Diesel Fuels Credit

This document contains official instructions for IRS Form 8864 , Biodiesel and Renewable Diesel Fuels Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8864 is available for download through this link.

FAQ

Q: What is IRS Form 8864?

A: IRS Form 8864 is a form used to claim the biodiesel and renewable diesel fuels credit.

Q: What is the biodiesel and renewable diesel fuels credit?

A: The biodiesel and renewable diesel fuels credit is a federal tax credit available to eligible taxpayers who produce and sell or use qualified biodiesel or renewable diesel fuels.

Q: Who is eligible to claim the credit?

A: Eligible taxpayers include blenders, producers, and sellers of biodiesel or renewable diesel fuels, as well as certain taxpayers who use these fuels in their trade or business.

Q: What are qualified biodiesel and renewable diesel fuels?

A: Qualified biodiesel and renewable diesel fuels are defined fuels that meet specific requirements, including the use of biomass or agricultural products.

Q: How do I claim the credit?

A: To claim the credit, you must complete and file IRS Form 8864, along with any required supporting documentation, with your annual tax return.

Q: What documentation is required to support the claim?

A: The documentation required to support your claim may include production records, purchase records, and certifications from fuel suppliers.

Q: Is there a limit to the credit amount that can be claimed?

A: Yes, there are limitations on the credit amount that can be claimed, based on the types and quantities of fuels produced or used.

Q: Are there any deadlines for claiming the credit?

A: Yes, the credit must be claimed on your annual tax return, which is typically due by April 15th of the following year.

Q: What happens if I file Form 8864 incorrectly?

A: If you file Form 8864 incorrectly or provide false or misleading information, you may be subject to penalties and interest charges.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.