This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8835

for the current year.

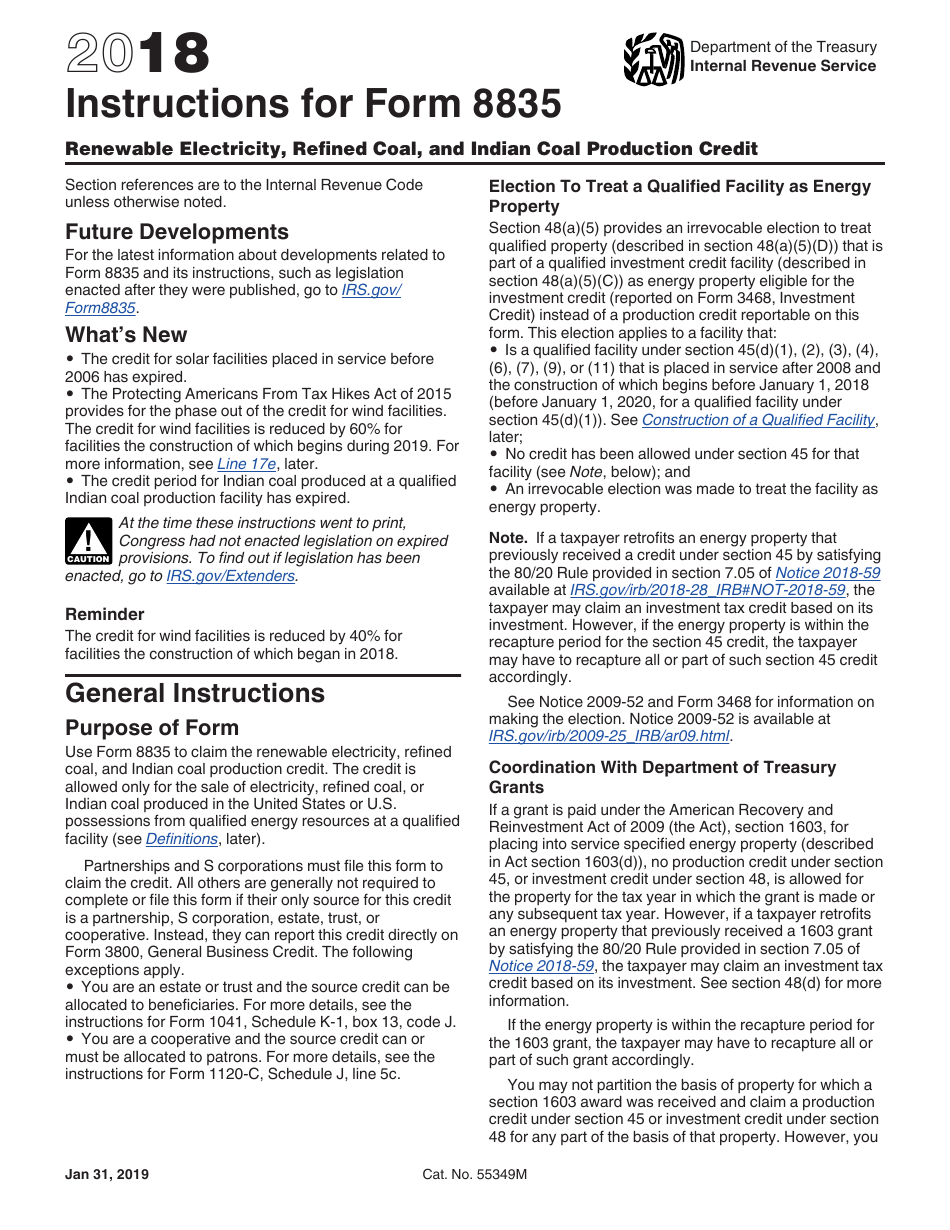

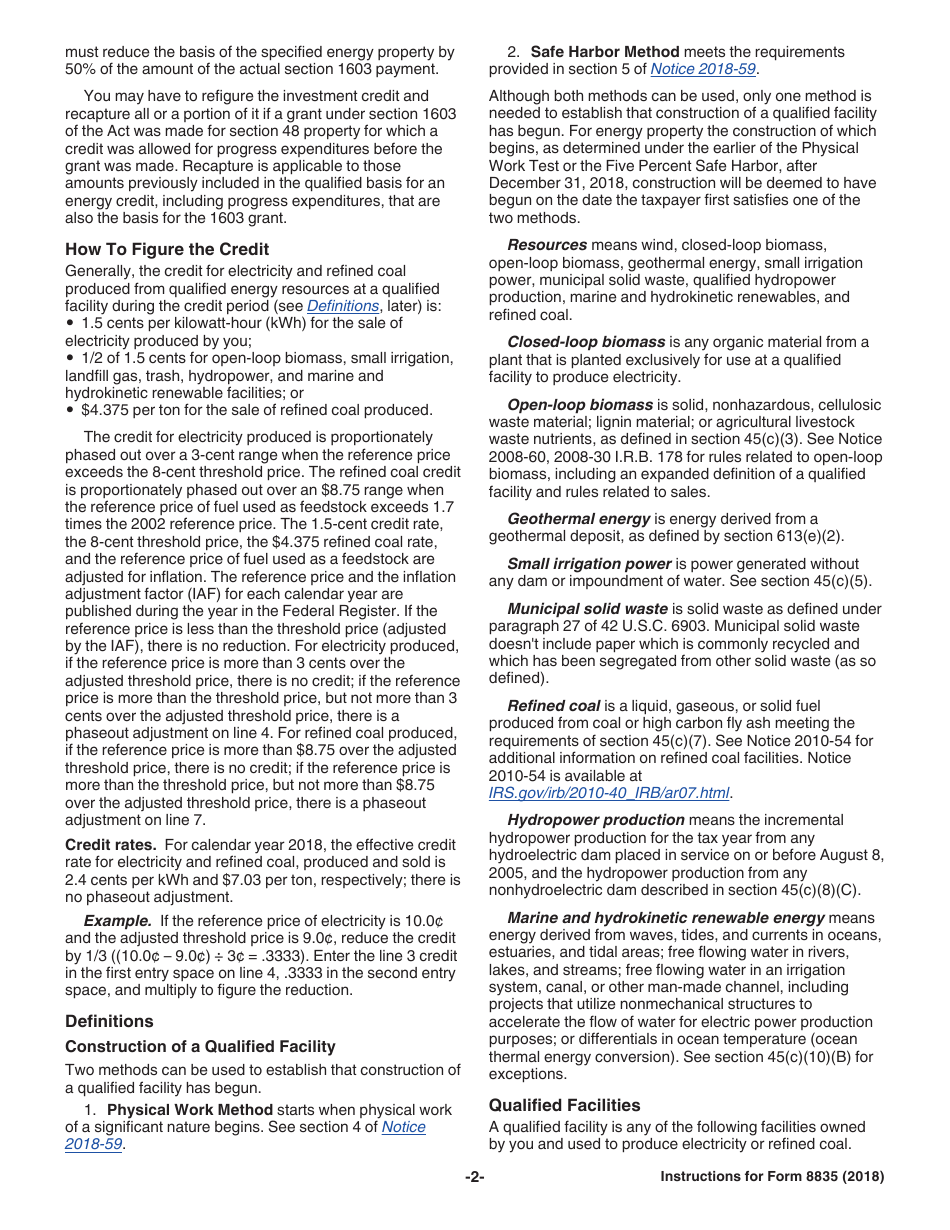

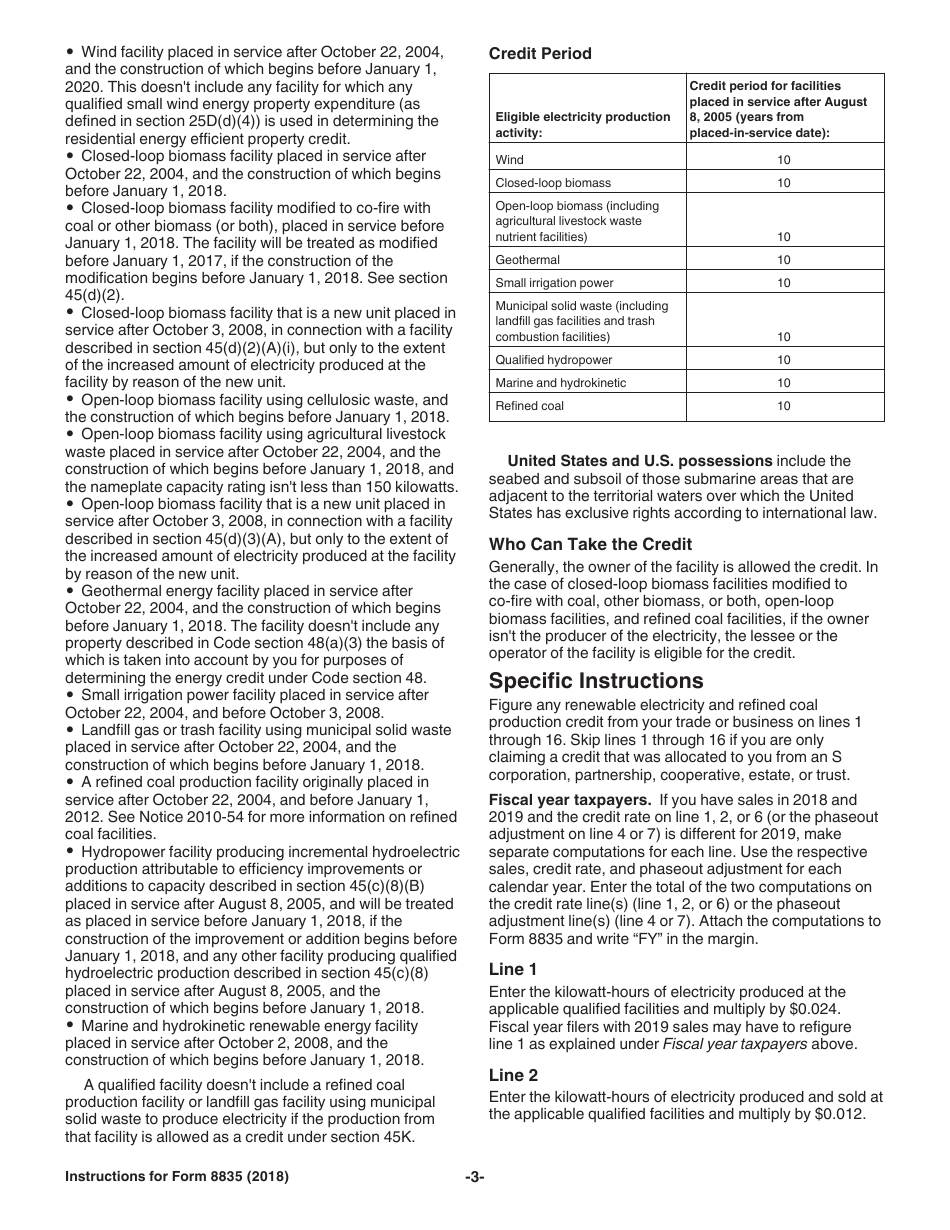

Instructions for IRS Form 8835 Renewable Electricity, Refined Coal, and Indian Coal Production Credit

This document contains official instructions for IRS Form 8835 , Renewable Electricity, Coal Production Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8835 is available for download through this link.

FAQ

Q: What is IRS Form 8835?

A: IRS Form 8835 is a form used to claim the Renewable Electricity, Refined Coal, and Indian Coal Production Credit.

Q: What is the purpose of IRS Form 8835?

A: The purpose of IRS Form 8835 is to allow taxpayers to claim credits for the production of renewable electricity, refined coal, or Indian coal.

Q: Who can use IRS Form 8835?

A: Taxpayers who have engaged in the production of renewable electricity, refined coal, or Indian coal may use IRS Form 8835.

Q: What credits can be claimed using IRS Form 8835?

A: IRS Form 8835 allows taxpayers to claim credits for the production of renewable electricity, refined coal, or Indian coal.

Q: What is the Renewable Electricity Production Credit?

A: The Renewable Electricity Production Credit is a credit provided to taxpayers who produce electricity from renewable resources.

Q: What is the Refined Coal Production Credit?

A: The Refined Coal Production Credit is a credit provided to taxpayers who produce refined coal.

Q: What is the Indian Coal Production Credit?

A: The Indian Coal Production Credit is a credit provided to taxpayers who produce Indian coal.

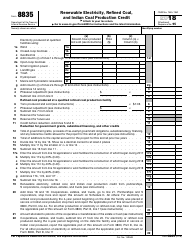

Q: How do I fill out IRS Form 8835?

A: To fill out IRS Form 8835, you will need to provide information about your production of renewable electricity, refined coal, or Indian coal, and calculate the credit amount.

Q: Are there any restrictions or limitations for claiming these credits?

A: Yes, there are certain restrictions and limitations for claiming the credits, such as production thresholds and qualification requirements. The instructions for IRS Form 8835 provide more details.

Q: Can I claim multiple credits on IRS Form 8835?

A: Yes, you can claim multiple credits on IRS Form 8835 if you qualify for them.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.