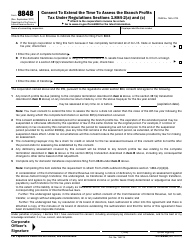

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8615

for the current year.

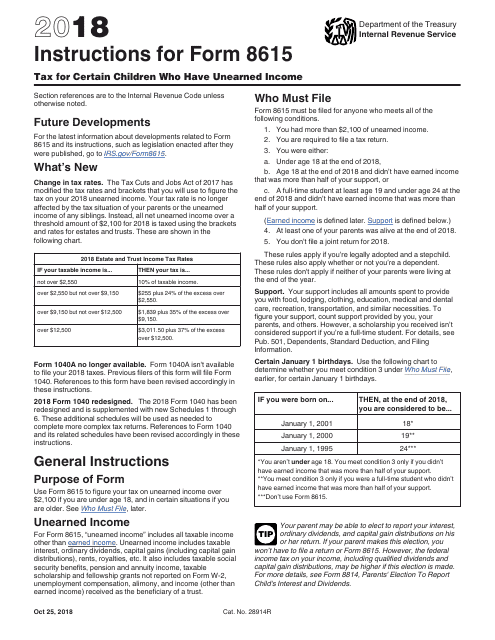

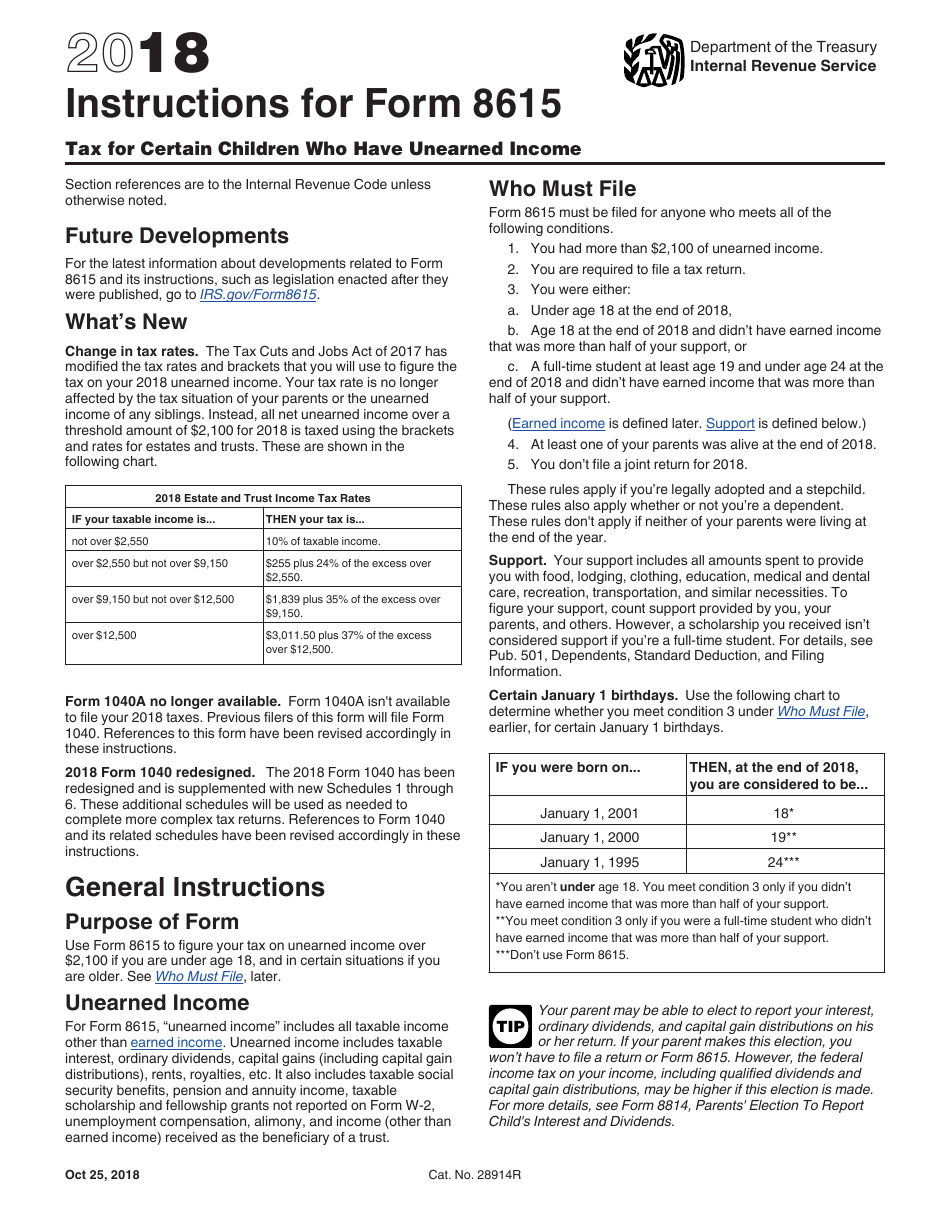

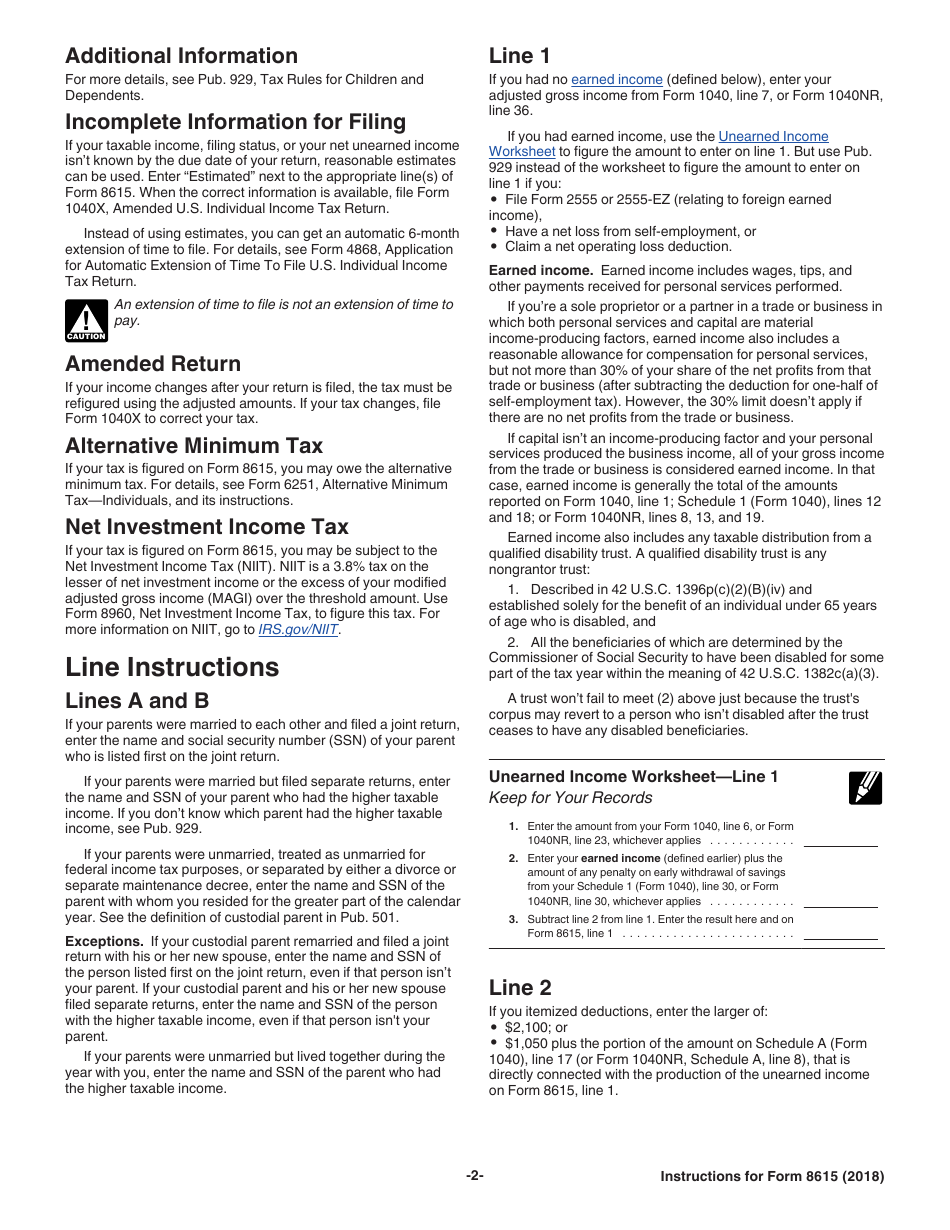

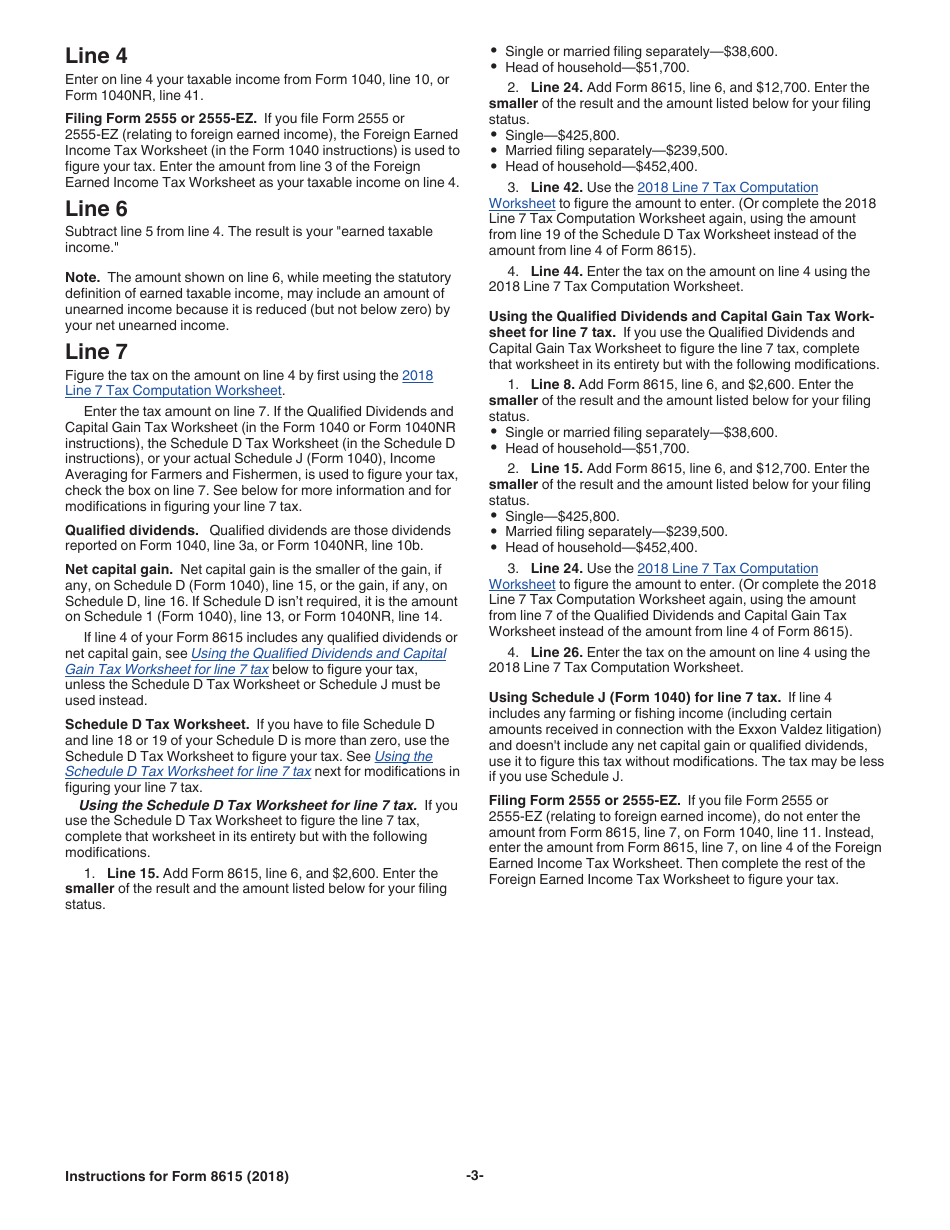

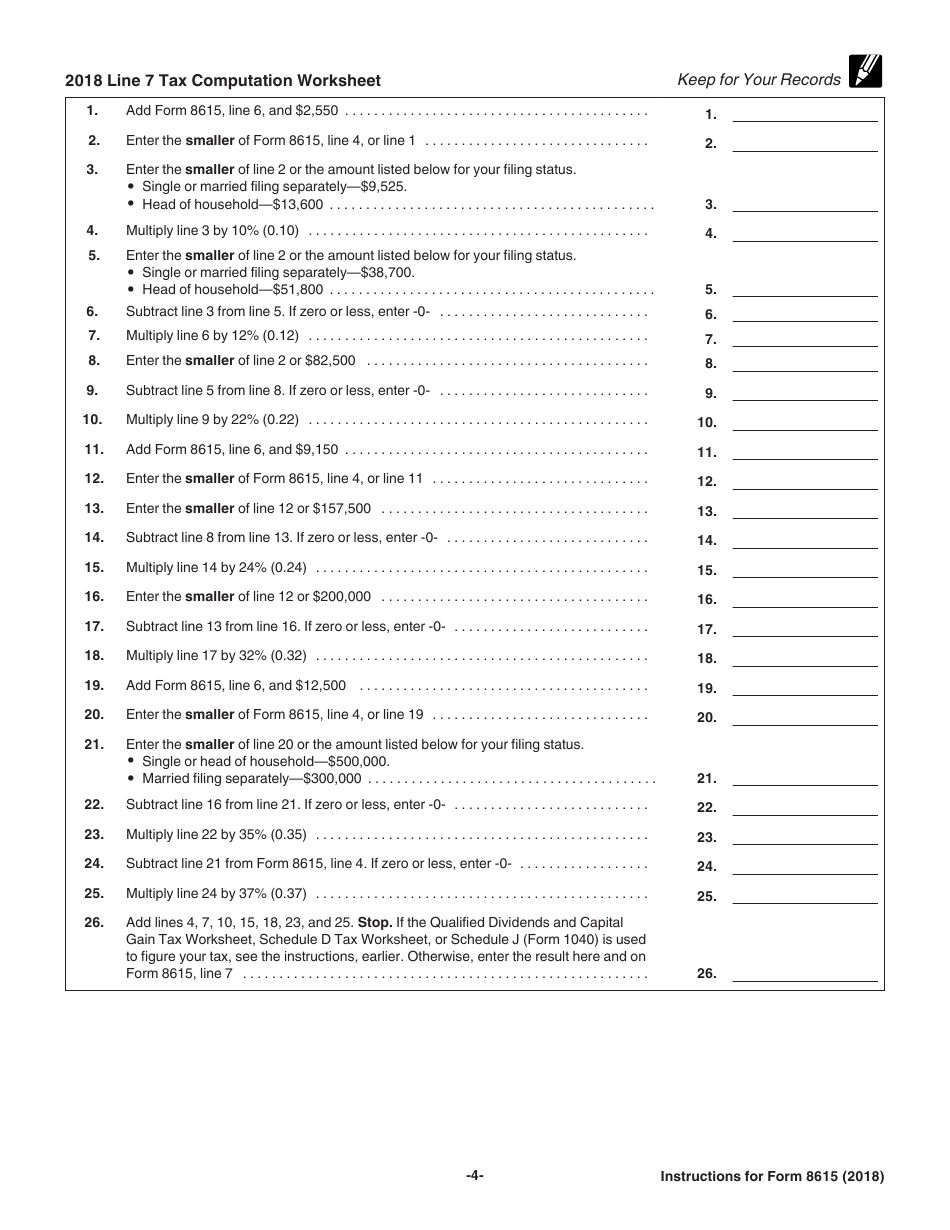

Instructions for IRS Form 8615 Tax for Certain Children Who Have Unearned Income

This document contains official instructions for IRS Form 8615 , Tax for Certain Children Who Have Unearned Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8615 is available for download through this link.

FAQ

Q: What is IRS Form 8615?

A: IRS Form 8615 is a tax form specifically for children who have unearned income.

Q: Who should use IRS Form 8615?

A: IRS Form 8615 should be used by children who have unearned income and meet certain criteria.

Q: What qualifies as unearned income?

A: Unearned income includes things like interest, dividends, capital gains, and taxable scholarships.

Q: What are the criteria for using Form 8615?

A: Children must meet age, income, and dependency criteria to use Form 8615.

Q: What is the purpose of IRS Form 8615?

A: The purpose of Form 8615 is to calculate the tax for children with unearned income and ensure they are paying their fair share.

Q: When is the deadline to file IRS Form 8615?

A: The deadline to file IRS Form 8615 is typically April 15th, the same as the regular tax filing deadline.

Q: Do children need to file taxes if they only have unearned income?

A: Yes, children with unearned income may be required to file taxes, and IRS Form 8615 is specifically for this purpose.

Q: Can parents file IRS Form 8615 on behalf of their children?

A: Yes, parents can file IRS Form 8615 on behalf of their children if they meet the criteria for using the form.

Q: What happens if a child does not file IRS Form 8615 when required?

A: If a child is required to file IRS Form 8615 and fails to do so, they may face penalties and interest on any unreported income.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.