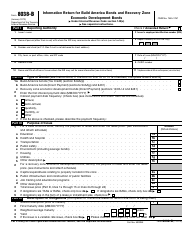

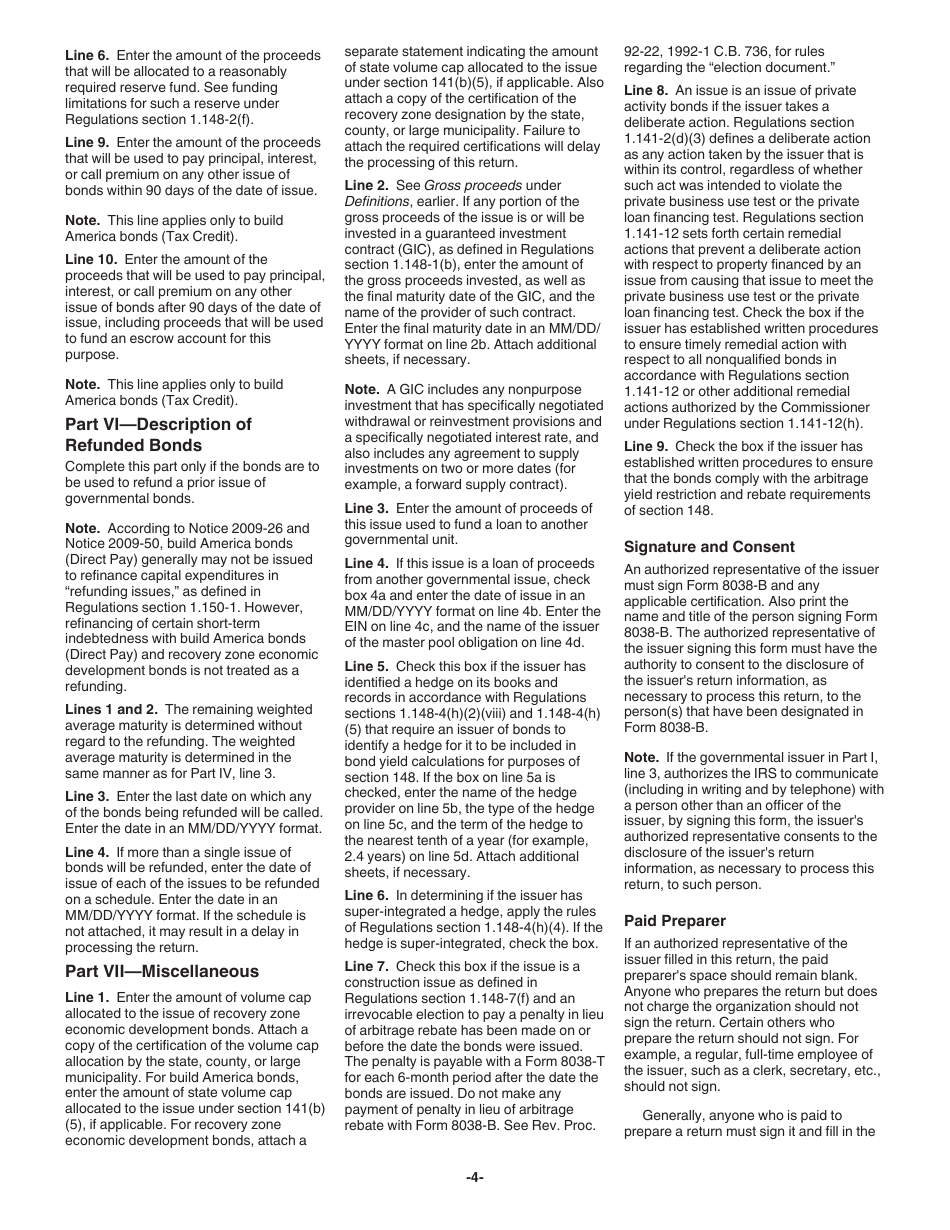

Instructions for IRS Form 8038-B Information Return for Build America Bonds and Recovery Zone Economic Development Bonds

This document contains official instructions for IRS Form 8038-B , Information Return for Build America Bonds and Recovery Zone Economic Development Bonds - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8038-B is available for download through this link.

FAQ

Q: What is Form 8038-B?

A: Form 8038-B is an information return for reporting Build America Bonds and Recovery Zone Economic Development Bonds.

Q: Who needs to file Form 8038-B?

A: Issuers of Build America Bonds or Recovery Zone Economic Development Bonds need to file Form 8038-B.

Q: What are Build America Bonds?

A: Build America Bonds are taxable bonds issued by state or local government to finance public infrastructure projects.

Q: What are Recovery Zone Economic Development Bonds?

A: Recovery Zone Economic Development Bonds are tax-exempt bonds issued by state or local government to finance certain economic development projects.

Q: What information is required on Form 8038-B?

A: Form 8038-B requires information about the issuer, bond issue details, and the use of bond proceeds.

Q: When is Form 8038-B due?

A: Form 8038-B is generally due within 90 days after the bond issue date.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.